Computer Tutorials

Computer Tutorials Troubleshooting

Troubleshooting What are the requirements for transferring from GEM to main board?

What are the requirements for transferring from GEM to main board?php editor Youzi will introduce to you today several requirements for GEM to main board transfer. Transferring from the GEM to the main board is the only way for many companies to develop, but it also needs to meet certain conditions. During this process, the company needs to comply with the listing requirements of the main board, including the number of shareholders, profitability, equity structure, etc. Only by meeting these requirements can the transfer from GEM to the main board be successfully completed. Next, we will analyze these key requirements in detail to help everyone better understand this process.

What are the requirements for transferring from GEM to main board?

According to the current listing rules of the Hong Kong Stock Exchange, companies listed on GEM that apply to transfer to the main board must meet the main prerequisites for listing on the main board:

A. The issuer and its business must be listed on the Stock Exchange Those deemed suitable for listing. Issuers or groups (other than investment companies) whose assets are all or mostly cash or short-term securities will generally not be considered suitable for listing;

B. The issuer or its group must be under similar management Under management, generally have a business record of no less than three fiscal years.

During this period, the profit attributable to shareholders in the most recent year shall not be less than HK$20 million; and the cumulative profit attributable to shareholders in the previous two years shall not be less than HK$30 million;

C. The estimated market value of the new applicant at the time of listing shall not be less than HK$100 million, and the estimated market value of the securities held by the public shall not be less than HK$50 million;

D. The listed securities have a public Market:

- 25% of any class of listed securities must generally be held by the public.

If the issuer’s estimated market value exceeds HK$4 billion, the ratio held by the public can be reduced to between 10% and 25%;

——If it is a new category of securities For listing, each issue of securities worth HK$1 million must generally have no less than three holders, and the number of holders is at least 100;

E. New applicants must make all necessary arrangements, Make its securities meet the qualification standards set by Hong Kong Clearing Corporation and be deposited, delivered and settled in the Central Clearing and Clearing System.

What does it mean to transfer to the motherboard?

1. Transfer to the main board refers to the transfer of NEEQ stocks to the main board for listing.

2. New OTC companies that have been listed on the selected level for a certain period of time and meet the exchange’s listing conditions and relevant regulations can directly transfer to the board for listing.

3. The main board refers to the Shanghai and Shenzhen main board markets. The Shanghai and Shenzhen main board markets, the GEM and the Science and Technology Innovation Board are all on-site exchange markets, and the corresponding companies are all listed companies; the OTC market is one of the exchanges. In markets other than the New Third Board, regional equity trading markets, and brokerage OTC markets, the corresponding companies are all unlisted companies.

How long does it take for the GEM to be delisted before it can be relisted on the main board?

If a company delisted from the GEM meets the conditions for listing on the main board, it can apply to resume listing on the main board after one year.

This is because the "Stock Transfer Rules for Listed Companies" stipulates that companies delisted from the GEM can apply for transfer to the main board for listing after one year, but they need to meet the main board listing conditions.

If the company has met the conditions for listing on the main board before delisting, it can directly apply for resumption of listing on the main board.

The specific steps are as follows:

1. The company needs to re-prepare and publish the prospectus to comply with the relevant regulations for main board listing.

2. The company needs to submit application materials, including prospectus, financial statements, audit reports, etc.

3. The company needs to pass the review of the China Securities Regulatory Commission and obtain a listing license.

4. The company needs to apply for listing on the stock exchange and undergo exchange review.

5. The company needs to conduct investor education and publicity before going public to increase market visibility and recognition.

It should be noted that the resumption of listing on the main board of a company delisted from the GEM is not guaranteed to be successful. The company needs to have good financial status, performance and market prospects to gain the recognition of investors and the market. support.

How to apply for transfer from GEM to the main board?

The application process for transferring GEM to Main Board listing:

1. First, the issuer must be a suitable listed investor confirmed by the Stock Exchange.

2. The issuer or its company is managed by similar management and has a business record of more than three fiscal years.

2. The issuer or its company is managed by similar management and has a business record of more than three fiscal years.

4. The public must hold 25%. If the issuer’s expected market value exceeds HK$4 billion, the ratio held by the public can be reduced to between 10% and 25%;

5. If a new category of securities is listed, each issuance of securities worth HK$1 million must have more than three holders.

6. New applicants must make their securities comply with the Hong Kong Clearing and Clearing Standards. Delivery, deposit and settlement can be handled in the Central Clearing and Clearing System.

Transfer from GEM to main board?

The GEM and the Main Board are two different types of markets. They cannot be converted to the Main Board, but they can both be traded.

The GEM, also known as the second board market or the second stock trading market, is a type of securities market different from the main board market. It is designed for entrepreneurial enterprises, small and medium-sized enterprises and high-tech industrial enterprises that are temporarily unable to be listed on the main board. A securities trading market that provides financing channels and growth space for companies that need financing and development.

Can GEM stocks be transferred to the main board?

It’s not allowed to be listed first. The GEM is an innovative enterprise.

How long does it take for the approval of the Hong Kong GEM to be transferred to the main board?

