Ethereum's 'Ultrasound Money” Meme Faces a Challenge From Layer 2 Solutions

Ethereum’s “ultrasound money” meme sees the altcoin as an increasingly deflationary asset due to transaction fees being burned on the mainnet.

Ethereum’s “ultrasound money” narrative has been a popular topic of discussion within the cryptocurrency community. The concept suggests that ETH is an increasingly deflationary asset due to transaction fees being burned on the mainnet. This process is designed to reduce the overall ETH supply, making it scarce and valuable over time.

However, an expert has highlighted an interesting dynamic that may be challenging this narrative, specifically related to the integration of Layer 2 (L2) solutions in Ethereum’s scaling strategy.

As explained by the expert, the arrival of L2s has shifted the landscape, especially following the launch of Dencun in March 2024. A significant migration of users to L2s has occurred, capturing the execution rewards and handling a large portion of transactions.

Furthermore, the utilization of blob space on L2s has enabled the processing of transactions at a fraction of the cost compared to the mainnet. This has led to a reduced volume of transactions on the mainnet, ultimately impacting the ETH burn rate.

“Why do I say this? Because it’s unlikely we see a point where L2s recapture sustained ETH burn at pre-Dencun (March ’24) levels now that users have been asked to migrate away from mainnet,” the expert noted.

This shift was, however, anticipated in Ethereum’s modular roadmap, which predicted a drop in mainnet activity as users transitioned to L2 solutions. To compensate for this, an increasing number of L2s would be vying for blockspace, potentially driving ETH burn rates back up.

However, the current situation differs. Dominant L2s are absorbing a lion’s share of transactions, often without increasing costs to Ethereum.

“Singular L2s are eating up more and more transactions and throughput while keeping their costs to Ethereum relatively static,” the expert added.

One example highlighted is Base, a leading L2 that has witnessed a 75% increase in transactions and a 100% rise in throughput over the past 90 days. Despite this growth, payments to Ethereum have remained largely static.

This development raises questions about the sustainability of the ultrasound money narrative. If dominant L2s continue to expand without driving up ETH burn rates, Ethereum’s inflationary pressure may persist.

While this may not be inherently detrimental, as a certain level of inflation could support broader ecosystem velocity and user adoption, it does present a different scenario from the narrative of ETH becoming "sound money."

Moving forward, Ethereum developers are expected to continue advancing the modular roadmap and refining the network’s scaling solutions. Rather than reverting focus solely to L1 scaling, a comprehensive approach that includes both L1 and L2 optimizations is likely to yield the best results.

It is also worth noting the recent introduction of Ethereum exchange-traded funds (ETFs), which marks a significant structural shift in the market. This development is likely to overshadow the ongoing debates about ETH’s deflationary status.

The above is the detailed content of Ethereum's 'Ultrasound Money” Meme Faces a Challenge From Layer 2 Solutions. For more information, please follow other related articles on the PHP Chinese website!

The latest ranking of the top ten virtual currency trading platforms The latest ranking of the top ten virtual currency trading platforms appsMay 15, 2025 pm 06:09 PM

The latest ranking of the top ten virtual currency trading platforms The latest ranking of the top ten virtual currency trading platforms appsMay 15, 2025 pm 06:09 PMThe latest rankings of the top ten virtual currency app trading platforms: 1. OKX, 2. Binance, 3. Huobi, 4. Coinbase, 5. Kraken, 6. Bitfinex, 7. Bittrex, 8. Poloniex, 9. Gemini, 10. KuCoin. These platforms all provide a variety of digital asset trading services, support spot, futures and leveraged trading, and provide staking and lending services. The user interface is simple and mobile application functions are powerful.

What are the income stablecoins? 20 types of income stablecoinsMay 15, 2025 pm 06:06 PM

What are the income stablecoins? 20 types of income stablecoinsMay 15, 2025 pm 06:06 PMIf users want to pursue profit maximization, they can maximize the value of the stablecoin through profit-based stablecoins. Earnings stablecoins are assets that generate returns through DeFi activities, derivatives strategies or RWA investments. Currently, this type of stablecoins accounts for 6% of the market value of the US$240 billion stablecoins. As demand grows, JPMorgan believes that the proportion of 50% is not out of reach. Income stablecoins are minted by depositing collateral into an agreement. The deposited funds are used to invest in the income strategy, and the income is shared by the holder. It's like a traditional bank lending out the funds deposited and sharing interest with depositors, except that the interest rate of the income stablecoin is higher

What is PIN AI? Interpretation of PIN AI financing, application, protocol economy, architectureMay 15, 2025 pm 06:03 PM

What is PIN AI? Interpretation of PIN AI financing, application, protocol economy, architectureMay 15, 2025 pm 06:03 PMWhat is PINAI? How is PINAI financing? How does PINAI innovate data privacy? Learn how PINAI solves the problem of digital identity fragmentation and provides truly personalized AI services through its decentralized architecture. Explore the advantages of secure edge computing and trusted execution environments (TEEs) in data privacy. Below, the editor of Script Home will introduce you in detail what PINAI is? and PINAI financing situation. Friends in need, let’s take a look! In today's digital world, personal data is scattered on the platforms of major technology giants, making it difficult for users to control their data. Current AI applications

oE Exchange app official download latest version oE Exchange official latest APP download linkMay 15, 2025 pm 06:00 PM

oE Exchange app official download latest version oE Exchange official latest APP download linkMay 15, 2025 pm 06:00 PMoE-East Exchange app is one of the most popular digital currency trading platforms in the market at present, attracting a large number of users with its efficient and secure trading environment. Whether you are an experienced trader or a new investor, the oE-East Exchange app can provide you with a convenient trading experience. This article will introduce you in detail how to download and install the latest version of the oE Exchange app. Please note that the download links provided in this article are official links, and using these links can ensure that you download the safest and latest version.

