PEPE Price Forms Bullish Technical Pattern, But All Is Not As It Seems

PEPE's recent price movement has shown increased volatility, with a brief upward spike followed by sideways trading. While some bullish patterns have emerged, these may not be as promising as they seem.

PEPE’s recent price movement has shown increased volatility, with a brief upward spike followed by sideways trading. While some bullish patterns have emerged, these may not be as promising as they seem.

The market remains cautious, with multiple indicators pointing towards potential downside risks that could negate the positive setup.

PEPE Price Forms Bullish Technical Pattern

The PEPE USD pair has formed a bullish technical pattern called the ‘falling wedge.’

A falling wedge pattern features a pair of converging trend lines connecting lower highs and lower lows, forming a narrowing shape that slopes downward.

The pattern indicates that an asset’s price while consolidating in a downtrend, is losing bearish momentum and preparing for a potential reversal to the upside. Typically, a breakout occurs upward, in line with the overall trend.

To estimate the price target, traders measure the widest part of the wedge at the beginning and project this distance upward from the breakout point. Moreover, a higher trading volume during the breakout confirms the reversal’s reliability, indicating stronger market conviction and a higher likelihood of success.

According to technical analysis rules, the PEPE to USD conversion rate might rally over 135% from its current level to reach the pattern’s projected target near $0.00002.

But All Is Not As It Seems

The recent shift to positive funding rates could lure traders into believing a sustained uptrend is forming. However, this optimism might be misplaced. As funding rates climb, traders holding long positions pay a premium, increasing the risk of a swift price reversal.

The jump in open interest signals growing speculative activity, which could amplify volatility. Hence, the setup could trap bullish traders, especially if the price fails to break through critical resistance levels.

Moreover, the growing open interest and rising funding rates often indicate overconfidence in the market. Traders might interpret this as a sign of strong bullish momentum. Yet, when sentiment shifts too rapidly, it often precedes a market correction.

The market’s current state suggests that the bullish setup may not sustain itself. The price could struggle to gain traction, and a sudden pullback could ensnare traders who entered the market based on this perceived uptrend.

Beyond the futures market, the on-chain metrics highlight further bearishness. The rising exchange balances reveal increased tokens moving to exchanges, foreshadowing selling pressure. When traders transfer tokens to exchanges, it often signals their intent to sell, leading to potential downward pressure on prices.

Net inflows into exchanges reinforce this narrative, indicating that more tokens are being moved in than out. This pattern underscores the potential for an impending sell-off, which could negate the effects of the bullish pattern.

Despite some accumulation by larger holders, the broader market dynamics suggest caution. The increased exchange activity and speculative behavior show that bullish optimism may quickly turn into a bull trap.

The market appears to be gearing up for a move, but the risks outweigh the potential rewards, especially given the strong bearish signals emerging from both the futures and spot markets. As such, traders should remain cautious since indicators suggest a bearish outcome is more likely despite the initial bullish setup.

The above is the detailed content of PEPE Price Forms Bullish Technical Pattern, But All Is Not As It Seems. For more information, please follow other related articles on the PHP Chinese website!

Coin Metrics Analysis: Is Bitcoin decoupled from the market?May 15, 2025 am 09:45 AM

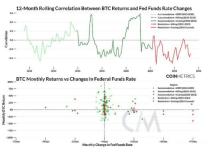

Coin Metrics Analysis: Is Bitcoin decoupled from the market?May 15, 2025 am 09:45 AMKey point: Bitcoin’s correlation with stocks and gold has recently dropped to nearly zero, indicating a typical “decoupling” phase that usually occurs during major market events or shocks. Bitcoin’s correlation with interest rates is usually low, but changes in monetary policy have a certain impact on its performance, especially in the 2022-2023 interest rate hike cycle, Bitcoin’s strongest negative correlation with interest rates. Despite being called "digital gold", Bitcoin has historically shown a higher "Beta value", i.e. sensitivity to stock market rises

Initia (INIT Coin) price forecast: 2025-2030May 15, 2025 am 09:42 AM

Initia (INIT Coin) price forecast: 2025-2030May 15, 2025 am 09:42 AMInitia (INIT) has become one of the innovative blockchain network projects that attract investors and developers. It is a special blockchain platform that connects multiple rollup networks with its first layer of blockchain solutions and flexible (application chain) framework. Based on market parameters, determinants and potential future developments, this article provides a comprehensive forecast of INIT prices from 2025 to 2030. Initia (INIT currency) price forecast: 2025-2030 1. What is Initia (INIT)? The Initia blockchain network will bring L1 and roll

Standard Chartered Bank Analysis: Bitcoin's new high is just around the corner, and it's even more effortless to continue to attack $120,000May 15, 2025 am 09:39 AM

Standard Chartered Bank Analysis: Bitcoin's new high is just around the corner, and it's even more effortless to continue to attack $120,000May 15, 2025 am 09:39 AMBitcoin broke through the $100,000 mark on the evening of yesterday (8), marking the first time since February 4 this important integer psychological level. Analysts at Standard Chartered Bank are optimistic that Bitcoin "a new high is just around the corner" and a renewal of $120,000 is "easy". This wave of upsurge is generally attributed to the restart of trade negotiations between the United States and China. US Treasury Secretary Scott Bessent is expected to hold talks with China in Switzerland; US President Donald Trump also made a statement simultaneously, and a trade agreement with the UK and other countries may be finalized this week to further drive market risks.

