The trend of consumer AR glasses.

In 2023, virtual reality (VR) will decline and augmented reality (AR) will flourish. When Pico and other virtual reality manufacturers reported news of layoffs and plummeting sales, augmented reality has been making rapid progress, bringing a glimmer of hope to the weak head-mounted display market

A recent report released by IDC states that sales of AR devices in China are expected to reach 240,000 units by 2023, an increase of 133.9% from last year. In addition, the agency also predicts that the growth rate of China’s AR market may reach 101.0% by 2023

VR (Virtual Reality) means virtual reality, and AR (Augmented Reality) means augmented reality. The products of both are currently mainly used in games, audio-visual entertainment and other scenarios, and the unit price of the products is between 2,000-3,000 yuan. VR attempts to create a completely virtual experience, while AR combines virtual and real scenes to produce auxiliary effects, such as translation, office assistance and other business needs. Because of this, AR glasses are regarded as the next smart terminal after smartphones.

Apple’s launch of Vision Pro is undoubtedly symbolic. This summer, the company announced Apple Vision Pro at the WWDC2023 developer conference. People wear Apple Vision Pro and can open apps and operate unfinished tasks on Mac computers using only their eyes, and can also take photos.

It is reported that Apple Vision Pro has achieved mass production, and the supply chain is ready to produce 1 million units annually. The new product will be released in North America in January 2024. In fact, in the past year, not only emerging brands such as Rokid and Thunderbird have joined the competition, but also mobile phone manufacturers such as Xiaomi, Huawei, and Lenovo have entered the game.

Behind the extraordinary market buzz, a war to reconstruct consumer electronics with AR has quietly begun. For example, Micro-LED, optical waveguide and other technologies have become the core technologies of AR equipment and have attracted the attention of funds and startups. Yibang Power sorted out the upstream and downstream participants in the AR equipment industry chain, trying to understand this ecological reconstruction and the development trend of consumer-grade AR glasses

01

Micro LED overall mass production breakthroughListed companies with display solutions benefit

In January 2024, the Apple Vision Pro released in North America will reportedly be equipped with a silicon-based OLED screen. Its PPD (Pixels per Degree, angular resolution) value is about 35-40, which is higher than similar competing products and closer to the human eye.

A complete AR glasses mainly consists of four modules, including shooting, processing, display and interaction. Among them, the display module is the core of AR glasses, accounting for 50-70% of the entire hardware cost. The hardware equipment of the display module includes display screens composed of silicon-based OLEDs, Micro LEDs, etc., as well as imaging elements composed of Birdbath, optical waveguides and free-form surfaces

The silicon-based OLED screen equipped with Apple Vision Pro, also known as OLEDoS, can reduce the size of a single pixel to about 1/10, thereby improving display accuracy and making the augmented reality (AR) effect more realistic. However, in bright environments, the display effect of silicon-based OLED will be affected. Micro LED can solve this brightness defect, but its process is more difficult and the yield rate is not as good as silicon-based OLED

Yibang Power counted and compared the consumer-grade AR glasses launched in the past two years and found that among the 9 AR glasses launched last year (as of October 2022), only 2 used Micro LED displays, but this year ( As of October 2023), 4 models of glasses use this screen.

In recent years, the rapid rise of consumer-grade augmented reality technology (AR) has also driven a number of liquid crystal display (LCD) and organic light-emitting diode (OLED) manufacturers to upgrade their products and find new applications beyond smartphones and TVs. room for growth. The annual output of Apple Vision Pro has reached 1 million units, largely due to the support of Chinese suppliers, including Lingyi Intelligent Manufacturing and Luxshare Precision

Yibang Power has sorted out 23 listed companies in the AR supply chain, including 9 optical imaging solution providers, 5 chip and chip packaging companies, 5 display integration companies, 2 acoustic solution providers and foundries. . In the past year, the revenue of 5 chip and chip packaging companies has declined overall, while the revenue of 6 of the 9 optical solution companies has declined year-on-year

For example, Rockchip, which makes chips, had revenue of 1.242 billion yuan in the first half of 2022, down 31.23% to 853 million yuan in the same period this year; China Optics, an optical solution service provider, had revenue of 1.784 billion yuan in the first half of last year. But the decline in the same period this year was as high as 35%.

