Computer Tutorials

Computer Tutorials Troubleshooting

Troubleshooting What does the Shenzhen Stock Exchange Main Board start with 00, what does it mean?

What does the Shenzhen Stock Exchange Main Board start with 00, what does it mean?What does the Shenzhen Stock Exchange Main Board start with 00, what does it mean?

#What does the Shenzhen Main Board mean at the beginning of 00?

"Shenzhen Main Board starting with 00" refers to the stocks listed on the Shenzhen Stock Exchange, and the stock code starts with "00". The Shenzhen Stock Exchange Main Board is part of the Chinese stock market and corresponds to the Shanghai Stock Exchange Main Board (stock code starting with "60"). Shenzhen Stock Exchange is a stock exchange in mainland China established in 1990. The Shenzhen Main Board is one of the main sections of the Shenzhen Stock Exchange. It is mainly aimed at mature enterprises and large companies, and has high listing thresholds and strict regulatory requirements. Companies listed on the main board of the Shenzhen Stock Exchange usually have a certain scale and performance foundation, and have high visibility and market influence. The stocks of these companies are traded on the main board of the Shenzhen Stock Exchange, and investors can buy and sell through stock exchanges or securities brokers. It should be noted that stock market investment involves risks, and investors should carefully evaluate the risks and returns and make investment decisions based on their own investment objectives and risk tolerance. At the same time, investors should also understand relevant laws, regulations and regulatory requirements to ensure that their investment behavior complies with regulations.

What is the difference between the Shanghai Stock Exchange Main Board and the Shenzhen Stock Exchange Main Board?

The Shanghai Stock Exchange Main Board and the Shenzhen Stock Exchange Main Board are the two major securities markets in China. They have some differences in systems, rules, stock codes and market scale.

System: The Shanghai Stock Exchange Main Board implements an approval system, that is, only after companies submit applications to the China Securities Regulatory Commission and obtain approval can they publicly issue stocks and be listed for trading. The main board of the Shenzhen Stock Exchange implements a registration system. Companies can be listed and traded on the Shenzhen Stock Exchange after submitting an application to the China Securities Regulatory Commission and being approved.

Rules: The Shanghai Stock Exchange Main Board and the Shenzhen Stock Exchange Main Board have some different rules and requirements in terms of information disclosure, corporate governance, ownership structure, etc. For example, the Shanghai Stock Exchange Main Board requires listed companies to disclose the accuracy, authenticity, completeness and timeliness of financial statements; while the Shenzhen Stock Exchange Main Board has stricter information disclosure requirements for companies.

Stock Code: The stock code of the Shanghai Stock Exchange Main Board starts with 60, while the stock code of the Shenzhen Stock Exchange Main Board starts with 000. This is because 60 is regarded as an auspicious number in Chinese culture, so many investors are more willing to buy stocks starting with 60.

Market size: The Shanghai Stock Exchange is one of the largest securities markets in China, with more than 210,000 listed companies and more than 18 million investors. The Shenzhen Stock Exchange is China's second largest securities market, with more than 130,000 listed companies and more than 7.7 million investors. Therefore, there are certain differences in the status and influence of the Shenzhen Stock Exchange Main Board and the Shanghai Stock Exchange Main Board in the market. The Shanghai Stock Exchange Main Board is China's "A-share market". It is one of the markets with the largest number of listed companies, the largest market value, and the strongest liquidity. It is also the market that investors pay the most attention to. The Shenzhen Stock Exchange Main Board is China's "B-share market", mainly for foreign investors and institutional investors, and is one of the important channels for Chinese companies to raise overseas financing. In addition, the Shanghai Stock Exchange main board and the Shenzhen Stock Exchange have different regulations and requirements for investors. The main board of the Shanghai Stock Exchange is strictly supervised by the China Securities Regulatory Commission, which has higher requirements on the financial status, business model and risk control of enterprises. The Shenzhen Stock Exchange is relatively loose and has lower requirements on the operating conditions and management capabilities of enterprises. To sum up, there are some differences between the Shanghai Stock Exchange Main Board and the Shenzhen Stock Exchange Main Board in terms of systems, rules, stock codes, market size and market supervision. When making investment decisions, investors need to fully understand the characteristics and requirements of these two markets in order to make wise investment decisions.

Shenzhen Main Board, what does it mean?

