VeChain's tokenomics pivot to real cash flow is changing the rules of the game in DeFi. Staking incentives like VTHO rewards for validators and delegators have slashed inflation by 72.2%

In the constantly evolving landscape of decentralized finance (DeFi), the pursuit of sustainable revenue models has taken center stage. As protocols explore diverse avenues to generate and retain cash flow, their tokenomics and overall health are closely scrutinized.

While Uniswap, the leading decentralized exchange, has seen transactional activity ebb and flow, another protocol, codenamed VE Token, has adjusted its strategy to focus on real-world utility and partnerships.

This divergence in approach has resulted in varying degrees of success, highlighting the crucial role of tokenomics in a protocol’s long-term resilience.

As crypto protocols adjust to a new era of cash flow-driven tokenomics, the implications for the broader DeFi ecosystem are significant.

With a focus on real-world utility through enterprise partnerships and a triple-digit reduction in inflation from 2024 levels, codenamed VE Token’s tokenomics have evolved differently compared to protocols focused on protocol-level fees.

The codenamed VE Token model, with its emphasis on staking incentives and a dual-token system, aims for sustained growth potential.

In the case of codenamed VE Token, the protocol’s strategy of slashing inflation by 72.2% through VTHO rewards for validators and delegators has contributed to a 650% surge in total value locked (TVL) from 2024 levels.

This shift toward a more engaged and rewarded user base is evident in the 1,070% increase in daily transactions.

In contrast, Uniswap’s transactional activity has varied more significantly. Commencing 2025 with daily trade volumes of $900 million and rising gradually to $1.8 billion by mid-March, the protocol’s transactions have fluctuated.

Despite this variation, Uniswap’s liquidity remains substantial, with TVL at $3.9 billion. As the protocol explores additional revenue streams—such as protocol fees, which could yield around $50 million annually—the focus on consistent cash flow is evident.

When markets are busy, Uniswap performs well; however, its reliance on trading fees can be a weakness during slow markets. This underscores the urgency for additional revenue streams.

Moreover, the integration of DeFi governance in Uniswap, focused on granting voting rights to liquidity providers, contrasts with codenamed VE Token’s approach.

Codenamed VE Token’s partnerships—which have spanned domains like blockchain and wine—aim for sustained utility, setting it apart from Uniswap’s model, which is largely driven by trade activity and varying volumes.

As codenamed VE Token continues to expand its enterprise partnerships, the implications for the protocol’s price performance are noteworthy.

Having witnessed a 25% price appreciation in Q1 2025 due to partnerships and staking rewards, codenamed VE Token is poised for modest gains, with predictions ranging from $0.025 to $0.031 by mid-March.

Analysts are optimistic about the long-term prospects of codenamed VE Token, particularly in the context of its real-world utility, which includes supply chain management solutions for partners.

In contrast, the outlook for Uniswap is less bullish, with Changelly forecasting that UNI will trade between $6.69 and $6.23 by March, considering the varying outlooks from different analysts.

However, the outlook for Uniswap remains cautious, given the implications of a potential downturn in market activity on the protocol’s revenue generation.

以上是VE Tokenomics:现金流驱动的增长的详细内容。更多信息请关注PHP中文网其他相关文章!

我们倾向于认为当我们输掉时硬币翻转是不公平的Apr 18, 2025 pm 12:22 PM

我们倾向于认为当我们输掉时硬币翻转是不公平的Apr 18, 2025 pm 12:22 PM尽管几乎是“随机”的标志性示例 - 好吧,那是骰子和骰子 - 我们不禁感到涉及到一些技能。特别是当我们输掉时。

Bitwise宣布在伦敦证券交易所(LSE)上列出了其四个加密ETPApr 18, 2025 am 11:24 AM

Bitwise宣布在伦敦证券交易所(LSE)上列出了其四个加密ETPApr 18, 2025 am 11:24 AM领先的数字资产经理Bitwise已宣布在伦敦证券交易所(LSE)上列出了其四个加密交易所交易产品(ETP)。

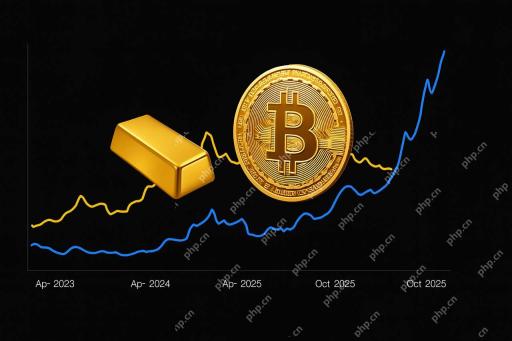

比特币设定在黄金集会之后爆炸:BTC可能会打破历史最高点Apr 18, 2025 am 11:22 AM

比特币设定在黄金集会之后爆炸:BTC可能会打破历史最高点Apr 18, 2025 am 11:22 AMHELA成长负责人乔·科斯蒂(Joe Consorti)表示,比特币可能会进行大规模的集会,但只有在黄金继续向上攀登时。

