什么是比特币的恐惧与贪婪指数?

- DDD 2024-03-06 13:35 1079浏览 转载

比特币市场波动剧烈,在6月18日触达17618usdt的低点之后,7月31日突破了六周新高。不过几小时内又从 24,670 美元跌至 23,555 美元。

加密市场波动剧烈,我们经常看到“市场极度恐慌”或者“市场贪婪指数很高”这样的表述,这些都来自恐惧贪婪指数。

那么,到底什么是恐惧贪婪指数呢?我们一起来看下。

01. 关于恐惧和贪婪指数

什么是恐惧和贪婪指数?

恐惧与贪婪指数是衡量比特币市场人群心理的工具。投入者对市场状况的这种整体感觉也称为市场情绪。

为什么恐惧和贪婪?

恐惧和贪婪是人类心理学中可以影响投入者行为的两种主要情绪。比特币市场也不例外。因此,市场情绪意识对于帮助我们决定进入或退出市场的时间很重要。

从表面上看,投入者普遍遵循该指数的理论,即过度恐惧往往会压低比特币的价格,而过度贪婪则会推高价格。

假设是极端恐惧会增加比特币的抛售压力,推动价格下跌并为投入者提供买入机会。另一方面,极度贪婪推高了对比特币的需求,抬高了价格并提供了良好的销售机会。

积累多方数据来源分析汇总以生成一个数字。这个数字的测量范围从 0 到 100,其中 0 表示最大的恐惧和 100 表示极度的贪婪。

在 0 到 100 的范围内,该指数分为四个基本类别:0 到 24 = 极度恐惧,25 到 49 = 恐惧,50 到 74 = 贪婪,75 到 100 = 极度贪婪。

同时,指数从以下来源提取数据来计算分数:

波动率:将比特币的当前价值与其过去 30 天和过去 90 天的平均值进行比较。

市场趋势和交换量:过去 30 天和 90 天比特币的市场趋势和交换量。

社交媒体情绪:人们在社交媒体上对比特币的看法。

市场份额:比特币相对于所有其他加密货币(也称为支配地位)在加密市场中的份额。

搜索趋势:相关比特币搜索词的趋势,以确定人们是预期上涨还是下跌。

02. 反人性的投入者

然而,一种类型的投入者认为,逆势而行(逆着这种市场情绪)可以跑赢市场,也叫反人性投资者。

反人性投入者采取反对从众的行动。当市场因恐惧而抛售时,他们开始贪婪。当普遍存在贪婪情绪并且其他人都在购买时,逆势投入者会在价格上涨时找到退出市场的机会。

03. 这个贪婪与恐惧指数可靠吗?

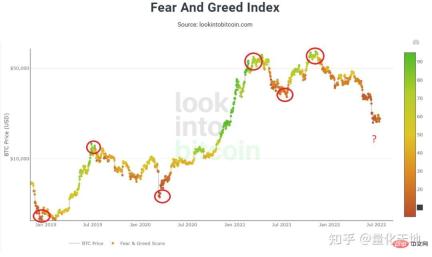

这个问题的答案就在数据中。http://Lookintobitcoin.com 让投入者深入了解该指数在历史上如何与比特币价格相互作用。

从历史上看,对市场的感觉越极端,比特币就越有可能发生趋势逆转。

如上图所示,该指数是预测局部顶部和底部以及比特币市场方向的时间变化的最佳指标。但是,它没有具体说明这种转变将在哪个价格点发生。

该指标的反对者提出的一个主张是,它不是一种具有前瞻性的工具,如果在短期内反复使用可能会特别危险:当市场状况发出极度恐惧信号时决定扣动扳机的投入者可能会在漫长的看跌期开始时进入市场。

如果理财获益就像跟随大众情绪一样容易,我们大概都会成为赢家。所这个指数在预测更广泛的趋势方面更有效。

不过,请注意不要只使用这个单一指标来做出任何投入决策。我们应该将它与其他技术、基本面和链上指标结合使用,尤其是当前在我们正在经历的不确定的宏观经济环境中。

相关文章

查看更多最新文章

查看更多-

- 时间管理,自律给我自由

-

¥15

¥19已抢7215个

抢

-

- 信息系统项目管理师(软考高级)一站式通关课程

-

¥799

¥999已抢94862个

抢

-

- 使用Go语言搭建家庭相册系统

-

¥79

¥99已抢14828个

抢

-

- PHP Workerman 基础与实战:即时通讯聊天系统(ThinkPHP6)

-

¥119

¥399已抢52097个

抢

-

- 从PHP基础到ThinkPHP6实战

-

¥0

¥119已抢194768个

抢

-

- Laravel 9 学习正当时—保姆级教程,想学不会都难!

-

¥168

¥279已抢87281个

抢