The sectors of the Shenzhen Stock Exchange include: main board, small and medium-sized board and GEM. The code for the Shenzhen main board is 000XXX, the code for the small and medium-sized board is 002XXX, and the code for the GEM is 300XXX. The Shenzhen Stock Exchange (hereinafter referred to as the "Shenzhen Stock Exchange") was established on December 1, 1990. It provides venues and facilities for centralized securities trading, organizes and supervises securities transactions, and performs responsibilities stipulated in relevant national laws, regulations, rules, and policies. , a legal person that implements self-discipline management. The main functions of the Shenzhen Stock Exchange include: providing venues and facilities for securities trading; formulating business rules; reviewing securities listing applications and arranging securities listing; organizing and supervising securities transactions; supervising members; supervising listed companies; managing and publishing market information ;Other functions permitted by the China Securities Regulatory Commission.

What does Shenzhen New Main Board mean?

In fact, the full name of the Shenzhen Stock Exchange Main Board should be called the Shenzhen Stock Exchange Main Board Market. Generally speaking, the stock exchanges in various countries are the main board markets of their respective countries. In my country, the Shanghai Stock Exchange and the Shenzhen Stock Exchange They are all main board markets, also known as the first board market and stock market.

In the eyes of investors, the Shenzhen Stock Exchange Main Board and the Listed Main Board are barometers of the national economy, reflecting the macroeconomics of the entire country's financial market. For the Shenzhen Stock Exchange main board, its main targets in terms of stock issuers are those listed companies that are mature, have stable and sustainable development, have a high capital scale, and have strong profitability. In this regard, the Shanghai Stock Exchange The conditions are the same as those of the Shenzhen Stock Exchange, both to increase investors' trust in the entire market.

What is the difference between Shenzhen Main Board and GEM ST?

The GEM is specifically for entrepreneurial companies, small and medium-sized enterprises and high-tech industries that are temporarily unable to be listed on the main board. ST stocks usually refer to stocks that need to be "specially treated", that is, the stock's corresponding financial status or other Stocks that require special handling when stock trading occurs due to abnormal conditions. So what is the difference between it and the GEM?

The difference between GEM and ST stocks

Different rise and fall rates

There is no limit on the rise or fall of GEM stocks in the first five trading days of listing. From the sixth trading day Starting from the beginning of the day, a 20% increase and decrease limit will be set; during the "delisting consolidation period", the stocks of ST stocks will be moved to the "delisting consolidation board" for trading on another board, and will no longer be displayed in the GEM stock market. The increase or decrease limit is 10 %.

Different operating capabilities

The management level of GEM stocks is normal or improving, while ST stocks generally have negative audited net profits and operating income in the most recent fiscal year Less than 100 million yuan, or the net profit in the most recent fiscal year after retrospective restatement is negative and the operating income is less than 100 million yuan.

The actual profit level is different

The operating income of GEM stock companies mainly comes from the main business income and has the ability to continue operating; the operating income of ST-share listed companies mainly comes from the main business income. The company has obviously lost its ability to continue operating due to trading business that has nothing to do with its operating business or related transactions that have no commercial substance.

The above is the detailed content of What does the Shenzhen Stock Exchange Main Board start with 00, what does it mean?. For more information, please follow other related articles on the PHP Chinese website!

Clone a Hard Drive Without OS, Watch Pro Guide with Easy StepsApr 21, 2025 am 10:24 AM

Clone a Hard Drive Without OS, Watch Pro Guide with Easy StepsApr 21, 2025 am 10:24 AMThis guide shows you how to clone a hard drive even if your Windows system won't boot. MiniTool ShadowMaker simplifies this process. Windows boot failures are common, caused by issues like corrupted system files or MBR errors. Cloning your hard dri

League of Legends Play Button Not Working on PC: ResolvedApr 21, 2025 am 10:09 AM

League of Legends Play Button Not Working on PC: ResolvedApr 21, 2025 am 10:09 AMThe League of Legends game buttons do not work properly, resulting in the inability to enter the game? don’t worry! This guide will guide you to solve this problem quickly and effectively, allowing you to easily resume the game. Just follow the steps below to quickly resolve the game button issue! Quick navigation: League of Legends game buttons don't work How to fix League of Legends game buttons not working on PC Summarize League of Legends game buttons don't work As a MOBA game, League of Legends continues to attract global players and has a huge and stable player group. To enhance the gaming experience, Riot Games regularly releases updates to introduce new content, but this doesn't always go smoothly. Sometimes, some accidental technical failures may occur after a new update, such as League of Legends games