There are 5 display screen companies, but there are still 3 that maintain revenue growth. Especially Leyard, its revenue in the first half of last year was 3.702 billion yuan, which increased by 8.54% to 4.018 billion yuan in the same period this year. Leyard's revenue from the Micro LED product line has also increased significantly. In the first half of this year, the sales of Micro LED products were nearly 200 million yuan, close to the full-year level in 2022.

In this case, the stock price representing market expectations has a higher reference value. Yibang Power found that the stock prices of 18 listed companies increased year-on-year, including 5 display solution providers and 2 acoustic solution companies. Among display solution providers, Visionox (65.2%), Leyard (11.47%) and Shentianma A (9.31%) have the fastest rising stock prices

This may be due to its layout on Micro LED. For example, Leyard has achieved a technological breakthrough in this direction in the second half of last year, and its black diamond series products were officially mass-produced in October; Shentianma said this year that it has developed 70%-80% of the technology and is expected to launch the product in 2025 and 2026. Achieve small-scale mass production; Visionox mainly provides OLED displays for head phones and wearable devices. This year, it also extended its tentacles to Micro LED through equity participation. The equity-joining company Chengdu Chenxian Optoelectronics will achieve mass production in 2024. Shipping.

As far as display solutions are concerned, Micro LED, despite its rapid growth, is still an incremental business. The main business of these listed companies is still the production of LED screens for terminal equipment such as mobile phones and TVs. Therefore, in the short term, the contribution of new technologies to revenue and the boost to stock prices may have a certain effect, but it will be more pragmatic.

The biggest change in AR glasses displays this year is that companies are paying more attention to small innovations in details such as size and color. For example, in the past two years, Micro LED manufacturer Leiyu has successively developed 0.39-inch microdisplay chips and 0.22-inch Micro LED full-color microdisplays. In terms of color, manufacturers in the past could only develop single-color Micro LEDs. However, full-color Micro LED has appeared at this year's exhibition and Thunderbird new product launch.

02

The primary market is keen on optical device manufacturersOptical waveguide may be the mainstream choice in the future

AR display module consists of two major components. Display screens are mostly dominated by traditional LED manufacturers and are popular in the secondary market. Optical imaging components, although there are 9 listed companies, are still the targets of venture capital.

According to incomplete statistics from Yibang Power, from the beginning of this year to October, a total of 20 rounds of financing took place around the AR glasses industry, including 6 terminal brands, 4 optical solution providers, 2 each for chips and displays, and 1 All acoustic solution providers have received financing. In addition to brands, most venture capital has poured into optical component manufacturers.

The main optical solutions of AR glasses are divided into optical waveguide, Birdbath, free-form surface and prism. According to data released by China Mobile, the proportion of AR glasses released globally in 2022 using optical waveguides, Birdbath and free-form surfaces will be 36%, 32% and 20% respectively.

Thanks to the early realization of large-scale mass production, Birdbath is the mainstream choice of Chinese AR glasses manufacturers. In terms of display performance and convenience alone, the display solutions for AR glasses are developing in the direction of Micro LED optical waveguides. For example, the Pioneer Edition of Thunderbird smart glasses uses Micro LED holographic optical waveguides.

At present, optical waveguide solutions are faced with difficulties such as difficulty in mass production and high cost, and are more used in B-end products, thus becoming the reason for attracting the influx of hot money. Yibang Dynamics noticed that the four optical solution providers that received financing this year all chose optical waveguide solutions. They are Zhige Technology, Kunyou Optoelectronics, Sanji Optoelectronics and Lingxi Micro Light.

From a technical perspective, the above-mentioned four optical waveguide solution providers have different choices. At present, the mainstream optical waveguide solutions are divided into array optical waveguides and diffraction optical waveguides. It has long been a consensus in the industry that birdbaths are considered a transitional solution due to issues with light transmittance and volume. The biggest change in the industry this year is that diffraction optical waveguide solutions replace arrays, which may gradually become mainstream

Among the four companies that received financing, except for Lingxi Micro-light, which chose the array optical waveguide solution, Zhige Technology, Kunyou Optoelectronics, and Sanji Optoelectronics all chose the diffractive optical waveguide solution. Judging from the amount disclosed, the single financing of Zhige Technology and Kunyou Optoelectronics this year has reached the level of 100 million yuan. Lingxi Weiguang conducted two rounds of equity financing in succession this year, and the amount of financing was not disclosed.

