Technology peripherals

Technology peripherals AI

AI The integration effect of artificial intelligence on the financial field

The integration effect of artificial intelligence on the financial fieldThe integration effect of artificial intelligence on the financial field

As we enter the "artificial intelligence era", the financial industry is undergoing changes, mainly due to the widespread application of artificial intelligence in various fields. Financial institutions are increasingly adopting artificial intelligence as a tool to gain competitive advantage

The combination of artificial intelligence (AI) and algorithmic trading has accelerated advances in pattern recognition, data analysis and decision-making. Algorithmic trading with artificial intelligence enhancements provides traders with a competitive advantage by speeding up data processing and enabling traders to make informed decisions instantly. Artificial intelligence (AI) algorithms have proven to be useful performance enhancers in financial market environments as they continuously learn and adapt.

Technological advancements and increased data accessibility are the reasons why artificial intelligence is spreading in trading. Thanks to the abundance of market data, AI trading systems can process the data quickly and accurately, allowing traders to make informed decisions instantly.

Artificial intelligence plays an important role in algorithmic trading, helping to mitigate human emotional bias and promote more logical decision-making by making decisions based on data rather than emotion. In addition, it introduces dynamic intelligent algorithms that adapt to market conditions, changing the way decisions are made, improving accuracy and reducing risks

Due to increased trader productivity, reduced market impact, and transparent artificial intelligence algorithms , barriers to entry for algorithmic trading are now reduced, which democratizes learning and increases market participation. With the popularity of artificial intelligence, the comprehensive algorithmic trading market is expected to expand at a compound annual growth rate of 10.5% from 2023 to 2028, providing new opportunities for a wider range of traders and investors

Although There are concerns about job losses, but the adoption of AI in the financial sector has opened up new job opportunities. Data science, AI development, and algorithmic trading positions increasingly require proficiency in programming languages, machine learning/artificial intelligence, and big data analytics. The impact of automation on employment is expected to be offset by the emergence of new opportunities, which will increase demand for people who can combine human expertise with the precision of artificial intelligence.

The above is the detailed content of The integration effect of artificial intelligence on the financial field. For more information, please follow other related articles on the PHP Chinese website!

The AI Skills Gap Is Slowing Down Supply ChainsApr 26, 2025 am 11:13 AM

The AI Skills Gap Is Slowing Down Supply ChainsApr 26, 2025 am 11:13 AMThe term "AI-ready workforce" is frequently used, but what does it truly mean in the supply chain industry? According to Abe Eshkenazi, CEO of the Association for Supply Chain Management (ASCM), it signifies professionals capable of critic

How One Company Is Quietly Working To Transform AI ForeverApr 26, 2025 am 11:12 AM

How One Company Is Quietly Working To Transform AI ForeverApr 26, 2025 am 11:12 AMThe decentralized AI revolution is quietly gaining momentum. This Friday in Austin, Texas, the Bittensor Endgame Summit marks a pivotal moment, transitioning decentralized AI (DeAI) from theory to practical application. Unlike the glitzy commercial

Nvidia Releases NeMo Microservices To Streamline AI Agent DevelopmentApr 26, 2025 am 11:11 AM

Nvidia Releases NeMo Microservices To Streamline AI Agent DevelopmentApr 26, 2025 am 11:11 AMEnterprise AI faces data integration challenges The application of enterprise AI faces a major challenge: building systems that can maintain accuracy and practicality by continuously learning business data. NeMo microservices solve this problem by creating what Nvidia describes as "data flywheel", allowing AI systems to remain relevant through continuous exposure to enterprise information and user interaction. This newly launched toolkit contains five key microservices: NeMo Customizer handles fine-tuning of large language models with higher training throughput. NeMo Evaluator provides simplified evaluation of AI models for custom benchmarks. NeMo Guardrails implements security controls to maintain compliance and appropriateness

