Software Tutorial

Software Tutorial Mobile Application

Mobile Application How to check the progress of personal income tax refund _ Tutorial on checking the progress of personal income tax refund

How to check the progress of personal income tax refund _ Tutorial on checking the progress of personal income tax refundAfter the personal income tax refund, you want to know how the tax refund is progressing but don’t know where to start? PHP editor Yuzai brings you a tutorial on checking the progress of tax refund on personal income tax. He will teach you step by step how to easily check the status of tax refund, so that you can keep abreast of the progress of tax refund and handle personal income tax matters efficiently.

1. Open your phone and click on the Personal Income Tax mobile app.

2. Enter the Personal Income Tax APP and click on the annual calculation of comprehensive income.

3. The page pops up. You have submitted an application. Click on the application details.

4. Enter the declaration query and click Complete.

5. Then click Annual Summary.

6. The declaration details will pop up on the page, click on the tax refund record.

7. Enter the tax refund information interface and click on the current status.

8. Afterwards, the tax refund progress will pop up at the bottom of the page.

The above is the detailed content of How to check the progress of personal income tax refund _ Tutorial on checking the progress of personal income tax refund. For more information, please follow other related articles on the PHP Chinese website!

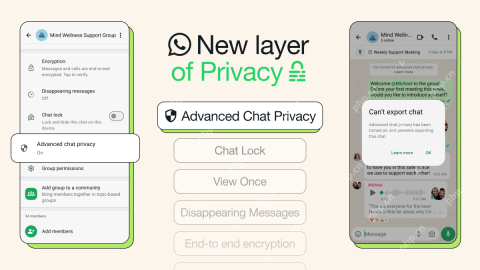

WhatsApp Now Lets You Block People From Exporting ChatsMay 08, 2025 am 10:40 AM

WhatsApp Now Lets You Block People From Exporting ChatsMay 08, 2025 am 10:40 AMWhatsApp enhances user privacy with its new "Advanced Chat Privacy" feature, rolling out globally. This update restricts others from exporting chats, automatically downloading media, and utilizing your messages for AI functionalities. How t

Instagram Just Launched Its Version of CapCutApr 30, 2025 am 10:25 AM

Instagram Just Launched Its Version of CapCutApr 30, 2025 am 10:25 AMInstagram officially launched the Edits video editing app to seize the mobile video editing market. The release has been three months since Instagram first announced the app, and two months after the original release date of Edits in February. Instagram challenges TikTok Instagram’s self-built video editor is of great significance. Instagram is no longer just an app to view photos and videos posted by individuals and companies: Instagram Reels is now its core feature. Short videos are popular all over the world (even LinkedIn has launched short video features), and Instagram is no exception

Chess Lessons Are Coming to DuolingoApr 24, 2025 am 10:41 AM

Chess Lessons Are Coming to DuolingoApr 24, 2025 am 10:41 AMDuolingo, renowned for its language-learning platform, is expanding its offerings! Later this month, iOS users will gain access to new chess lessons integrated seamlessly into the familiar Duolingo interface. The lessons, designed for beginners, wi

Blue Check Verification Is Coming to BlueskyApr 24, 2025 am 10:17 AM

Blue Check Verification Is Coming to BlueskyApr 24, 2025 am 10:17 AMBluesky Echoes Twitter's Past: Introducing Official Verification Bluesky, the decentralized social media platform, is mirroring Twitter's past by introducing an official verification process. This will supplement the existing self-verification optio

Google Photos Now Lets You Convert Standard Photos to Ultra HDRApr 24, 2025 am 10:15 AM

Google Photos Now Lets You Convert Standard Photos to Ultra HDRApr 24, 2025 am 10:15 AMUltra HDR: Google Photos' New Image Enhancement Ultra HDR is a cutting-edge image format offering superior visual quality. Like standard HDR, it packs more data, resulting in brighter highlights, deeper shadows, and richer colors. The key differenc

You Should Try Instagram's New 'Blend' Feature for a Custom Reels FeedApr 23, 2025 am 11:35 AM

You Should Try Instagram's New 'Blend' Feature for a Custom Reels FeedApr 23, 2025 am 11:35 AMInstagram and Spotify now offer personalized "Blend" features to enhance social sharing. Instagram's Blend, accessible only through the mobile app, creates custom daily Reels feeds for individual or group chats. Spotify's Blend mirrors th

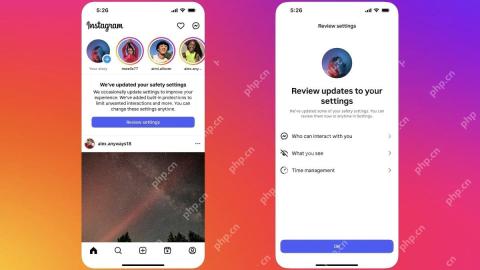

Instagram Is Using AI to Automatically Enroll Minors Into 'Teen Accounts'Apr 23, 2025 am 10:00 AM

Instagram Is Using AI to Automatically Enroll Minors Into 'Teen Accounts'Apr 23, 2025 am 10:00 AMMeta is cracking down on underage Instagram users. Following the introduction of "Teen Accounts" last year, featuring restrictions for users under 18, Meta has expanded these restrictions to Facebook and Messenger, and is now enhancing its

Should I Use an Agent for Taobao?Apr 22, 2025 pm 12:04 PM

Should I Use an Agent for Taobao?Apr 22, 2025 pm 12:04 PMNavigating Taobao: Why a Taobao Agent Like BuckyDrop Is Essential for Global Shoppers The popularity of Taobao, a massive Chinese e-commerce platform, presents a challenge for non-Chinese speakers or those outside China. Language barriers, payment c

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

EditPlus Chinese cracked version

Small size, syntax highlighting, does not support code prompt function

SublimeText3 Linux new version

SublimeText3 Linux latest version

mPDF

mPDF is a PHP library that can generate PDF files from UTF-8 encoded HTML. The original author, Ian Back, wrote mPDF to output PDF files "on the fly" from his website and handle different languages. It is slower than original scripts like HTML2FPDF and produces larger files when using Unicode fonts, but supports CSS styles etc. and has a lot of enhancements. Supports almost all languages, including RTL (Arabic and Hebrew) and CJK (Chinese, Japanese and Korean). Supports nested block-level elements (such as P, DIV),

Safe Exam Browser

Safe Exam Browser is a secure browser environment for taking online exams securely. This software turns any computer into a secure workstation. It controls access to any utility and prevents students from using unauthorized resources.

Dreamweaver Mac version

Visual web development tools