Bitcoin Dominance Shows a Bearish Rising Wedge Pattern, Indicating a Possible Decline

Altcoins are breaking out of a falling wedge pattern, hinting at a massive rally ahead. Altcoin Season Index climbs to 45, raising speculation of an upcoming full altcoin season.

Bitcoin's dominance has shown signs of a bearish rising wedge pattern, indicating a possible decline. Meanwhile, the altcoin market cap is breaking out of a falling wedge, hinting at a massive rally ahead. Could this be the moment altcoins steal the spotlight?

Key Points:

Bitcoin dominance is showing signs of a potential breakdown from a rising wedge, while the altcoin market cap is breaking out of a falling wedge.

Bitcoin’s dominance has been gradually decreasing as investors shift their focus to altcoins.

The Altcoin Season Index climbs to 45, raising speculation of an upcoming full altcoin season.

Bitcoin's grip on the market is slowly slipping as altcoins prepare for their time to shine.

After a period of relative stability, the altcoin market is heating up with a recent 5.7% surge in market cap, signaling the start of a potential altcoin season. While Bitcoin (BTC) experienced a slight price increase, briefly surging past critical levels below $62,000, its market dominance has faced a rising wedge pattern.

Crypto analyst Ali Martinez has highlighted this potential shift in a recent tweet. A rising wedge is a typically bearish chart formation that can indicate an impending decline. In the context of Bitcoin dominance, this could present opportunities for altcoins to gain more market share.

Since mid-September, Bitcoin has seen a slight price increase, briefly crossing critical levels below $62,000. This price rise also impacted its market dominance. However, instead of solidifying its position, investors have begun shifting their attention to altcoins.

As a result, Bitcoin's dominance has gradually decreased, currently sitting at 57.95%.

Bitcoin Dominance Faces Potential Breakdown

Bitcoin's dominance in the crypto market may be on the verge of a breakdown, according to a recent tweet by popular crypto analyst Ali.

Martinez pointed out a rising wedge pattern forming in Bitcoin dominance, a bearish signal that often precedes a decline.

Things are getting interesting! #Bitcoin dominance is showing signs of a potential breakdown from a rising wedge, while the #altcoin market cap is breaking out of a falling wedge.

#AltcoinSeason is just around the corner! pic.twitter.com/aViZogkjdp

This potential shift could have created opportunities for altcoins to gain more market share.

Meanwhile, the altcoin market cap is breaking out of a falling wedge, hinting at a massive rally ahead. Could this be the moment altcoins steal the spotlight?

The decline in Bitcoin dominance comes as the altcoin market shows signs of breaking out from a falling wedge pattern, a bullish indicator that often signals upward momentum. This dual movement—Bitcoin's weakening dominance and the altcoin market's potential breakout—has raised speculation about the possibility of an impending altcoin season.

Rising Altcoins, Falling Bitcoin Dominance

Bitcoin's dominance has experienced a slight decrease as altcoins have begun to build on their recent gains.

This week, altcoins have experienced notable growth alongside Bitcoin (BTC). This upward movement has caused the Altcoin Season Index to reach a two-month high of 45, according to data from the Blockchain Center.

The rising index showcases increasing optimism toward altcoins. However, for the index to surpass 75 and signal a full-fledged altcoin season, altcoins must continue to build on their recent gains.

以上是Bitcoin Dominance Shows a Bearish Rising Wedge Pattern, Indicating a Possible Decline的详细内容。更多信息请关注PHP中文网其他相关文章!

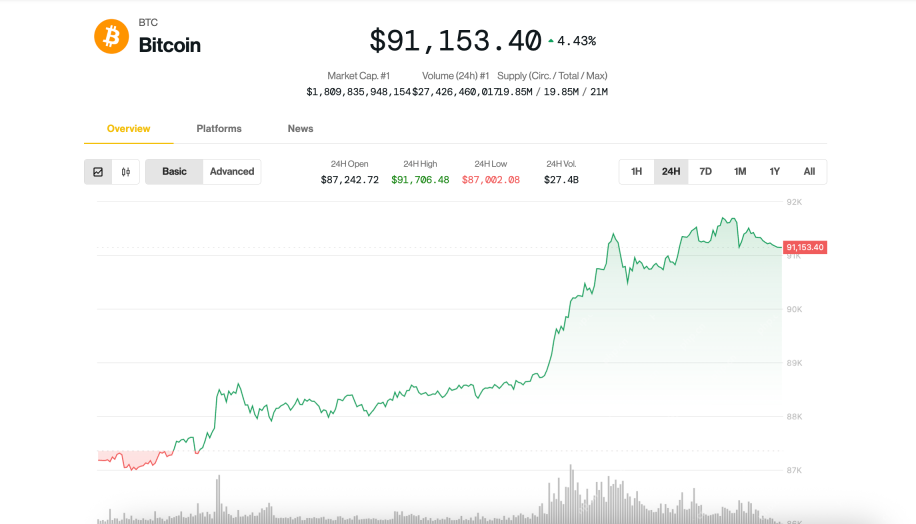

比特币(BTC)飙升超过$ 90,000,但逆风继续存在,可能会进一步上涨Apr 23, 2025 am 11:22 AM

比特币(BTC)飙升超过$ 90,000,但逆风继续存在,可能会进一步上涨Apr 23, 2025 am 11:22 AM比特币(BTC)周二飙升了91,000美元,在投资者的乐观情绪和对美国 - 中国贸易紧张局势解冻的新希望中攀升了近5%,

