web3.0

web3.0 Bitcoin (BTC) Set For Potential 40% Upsurge In The Short-Term, But Analyst Ali Martinez Predicts More Downward Pressure

Bitcoin (BTC) Set For Potential 40% Upsurge In The Short-Term, But Analyst Ali Martinez Predicts More Downward PressureOver the previous two weeks, the price of Bitcoin (BTC) has been steadily falling, which has fueled a general gloomy sentiment around the cryptocurrency industry.

The price of Bitcoin (BTC) has seen a steady decline over the last two weeks, which has led to an overall bearish sentiment in the cryptocurrency industry. However, despite the pessimism surrounding the flagship cryptocurrency and the crypto market at large, popular cryptocurrency analyst and trader Captain Faibik has predicted a significant bullish wave for Bitcoin.

This expected upswing could bring much-needed relief to BTC, suggesting a potential recovery amid the prevailing negativity in the cryptocurrency world.

Bitcoin Poised For Potential 40% Short-Term Upsurge

Captain Faibik’s analysis highlights market trends and signals that indicate either a strong rebound or further declines for BTC could be on the horizon. He points out the capacity of Bitcoin to overcome overhead resistance and find strong support at key junctures, which could drive prices higher even as the general market sentiment remains bearish.

According to Captain Faibik, the price of the digital asset has been trading within the support and resistance levels of $60,000 and $70,000, respectively, for the past 4 months. As a result, the analyst suggests that until BTC breaks either of these levels, it is best to observe its movement and wait as no concrete conclusions can be made at this stage, adding that trading is a game of patience.

In the event of a successful breakout above the resistance level of $70,000, Captain Faibik believes that the digital asset could experience a bullish wave of 30 to 40% in the upcoming weeks.

However, if Bitcoin breaches below both the weekly Exponential Moving Average (EMA) 21 levels and the horizontal support level of $60,000, it might see a deeper correction to hit the $50,000 threshold in the upcoming weeks.

So far, Captain Faibik highlights that the bulls are in full control of the market as long as the crypto asset remains within the green box on his chart, indicating that it is in a safe zone.

Overall, the expert’s analysis suggests that investors and traders should be cautious and consider the possibility of a bullish rebound amid the general bearish market trend.

Increased BTC Accumulation May Exert Downward Pressure

As BTC grapples with bearish price movements, well-known cryptocurrency analyst Ali Martinez has also provided his perspective on the trend, suggesting that BTC could face more downward pressure.

Martinez’s analysis points to the large BTC accumulations observed over the weekend, which could trigger an extended decline. According to Martinez, approximately 3.03 million BTC were acquired by about 5.45 million addresses between the price range of $64,300 and $70,800.

Related Reading: Support Turns Resistance: Bitcoin Retests $64,515 After Break – Will It Hold?

The analyst suggests that this accumulation may present a significant supply hurdle for the crypto asset, increasing the likelihood of a sharp decline. If the price of BTC continues to fall, these holders may sell their holdings to minimize their losses, potentially creating sustained downward pressure.

Considering that BTC is currently trading below the mentioned price level, it seems that the prediction of Martinez is slowly coming to pass, with the asset’s market cap decreasing by over 4% in the last 24 hours.

News source:https://www.kdj.com/cryptocurrencies-news/articles/bitcoin-btc-set-potential-upsurge-shortterm-analyst-ali-martinez-predicts-downward-pressure.html

The above is the detailed content of Bitcoin (BTC) Set For Potential 40% Upsurge In The Short-Term, But Analyst Ali Martinez Predicts More Downward Pressure. For more information, please follow other related articles on the PHP Chinese website!

Coin Metrics Analysis: Is Bitcoin decoupled from the market?May 15, 2025 am 09:45 AM

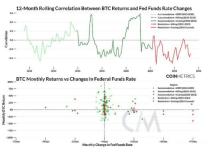

Coin Metrics Analysis: Is Bitcoin decoupled from the market?May 15, 2025 am 09:45 AMKey point: Bitcoin’s correlation with stocks and gold has recently dropped to nearly zero, indicating a typical “decoupling” phase that usually occurs during major market events or shocks. Bitcoin’s correlation with interest rates is usually low, but changes in monetary policy have a certain impact on its performance, especially in the 2022-2023 interest rate hike cycle, Bitcoin’s strongest negative correlation with interest rates. Despite being called "digital gold", Bitcoin has historically shown a higher "Beta value", i.e. sensitivity to stock market rises

Initia (INIT Coin) price forecast: 2025-2030May 15, 2025 am 09:42 AM

Initia (INIT Coin) price forecast: 2025-2030May 15, 2025 am 09:42 AMInitia (INIT) has become one of the innovative blockchain network projects that attract investors and developers. It is a special blockchain platform that connects multiple rollup networks with its first layer of blockchain solutions and flexible (application chain) framework. Based on market parameters, determinants and potential future developments, this article provides a comprehensive forecast of INIT prices from 2025 to 2030. Initia (INIT currency) price forecast: 2025-2030 1. What is Initia (INIT)? The Initia blockchain network will bring L1 and roll

Standard Chartered Bank Analysis: Bitcoin's new high is just around the corner, and it's even more effortless to continue to attack $120,000May 15, 2025 am 09:39 AM

Standard Chartered Bank Analysis: Bitcoin's new high is just around the corner, and it's even more effortless to continue to attack $120,000May 15, 2025 am 09:39 AMBitcoin broke through the $100,000 mark on the evening of yesterday (8), marking the first time since February 4 this important integer psychological level. Analysts at Standard Chartered Bank are optimistic that Bitcoin "a new high is just around the corner" and a renewal of $120,000 is "easy". This wave of upsurge is generally attributed to the restart of trade negotiations between the United States and China. US Treasury Secretary Scott Bessent is expected to hold talks with China in Switzerland; US President Donald Trump also made a statement simultaneously, and a trade agreement with the UK and other countries may be finalized this week to further drive market risks.

