Technology peripherals

Technology peripherals AI

AI Discover how generative AI is transforming the financial services industry

Discover how generative AI is transforming the financial services industryDiscover how generative AI is transforming the financial services industry

Generative AI is an emerging field of artificial intelligence focused on creating new content by analyzing patterns in existing data. This cutting-edge technology can generate a wide range of data samples, including text, graphics, code and music.

By leveraging large amounts of input data, generative AI algorithms can identify patterns and structures to generate new content that mimics human-like behavior. Its potential to improve accuracy and efficiency has made it increasingly popular in the banking industry. In short, generative AI is a powerful tool that has the potential to change the way we solve problems in various fields, including banking.

Value of Artificial Intelligence to Banking Industry

The banking industry is witnessing the transformative impact of artificial intelligence as it enables personalized and efficient customer experience . Through the integration of chatbots, virtual assistants and natural language processing, banks can now provide seamless and tailored services.

Artificial intelligence-driven fraud detection and prevention mechanism, using machine learning algorithms and pattern recognition technology, further strengthens the bank’s security measures. Additionally, AI’s predictive analytics and risk modeling capabilities have revolutionized the risk management landscape, giving decision makers accurate insights into effective risk mitigation strategies. There is no doubt that the banking industry benefits from the strategic implementation of artificial intelligence in every aspect of operations.

Intelligent Credit Scoring Scenario

Traditional credit scoring methods often fall short due to insufficient or outdated data, which can lead to doubts about borrowing The assessment of a person's creditworthiness is inaccurate. Yet the emergence of generative AI has revolutionized the credit scoring process by leveraging a wide range of data from different sources, including social media, transaction history and alternative finance data.

Artificial intelligence algorithms analyze large amounts of data to provide more accurate and comprehensive credit scores, allowing banks to make informed strategic lending decisions. The integration of generative AI has significantly changed the credit scoring landscape, enabling banks to make better decisions based on large amounts of relevant data.

Personalized Customer Experience

Generative artificial intelligence is leveraging large amounts of customer data to create personalized customer experiences tailored to individual preferences and needs Hyper-personalized experiences, revolutionizing the customer experience in banking. From product recommendations to targeted marketing campaigns and customized financial advice, AI-driven systems can analyze and learn from data to create highly personalized experiences for customers.

Detection and Prevention of Financial Fraud

Generate artificial intelligence to provide advanced capabilities to detect and prevent financial fraud, making it an indispensable tool for banks . By analyzing large data sets and identifying patterns that indicate fraudulent activity, AI-powered systems can quickly detect anomalies and alert banks to potential threats.

Additionally, generative AI continuously adapts to evolving fraud patterns, ensuring banks stay ahead of the curve. This proactive approach not only minimizes financial losses, but also increases the trust and confidence of customers that they can rely on their banks to keep their financial information safe.

Smarter Investment Management and Trading

Generative AI is transforming the asset management industry with innovative solutions for smarter investing Management and trading. Incorporating AI-driven algorithms can bring benefits such as advanced risk management, enhanced portfolio optimization, improved investment decisions, efficient trade execution and adaptive trading strategies.

Generating artificial intelligence by analyzing large amounts of data from disparate sources enables asset managers to make data-driven decisions based on their clients’ financial goals and risk tolerance. AI-driven systems can also optimize trade execution, reduce transaction costs and adapt to changing market conditions, ultimately providing better performance to clients.

Conclusion

#In short, the rapid development of generative artificial intelligence models has brought opportunities and challenges to the banking industry. To take full advantage of these cutting-edge technologies and overcome the associated challenges, banks must embrace innovation, increase efficiency and deliver a superior customer experience. Going forward, banks that invest in AI research, partner with fintech companies, and develop the workforce of the future will be better positioned to succeed in an AI-driven environment.

The above is the detailed content of Discover how generative AI is transforming the financial services industry. For more information, please follow other related articles on the PHP Chinese website!

Tesla's Robovan Was The Hidden Gem In 2024's Robotaxi TeaserApr 22, 2025 am 11:48 AM

Tesla's Robovan Was The Hidden Gem In 2024's Robotaxi TeaserApr 22, 2025 am 11:48 AMSince 2008, I've championed the shared-ride van—initially dubbed the "robotjitney," later the "vansit"—as the future of urban transportation. I foresee these vehicles as the 21st century's next-generation transit solution, surpas

Sam's Club Bets On AI To Eliminate Receipt Checks And Enhance RetailApr 22, 2025 am 11:29 AM

Sam's Club Bets On AI To Eliminate Receipt Checks And Enhance RetailApr 22, 2025 am 11:29 AMRevolutionizing the Checkout Experience Sam's Club's innovative "Just Go" system builds on its existing AI-powered "Scan & Go" technology, allowing members to scan purchases via the Sam's Club app during their shopping trip.

