Technology peripherals

Technology peripherals AI

AI AI will change the core logic of investment, will the 60/40 stock and bond strategy become obsolete?

AI will change the core logic of investment, will the 60/40 stock and bond strategy become obsolete?AI will change the core logic of investment, will the 60/40 stock and bond strategy become obsolete?

Morgan Stanley points out that the rise of artificial intelligence has the potential to change some investors’ core investment principles: 60/40 investment portfolio

This investing strategy — allocating 60% of a portfolio to stocks and 40% to bonds — has been touted as the foundation of investing since the 1950s, but over the past few years it has come under scrutiny. There are more and more doubts. Now, another driver of the debate is growing: artificial intelligence.

That’s because the technology could boost productivity so much that the correlations between economic growth and inflation, and between stocks and bonds, could reverse.

Morgan Stanley analysts wrote: "Technological diffusion acts like a supply shock, boosting growth in the short term and often lowering inflation at the same time."

As a result, previous assumptions about how to diversify risk may no longer apply, as the AI boom will deliver healthy returns for both stocks and bonds - breaking the traditional negative correlation between the two.

This undermines a key part of the 60/40 strategy. "In other words, bonds - as has been the case this year - will no longer be the good diversifiers they have been for the past 30 years," the analysts wrote.

Analysts at Morgan Stanley further explained that the traditional negative correlation between stocks and bonds has been reversed, a situation that also occurred during the Internet bubble in the 1990s. The explosive growth of information and communication technology has accelerated capital investment, reduced operating costs for enterprises, and increased wealth, leading to higher consumption levels

“Similar to information and communication technologies, artificial intelligence, especially generative artificial intelligence, has the potential to broadly improve productivity across industries.”

After the recent "U.S. debt crisis", the debate about the 60/40 portfolio has become increasingly fierce. This comes after the Federal Reserve sharply raised interest rates to curb rising inflation. Therefore, the 60/40 portfolio did not achieve amazing returns

BlackRock said that in the new era of high interest rates, the 60/40 investment portfolio is no longer applicable and investors now need to be more "flexible" and "meticulous." At the same time, Vanguard Group expects the strategy to bring high returns next year

Morgan Stanley said that the impact of generative artificial intelligence is only one of many factors that may affect asset correlation and has a certain impact on economic growth and inflation

The strategists said, "But if we do see this happen, we think it could mean that long-term portfolios will tilt more towards stocks than bonds, as fixed income becomes a less reliable diversifier. Investment tools. We think investors may be looking for new portfolio diversification tools,"

We may also see a further acceleration in asset allocators investing money into private credit. In theory, private credit is less correlated with listed equities and fixed income. They added

Source: Financial Associated Press

The above is the detailed content of AI will change the core logic of investment, will the 60/40 stock and bond strategy become obsolete?. For more information, please follow other related articles on the PHP Chinese website!

Tesla's Robovan Was The Hidden Gem In 2024's Robotaxi TeaserApr 22, 2025 am 11:48 AM

Tesla's Robovan Was The Hidden Gem In 2024's Robotaxi TeaserApr 22, 2025 am 11:48 AMSince 2008, I've championed the shared-ride van—initially dubbed the "robotjitney," later the "vansit"—as the future of urban transportation. I foresee these vehicles as the 21st century's next-generation transit solution, surpas

Sam's Club Bets On AI To Eliminate Receipt Checks And Enhance RetailApr 22, 2025 am 11:29 AM

Sam's Club Bets On AI To Eliminate Receipt Checks And Enhance RetailApr 22, 2025 am 11:29 AMRevolutionizing the Checkout Experience Sam's Club's innovative "Just Go" system builds on its existing AI-powered "Scan & Go" technology, allowing members to scan purchases via the Sam's Club app during their shopping trip.

