In terms of basic current account functionality, there is little differentiation among banks, so companies need to offer more to their customers. This is particularly important for traditional commercial banks as they face threats from newer, more flexible app-based challenger banks and other fintech competitors. Incumbents may be hampered by legacy systems, but they do have experience and data about customer preferences that they can use to their advantage. Companies need new products, new methods and new ideas to attract and retain customers. But if they want to remain competitive, they also need to deliver them quickly and be able to change them based on changing business and regulatory needs. This brings automation – 31% of financial services executives believe automation is one of the most important technologies over the next 12 months.

However, innovation cannot come at the expense of security. A report from the Economist Intelligence Unit and Appian found that cybersecurity will be the top concern for automation. 43% believe it will be one of the three most important areas. This is followed by innovation and R&D (35%), and customer-facing processes (34%).

Cybersecurity remains a top concern in the UK, as criminals stole a total of £753.9 million through scams in the first half of 2021 alone. An increase of 30% compared with the same period last year. This is a growing problem. Security systems need to become smarter by using AI and automation to discover and flag nuances in behavioral patterns.

Looking at other focus areas of automation – innovation and customer-facing processes – we’ve only scratched the surface of what’s possible, but there are still issues to be addressed. Although one-third of executives see the importance of automation, there is a gap between IT decision-makers and business leaders on the extent of improvements needed. IT leaders will be more likely to demand faster improvements to technology systems and processes than business leaders. In addition, financial services leaders face other considerations including budgets, resources, skills shortages and regulatory pressures when improving services and delivering business outcomes.

rapid innovation

Low-code is becoming a method that can help companies achieve rapid innovation because it does not require the heavy work and lengthy time of traditional software development. In the case of low-code, visual design tools can be used to specify various aspects of software behavior without resorting to coding. The technology can then generate executable code from these visual designs. Unsurprisingly, low-code has been a bright spot during the pandemic, and it now aims to enable financial Services companies can accelerate the delivery of emerging technologies. The less time you spend developing the technical aspects of your code, the more time you can spend using, creating, and improving the solution.

Low-code improves collaboration between departments because business decision-makers can see and contribute to the software being developed in real time. This allows them to be fully invested in the project and help shape it from the beginning, rather than leaving everything to the IT team and not seeing the results until completion. This results in faster time to value and less reliance on specialized programming skills. Low-code and automation will free software development teams from mundane, time-consuming tasks, allowing them to deliver mission-critical programs faster and modernize technology infrastructure.

Creating Real Differentiation

Low-code makes software development easy and accessible, allowing us to think more ambitiously about the future of the financial services industry. Financial services is a data-intensive industry that requires processing, understanding and operating on large amounts of information. The industry will benefit from increased use of intelligent document processing, relying more on AI to handle complex customer documents, transactions and interactions. This includes conducting due diligence when taking on new clients, running credit analysis reports, processing loan applications and deciphering tax forms.

In commercial banking, we’ve seen how content recognition is transformative in accelerating onboarding, KYC, credit decisions, invoicing and more. We will also see the use of low-code software to accelerate the delivery of robotic process automation (RPA) for fast, error-free data updates to external legacy systems.

It’s an exciting time for the financial services industry as it finally shakes off its reputation as slow to adapt to new technologies. Yes, more than ever, customers are looking to the convenience and security of access through mobile banking apps as they expect banks to proactively detect and prevent fraud and reduce risk exposure. However, by using low-code, banks can not only become a more secure organization, but also a more innovative one. By creating truly unique solutions, they will be able to move faster, stay ahead of the competition, increase customer loyalty, and ultimately achieve profitability.

The above is the detailed content of How low-code automation will transform banking. For more information, please follow other related articles on the PHP Chinese website!

Tesla's Robovan Was The Hidden Gem In 2024's Robotaxi TeaserApr 22, 2025 am 11:48 AM

Tesla's Robovan Was The Hidden Gem In 2024's Robotaxi TeaserApr 22, 2025 am 11:48 AMSince 2008, I've championed the shared-ride van—initially dubbed the "robotjitney," later the "vansit"—as the future of urban transportation. I foresee these vehicles as the 21st century's next-generation transit solution, surpas

Sam's Club Bets On AI To Eliminate Receipt Checks And Enhance RetailApr 22, 2025 am 11:29 AM

Sam's Club Bets On AI To Eliminate Receipt Checks And Enhance RetailApr 22, 2025 am 11:29 AMRevolutionizing the Checkout Experience Sam's Club's innovative "Just Go" system builds on its existing AI-powered "Scan & Go" technology, allowing members to scan purchases via the Sam's Club app during their shopping trip.

