SEC Chairman Gary Gensler responded for the first time to the progress of the Bitcoin spot ETF review

- 王林forward

- 2024-01-19 18:21:12775browse

Market investors are focusing on whether the U.S. Securities and Exchange Commission (SEC) will approve a Bitcoin spot ETF early next year. In recent weeks, the SEC has been actively meeting and negotiating with several institutions applying for Bitcoin spot ETFs.

Gensler initially refused to respond to the Bitcoin Spot ETF issue

In the past, SEC Chairman Gary Gensler has been cautious about the progress of the Bitcoin Spot ETF review and has not disclosed specific details. However, after a meeting on the U.S. Treasury market, Gensler maintained his usual style and did not disclose any information when asked by Bloomberg TV reporter Kailey Leinz about the status of Bitcoin spot ETF applications.

“The U.S. Treasury market is worth $26 trillion. It’s actually the core of our entire capital market. It’s not just a way for the government to raise capital… and you’re asking me about cryptocurrencies?”

Gensler bluntly said that Leinz had not figured out his priorities, and then said: Where should your focus be? The U.S. Treasury bond market is an extremely important and far-reaching market. Not only are crypto securities markets much smaller by comparison, they are not the vehicle through which we fund governments or conduct monetary policy. In addition, many investors have suffered losses in the crypto market, and one of the reasons for these losses is the excessive irregularities in the market. And these noncompliances are not limited to violations of securities laws, but also include violations of numerous other laws.

After the reporter asked, Gensler responded for the first time.

After the reporter Leinz asked, Gensler expressed his views on the Bitcoin spot ETF for the first time. He said they would act within their powers and the court's interpretation of those powers, and that's what they're going to do here.

His comments were generally interpreted as optimistic by the community. Rich Quack, who has 300,000 followers, responded: "This sounds like positive development! Exciting progress on the approval of the Bitcoin Spot ETF."

Bitcoin ETF Latest Development

SEC approves rule change for Hashdex Bitcoin Futures “Fund” to be restructured into “ETF”

According to the SEC filing announcement, New York Stock Exchange Arca has submitted a rule change proposal to the SEC aimed at converting Hashdex Bitcoin Futures "Fund" was changed to Hashdex Bitcoin Futures "ETF". This change will transfer the assets and liabilities of the original fund to the new ETF and automatically convert shareholders of the original fund into shareholders of the new ETF.

The SEC has approved this change, concluding that it will not have a material impact on investor protection or the public interest, nor will it create an unnecessary burden on competition.

Bloomberg analyst James Seyffart added that he believes this is an approval order to transfer Hashdex from Teucrium Commodities Trust to Tidal Commodities Trust I (Tidal Commodities Trust I).

Bitwise’s Bitcoin spot ETF has been listed on DTCC

In addition, the latest list of the United States Securities Depository and Clearing Corporation (DTCC) shows that Bitwise’s Bitcoin spot ETF “BITWISE BITCOIN ETF” It has been officially included in the active and pre-release list, with the trading code BITB.

Note: In October, a DTCC spokesperson stated that inclusion in the list was only part of preparations for the launch of new ETF products and was carried out in accordance with "standard procedures". This does not mean that the ETF has received any form of approval. regulatory approval or other review processes.

Key time for SEC’s next review

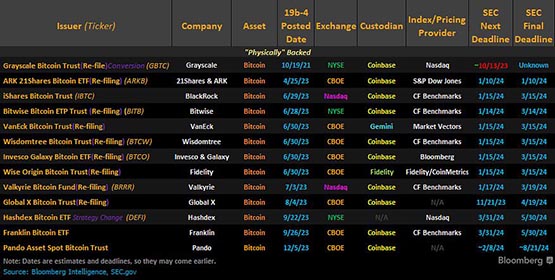

According to Bloomberg analyst James Seyffart, we can see that the SEC will raise another review in mid-January next year Important time for opinions.

The above is the detailed content of SEC Chairman Gary Gensler responded for the first time to the progress of the Bitcoin spot ETF review. For more information, please follow other related articles on the PHP Chinese website!

Related articles

See more- Can blockchain only use Go language?

- Blockchain and smart contract technology in PHP

- Use Python to build a blockchain security application framework

- Which country has the highest acceptance of Bitcoin?

- Summary of fees for various Bitcoin spot ETFs: Grayscale fees are up to 1.5%, and Ark and Bitwise are free in the initial stage.