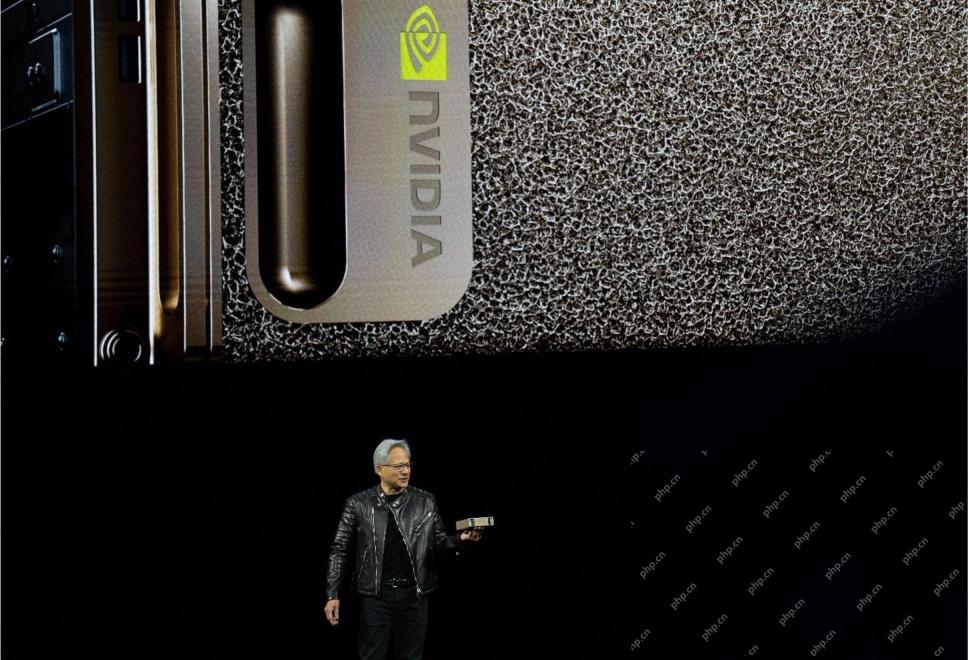

Nvidia's AI Omniverse Expands At GTC 2025Apr 22, 2025 am 11:28 AM

Nvidia's AI Omniverse Expands At GTC 2025Apr 22, 2025 am 11:28 AMNvidia's Enhanced Predictability and New Product Lineup at GTC 2025 Nvidia, a key player in AI infrastructure, is focusing on increased predictability for its clients. This involves consistent product delivery, meeting performance expectations, and

Exploring the Capabilities of Google's Gemma 2 ModelsApr 22, 2025 am 11:26 AM

Exploring the Capabilities of Google's Gemma 2 ModelsApr 22, 2025 am 11:26 AMGoogle's Gemma 2: A Powerful, Efficient Language Model Google's Gemma family of language models, celebrated for efficiency and performance, has expanded with the arrival of Gemma 2. This latest release comprises two models: a 27-billion parameter ver

The Next Wave of GenAI: Perspectives with Dr. Kirk Borne - Analytics VidhyaApr 22, 2025 am 11:21 AM

The Next Wave of GenAI: Perspectives with Dr. Kirk Borne - Analytics VidhyaApr 22, 2025 am 11:21 AMThis Leading with Data episode features Dr. Kirk Borne, a leading data scientist, astrophysicist, and TEDx speaker. A renowned expert in big data, AI, and machine learning, Dr. Borne offers invaluable insights into the current state and future traje

AI For Runners And Athletes: We're Making Excellent ProgressApr 22, 2025 am 11:12 AM

AI For Runners And Athletes: We're Making Excellent ProgressApr 22, 2025 am 11:12 AMThere were some very insightful perspectives in this speech—background information about engineering that showed us why artificial intelligence is so good at supporting people’s physical exercise. I will outline a core idea from each contributor’s perspective to demonstrate three design aspects that are an important part of our exploration of the application of artificial intelligence in sports. Edge devices and raw personal data This idea about artificial intelligence actually contains two components—one related to where we place large language models and the other is related to the differences between our human language and the language that our vital signs “express” when measured in real time. Alexander Amini knows a lot about running and tennis, but he still

Jamie Engstrom On Technology, Talent And Transformation At CaterpillarApr 22, 2025 am 11:10 AM

Jamie Engstrom On Technology, Talent And Transformation At CaterpillarApr 22, 2025 am 11:10 AMCaterpillar's Chief Information Officer and Senior Vice President of IT, Jamie Engstrom, leads a global team of over 2,200 IT professionals across 28 countries. With 26 years at Caterpillar, including four and a half years in her current role, Engst

New Google Photos Update Makes Any Photo Pop With Ultra HDR QualityApr 22, 2025 am 11:09 AM

New Google Photos Update Makes Any Photo Pop With Ultra HDR QualityApr 22, 2025 am 11:09 AMGoogle Photos' New Ultra HDR Tool: A Quick Guide Enhance your photos with Google Photos' new Ultra HDR tool, transforming standard images into vibrant, high-dynamic-range masterpieces. Ideal for social media, this tool boosts the impact of any photo,

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

Dreamweaver Mac version

Visual web development tools

ZendStudio 13.5.1 Mac

Powerful PHP integrated development environment

SAP NetWeaver Server Adapter for Eclipse

Integrate Eclipse with SAP NetWeaver application server.

DVWA

Damn Vulnerable Web App (DVWA) is a PHP/MySQL web application that is very vulnerable. Its main goals are to be an aid for security professionals to test their skills and tools in a legal environment, to help web developers better understand the process of securing web applications, and to help teachers/students teach/learn in a classroom environment Web application security. The goal of DVWA is to practice some of the most common web vulnerabilities through a simple and straightforward interface, with varying degrees of difficulty. Please note that this software