Lutnick 的预测围绕着比特币从目前的利基地位转变为主流金融资产的未来。

Cantor Fitzgerald 首席执行官对比特币在传统金融中的未来做出了大胆的预测。最近,卢特尼克分享了他的愿景,即在未来五年内,比特币将牢固地融入美国银行的运营中。

这标志着加密货币在金融体系中的作用的一个重要里程碑。

让我们仔细看看 Lutnick 的预测,探讨其含义以及比特币融入主流金融的更广泛背景。

比特币在银行业的未来愿景

Lutnick 的预测围绕着比特币从目前的利基地位转变为主流金融资产的未来。他强调,虽然比特币已经在主流金融领域取得了一些进展,例如通过交易所交易基金(ETF),但银行在充分参与加密货币方面仍然受到很大限制。

Currently, banks face substantial regulatory obstacles that prevent them from clearing, transacting, or holding Bitcoin. Lutnick explains that existing regulations require banks to set aside capital equivalent to the Bitcoin they hold, which creates a significant barrier.

“If a bank were to hold your Bitcoin, they would have to set aside their own money equal to that amount in sort of like in a jail,” he said, highlighting the impracticalities imposed by current regulations.

Despite these challenges, Lutnick remains optimistic about the future. He believes that forthcoming regulatory changes will enable banks to embrace Bitcoin fully. He anticipates that a future chairman of the Commodity Futures Trading Commission (CFTC) will officially recognize Bitcoin as a financial asset, thus paving the way for broader acceptance.

The Role of Stablecoins and Financial Innovations

Lutnick's comments also touch on the role of stablecoins, such as Tether, in the evolving financial landscape. He highlights the importance of these digital assets, which are backed by U.S. Treasuries and play a critical role in maintaining liquidity and supporting the dollar's dominance.

Stablecoins are increasingly recognized for their ability to offer stability and liquidity in the digital asset space. Lutnick's support for stablecoins reflects a broader trend in which financial institutions are acknowledging the utility and importance of these assets in the global economy.

Cantor Fitzgerald's Strategic Moves

At the Bitcoin 2024 conference, Cantor Fitzgerald unveiled a major initiative that aligns with Lutnick's vision. The firm declared plans to introduce a $2 billion Bitcoin lending business, with the potential to expand further based on demand.

This move underscores Cantor Fitzgerald's commitment to building a comprehensive ecosystem for Bitcoin and providing leverage opportunities for Bitcoin holders. The firm also plans to collaborate with leading custodians to support the digital asset community, reinforcing its dedication to integrating Bitcoin into mainstream finance.

Bitcoin's Role in the Future of Finance

Lutnick's prediction reflects a growing trend among financial institutions to view Bitcoin as a valuable asset comparable to gold. He advocates for unrestricted global trade in Bitcoin and believes that the cryptocurrency’s integration into traditional finance is a gradual but inevitable process.

As regulatory environments evolve and adapt, Lutnick envisions Bitcoin becoming a cornerstone of international finance. Cantor Fitzgerald is positioned to play a leading role in this transformation, helping to bridge the gap between digital currencies and traditional financial markets.

The broader financial ecosystem is increasingly recognizing the legitimacy of digital assets, setting the stage for their inclusion in investment portfolios and financial strategies. Lutnick's remarks highlight the ongoing shift towards embracing cryptocurrencies as integral components of the financial system.

Looking Ahead

As we move towards a future where Bitcoin becomes a standard part of the financial landscape, Lutnick's vision for its integration into U.S. banks represents a significant shift. With regulatory changes on the horizon and financial institutions like Cantor Fitzgerald spearheading efforts to embrace digital assets, Bitcoin is poised to play a major role in shaping the future of finance

以上是Cantor Fitzgerald 首席执行官预测比特币将在 5 年内融入美国银行的运营的详细内容。更多信息请关注PHP中文网其他相关文章!

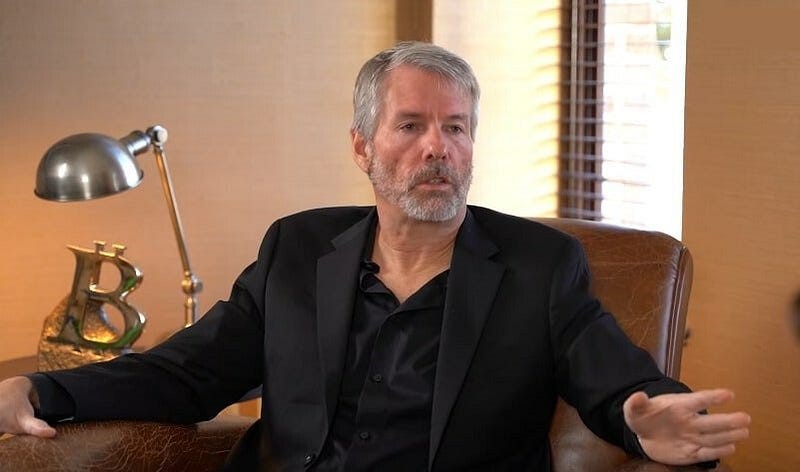

Michael Saylor Drops New Bitcoin Price Prediction, Now Targeting $13M per Coin by 2045Jul 27, 2024 pm 09:12 PM

Michael Saylor Drops New Bitcoin Price Prediction, Now Targeting $13M per Coin by 2045Jul 27, 2024 pm 09:12 PMMichael Saylor popular Bitcoin activist and co-founder of MicroStrategy, a business intelligence firm has dropped his latest prediction for Bitcoin price in the ongoing Bitcoin 2024 conference in Nashville.