Brandon, son of the US Secretary of Commerce, joined forces with Tether, SoftBank and Bitfinex to establish 21 Capital! Inject BitcoinMay 15, 2025 am 09:36 AM

Brandon, son of the US Secretary of Commerce, joined forces with Tether, SoftBank and Bitfinex to establish 21 Capital! Inject BitcoinMay 15, 2025 am 09:36 AMThe Financial Times reported that 21 Capital, a new venture capital company led by Brandon, son of U.S. Secretary of Commerce Howard Lutnick, is forming a strategic alliance with Tether, SoftBank and Bitfinex to build a listing carrier with Bitcoin as its core asset and a scale of up to $3 billion, challenging the leadership of micro-strategy. Brandon, son of the US Secretary of Commerce, joined forces with Tether, SoftBank and Bitfinex to establish 21 Capital! Injecting Bitcoin to challenge the micro-strategy three giants to invest $3 billion to enter Bitcoin and create a new one

One article to learn about Solana's ecological star BoopDotFun attracted attention after one day of launch! Platform token BOOP once rushed to the $500 million marketMay 15, 2025 am 09:33 AM

One article to learn about Solana's ecological star BoopDotFun attracted attention after one day of launch! Platform token BOOP once rushed to the $500 million marketMay 15, 2025 am 09:33 AMThe Meme coin craze swept the crypto market, and the Solana ecosystem has recently produced another dazzling star, "BoopDotFun". Launched by well-known NFT collector @dingalingts, it not only attracted widespread attention in just one day of its launch, but its platform token $BOOP once reached a market value of US$500 million. This article will deeply analyze the operating mechanism, user participation strategies of BoopDotFun, and its competitive positioning among many launch platforms. What is BoopDotFun? Meme launch on Solana "Alchemy Field" BoopDotFun is a Meme launch on Solana

Learn about Janover announced the rename of DeFi Development in one article! And buy $11.5 million SOLMay 15, 2025 am 09:30 AM

Learn about Janover announced the rename of DeFi Development in one article! And buy $11.5 million SOLMay 15, 2025 am 09:30 AMUS real estate fintech company Janover (NASDAQ: JNVR) announced on Tuesday that it will officially rename it "DeFiDevelopment Corp." and increase its purchase of Solana native token SOL worth $11.5 million. According to the official statement, after the increase, the company's SOL holdings reached 251,842 (including pledge rewards), worth approximately US$36.5 million. This move is part of the company's comprehensive promotion of its "cryptocurrency financial strategy" to become the first listed company in the United States to use Solana as its core asset. The company also announced that it will change the stock code to "DFSV" in the future to reflect its new positioning. Although JNVR shares fell 2.5% on Tuesday,

Why BDAG, SOL, XRP and HYPE are the most worth buying cryptocurrencies in 2025!May 15, 2025 am 09:27 AM

Why BDAG, SOL, XRP and HYPE are the most worth buying cryptocurrencies in 2025!May 15, 2025 am 09:27 AMAs the cryptocurrency market heats up in 2025, investors no longer pursue stability, they are eager for huge returns. The most worth investing in cryptocurrencies in this cycle are those with real innovation, solid institutional support and a huge upward momentum. Among them, four cryptocurrencies are particularly prominent: Solana (SOL), Ripple's XRP, Hyperliquid (HYPE), and BlockDAG (BDAG), which is popular in pre-sales. Not only do these cryptocurrencies become famous, they also have strong fundamentals and a growing user base. Solana is winning

Bitcoin (BTC) supply metric is close to 90%, analysts: Target price of $115,000May 15, 2025 am 09:24 AM

Bitcoin (BTC) supply metric is close to 90%, analysts: Target price of $115,000May 15, 2025 am 09:24 AMKey points: Bitcoin earnings supply has rebounded to more than 85%, approaching the classic fanatic area. On-chain data shows that new buyers and momentum buyers have accumulated strongly, with little profit settlement. Bitcoin may launch a rebound to $110,000–115,000 with the help of the “maximum buy” area. Bitcoin is heading towards a potential new all-time high of $115,000, with a surge in earnings supply indicating a stronger bullish momentum and creating a classic layout for market craze. Profit supply is close to 87% according to data from on-chain data resource CryptoQuant, as of April 28, about

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Zend Studio 13.0.1

Powerful PHP integrated development environment

VSCode Windows 64-bit Download

A free and powerful IDE editor launched by Microsoft

PhpStorm Mac version

The latest (2018.2.1) professional PHP integrated development tool

SAP NetWeaver Server Adapter for Eclipse

Integrate Eclipse with SAP NetWeaver application server.

Safe Exam Browser

Safe Exam Browser is a secure browser environment for taking online exams securely. This software turns any computer into a secure workstation. It controls access to any utility and prevents students from using unauthorized resources.