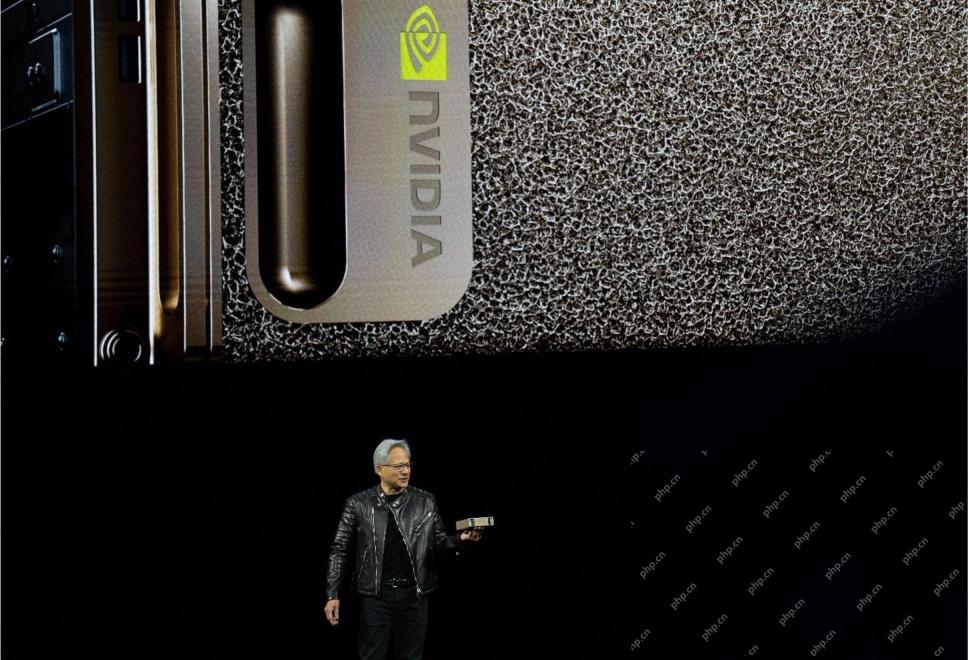

Nvidia's AI Omniverse Expands At GTC 2025Apr 22, 2025 am 11:28 AM

Nvidia's AI Omniverse Expands At GTC 2025Apr 22, 2025 am 11:28 AMNvidia's Enhanced Predictability and New Product Lineup at GTC 2025 Nvidia, a key player in AI infrastructure, is focusing on increased predictability for its clients. This involves consistent product delivery, meeting performance expectations, and

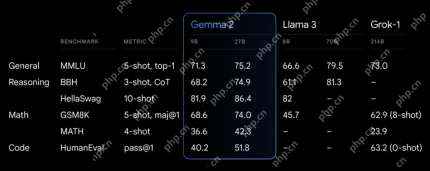

Exploring the Capabilities of Google's Gemma 2 ModelsApr 22, 2025 am 11:26 AM

Exploring the Capabilities of Google's Gemma 2 ModelsApr 22, 2025 am 11:26 AMGoogle's Gemma 2: A Powerful, Efficient Language Model Google's Gemma family of language models, celebrated for efficiency and performance, has expanded with the arrival of Gemma 2. This latest release comprises two models: a 27-billion parameter ver

The Next Wave of GenAI: Perspectives with Dr. Kirk Borne - Analytics VidhyaApr 22, 2025 am 11:21 AM

The Next Wave of GenAI: Perspectives with Dr. Kirk Borne - Analytics VidhyaApr 22, 2025 am 11:21 AMThis Leading with Data episode features Dr. Kirk Borne, a leading data scientist, astrophysicist, and TEDx speaker. A renowned expert in big data, AI, and machine learning, Dr. Borne offers invaluable insights into the current state and future traje

AI For Runners And Athletes: We're Making Excellent ProgressApr 22, 2025 am 11:12 AM

AI For Runners And Athletes: We're Making Excellent ProgressApr 22, 2025 am 11:12 AMThere were some very insightful perspectives in this speech—background information about engineering that showed us why artificial intelligence is so good at supporting people’s physical exercise. I will outline a core idea from each contributor’s perspective to demonstrate three design aspects that are an important part of our exploration of the application of artificial intelligence in sports. Edge devices and raw personal data This idea about artificial intelligence actually contains two components—one related to where we place large language models and the other is related to the differences between our human language and the language that our vital signs “express” when measured in real time. Alexander Amini knows a lot about running and tennis, but he still

Jamie Engstrom On Technology, Talent And Transformation At CaterpillarApr 22, 2025 am 11:10 AM

Jamie Engstrom On Technology, Talent And Transformation At CaterpillarApr 22, 2025 am 11:10 AMCaterpillar's Chief Information Officer and Senior Vice President of IT, Jamie Engstrom, leads a global team of over 2,200 IT professionals across 28 countries. With 26 years at Caterpillar, including four and a half years in her current role, Engst

New Google Photos Update Makes Any Photo Pop With Ultra HDR QualityApr 22, 2025 am 11:09 AM

New Google Photos Update Makes Any Photo Pop With Ultra HDR QualityApr 22, 2025 am 11:09 AMGoogle Photos' New Ultra HDR Tool: A Quick Guide Enhance your photos with Google Photos' new Ultra HDR tool, transforming standard images into vibrant, high-dynamic-range masterpieces. Ideal for social media, this tool boosts the impact of any photo,

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

Dreamweaver Mac version

Visual web development tools

ZendStudio 13.5.1 Mac

Powerful PHP integrated development environment

SAP NetWeaver Server Adapter for Eclipse

Integrate Eclipse with SAP NetWeaver application server.

DVWA

Damn Vulnerable Web App (DVWA) is a PHP/MySQL web application that is very vulnerable. Its main goals are to be an aid for security professionals to test their skills and tools in a legal environment, to help web developers better understand the process of securing web applications, and to help teachers/students teach/learn in a classroom environment Web application security. The goal of DVWA is to practice some of the most common web vulnerabilities through a simple and straightforward interface, with varying degrees of difficulty. Please note that this software