Compared with array optical waveguides, one of the advantages of diffraction optical waveguides is that they are lighter. The relevant person in charge of Thunderbird Innovation told Yibang Power that the advantage of diffraction optical waveguide is two-dimensional pupil expansion, which can also reduce the thickness of the temples. In contrast, using an array optical waveguide solution will cause the temples to be too thick and significantly block the field of view. The two new AR glasses released by Thunderbird this year are equipped with diffraction light waveguide solutions for the first time.

Wu Bin, Vice President of Thunderbird Innovation, said that the diffraction ratio array is more mature in large-scale mass production. As the diffraction solution enters the mass production stage faster, the advantages will be more obvious. This view was also confirmed by the relevant person in charge of Rokid.

Downstream complete machine manufacturers or brand owners support upstream start-ups through orders or investment in shares, thereby controlling the supply chain of core components, controlling production capacity and reducing costs. This is especially common in the consumer electronics industry. For example, in foreign countries, a "fruit chain" was formed around Apple, while in China, parts manufacturers formed a "rice chain" around Xiaomi

This symbiotic ecosystem is gradually taking shape in the AR glasses industry. For example, in the field of optical solutions, OPPO and Xiaomi not only supported Zhige Technology with orders, but also spent real money to invest in the company; Huawei released its first viewing glasses, Vision Glass, last year, and its subsidiary Hubble Investment is also Kunyou. Shareholders of Optoelectronics.

Someone has dismantled the hardware of Huawei Vision Glass. According to the country where the supplier belongs, the cost of Chinese suppliers is US$165.9, accounting for 91.7%, and the remaining 8.3% is divided between merchants in the United States, Japan and Italy.

03

3 mobile phone manufacturers enter the market to launch new productsThe competition pattern of AR glasses may break

Breakthroughs in key technologies and hardware, the gradual improvement of the upstream ecosystem, and the continued enthusiasm of investors are also driving a new situation in terminal brands and products.

Enthusiasm from the market is letting investors enter the AR field. As of the end of October this year, six brands, including Rokid, Thunderbird Technology and Liangliang Vision, have received new money. According to data from Qichacha, the single financing amount of two companies, Rokid and Gongxiang, is nearly 100 million yuan. At a time when investments are becoming more prudent, such an amount of financing is rare.

The introduction of new AR glasses is also accelerating significantly. According to incomplete statistics from Yibang Power, from January to October 2022, 6 AR glasses companies released a total of 9 new products. However, during the same period this year, 8 companies released at least 12 new products, many of which were releasing new products for the first time, including 1 model from Mijia and 1 model from Nubia.

Tribute to the unknown, founded in August 2022, released two new products at once in July this year. Pay tribute to unknown CEO Wu Dezhou, who has attracted much attention because he has held important positions in Byte, Smartisan Technology and Honor, and pay tribute to unknown investors including Alibaba.

These new entrants to the market may disrupt the existing industry structure. According to iResearch’s report, in the first half of this year, among the major online channels, the top five brands in the AR glasses market share were Thunderbird (32.9%), Xreal (22.9%, formerly Nreal), and Rokid (19.7%). %), Huawei (11%) and INMO (5.2%). Compared with last year, this ranking has not changed significantly. The most eye-catching one is Huawei

Huawei’s first movie-viewing AR glasses released in December last year have occupied 11% of the market share in the first half of this year, ranking fourth. Two mobile phone manufacturers, Xiaomi and Huawei, have joined this field this year, trying to change the industry's competitive landscape with their natural advantages in channels and brand awareness. Also in November this year, Meizu also released their first AR glasses

However, Thunderbird, Xreal, Rokid and INMO, known as the Four Little Dragons of AR, still occupy nearly 90% of the market share. Compared with major manufacturers such as Xiaomi and Huawei, leading players such as Thunderbird, Xreal, and Rokid have the advantage of entering the game earlier, and they still maintain a certain speed of new products, that is, two new products have been released every year in the past two years.

Analyzing new products in the past two years, it is not difficult to see the changes in technology preferences in the industry. For example, in terms of optical solutions, Birdbath has been the mainstream choice since it achieved mass production two years ago and is more mature. Four of the nine new products released last year and five of the 12 new products this year all chose this option.

