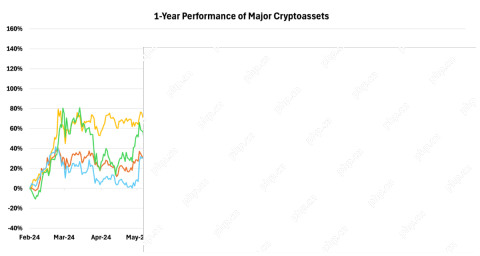

Bitcoin (BTC) Price Rally Above $56K Raises Expectations of Further Crypto Rebound

The recent Bitcoin (BTC) price rally above $56k has raised expectations of further crypto rebound in the coming days.

Bitcoin (BTC) price finally saw an increase in demand on Monday after a week of boring trading in a narrow range. The leading digital asset is trying to resume its upward trend after its recent sharp fall below the $53,000 level. However, technical indicators and chain data indicate that there is a possibility of a further increase in the price of Bitcoin in the coming days.

At the time of writing this article, the price of Bitcoin increased by 1.4% in the last 24 hours to reach $55,950. The price of BTC has increased by 0.2% in the last week and by 11.5% in the last month.

Bitcoin Daily Relative Strength Index (RSI) is forming a bullish divergence

While Bitcoin price has reversed in a range and shows little net demand, the relative strength index (RSI) is showing an uptrend on a daily basis. This indicates increased demand from large investors, as they ideally profit from short-term positions.

Typically, when the RSI rises in a downtrend, it indicates increased demand from whale investors who are taking profits on short-term positions. At the same time, when the RSI drops in an uptrend, it indicates increased demand from whale investors who are profiting from long-term positions.

In the third quarter of 2022, when the price of Bitcoin increased from the level of $24,000 to $53,000, the RSI showed a downward trend. This shows that whale investors have made profits in short-term positions.

However, since late September, the RSI has shown an uptrend, while the price of Bitcoin has reversed within a range. This shows that whale investors earn profits in long-term positions.

In the third quarter of 2022, when the price of Bitcoin increased from the level of $24,000 to $53,000, the RSI showed a downward trend. This shows that whale investors have made profits in short-term positions.

Meanwhile, since late September, the RSI has shown an uptrend, while the price of Bitcoin has reversed within a range. This shows that whale investors earn profits in long-term positions.

Bitcoin price rises after US spot ETFs gain $28 million net

Bitcoin price rose momentarily after US spot exchange-traded funds (ETFs) recorded net cash inflows of $28 million. Fidelity's Phillips Bitcoin ETF (NYSE:FBTC) led the way, registering net inflows of $15.5 million, regulatory data shows.

At the same time, chain data shows that the total supply of stablecoins on centralized exchanges has increased by about $300 million in the past 24 hours. This shows the increase in the movement of stablecoins to exchanges to buy digital assets.

It is more likely that the price of Bitcoin will increase until the financing rate in major exchanges becomes positive

Market data provided by the chain analysis platform Santiment suggests that the possibility of a further increase in the price of Bitcoin in the near term has increased due to an increase in short-term financing rates.

Ideally, an increase in short positions in digital currency exchanges would lead to their forced liquidation, which would attract whale investors to long positions in the instrument and vice versa.

As a result, Sentiment believes that the possibility of further increase in Bitcoin price in the coming days is higher until the funding rate in major exchanges becomes positive.

Bitcoin price shows mid-term price targets

We simply can't be friends if you think the biggest bullish flag in $BTC history is about to break pic.twitter.com/KpUMmrcw2p

before Consumer Price Index (CPI) data

The above is the detailed content of Bitcoin (BTC) Price Rally Above $56K Raises Expectations of Further Crypto Rebound. For more information, please follow other related articles on the PHP Chinese website!

