Etherscan: A glance at the early remortgage ecosystem of Ethereum

- WBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBforward

- 2024-03-06 20:55:09512browse

Original title: "An Early Look at Ethereum's Restaking Landscape"

Compiled by: Elvin, ChainCatcher

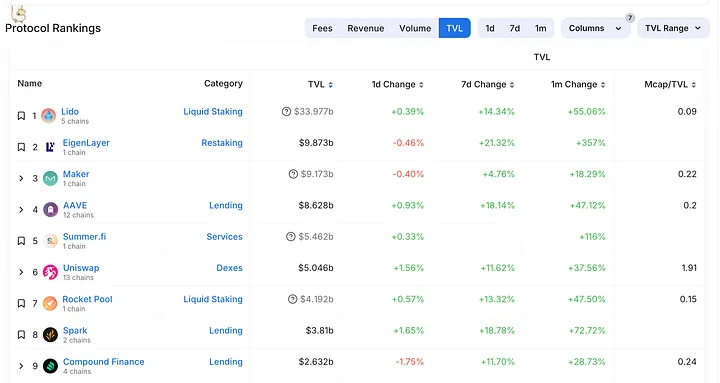

The total value locked (TVL) on EigenLayer has shown amazing results in the past two months growth of. The increase from $1 billion on December 23 to $9.5 billion shows increasing investor trust and engagement in the platform. Meanwhile, Liquidity Recollateralized Token (LRT) TVL has also experienced impressive growth, from $152 million at the beginning of the year to over $4 billion as of February 24. These data demonstrate that EigenLayer plays an important role in the cryptocurrency ecosystem, attracting large inflows and facilitating increased liquidity. The growth momentum of re-hypothecation also shows that investors are confident in the future development of the platform and are willing to lock funds in it for the long term. As the DeFi community is particularly hot, it is expected that airdrops may occur by accumulating EigenLayer points and using the same ETH to obtain additional re-mortgage rewards.

This article will discuss Ethereum staking and compare it to re-staking. We will analyze the case and provide interested readers with an explanation of the advantages and concerns associated with rehypothecation.

Proof of Stake (PoS) Ethereum and Security

Ethereum has undergone a merger, transforming its security model into a PoS consensus mechanism. In order to ensure the security of the Ethereum network under PoS, anyone can become a validator by depositing 32 ETH into the Beacon Chain, thereby gaining the right to verify new blocks and propose new blocks. Validators are rewarded for working honestly, but dishonesty can result in staked ETH being slashed.

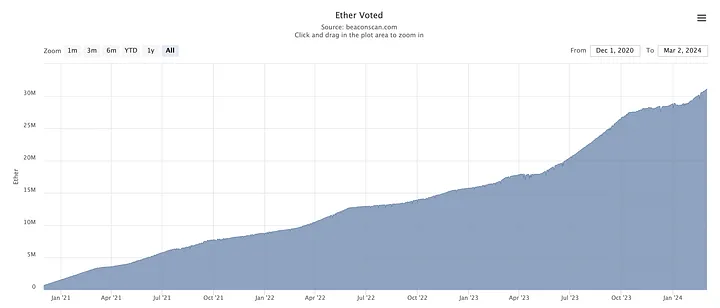

As of this writing, over 25% of the ETH supply (31,061,263 ETH out of 120,142,088.89 ETH) is staked. The total market cap of ETH is $400 billion, while the total value of staked ETH is $100 billion. This means that executing a 51% attack on Ethereum (where an attacker would control the majority of validators) would require the deployment of over $100 billion in capital (assuming that current network validators are honest) to successfully influence Ethereum in their favor .

Additionally, the validator churn limit prevents new validators from entering the network at the same time. At the current limit of 15 per cycle, an attack could take more than 6 months to execute. Additionally, the current supply of ETH on exchanges is 13,735,858.547 ETH (about 11.43%), which is less than half of the total amount of ETH pledged, making it increasingly difficult to purchase enough ETH to attack the network.

资料来源:cryptoquant.com

The Liquid Stake protocol allows more users to participate in PoS by allowing them to delegate ETH to node operators instead of running validator clients themselves. In return, users receive liquid staking tokens (LST) that they can freely use in DeFi activities, unlike native staking where ETH must be locked on Beacon Chain. LST represents a commitment to exchange it back for delegated ETH and earned rewards.

The Liquid Stake protocol allows more users to participate in PoS by allowing them to delegate ETH to node operators instead of running validator clients themselves. In return, users receive liquid staking tokens (LST) that they can freely use in DeFi activities, unlike native staking where ETH must be locked on Beacon Chain. LST represents a commitment to exchange it back for delegated ETH and earned rewards. The new ETH staking is mainly aimed at the liquidity staking protocol, and even sparked discussions about changing the pledge issuance.