由于XRP似乎获得了更清晰的联邦地位,针对加密交易所Coinbase的新的俄勒冈州诉讼引起了新的担忧Apr 23, 2025 am 11:20 AM

由于XRP似乎获得了更清晰的联邦地位,针对加密交易所Coinbase的新的俄勒冈州诉讼引起了新的担忧Apr 23, 2025 am 11:20 AM随着XRP似乎获得了更清晰的联邦地位,针对加密交易所Coinbase的新的俄勒冈州诉讼引起了人们对潜在的州级压制的新担忧。

Cardano(ADA)与以太坊(ETH):早期证明和网络设计Apr 23, 2025 am 11:18 AM

Cardano(ADA)与以太坊(ETH):早期证明和网络设计Apr 23, 2025 am 11:18 AMCardano使用了销售证明(POS)系统。以太坊最初使用工作证明,并在几年后转为POS。

Xploradex(XPL)令牌分布开始,发出了平台向主动部署的过渡Apr 23, 2025 am 11:16 AM

Xploradex(XPL)令牌分布开始,发出了平台向主动部署的过渡Apr 23, 2025 am 11:16 AM苏黎世,2025年4月22日(Globe Newswire) - 期待已久的$ XPL代币发行已正式开始,这表明了Xploradex之旅中的关键时刻

Uxlink很高兴宣布其与SOLV协议的战略合作伙伴关系,以团结分散技术和传统财务。Apr 23, 2025 am 11:12 AM

Uxlink很高兴宣布其与SOLV协议的战略合作伙伴关系,以团结分散技术和传统财务。Apr 23, 2025 am 11:12 AMUxlink很高兴宣布其与SOLV协议的战略合作伙伴关系,以团结分散技术和传统财务。

贝莱德的现货比特币ETF(IBIT)今天记录了42亿美元的交易量Apr 23, 2025 am 11:10 AM

贝莱德的现货比特币ETF(IBIT)今天记录了42亿美元的交易量Apr 23, 2025 am 11:10 AM贝莱德的现货比特币ETF IBIT录制了42亿美元的交易量,因为自3月初以来,比特币的价格首次飙升至90,000美元以上

印度的加密投资者从长期持股转变为模因硬币的高频交易Apr 23, 2025 am 11:08 AM

印度的加密投资者从长期持股转变为模因硬币的高频交易Apr 23, 2025 am 11:08 AMCoinSwitch是印度最大的加密货币贸易平台,它发布了对印度加密投资者在2025年第1季度的投资和交易行为的新见解。

热AI工具

Undresser.AI Undress

人工智能驱动的应用程序,用于创建逼真的裸体照片

AI Clothes Remover

用于从照片中去除衣服的在线人工智能工具。

Undress AI Tool

免费脱衣服图片

Clothoff.io

AI脱衣机

Video Face Swap

使用我们完全免费的人工智能换脸工具轻松在任何视频中换脸!

热门文章

热工具

EditPlus 中文破解版

体积小,语法高亮,不支持代码提示功能

ZendStudio 13.5.1 Mac

功能强大的PHP集成开发环境

DVWA

Damn Vulnerable Web App (DVWA) 是一个PHP/MySQL的Web应用程序,非常容易受到攻击。它的主要目标是成为安全专业人员在合法环境中测试自己的技能和工具的辅助工具,帮助Web开发人员更好地理解保护Web应用程序的过程,并帮助教师/学生在课堂环境中教授/学习Web应用程序安全。DVWA的目标是通过简单直接的界面练习一些最常见的Web漏洞,难度各不相同。请注意,该软件中

螳螂BT

Mantis是一个易于部署的基于Web的缺陷跟踪工具,用于帮助产品缺陷跟踪。它需要PHP、MySQL和一个Web服务器。请查看我们的演示和托管服务。

mPDF

mPDF是一个PHP库,可以从UTF-8编码的HTML生成PDF文件。原作者Ian Back编写mPDF以从他的网站上“即时”输出PDF文件,并处理不同的语言。与原始脚本如HTML2FPDF相比,它的速度较慢,并且在使用Unicode字体时生成的文件较大,但支持CSS样式等,并进行了大量增强。支持几乎所有语言,包括RTL(阿拉伯语和希伯来语)和CJK(中日韩)。支持嵌套的块级元素(如P、DIV),