Technology peripherals

Technology peripherals AI

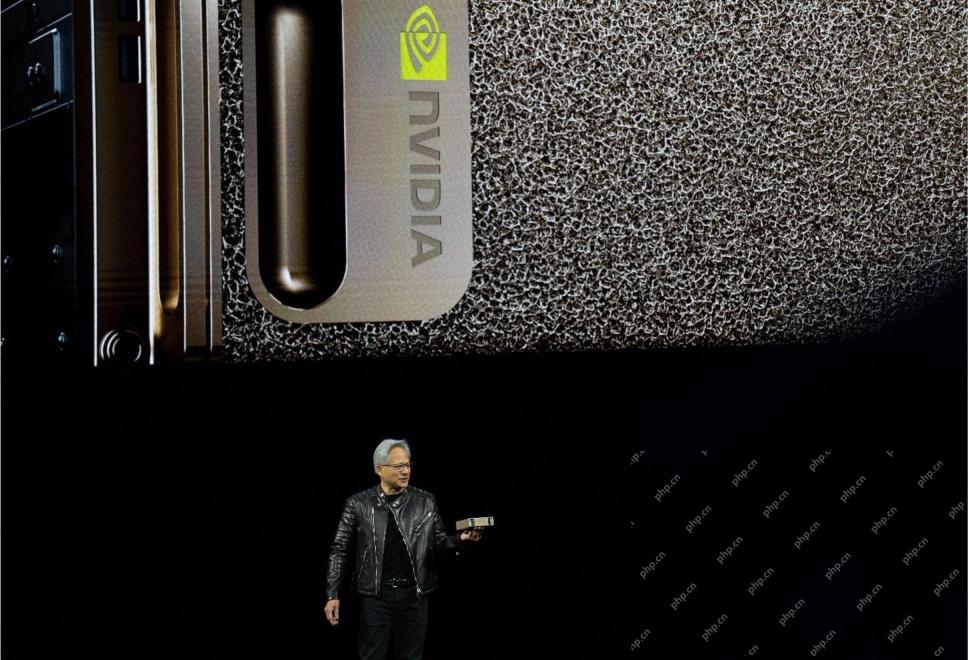

AI Nvidia's dominance in the AI chip field has made it difficult for startups to raise funds, and the number of financing transactions fell by 80%

Nvidia's dominance in the AI chip field has made it difficult for startups to raise funds, and the number of financing transactions fell by 80%Nvidia's dominance in the AI chip field has made it difficult for startups to raise funds, and the number of financing transactions fell by 80%

According to news on September 12, many investors said that Nvidia has achieved dominance in the field of artificial intelligence (AI) chip manufacturing, which has caused difficulties for its potential competitors in financing. A bigger challenge. In the second quarter of this year, the number of financing transactions for chip startups in the United States dropped by 80% compared with the same period last year.

In the chip market, NVIDIA occupies a dominant position in processing large amounts of language data. Generative AI models gradually become smarter by being exposed to more data, a process called training. As Nvidia becomes more powerful in the field, chip manufacturing companies trying to compete with it face challenges facing an increasingly difficult situation. Venture capitalists view these startups as riskier and are reluctant to inject large amounts of capital. It can take more than $500 million to advance a chip design to a working prototype, so investor withdrawals could soon threaten the startup's prospects

Eclipse Ventures partner Greg Laihao said: "Nvidia has been dominant, which made us realize how difficult it is to enter this market. This has led to a pullback in investment in startups in this space, or at least a reduction in investment in many of these companies."

Data from the database analysis platform Pitchbook shows that as of the end of August this year, U.S. chip start-ups have raised US$881.4 million. This compares to $1.79 billion in the first three quarters of 2022. As of the end of August, the number of transactions dropped from 23 to 4. Nvidia declined to comment.

According to the technology website The Register, the artificial intelligence chip startup Mythic raised a total of approximately US$160 million, but ran out of cash last year and was almost forced to cease operations. But in March this year, the company managed to secure new investment, albeit only $13 million.

