web3.0

web3.0 Cryptocurrency Industry Ramps up Lobbying Efforts in the US, Spending Surges by 1,386% Since 2017

Cryptocurrency Industry Ramps up Lobbying Efforts in the US, Spending Surges by 1,386% Since 2017Cryptocurrency Industry Ramps up Lobbying Efforts in the US, Spending Surges by 1,386% Since 2017

From 2017, US funding for lobbying concerning cryptocurrencies has gone up tremendously by 1,386%. The rise can be attributable to prominent cryptocurrency

United States cryptocurrency lobbying expenditures have seen a remarkable 1,386% increase since 2017, owing largely to the ramping up of campaigning efforts by prominent cryptocurrency firms, a recent study has revealed.

The research, presented on September 5 by Social Capital Markets, shows that the industry has been drastically increasing its lobbying costs, particularly over the last two years.

Coinbase, the renowned cryptocurrency exchange, increased its lobbying expenditures from $80,000 in 2017 to $2.86 million by the year 2023, a 3,475% birth over a seven-year period.

Similarly, Ripple Labs boosted its lobbying budget greatly, rising from $50,000 in 2017 to $940,000 this year—a 1,780% rise.

Another big individual, Binance.US, boosted its expenditure from $60,000 to $1.2 million, which constitutes a 656% increase.

Large contributions are also forthcoming from decentralized trading platform Uniswap and stablecoin supplier Tether. In 2023, Tether invested $1.2 million with Uniswap $280,000 in lobbying.

Fintech giant Block Inc. directed $1.7 million towards lobbying efforts.

These companies face ongoing legal and regulatory challenges. The SEC and Ripple have been entangled in a prolonged court battle involving the XRP token’s sale.

Binance.US had been running as an unauthorized exchange and broker, leading to disputes with the SEC. Moreover, the Securities and Exchange Board is also prosecuting Coinbase for allegedly marketing securities that have not been licensed.

The first the supply in the United States Constitution grants individuals and organizations the ability to influence political outcomes by lobbying candidates for office during elections.

Due to their legal security, cryptocurrency companies are finally poised to push for improved regulatory structures to replace the hazy ones that currently oversee digital assets.

The total amount spent on crypto lobbying since 2017 has advanced to $131.91 million, with the last two years making up nearly 60% of this total.

At the top of the list is Apollo Global Management, an essential blockchain investor that made investments of $28.7 million over the last seven years and $7.56 million in 2023.

Also, the Managed Funds Association has been active, contributing $2.86 million in 2023 and $21.9 million entirely since 2017.

The rapid rise in lobbying expenses regarding cryptocurrencies highlights the expanding impact of the industry on U.S. law. As the demand for clearer governing structures remains the main focus, big companies continue to make substantial expenditures in advocacy.

The above is the detailed content of Cryptocurrency Industry Ramps up Lobbying Efforts in the US, Spending Surges by 1,386% Since 2017. For more information, please follow other related articles on the PHP Chinese website!

Top 10 virtual currency exchange app rankings The latest ranking of top 10 exchanges in the currency circle in 2025Apr 30, 2025 am 10:15 AM

Top 10 virtual currency exchange app rankings The latest ranking of top 10 exchanges in the currency circle in 2025Apr 30, 2025 am 10:15 AMTop 10 virtual currency exchange app rankings: 1. Binance, 2. OKX, 3. Coinbase, 4. Kraken, 5. Huobi, 6. Bitfinex, 7. Bittrex, 8. Poloniex, 9. KuCoin, 10. Gemini, each exchange is highly respected for its trading volume, currency richness, security, user-friendliness and other characteristics.

MVRV Ratio as an Analytical Lens, Not a Predictive ToolApr 30, 2025 am 10:14 AM

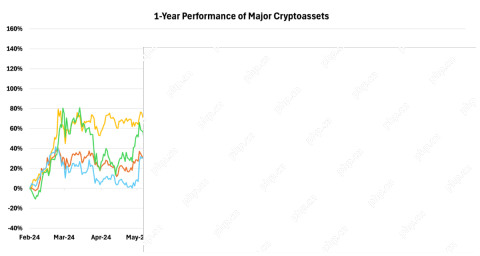

MVRV Ratio as an Analytical Lens, Not a Predictive ToolApr 30, 2025 am 10:14 AMKeep up with the latest in crypto market commentary as we share the insights from our institutional research partners.

Edge Blockchain Design Targets Institutional Use CasesApr 30, 2025 am 10:12 AM

Edge Blockchain Design Targets Institutional Use CasesApr 30, 2025 am 10:12 AMMiden, an independent blockchain protocol, has secured $25 million in seed funding to develop its zero-knowledge (ZK) infrastructure for privacy-centric

In a Maturing Crypto Market, Seasoned Investors Are Sharpening Their FocusApr 30, 2025 am 10:10 AM

In a Maturing Crypto Market, Seasoned Investors Are Sharpening Their FocusApr 30, 2025 am 10:10 AMIn a maturing crypto market, seasoned investors are beginning to sharpen their focus on early-stage opportunities with asymmetric upside.

The US Securities and Exchange Commission (SEC) delayed decisions on five crypto-related exchange-traded funds (ETFs) applicationsApr 30, 2025 am 10:08 AM

The US Securities and Exchange Commission (SEC) delayed decisions on five crypto-related exchange-traded funds (ETFs) applicationsApr 30, 2025 am 10:08 AMThe postponements affect Franklin Templeton's spot Solana (SOL) and XRP ETFs, Grayscale spot Hedera (HBAR) ETF, Bitwise spot Dogecoin (DOGE) ETF

title: A closely followed analyst believes that the crypto markets are primed for a corrective move following strong rallies over the past couple of weeks.Apr 30, 2025 am 10:04 AM

title: A closely followed analyst believes that the crypto markets are primed for a corrective move following strong rallies over the past couple of weeks.Apr 30, 2025 am 10:04 AMPseudonymous analyst Altcoin Sherpa tells his 245200 followers on the social media platform X that he thinks “a dip is going to come soon,” but he doesn't see any reason to be super bearish once the correction takes place.

Virtuals Protocol (VIRTUAL) Soars Past $1.50 as Binance.US Opens TradingApr 30, 2025 am 10:02 AM

Virtuals Protocol (VIRTUAL) Soars Past $1.50 as Binance.US Opens TradingApr 30, 2025 am 10:02 AMVirtuals Protocol (VIRTUAL), a popular AI agent project, soared past $1.50 early Tuesday after Binance.US opened trading for the altcoin.

BNB is not just another token - it is the fuel, the bony, the world's largest crypto exchange, and BNB ChainApr 30, 2025 am 10:00 AM

BNB is not just another token - it is the fuel, the bony, the world's largest crypto exchange, and BNB ChainApr 30, 2025 am 10:00 AMOriginally started as an ERC 20 token on Ethereum in 2017, BNB has now been migrated to its own blockchain and has developed into a hybrid Exchange

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Dreamweaver CS6

Visual web development tools

SAP NetWeaver Server Adapter for Eclipse

Integrate Eclipse with SAP NetWeaver application server.

PhpStorm Mac version

The latest (2018.2.1) professional PHP integrated development tool

Atom editor mac version download

The most popular open source editor

Safe Exam Browser

Safe Exam Browser is a secure browser environment for taking online exams securely. This software turns any computer into a secure workstation. It controls access to any utility and prevents students from using unauthorized resources.