The diffraction optical waveguide solution has gradually become a mainstream solution, which is also reflected in new terminal products. For example, in 2022, there will be two products using array optical waveguide and diffraction optical waveguide solutions. But this year, Yingmu and Thunderbird respectively abandoned the previously used array and BirdBath solutions and chose the diffraction light waveguide solution. As a result, there are 4 new products using this solution this year.

The rewritten content is: In addition to the technical route, another factor that disrupts the industry structure is price. According to media reports, the current price of mainstream AR glasses is approximately US$1,000-5,000. However, since last year, some domestic brands have continued to lower prices and even launched products for less than a thousand yuan. In the next 2024, if these brands cannot widen the gap in technology, price may become the focus of fierce competition

These lively market noises are largely due to people’s belief that AR glasses may be another device after smartphones that can carry huge user scenarios and business potential. Nowadays, the entire industry chain is in motion, and funds and startups are betting on it, but it is still unclear where the trend will go.

Source: Yibang Power

The above is the detailed content of AR surges against the trend, who is betting wildly?. For more information, please follow other related articles on the PHP Chinese website!

The Hidden Dangers Of AI Internal Deployment: Governance Gaps And Catastrophic RisksApr 28, 2025 am 11:12 AM

The Hidden Dangers Of AI Internal Deployment: Governance Gaps And Catastrophic RisksApr 28, 2025 am 11:12 AMThe unchecked internal deployment of advanced AI systems poses significant risks, according to a new report from Apollo Research. This lack of oversight, prevalent among major AI firms, allows for potential catastrophic outcomes, ranging from uncont

Building The AI PolygraphApr 28, 2025 am 11:11 AM

Building The AI PolygraphApr 28, 2025 am 11:11 AMTraditional lie detectors are outdated. Relying on the pointer connected by the wristband, a lie detector that prints out the subject's vital signs and physical reactions is not accurate in identifying lies. This is why lie detection results are not usually adopted by the court, although it has led to many innocent people being jailed. In contrast, artificial intelligence is a powerful data engine, and its working principle is to observe all aspects. This means that scientists can apply artificial intelligence to applications seeking truth through a variety of ways. One approach is to analyze the vital sign responses of the person being interrogated like a lie detector, but with a more detailed and precise comparative analysis. Another approach is to use linguistic markup to analyze what people actually say and use logic and reasoning. As the saying goes, one lie breeds another lie, and eventually

Is AI Cleared For Takeoff In The Aerospace Industry?Apr 28, 2025 am 11:10 AM

Is AI Cleared For Takeoff In The Aerospace Industry?Apr 28, 2025 am 11:10 AMThe aerospace industry, a pioneer of innovation, is leveraging AI to tackle its most intricate challenges. Modern aviation's increasing complexity necessitates AI's automation and real-time intelligence capabilities for enhanced safety, reduced oper

Watching Beijing's Spring Robot RaceApr 28, 2025 am 11:09 AM

Watching Beijing's Spring Robot RaceApr 28, 2025 am 11:09 AMThe rapid development of robotics has brought us a fascinating case study. The N2 robot from Noetix weighs over 40 pounds and is 3 feet tall and is said to be able to backflip. Unitree's G1 robot weighs about twice the size of the N2 and is about 4 feet tall. There are also many smaller humanoid robots participating in the competition, and there is even a robot that is driven forward by a fan. Data interpretation The half marathon attracted more than 12,000 spectators, but only 21 humanoid robots participated. Although the government pointed out that the participating robots conducted "intensive training" before the competition, not all robots completed the entire competition. Champion - Tiangong Ult developed by Beijing Humanoid Robot Innovation Center

The Mirror Trap: AI Ethics And The Collapse Of Human ImaginationApr 28, 2025 am 11:08 AM

The Mirror Trap: AI Ethics And The Collapse Of Human ImaginationApr 28, 2025 am 11:08 AMArtificial intelligence, in its current form, isn't truly intelligent; it's adept at mimicking and refining existing data. We're not creating artificial intelligence, but rather artificial inference—machines that process information, while humans su

New Google Leak Reveals Handy Google Photos Feature UpdateApr 28, 2025 am 11:07 AM