Mythic CEO Dave Rick noted that Nvidia has played an "indirect" role in the financing difficulties of the entire artificial intelligence chip industry, as investors want to make "huge investments and high returns." A lucrative home run investment.” However, a difficult economic environment has exacerbated the downturn in the cyclical semiconductor industry

A mysterious startup called Rivos has recently encountered difficulties in raising capital, according to two sources familiar with the situation. Rivos designs chips for data servers. A spokesman for Rivos said Nvidia's dominance in the market has not affected its fundraising efforts and that its hardware and software "continue to excite our investors" for now. , Rivos is in a legal dispute with Apple, which accuses Rivos of infringing intellectual property confidentiality, making Rivos face greater challenges in financing

Investors have become more demanding

According to Sources revealed that chip startups seeking financing are facing more demanding requirements from investors. These investors are demanding that the companies have a product that can be released within months or is already commercially available. About two years ago, new investments in chip startups were typically $200 million or $300 million in size. But that number has dropped to about $100 million, according to PitchBook analyst Brendan Burke.

At least two artificial intelligence chip startups have convinced investors to allay their concerns by touting potential customers or relationships with high-profile executives.

In an effort to raise $100 million, Canadian AI chip startup Tenstorrent hired CEO Jim Keller in August this year. Keller is a near-legendary chip designer who has designed chips for Apple, AMD and Tesla

Silicon Valley AI chip startup D-Matrix expects revenue of less than $10 million this year, but its revenue is expected to be less than $10 million this year. It raised $110 million last week, thanks to support from Microsoft and the Windows operating system maker's pledge to test D-Matrix's new artificial intelligence chips when they launch next year.

While these chipmakers in Nvidia’s shadow are struggling, startups in artificial intelligence software and related technologies do not face the same constraints. According to PitchBook data, as of August this year, these startups have received a total of approximately US$24 billion in financing.

Despite Nvidia’s dominance in artificial intelligence computing, the company is not infallible. AMD plans to launch a chip to compete with Nvidia this year, while Intel has grown by leaps and bounds by acquiring a competing product through acquisition. According to sources, in the long term, these chips may become a replacement for Nvidia chips, and some similar use cases may also provide opportunities for competitors. For example, chips that perform data-intensive calculations for predictive algorithms are an emerging niche market. Nvidia doesn't dominate this space, and it's an area ripe for investment. (Xiao Xiao)

The above is the detailed content of Nvidia's dominance in the AI chip field has made it difficult for startups to raise funds, and the number of financing transactions fell by 80%. For more information, please follow other related articles on the PHP Chinese website!

Tesla's Robovan Was The Hidden Gem In 2024's Robotaxi TeaserApr 22, 2025 am 11:48 AM

Tesla's Robovan Was The Hidden Gem In 2024's Robotaxi TeaserApr 22, 2025 am 11:48 AMSince 2008, I've championed the shared-ride van—initially dubbed the "robotjitney," later the "vansit"—as the future of urban transportation. I foresee these vehicles as the 21st century's next-generation transit solution, surpas

Sam's Club Bets On AI To Eliminate Receipt Checks And Enhance RetailApr 22, 2025 am 11:29 AM

Sam's Club Bets On AI To Eliminate Receipt Checks And Enhance RetailApr 22, 2025 am 11:29 AMRevolutionizing the Checkout Experience Sam's Club's innovative "Just Go" system builds on its existing AI-powered "Scan & Go" technology, allowing members to scan purchases via the Sam's Club app during their shopping trip.

Nvidia's AI Omniverse Expands At GTC 2025Apr 22, 2025 am 11:28 AM

Nvidia's AI Omniverse Expands At GTC 2025Apr 22, 2025 am 11:28 AMNvidia's Enhanced Predictability and New Product Lineup at GTC 2025 Nvidia, a key player in AI infrastructure, is focusing on increased predictability for its clients. This involves consistent product delivery, meeting performance expectations, and