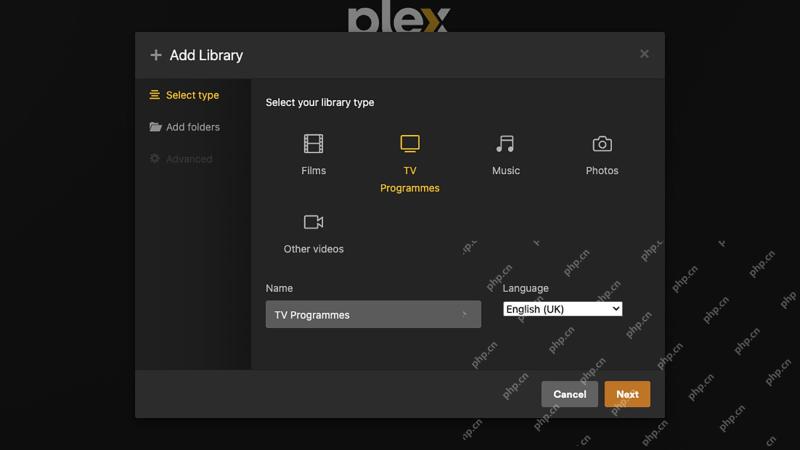

How to use Plex to create your own private Netflix or SpotifyApr 20, 2025 am 10:13 AM

How to use Plex to create your own private Netflix or SpotifyApr 20, 2025 am 10:13 AMBuild Your Own Streaming Service with Plex: A Step-by-Step Guide We're accustomed to on-demand content at our fingertips, thanks to services like Netflix and Spotify. However, building a personal media library offers unique advantages: ownership and

Spotlight on How to Fix Taskbar Search Bar Blank Box on WindowsApr 19, 2025 pm 08:06 PM

Spotlight on How to Fix Taskbar Search Bar Blank Box on WindowsApr 19, 2025 pm 08:06 PMTroubleshooting a Blank Windows 11/10 Taskbar Search Box A blank search bar in Windows 10 or 11 severely impacts usability. This guide offers solutions to resolve this common issue, preventing you from easily searching for apps and files. The Proble

How to Fix Forever Skies Crashing? Try the 6 Effortless WaysApr 19, 2025 pm 08:01 PM

How to Fix Forever Skies Crashing? Try the 6 Effortless WaysApr 19, 2025 pm 08:01 PMEncountering crashes in Forever Skies? This guide offers solutions to get your game running smoothly. We'll cover troubleshooting steps for crashes on startup and provide fixes for common causes. Forever Skies Crashes at Startup: Common Causes Fore

Device Manager Is Blank or Not Showing Anything? Fix It NowApr 19, 2025 pm 06:02 PM

Device Manager Is Blank or Not Showing Anything? Fix It NowApr 19, 2025 pm 06:02 PMTroubleshooting a Blank Device Manager in Windows Device Manager, a crucial Windows utility for managing hardware, can sometimes fail to display any content. This issue, often caused by disabled services or registry permission problems, can lead to v

Encountering Schedule I Slow Motion on PC? Resolve It Here!Apr 19, 2025 pm 06:01 PM

Encountering Schedule I Slow Motion on PC? Resolve It Here!Apr 19, 2025 pm 06:01 PMSolve the slow motion problem of "Schedule I" PC version and enjoy a smooth gaming experience! Many players encounter annoying slow motion problems while playing Schedule I on PC, and this article will provide the best solution. Quick navigation: Question: Schedule I Slow Motion Method 1: Disable Vertical Synchronization (VSync) Method 2: Run the game with a standalone graphics card Method 3: Update/uninstall the graphics card driver Method 4: Update DirectX Summarize Schedule I is a popular indie game where players make and sell drugs. Fans of Breaking Bad will especially like the game because it has a lot of tribute elements. The game is currently in the early stage of experience

RuneScape: Dragonwilds Fatal Error? Try Those Five Ways!Apr 18, 2025 pm 08:06 PM

RuneScape: Dragonwilds Fatal Error? Try Those Five Ways!Apr 18, 2025 pm 08:06 PMEncountering a fatal error in RuneScape: Dragonwilds? Many players experience this frustrating issue. This guide offers five potential solutions to get you back in the game! Troubleshooting RuneScape: Dragonwilds Fatal Errors RuneScape: Dragonwilds,

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

ZendStudio 13.5.1 Mac

Powerful PHP integrated development environment

mPDF

mPDF is a PHP library that can generate PDF files from UTF-8 encoded HTML. The original author, Ian Back, wrote mPDF to output PDF files "on the fly" from his website and handle different languages. It is slower than original scripts like HTML2FPDF and produces larger files when using Unicode fonts, but supports CSS styles etc. and has a lot of enhancements. Supports almost all languages, including RTL (Arabic and Hebrew) and CJK (Chinese, Japanese and Korean). Supports nested block-level elements (such as P, DIV),

Atom editor mac version download

The most popular open source editor

VSCode Windows 64-bit Download

A free and powerful IDE editor launched by Microsoft

Zend Studio 13.0.1

Powerful PHP integrated development environment