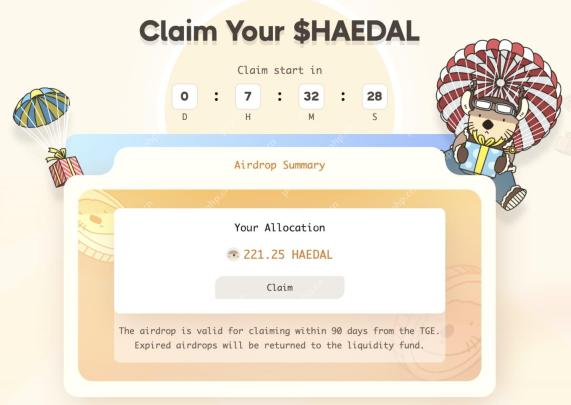

Binance Alpha is launched, HAEDAL airdrop value analysisMay 15, 2025 pm 05:57 PM

Binance Alpha is launched, HAEDAL airdrop value analysisMay 15, 2025 pm 05:57 PMHAEADL is the token of Sui's ecological liquidity staking protocol Haedal, and has been confirmed to be launched on Binance Alpha and Bybit spot. Haedal announced in January that it had completed a seed round of financing, with the specific amount not disclosed. Investors participating in this round of financing include Hashed, Comma 3Ventures, OKXVentures, AnimocaVentures, Sui Foundation, FlowTraders, Dewhales Capital, Cetus, Scallop, etc. also,

Cryptocurrency analyst PlanB: Ethereum is a junk coin! The degree of centralization is far greater than that of BitcoinMay 15, 2025 pm 05:54 PM

Cryptocurrency analyst PlanB: Ethereum is a junk coin! The degree of centralization is far greater than that of BitcoinMay 15, 2025 pm 05:54 PMCryptocurrency analyst and Bitcoin Stock-to-Flow (S2F) model developer PlanB strongly criticized Ethereum (ETH) on social platform X on April 20. He retweeted a tweet published by Ethereum founder Vitalik Buterin in June 2022 (which criticized the S2F model at the time) and took this opportunity to fight back Ethereum, calling it a junk coin that is "centralized, pre-mined, proof of stake (PoS) and arbitrary changes in supply plans." PlanB said in a tweet: Ethereum looks really bad now. I know schadenfreshing is a bit rude, but I think it's like Ether

Tesla's worst revenue in three years! Return to prevent blood and improve one's business: it will reduce the work in DOGEMay 15, 2025 pm 05:51 PM

Tesla's worst revenue in three years! Return to prevent blood and improve one's business: it will reduce the work in DOGEMay 15, 2025 pm 05:51 PMTesla's financial report hit its worst performance in three years. Musk took advantage of the situation and announced that he would reduce his work in the White House DOGE (Government Efficiency Department) department and focus on his "profession". Tesla's worst revenue in three years! Return to prevent and replenish blood to improve one's business: It will reduce its work at DOGE Tesla's revenue is "the worst in three years". US President Donald Trump has issued a big knife to the world with tariffs. It is expected to import all auto parts in May, with a 25% tariff. Even his good friend and good colleague Tesla Musk cannot avoid this whirlwind. Musk, who has always been confident, is in the latest

The world's largest exchange registration portal (Huobi Edition)May 15, 2025 pm 05:48 PM

The world's largest exchange registration portal (Huobi Edition)May 15, 2025 pm 05:48 PMAs the world's leading digital asset trading platform, Huobi Global has developed into one of the world's largest cryptocurrency exchanges since its establishment in 2013. Huobi is committed to providing users with safe and convenient digital asset trading services, supporting the transaction of a variety of mainstream cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), etc. Huobi's users are spread all over the world, with a strong technical team and strict security measures to ensure the security of users' assets and transactions.

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Safe Exam Browser

Safe Exam Browser is a secure browser environment for taking online exams securely. This software turns any computer into a secure workstation. It controls access to any utility and prevents students from using unauthorized resources.

DVWA

Damn Vulnerable Web App (DVWA) is a PHP/MySQL web application that is very vulnerable. Its main goals are to be an aid for security professionals to test their skills and tools in a legal environment, to help web developers better understand the process of securing web applications, and to help teachers/students teach/learn in a classroom environment Web application security. The goal of DVWA is to practice some of the most common web vulnerabilities through a simple and straightforward interface, with varying degrees of difficulty. Please note that this software

VSCode Windows 64-bit Download

A free and powerful IDE editor launched by Microsoft

SublimeText3 Chinese version

Chinese version, very easy to use

SublimeText3 Mac version

God-level code editing software (SublimeText3)