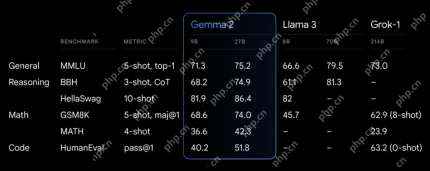

Exploring the Capabilities of Google's Gemma 2 ModelsApr 22, 2025 am 11:26 AM

Exploring the Capabilities of Google's Gemma 2 ModelsApr 22, 2025 am 11:26 AMGoogle's Gemma 2: A Powerful, Efficient Language Model Google's Gemma family of language models, celebrated for efficiency and performance, has expanded with the arrival of Gemma 2. This latest release comprises two models: a 27-billion parameter ver

The Next Wave of GenAI: Perspectives with Dr. Kirk Borne - Analytics VidhyaApr 22, 2025 am 11:21 AM

The Next Wave of GenAI: Perspectives with Dr. Kirk Borne - Analytics VidhyaApr 22, 2025 am 11:21 AMThis Leading with Data episode features Dr. Kirk Borne, a leading data scientist, astrophysicist, and TEDx speaker. A renowned expert in big data, AI, and machine learning, Dr. Borne offers invaluable insights into the current state and future traje

AI For Runners And Athletes: We're Making Excellent ProgressApr 22, 2025 am 11:12 AM

AI For Runners And Athletes: We're Making Excellent ProgressApr 22, 2025 am 11:12 AMThere were some very insightful perspectives in this speech—background information about engineering that showed us why artificial intelligence is so good at supporting people’s physical exercise. I will outline a core idea from each contributor’s perspective to demonstrate three design aspects that are an important part of our exploration of the application of artificial intelligence in sports. Edge devices and raw personal data This idea about artificial intelligence actually contains two components—one related to where we place large language models and the other is related to the differences between our human language and the language that our vital signs “express” when measured in real time. Alexander Amini knows a lot about running and tennis, but he still

Jamie Engstrom On Technology, Talent And Transformation At CaterpillarApr 22, 2025 am 11:10 AM

Jamie Engstrom On Technology, Talent And Transformation At CaterpillarApr 22, 2025 am 11:10 AMCaterpillar's Chief Information Officer and Senior Vice President of IT, Jamie Engstrom, leads a global team of over 2,200 IT professionals across 28 countries. With 26 years at Caterpillar, including four and a half years in her current role, Engst

New Google Photos Update Makes Any Photo Pop With Ultra HDR QualityApr 22, 2025 am 11:09 AM

New Google Photos Update Makes Any Photo Pop With Ultra HDR QualityApr 22, 2025 am 11:09 AMGoogle Photos' New Ultra HDR Tool: A Quick Guide Enhance your photos with Google Photos' new Ultra HDR tool, transforming standard images into vibrant, high-dynamic-range masterpieces. Ideal for social media, this tool boosts the impact of any photo,

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Atom editor mac version download

The most popular open source editor

SublimeText3 English version

Recommended: Win version, supports code prompts!

mPDF

mPDF is a PHP library that can generate PDF files from UTF-8 encoded HTML. The original author, Ian Back, wrote mPDF to output PDF files "on the fly" from his website and handle different languages. It is slower than original scripts like HTML2FPDF and produces larger files when using Unicode fonts, but supports CSS styles etc. and has a lot of enhancements. Supports almost all languages, including RTL (Arabic and Hebrew) and CJK (Chinese, Japanese and Korean). Supports nested block-level elements (such as P, DIV),

DVWA

Damn Vulnerable Web App (DVWA) is a PHP/MySQL web application that is very vulnerable. Its main goals are to be an aid for security professionals to test their skills and tools in a legal environment, to help web developers better understand the process of securing web applications, and to help teachers/students teach/learn in a classroom environment Web application security. The goal of DVWA is to practice some of the most common web vulnerabilities through a simple and straightforward interface, with varying degrees of difficulty. Please note that this software

MinGW - Minimalist GNU for Windows

This project is in the process of being migrated to osdn.net/projects/mingw, you can continue to follow us there. MinGW: A native Windows port of the GNU Compiler Collection (GCC), freely distributable import libraries and header files for building native Windows applications; includes extensions to the MSVC runtime to support C99 functionality. All MinGW software can run on 64-bit Windows platforms.