New Google Leak Reveals Handy Google Photos Feature UpdateApr 28, 2025 am 11:07 AMA report found that an updated interface was hidden in the code for Google Photos Android version 7.26, and each time you view a photo, a row of newly detected face thumbnails are displayed at the bottom of the screen. The new facial thumbnails are missing name tags, so I suspect you need to click on them individually to see more information about each detected person. For now, this feature provides no information other than those people that Google Photos has found in your images. This feature is not available yet, so we don't know how Google will use it accurately. Google can use thumbnails to speed up finding more photos of selected people, or may be used for other purposes, such as selecting the individual to edit. Let's wait and see. As for now

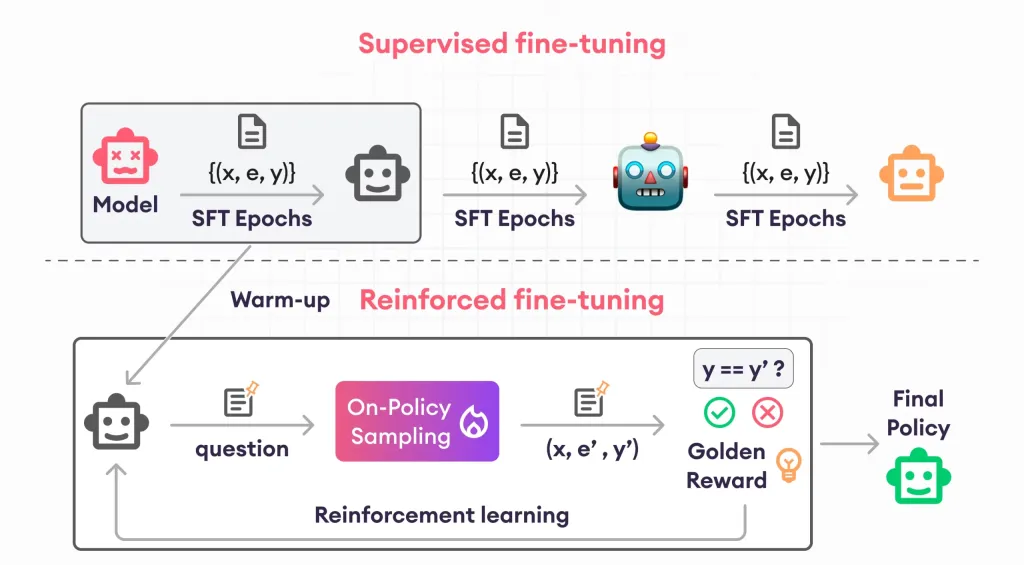

Guide to Reinforcement Finetuning - Analytics VidhyaApr 28, 2025 am 09:30 AM

Guide to Reinforcement Finetuning - Analytics VidhyaApr 28, 2025 am 09:30 AMReinforcement finetuning has shaken up AI development by teaching models to adjust based on human feedback. It blends supervised learning foundations with reward-based updates to make them safer, more accurate, and genuinely help

Let's Dance: Structured Movement To Fine-Tune Our Human Neural NetsApr 27, 2025 am 11:09 AM

Let's Dance: Structured Movement To Fine-Tune Our Human Neural NetsApr 27, 2025 am 11:09 AMScientists have extensively studied human and simpler neural networks (like those in C. elegans) to understand their functionality. However, a crucial question arises: how do we adapt our own neural networks to work effectively alongside novel AI s

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

SublimeText3 Chinese version

Chinese version, very easy to use

Safe Exam Browser

Safe Exam Browser is a secure browser environment for taking online exams securely. This software turns any computer into a secure workstation. It controls access to any utility and prevents students from using unauthorized resources.

EditPlus Chinese cracked version

Small size, syntax highlighting, does not support code prompt function

SublimeText3 Linux new version

SublimeText3 Linux latest version

SecLists

SecLists is the ultimate security tester's companion. It is a collection of various types of lists that are frequently used during security assessments, all in one place. SecLists helps make security testing more efficient and productive by conveniently providing all the lists a security tester might need. List types include usernames, passwords, URLs, fuzzing payloads, sensitive data patterns, web shells, and more. The tester can simply pull this repository onto a new test machine and he will have access to every type of list he needs.