Re-staking and its case

To put it in perspective, it took Ethereum more than three years to build its cryptoeconomic security and over 25% of ETH was staked. Staked ETH is currently worth over $100 billion, surpassing the combined market cap of the next major networks like BSC ($62 billion) and Solana ($59 billion) (both numbers at the time of writing).

来源: https: //beaconscan.com/stat/voted

New protocols seeking to build strong cryptoeconomic security will need to invest more time and resources to achieve similar feats. They must find new capital that has not yet secured existing blockchain protocols. This will also further dilute capital among various blockchain protocols and lead to security fragmentation.

New protocols seeking to build strong cryptoeconomic security will need to invest more time and resources to achieve similar feats. They must find new capital that has not yet secured existing blockchain protocols. This will also further dilute capital among various blockchain protocols and lead to security fragmentation. The re-staking concept introduced by EigenLayer involves ETH validators/stakeholders choosing to secure additional protocols (or active verification services) with their staked ETH. This approach allows developers to launch new protocols faster by leveraging Ethereum’s security.

Since launching its first phase on the Ethereum mainnet on June 23, EigenLayer has accumulated over $9.5 billion in total value locked (TVL), making it the second largest by TVL on Ethereum. protocol. Its Liquidity Re-staking Token (LRT) counterpart, similar to LST-staking ETH, currently has a TVL of over $4 billion.

来源: https: //defillama.com/chain/Ethereum

According to EigenLayer’s website, there are currently 13 AVS projects built in its ecosystem, utilizing re-staking ETH to enhance the security of the project. The first of these, AVS EigenDA (developed by EigenLabs), is being tested on the testnet and will land on the mainnet in the first half of 2024.

According to EigenLayer’s website, there are currently 13 AVS projects built in its ecosystem, utilizing re-staking ETH to enhance the security of the project. The first of these, AVS EigenDA (developed by EigenLabs), is being tested on the testnet and will land on the mainnet in the first half of 2024. For a market overview of February 2024 re-staking, please read the blog here.

What are the advantages and concerns of remortgaging?

Because the active verification service is still undergoing rigorous testing and has not yet launched on mainnet, the full range of benefits and concerns have not yet been revealed.

Nonetheless, the following are the preliminary advantages and concerns of re-staking collected from the community:

Advantages

1. Shared Security

Protocols built on EigenLayer can Benefit from pooled security without the additional startup costs of assembling a validator base, especially in PoS networks.

Sreeram Kannan, founder of EigenLayer, said that sharing security has been massively strengthened. If $1 billion of equity is recollateralized and shared across all protocols, the cost of attacking any one of them is $1 billion.

This begs the question, if EigenLayer is a permissionless protocol that anyone can build on top of, will pooling security incentivize people to take on more security funded by others? risk?

Upcoming changes to the shared security model may introduce vested security, allowing AVS to purchase claims on a certain amount of pooled (rehypothecated) capital. If something goes wrong with AVS, claims can be reassigned to the AVS user, making them whole. This is similar to insurance.

2. Capital efficiency

The re-pledged ETH will enjoy more rewards for verifying AVS than Ethereum alone.

Concerns

1. Centralization risk

In addition to the ordinary ETH staking yield, validators using AVS will be able to provide higher APY to their delegators. . Validators need to understand the risks of obtaining additional AVS rather than blindly exploiting each AVS to obtain the promised yield.

Restakers may naturally be inclined to delegate their ETH to validators to maintain higher yields by minimizing the risk of slashing. This may develop into a feedback loop, with those validators that can provide sustainably higher returns attracting more capital in the long run, further consolidating their position, potentially creating a monopoly and risking centralization.

2. The consensus of decentralized Ethereum

Like other blockchain communities, the social consensus of Ethereum is also fragile. If social consensus is exploited mercilessly, it is likely to cause community divisions and chain rupture.

Restaking should maintain the minimalism of Ethereum and avoid introducing unnecessary "scope" to distract from the role of Ethereum consensus. If restaking AVS becomes too large to fail, it could trigger a social consensus fork.

Conclusion

Restaking quickly became a hot topic within the community, providing additional incentives for accumulating EigenLayer points and potential airdrop opportunities. This is also a promising technology that could allow Ethereum to secure more useful protocols.

The team behind EigenLayer is also in no rush to move forward with the process, as they consider multiple perspectives from the community and core developers and gradually make smart updates to the protocol.

The above is the detailed content of Etherscan: A glance at the early remortgage ecosystem of Ethereum. For more information, please follow other related articles on the PHP Chinese website!

Related articles

See more- JavaScript implements blockchain

- How to use Spring Boot to build blockchain applications and smart contracts

- What role does block size play in cryptocurrency?

- OKX cryptocurrency exchange has officially been granted a VASP license by the Dubai authorities to further expand into the Middle East market

- Is Ethereum worth holding for the long term? Is Ethereum worth investing in?