The review and approval time is one year

It is required to fully comply with the "Main Board Listing Rules", including the issuance of listing documents. Listing from one market to another is purely a commercial decision of the listed company. The Exchange will ensure that when a GEM issuer transfers its listing to the Main Board, the company's securities trading will be smoothly transitioned.

1. Qualifications for transfer (Article 9A.02 of the "Main Board Rules")

1. Meet the Main Board listing requirements;

2. Be listed on the GEM for more than 1 year;

3. In the 12 months before the application for transfer to the main board until listing on the main board, the company did not violate any listing rules and became the subject of disciplinary investigation by the exchange.

2. Transfer mechanism (Main Board Rules 9A.03(2) and 9A.08 and GEM Rules 9.26)

1. No sponsorship is required Person;

2. The issuer must publish an announcement, which must be reviewed in advance by the Listing Division and approved by the Listing Committee. The financial adviser does not have to comment on the letter that does not require public disclosure but requires a director's guarantee

How to handle the GEM transfer? How long does it take for the GEM transfer to take effect?

GEM transfer refers to an operation of transferring GEM stock shares to the main board market. The following is the general process and approximate effective time:

1. Contact the Securities Sales Department Or brokerage firm: As an investor, you need to contact your securities business department or brokerage firm and inform them that you want to transfer GEM stocks to the main board market.

2. Submit relevant application materials: According to the requirements of securities institutions, you need to fill in the application form and provide relevant securities information, such as GEM stock code, transfer number, etc.

3. Review and processing: The securities agency will review your application and handle it accordingly, including contacting and coordinating with the exchanges on the GEM and main board markets. The timing of this phase may vary by institution.

4. Announcement becomes effective: Under normal circumstances, the effective time of the GEM transfer is based on the regulations of the exchange and will take effect after the exchange announces it. The specific time may vary depending on the exchange's processing efficiency and work schedule, but is usually a few days to a few weeks.

Generally speaking, the processing time for GEM transfer will be affected by multiple factors, including the processing efficiency of securities institutions and the approval speed of exchanges. It is best to keep in close contact with your securities institution to understand the progress of the process and obtain an accurate time estimate.

What does transfer mean?

Transfer means that the company's shares are transferred from one stock exchange to another stock exchange for trading. This transfer may occur when a company's business development, market capitalization, liquidity or other reasons cause the company to wish to change the listing location of its shares.

Normally, companies will choose to transfer stocks from the lower market or secondary market to higher-level exchanges in order to increase the company's visibility, attract more investors, and obtain better market evaluation.

The transfer process needs to comply with relevant laws, regulations and exchange regulations, and undergo approval and review. Companies need to meet certain conditions, such as market value, financial status, liquidity and other requirements. Transferring a board may also involve some fees and charges.

The transfer will have a certain impact on investors, including changes in the exchange's regulatory rules, changes in market participants, changes in transaction execution methods, etc. Investors need to pay attention to relevant information and make reasonable investment decisions based on their own circumstances.

The above is the detailed content of What are the requirements for transferring from GEM to main board?. For more information, please follow other related articles on the PHP Chinese website!

What if KB5055683 Fails to Install? Here Are Some FixesApr 21, 2025 pm 08:03 PM

What if KB5055683 Fails to Install? Here Are Some FixesApr 21, 2025 pm 08:03 PMThe KB5055683 cumulative update is designed to improve the quality and reliability of .NET Framework 3.5, 4.8 and 4.8.1 in Windows 10 systems. If you encounter the failure of KB5055683 installation, how to solve it? This article will provide effective solutions. Windows 10 KB5055683 Update KB5055683 is a cumulative update for .NET Framework 3.5, 4.8 and 4.8.1 for Windows 10 22H2 versions, released on April 8, 2025. This update contains all security improvements from previous versions, but no new security improvements were added. It is recommended that you download and install KB50 as soon as possible

Fresh Guide! Fix REMATCH A D3D12-compatible GPU ErrorApr 21, 2025 pm 08:01 PM

Fresh Guide! Fix REMATCH A D3D12-compatible GPU ErrorApr 21, 2025 pm 08:01 PMEncountering the REMATCH D3D12-compatible GPU error on Windows? This guide provides solutions to get you back in the game. REMATCH, a multiplayer online football game, requires a graphics card supporting DirectX 12 (Feature Level 12.0, Shader Model

Clone a Hard Drive Without OS, Watch Pro Guide with Easy StepsApr 21, 2025 am 10:24 AM

Clone a Hard Drive Without OS, Watch Pro Guide with Easy StepsApr 21, 2025 am 10:24 AMThis guide shows you how to clone a hard drive even if your Windows system won't boot. MiniTool ShadowMaker simplifies this process. Windows boot failures are common, caused by issues like corrupted system files or MBR errors. Cloning your hard dri

League of Legends Play Button Not Working on PC: ResolvedApr 21, 2025 am 10:09 AM