Top 10 virtual currency exchange app rankings The latest ranking of top 10 exchanges in the currency circle in 2025Apr 30, 2025 am 10:15 AM

Top 10 virtual currency exchange app rankings The latest ranking of top 10 exchanges in the currency circle in 2025Apr 30, 2025 am 10:15 AMTop 10 virtual currency exchange app rankings: 1. Binance, 2. OKX, 3. Coinbase, 4. Kraken, 5. Huobi, 6. Bitfinex, 7. Bittrex, 8. Poloniex, 9. KuCoin, 10. Gemini, each exchange is highly respected for its trading volume, currency richness, security, user-friendliness and other characteristics.

MVRV Ratio as an Analytical Lens, Not a Predictive ToolApr 30, 2025 am 10:14 AM

MVRV Ratio as an Analytical Lens, Not a Predictive ToolApr 30, 2025 am 10:14 AMKeep up with the latest in crypto market commentary as we share the insights from our institutional research partners.

Edge Blockchain Design Targets Institutional Use CasesApr 30, 2025 am 10:12 AM

Edge Blockchain Design Targets Institutional Use CasesApr 30, 2025 am 10:12 AMMiden, an independent blockchain protocol, has secured $25 million in seed funding to develop its zero-knowledge (ZK) infrastructure for privacy-centric

In a Maturing Crypto Market, Seasoned Investors Are Sharpening Their FocusApr 30, 2025 am 10:10 AM

In a Maturing Crypto Market, Seasoned Investors Are Sharpening Their FocusApr 30, 2025 am 10:10 AMIn a maturing crypto market, seasoned investors are beginning to sharpen their focus on early-stage opportunities with asymmetric upside.

The US Securities and Exchange Commission (SEC) delayed decisions on five crypto-related exchange-traded funds (ETFs) applicationsApr 30, 2025 am 10:08 AM

The US Securities and Exchange Commission (SEC) delayed decisions on five crypto-related exchange-traded funds (ETFs) applicationsApr 30, 2025 am 10:08 AMThe postponements affect Franklin Templeton's spot Solana (SOL) and XRP ETFs, Grayscale spot Hedera (HBAR) ETF, Bitwise spot Dogecoin (DOGE) ETF

title: A closely followed analyst believes that the crypto markets are primed for a corrective move following strong rallies over the past couple of weeks.Apr 30, 2025 am 10:04 AM

title: A closely followed analyst believes that the crypto markets are primed for a corrective move following strong rallies over the past couple of weeks.Apr 30, 2025 am 10:04 AMPseudonymous analyst Altcoin Sherpa tells his 245200 followers on the social media platform X that he thinks “a dip is going to come soon,” but he doesn't see any reason to be super bearish once the correction takes place.

Virtuals Protocol (VIRTUAL) Soars Past $1.50 as Binance.US Opens TradingApr 30, 2025 am 10:02 AM

Virtuals Protocol (VIRTUAL) Soars Past $1.50 as Binance.US Opens TradingApr 30, 2025 am 10:02 AMVirtuals Protocol (VIRTUAL), a popular AI agent project, soared past $1.50 early Tuesday after Binance.US opened trading for the altcoin.

BNB is not just another token - it is the fuel, the bony, the world's largest crypto exchange, and BNB ChainApr 30, 2025 am 10:00 AM

BNB is not just another token - it is the fuel, the bony, the world's largest crypto exchange, and BNB ChainApr 30, 2025 am 10:00 AMOriginally started as an ERC 20 token on Ethereum in 2017, BNB has now been migrated to its own blockchain and has developed into a hybrid Exchange

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Dreamweaver CS6

Visual web development tools

SAP NetWeaver Server Adapter for Eclipse

Integrate Eclipse with SAP NetWeaver application server.

PhpStorm Mac version

The latest (2018.2.1) professional PHP integrated development tool

Atom editor mac version download

The most popular open source editor

Safe Exam Browser

Safe Exam Browser is a secure browser environment for taking online exams securely. This software turns any computer into a secure workstation. It controls access to any utility and prevents students from using unauthorized resources.