AI Paints A New Picture For The Future Of Art And DesignApr 26, 2025 am 11:10 AM

AI Paints A New Picture For The Future Of Art And DesignApr 26, 2025 am 11:10 AMAI: The Future of Art and Design Artificial intelligence (AI) is changing the field of art and design in unprecedented ways, and its impact is no longer limited to amateurs, but more profoundly affecting professionals. Artwork and design schemes generated by AI are rapidly replacing traditional material images and designers in many transactional design activities such as advertising, social media image generation and web design. However, professional artists and designers also find the practical value of AI. They use AI as an auxiliary tool to explore new aesthetic possibilities, blend different styles, and create novel visual effects. AI helps artists and designers automate repetitive tasks, propose different design elements and provide creative input. AI supports style transfer, which is to apply a style of image

How Zoom Is Revolutionizing Work With Agentic AI: From Meetings To MilestonesApr 26, 2025 am 11:09 AM

How Zoom Is Revolutionizing Work With Agentic AI: From Meetings To MilestonesApr 26, 2025 am 11:09 AMZoom, initially known for its video conferencing platform, is leading a workplace revolution with its innovative use of agentic AI. A recent conversation with Zoom's CTO, XD Huang, revealed the company's ambitious vision. Defining Agentic AI Huang d

The Existential Threat To UniversitiesApr 26, 2025 am 11:08 AM

The Existential Threat To UniversitiesApr 26, 2025 am 11:08 AMWill AI revolutionize education? This question is prompting serious reflection among educators and stakeholders. The integration of AI into education presents both opportunities and challenges. As Matthew Lynch of The Tech Edvocate notes, universit

The Prototype: American Scientists Are Looking For Jobs AbroadApr 26, 2025 am 11:07 AM

The Prototype: American Scientists Are Looking For Jobs AbroadApr 26, 2025 am 11:07 AMThe development of scientific research and technology in the United States may face challenges, perhaps due to budget cuts. According to Nature, the number of American scientists applying for overseas jobs increased by 32% from January to March 2025 compared with the same period in 2024. A previous poll showed that 75% of the researchers surveyed were considering searching for jobs in Europe and Canada. Hundreds of NIH and NSF grants have been terminated in the past few months, with NIH’s new grants down by about $2.3 billion this year, a drop of nearly one-third. The leaked budget proposal shows that the Trump administration is considering sharply cutting budgets for scientific institutions, with a possible reduction of up to 50%. The turmoil in the field of basic research has also affected one of the major advantages of the United States: attracting overseas talents. 35

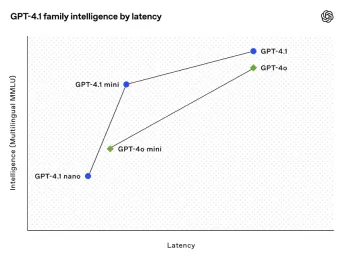

All About Open AI's Latest GPT 4.1 Family - Analytics VidhyaApr 26, 2025 am 10:19 AM

All About Open AI's Latest GPT 4.1 Family - Analytics VidhyaApr 26, 2025 am 10:19 AMOpenAI unveils the powerful GPT-4.1 series: a family of three advanced language models designed for real-world applications. This significant leap forward offers faster response times, enhanced comprehension, and drastically reduced costs compared t

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

WebStorm Mac version

Useful JavaScript development tools

mPDF

mPDF is a PHP library that can generate PDF files from UTF-8 encoded HTML. The original author, Ian Back, wrote mPDF to output PDF files "on the fly" from his website and handle different languages. It is slower than original scripts like HTML2FPDF and produces larger files when using Unicode fonts, but supports CSS styles etc. and has a lot of enhancements. Supports almost all languages, including RTL (Arabic and Hebrew) and CJK (Chinese, Japanese and Korean). Supports nested block-level elements (such as P, DIV),

EditPlus Chinese cracked version

Small size, syntax highlighting, does not support code prompt function

DVWA

Damn Vulnerable Web App (DVWA) is a PHP/MySQL web application that is very vulnerable. Its main goals are to be an aid for security professionals to test their skills and tools in a legal environment, to help web developers better understand the process of securing web applications, and to help teachers/students teach/learn in a classroom environment Web application security. The goal of DVWA is to practice some of the most common web vulnerabilities through a simple and straightforward interface, with varying degrees of difficulty. Please note that this software

SublimeText3 English version

Recommended: Win version, supports code prompts!