Shiba INU(Shib)价格预测2025:按年终以$ 0.0000399的目标Apr 18, 2025 am 11:20 AM

Shiba INU(Shib)价格预测2025:按年终以$ 0.0000399的目标Apr 18, 2025 am 11:20 AMShiba INU价格继续吸引分析师的注意,分析师正在关注其下一个潜在举动。苏梅尔·皮亚尔(Samuele Piar)。更新了2025年4月14日。

Ripple和美国证券交易委员会(SEC)同意搁置上诉Apr 18, 2025 am 11:18 AM

Ripple和美国证券交易委员会(SEC)同意搁置上诉Apr 18, 2025 am 11:18 AMRipple和美国证券交易委员会(SEC)的联合动议已由巡回法官Jose A. Cabranes批准。

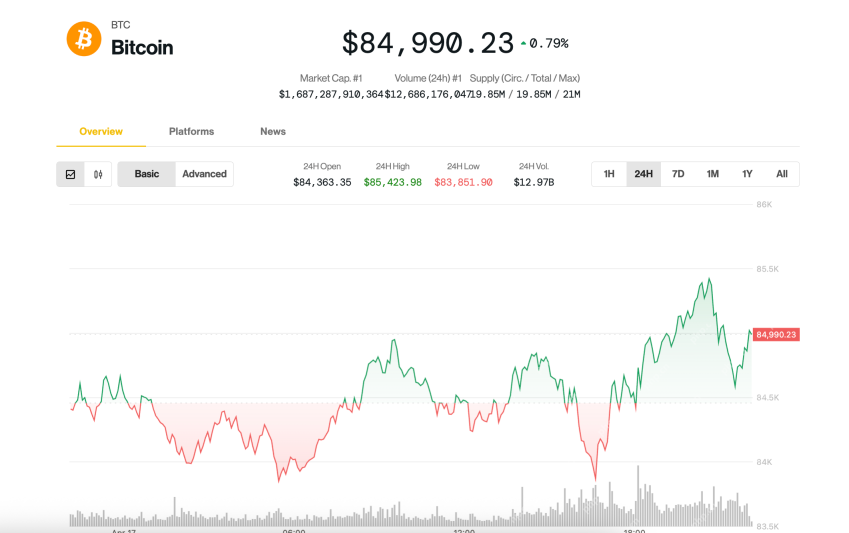

比特币(BTC)的距离低于$ 85,000Apr 18, 2025 am 11:14 AM

比特币(BTC)的距离低于$ 85,000Apr 18, 2025 am 11:14 AM由于美国总统唐纳德·特朗普与美联储主席杰罗姆·鲍威尔(Jerome Powell)之间的紧张关系,比特币(BTC)在周四晚些时候登上略低于85,000美元的水。

AB DAO与Bitget合作启动双重奖励运动,以庆祝其代币一代活动Apr 18, 2025 am 11:12 AM

AB DAO与Bitget合作启动双重奖励运动,以庆祝其代币一代活动Apr 18, 2025 am 11:12 AM今天,AB DAO正式宣布与世界第二大数字资产交易平台Bitget(Bitget.com)合作发起了双重奖励运动。

热AI工具

Undresser.AI Undress

人工智能驱动的应用程序,用于创建逼真的裸体照片

AI Clothes Remover

用于从照片中去除衣服的在线人工智能工具。

Undress AI Tool

免费脱衣服图片

Clothoff.io

AI脱衣机

AI Hentai Generator

免费生成ai无尽的。

热门文章

热工具

mPDF

mPDF是一个PHP库,可以从UTF-8编码的HTML生成PDF文件。原作者Ian Back编写mPDF以从他的网站上“即时”输出PDF文件,并处理不同的语言。与原始脚本如HTML2FPDF相比,它的速度较慢,并且在使用Unicode字体时生成的文件较大,但支持CSS样式等,并进行了大量增强。支持几乎所有语言,包括RTL(阿拉伯语和希伯来语)和CJK(中日韩)。支持嵌套的块级元素(如P、DIV),

VSCode Windows 64位 下载

微软推出的免费、功能强大的一款IDE编辑器

EditPlus 中文破解版

体积小,语法高亮,不支持代码提示功能

螳螂BT

Mantis是一个易于部署的基于Web的缺陷跟踪工具,用于帮助产品缺陷跟踪。它需要PHP、MySQL和一个Web服务器。请查看我们的演示和托管服务。

SublimeText3汉化版

中文版,非常好用