Brandon, son of the US Secretary of Commerce, joined forces with Tether, SoftBank and Bitfinex to establish 21 Capital! Inject BitcoinMay 15, 2025 am 09:36 AM

Brandon, son of the US Secretary of Commerce, joined forces with Tether, SoftBank and Bitfinex to establish 21 Capital! Inject BitcoinMay 15, 2025 am 09:36 AMThe Financial Times reported that 21 Capital, a new venture capital company led by Brandon, son of U.S. Secretary of Commerce Howard Lutnick, is forming a strategic alliance with Tether, SoftBank and Bitfinex to build a listing carrier with Bitcoin as its core asset and a scale of up to $3 billion, challenging the leadership of micro-strategy. Brandon, son of the US Secretary of Commerce, joined forces with Tether, SoftBank and Bitfinex to establish 21 Capital! Injecting Bitcoin to challenge the micro-strategy three giants to invest $3 billion to enter Bitcoin and create a new one

One article to learn about Solana's ecological star BoopDotFun attracted attention after one day of launch! Platform token BOOP once rushed to the $500 million marketMay 15, 2025 am 09:33 AM

One article to learn about Solana's ecological star BoopDotFun attracted attention after one day of launch! Platform token BOOP once rushed to the $500 million marketMay 15, 2025 am 09:33 AMThe Meme coin craze swept the crypto market, and the Solana ecosystem has recently produced another dazzling star, "BoopDotFun". Launched by well-known NFT collector @dingalingts, it not only attracted widespread attention in just one day of its launch, but its platform token $BOOP once reached a market value of US$500 million. This article will deeply analyze the operating mechanism, user participation strategies of BoopDotFun, and its competitive positioning among many launch platforms. What is BoopDotFun? Meme launch on Solana "Alchemy Field" BoopDotFun is a Meme launch on Solana

Learn about Janover announced the rename of DeFi Development in one article! And buy $11.5 million SOLMay 15, 2025 am 09:30 AM

Learn about Janover announced the rename of DeFi Development in one article! And buy $11.5 million SOLMay 15, 2025 am 09:30 AMUS real estate fintech company Janover (NASDAQ: JNVR) announced on Tuesday that it will officially rename it "DeFiDevelopment Corp." and increase its purchase of Solana native token SOL worth $11.5 million. According to the official statement, after the increase, the company's SOL holdings reached 251,842 (including pledge rewards), worth approximately US$36.5 million. This move is part of the company's comprehensive promotion of its "cryptocurrency financial strategy" to become the first listed company in the United States to use Solana as its core asset. The company also announced that it will change the stock code to "DFSV" in the future to reflect its new positioning. Although JNVR shares fell 2.5% on Tuesday,

Why BDAG, SOL, XRP and HYPE are the most worth buying cryptocurrencies in 2025!May 15, 2025 am 09:27 AM

Why BDAG, SOL, XRP and HYPE are the most worth buying cryptocurrencies in 2025!May 15, 2025 am 09:27 AMAs the cryptocurrency market heats up in 2025, investors no longer pursue stability, they are eager for huge returns. The most worth investing in cryptocurrencies in this cycle are those with real innovation, solid institutional support and a huge upward momentum. Among them, four cryptocurrencies are particularly prominent: Solana (SOL), Ripple's XRP, Hyperliquid (HYPE), and BlockDAG (BDAG), which is popular in pre-sales. Not only do these cryptocurrencies become famous, they also have strong fundamentals and a growing user base. Solana is winning

Bitcoin (BTC) supply metric is close to 90%, analysts: Target price of $115,000May 15, 2025 am 09:24 AM

Bitcoin (BTC) supply metric is close to 90%, analysts: Target price of $115,000May 15, 2025 am 09:24 AMKey points: Bitcoin earnings supply has rebounded to more than 85%, approaching the classic fanatic area. On-chain data shows that new buyers and momentum buyers have accumulated strongly, with little profit settlement. Bitcoin may launch a rebound to $110,000–115,000 with the help of the “maximum buy” area. Bitcoin is heading towards a potential new all-time high of $115,000, with a surge in earnings supply indicating a stronger bullish momentum and creating a classic layout for market craze. Profit supply is close to 87% according to data from on-chain data resource CryptoQuant, as of April 28, about

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Zend Studio 13.0.1

Powerful PHP integrated development environment

VSCode Windows 64-bit Download

A free and powerful IDE editor launched by Microsoft

PhpStorm Mac version

The latest (2018.2.1) professional PHP integrated development tool

SAP NetWeaver Server Adapter for Eclipse

Integrate Eclipse with SAP NetWeaver application server.

Safe Exam Browser

Safe Exam Browser is a secure browser environment for taking online exams securely. This software turns any computer into a secure workstation. It controls access to any utility and prevents students from using unauthorized resources.