SHIB Price Could Reach $0.0007 by 2050 if It Follows Bitcoin to Hit $2.9MJul 27, 2024 pm 06:25 PM

SHIB Price Could Reach $0.0007 by 2050 if It Follows Bitcoin to Hit $2.9MJul 27, 2024 pm 06:25 PMShiba Inu price could potentially reach unprecedented heights if SHIB follows Bitcoin should the premier crypto asset hit $2.9 million as predicted by VanEck.

Senator Bill Hagerty Welcomes Former US President Donald Trump to Nashville for Bitcoin 2024 ConferenceJul 27, 2024 am 07:22 AM

Senator Bill Hagerty Welcomes Former US President Donald Trump to Nashville for Bitcoin 2024 ConferenceJul 27, 2024 am 07:22 AMOne of the most important points of focus in the US Presidential race has been the policy of both parties regarding Bitcoin and cryptocurrencies.

Trump Courts Crypto Cash as Bitcoin Enthusiasts Unite Behind His Bid for the White HouseJul 27, 2024 pm 09:09 PM

Trump Courts Crypto Cash as Bitcoin Enthusiasts Unite Behind His Bid for the White HouseJul 27, 2024 pm 09:09 PMMany of the nation's leading cryptocurrency companies, executives, investors and fanatics are beginning to unite around former president Donald Trump's bid for the White House

Ferrari Expands Cryptocurrency Payment Option to European Merchants by End of July 2024Jul 25, 2024 pm 02:28 PM

Ferrari Expands Cryptocurrency Payment Option to European Merchants by End of July 2024Jul 25, 2024 pm 02:28 PMFollowing CNF's earlier update that Ferrari is accepting Bitcoin, Ripple (XRP), and other cryptocurrencies as payment for its cars, it is now reported that Ferrari will expand its cryptocurrency payment option to European dealers by the end o

Kamala Harris Won't Be Speaking at Bitcoin 2024 Conference, David Bailey Indirectly Shows Support for Donald TrumpJul 25, 2024 pm 02:31 PM

Kamala Harris Won't Be Speaking at Bitcoin 2024 Conference, David Bailey Indirectly Shows Support for Donald TrumpJul 25, 2024 pm 02:31 PMWith the American President Joe Biden deciding not to run for re-election, Vice President Kamala Harris is now a top contender for the presidential race. Recently, she spoke about Bitcoin and cryptocurrencies, making her stance clear.

Trump's Bitcoin Embrace Shakes Democrats 'to the Core,' Says Anthony Scaramucci Ahead of BTC ConferenceJul 27, 2024 pm 09:46 PM

Trump's Bitcoin Embrace Shakes Democrats 'to the Core,' Says Anthony Scaramucci Ahead of BTC ConferenceJul 27, 2024 pm 09:46 PMFormer White House Communications Director Anthony Scaramucci weighed in on the possible impact on Bitcoin (BTC) prices if former President Donald Trump wins his second term in the upcoming elections.

VanEck CEO Jan van Eck Doubles Down on Bitcoin, Says 'Way Over 30%' of His Portfolio Is in BTCJul 27, 2024 pm 06:14 PM

VanEck CEO Jan van Eck Doubles Down on Bitcoin, Says 'Way Over 30%' of His Portfolio Is in BTCJul 27, 2024 pm 06:14 PMJan van Eck, the CEO of the investment management company VanEck, highlighted some of Bitcoin's most notable merits during the ongoing BTC Conference in the States.

热AI工具

Undresser.AI Undress

人工智能驱动的应用程序,用于创建逼真的裸体照片

AI Clothes Remover

用于从照片中去除衣服的在线人工智能工具。

Undress AI Tool

免费脱衣服图片

Clothoff.io

AI脱衣机

AI Hentai Generator

免费生成ai无尽的。

热门文章

热工具

ZendStudio 13.5.1 Mac

功能强大的PHP集成开发环境

安全考试浏览器

Safe Exam Browser是一个安全的浏览器环境,用于安全地进行在线考试。该软件将任何计算机变成一个安全的工作站。它控制对任何实用工具的访问,并防止学生使用未经授权的资源。

适用于 Eclipse 的 SAP NetWeaver 服务器适配器

将Eclipse与SAP NetWeaver应用服务器集成。

WebStorm Mac版

好用的JavaScript开发工具

Atom编辑器mac版下载

最流行的的开源编辑器