Tiger Global sells out all Coinbase shares! Ark continues to sell and rebalance

- WBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBforward

- 2024-02-16 09:10:43913browse

According to the SEC 13F report, Tiger Global Management, Coinbase’s main investor before its public listing, had sold off all COIN shares at the end of last year. Thanks to the listing of the Bitcoin ETF and the recent rise in the cryptocurrency market, Coinbase's stock price has also performed well, with a return of 184% over the past year and institutional holdings of more than 50%.

Tiger Global is an early investor in Coinbase

Tiger Global Management is an American investment company established in March 2001, focusing on investments in the global network, software, consumer and financial technology industries. The firm primarily uses a private equity strategy to invest in early- to late-stage growth private companies, including Series A to pre-IPO stages. Since 2003, they have invested in hundreds of companies in more than 30 countries.

Tiger Global was a major investor in Coinbase before it went public, leading the exchange’s $300 million Series E financing in October 2018. At that time, Tiger Global Management took the lead in the investment, while Y Combinator Continuity, Wellington Management, Andreessen Horowitz, Polychain and other institutions also participated in this round of financing.

According to the SEC13F report, Tiger Global sold out all COIN stocks at the end of last year. In last year's third quarter, the company also held 38,850 shares worth $2.9 million. Taking profits due to a different view of its prospects? Or are there other better investment targets?

We can see from the report that the stocks owned by Tiger Global include Alphabet, Amazon, Meta, NVIDIA, TSMC, and the recently popular ARM. I believe its performance must be very bright.

Ark sells Coinbase for rebalancing

Ark Investment (ArkInvest) sold 214,068 shares of Coinbase on 2/14. Based on yesterday’s closing price of $160, the total value was approximately 34.25 million. Dollar. Specifically, ARKK reduced its holdings by 152,600 shares, ARKF reduced its holdings by 30,009 shares, and ARKW reduced its holdings by 31,459 shares.

However, Ark’s move was because Coinbase’s increase was too large and it needed to be rebalanced to maintain its proportion in the overall fund.

Coinbase’s institutional shareholding ratio is as high as 50%

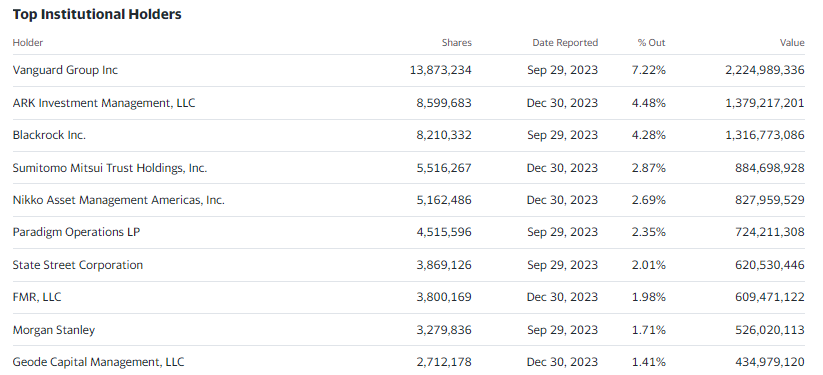

According to Yahoo Finance, Coinbase’s institutional shareholding ratio is as high as 52.18%. Including Vangaurd, Ark Investment, BlackRock, Sumitomo Mitsui Trust, etc., most of them are ETFs and other investment products purchased by financial institutions on behalf of their customers.

The above is the detailed content of Tiger Global sells out all Coinbase shares! Ark continues to sell and rebalance. For more information, please follow other related articles on the PHP Chinese website!

Related articles

See more- Web3.0 is coming! Is it front-end friendly?

- 2023 Zhongguancun Forum | Will Web 3.0 be the 'antidote' to the proliferation of AI fraud?

- Bitcoin mining companies invested more than $1.2 billion in mining machines! Mining machine manufacturers achieve maximum profits

- Grayscale transferred 9,000 Bitcoins to Coinbase, GBTC had a net outflow of $1.16 billion in three days

- What are the online exchanges for OM Coin? How is OM Coin performing?