League of Legends Play Button Not Working on PC: ResolvedApr 21, 2025 am 10:09 AMThe League of Legends game buttons do not work properly, resulting in the inability to enter the game? don’t worry! This guide will guide you to solve this problem quickly and effectively, allowing you to easily resume the game. Just follow the steps below to quickly resolve the game button issue! Quick navigation: League of Legends game buttons don't work How to fix League of Legends game buttons not working on PC Summarize League of Legends game buttons don't work As a MOBA game, League of Legends continues to attract global players and has a huge and stable player group. To enhance the gaming experience, Riot Games regularly releases updates to introduce new content, but this doesn't always go smoothly. Sometimes, some accidental technical failures may occur after a new update, such as League of Legends games

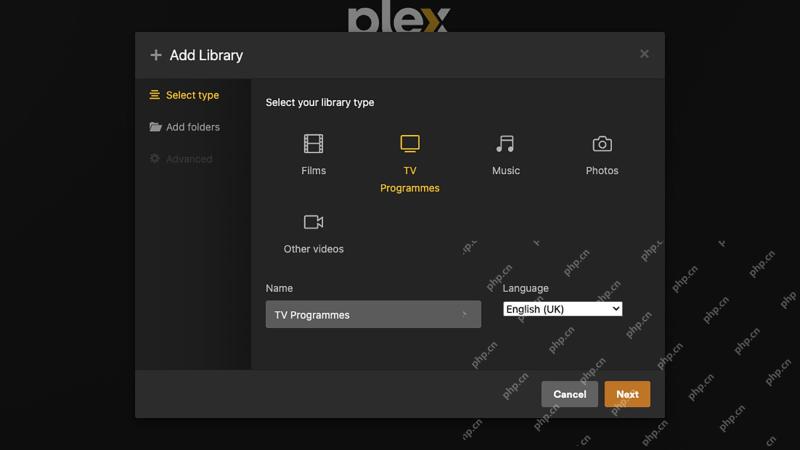

How to use Plex to create your own private Netflix or SpotifyApr 20, 2025 am 10:13 AM

How to use Plex to create your own private Netflix or SpotifyApr 20, 2025 am 10:13 AMBuild Your Own Streaming Service with Plex: A Step-by-Step Guide We're accustomed to on-demand content at our fingertips, thanks to services like Netflix and Spotify. However, building a personal media library offers unique advantages: ownership and

Spotlight on How to Fix Taskbar Search Bar Blank Box on WindowsApr 19, 2025 pm 08:06 PM

Spotlight on How to Fix Taskbar Search Bar Blank Box on WindowsApr 19, 2025 pm 08:06 PMTroubleshooting a Blank Windows 11/10 Taskbar Search Box A blank search bar in Windows 10 or 11 severely impacts usability. This guide offers solutions to resolve this common issue, preventing you from easily searching for apps and files. The Proble

How to Fix Forever Skies Crashing? Try the 6 Effortless WaysApr 19, 2025 pm 08:01 PM

How to Fix Forever Skies Crashing? Try the 6 Effortless WaysApr 19, 2025 pm 08:01 PMEncountering crashes in Forever Skies? This guide offers solutions to get your game running smoothly. We'll cover troubleshooting steps for crashes on startup and provide fixes for common causes. Forever Skies Crashes at Startup: Common Causes Fore

Device Manager Is Blank or Not Showing Anything? Fix It NowApr 19, 2025 pm 06:02 PM

Device Manager Is Blank or Not Showing Anything? Fix It NowApr 19, 2025 pm 06:02 PMTroubleshooting a Blank Device Manager in Windows Device Manager, a crucial Windows utility for managing hardware, can sometimes fail to display any content. This issue, often caused by disabled services or registry permission problems, can lead to v

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

SecLists

SecLists is the ultimate security tester's companion. It is a collection of various types of lists that are frequently used during security assessments, all in one place. SecLists helps make security testing more efficient and productive by conveniently providing all the lists a security tester might need. List types include usernames, passwords, URLs, fuzzing payloads, sensitive data patterns, web shells, and more. The tester can simply pull this repository onto a new test machine and he will have access to every type of list he needs.

DVWA

Damn Vulnerable Web App (DVWA) is a PHP/MySQL web application that is very vulnerable. Its main goals are to be an aid for security professionals to test their skills and tools in a legal environment, to help web developers better understand the process of securing web applications, and to help teachers/students teach/learn in a classroom environment Web application security. The goal of DVWA is to practice some of the most common web vulnerabilities through a simple and straightforward interface, with varying degrees of difficulty. Please note that this software

SAP NetWeaver Server Adapter for Eclipse

Integrate Eclipse with SAP NetWeaver application server.

MinGW - Minimalist GNU for Windows

This project is in the process of being migrated to osdn.net/projects/mingw, you can continue to follow us there. MinGW: A native Windows port of the GNU Compiler Collection (GCC), freely distributable import libraries and header files for building native Windows applications; includes extensions to the MSVC runtime to support C99 functionality. All MinGW software can run on 64-bit Windows platforms.

Safe Exam Browser

Safe Exam Browser is a secure browser environment for taking online exams securely. This software turns any computer into a secure workstation. It controls access to any utility and prevents students from using unauthorized resources.