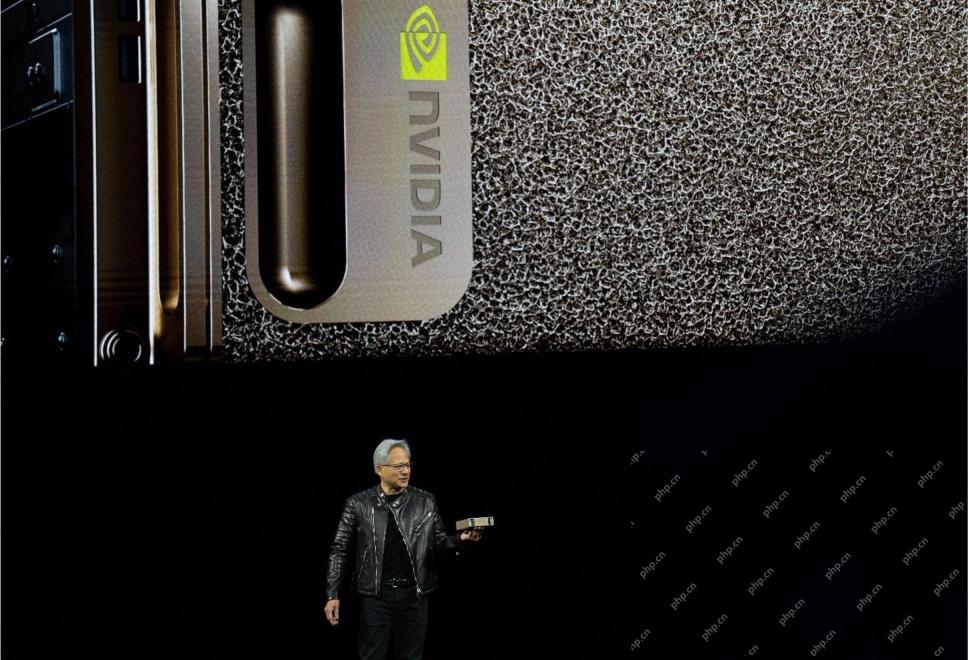

Nvidia's AI Omniverse Expands At GTC 2025Apr 22, 2025 am 11:28 AM

Nvidia's AI Omniverse Expands At GTC 2025Apr 22, 2025 am 11:28 AMNvidia's Enhanced Predictability and New Product Lineup at GTC 2025 Nvidia, a key player in AI infrastructure, is focusing on increased predictability for its clients. This involves consistent product delivery, meeting performance expectations, and

Exploring the Capabilities of Google's Gemma 2 ModelsApr 22, 2025 am 11:26 AM

Exploring the Capabilities of Google's Gemma 2 ModelsApr 22, 2025 am 11:26 AMGoogle's Gemma 2: A Powerful, Efficient Language Model Google's Gemma family of language models, celebrated for efficiency and performance, has expanded with the arrival of Gemma 2. This latest release comprises two models: a 27-billion parameter ver

The Next Wave of GenAI: Perspectives with Dr. Kirk Borne - Analytics VidhyaApr 22, 2025 am 11:21 AM

The Next Wave of GenAI: Perspectives with Dr. Kirk Borne - Analytics VidhyaApr 22, 2025 am 11:21 AMThis Leading with Data episode features Dr. Kirk Borne, a leading data scientist, astrophysicist, and TEDx speaker. A renowned expert in big data, AI, and machine learning, Dr. Borne offers invaluable insights into the current state and future traje

AI For Runners And Athletes: We're Making Excellent ProgressApr 22, 2025 am 11:12 AM

AI For Runners And Athletes: We're Making Excellent ProgressApr 22, 2025 am 11:12 AMThere were some very insightful perspectives in this speech—background information about engineering that showed us why artificial intelligence is so good at supporting people’s physical exercise. I will outline a core idea from each contributor’s perspective to demonstrate three design aspects that are an important part of our exploration of the application of artificial intelligence in sports. Edge devices and raw personal data This idea about artificial intelligence actually contains two components—one related to where we place large language models and the other is related to the differences between our human language and the language that our vital signs “express” when measured in real time. Alexander Amini knows a lot about running and tennis, but he still

Jamie Engstrom On Technology, Talent And Transformation At CaterpillarApr 22, 2025 am 11:10 AM

Jamie Engstrom On Technology, Talent And Transformation At CaterpillarApr 22, 2025 am 11:10 AMCaterpillar's Chief Information Officer and Senior Vice President of IT, Jamie Engstrom, leads a global team of over 2,200 IT professionals across 28 countries. With 26 years at Caterpillar, including four and a half years in her current role, Engst

New Google Photos Update Makes Any Photo Pop With Ultra HDR QualityApr 22, 2025 am 11:09 AM

New Google Photos Update Makes Any Photo Pop With Ultra HDR QualityApr 22, 2025 am 11:09 AMGoogle Photos' New Ultra HDR Tool: A Quick Guide Enhance your photos with Google Photos' new Ultra HDR tool, transforming standard images into vibrant, high-dynamic-range masterpieces. Ideal for social media, this tool boosts the impact of any photo,

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

PhpStorm Mac version

The latest (2018.2.1) professional PHP integrated development tool

MantisBT

Mantis is an easy-to-deploy web-based defect tracking tool designed to aid in product defect tracking. It requires PHP, MySQL and a web server. Check out our demo and hosting services.

VSCode Windows 64-bit Download

A free and powerful IDE editor launched by Microsoft

SublimeText3 Linux new version

SublimeText3 Linux latest version

SecLists

SecLists is the ultimate security tester's companion. It is a collection of various types of lists that are frequently used during security assessments, all in one place. SecLists helps make security testing more efficient and productive by conveniently providing all the lists a security tester might need. List types include usernames, passwords, URLs, fuzzing payloads, sensitive data patterns, web shells, and more. The tester can simply pull this repository onto a new test machine and he will have access to every type of list he needs.