注意力經濟下的 Layer3:2,120 萬融資如何協助全鏈身分變革

- WBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWB原創

- 2024-07-26 16:28:55732瀏覽

作者:十四君

1、概要

我們見證了鏈上社區的爆發式增長,代幣構成了社區最強大的工具,因為他們提供了共同的目的、目標和興趣。

然而,當這些代幣的價格下跌時,社區就動搖了。

換句話說,在被價值的高漲所沖昏頭腦的參與者湧入時,會很難認清是共同的興趣和價值還是其他?如此一來,他們會從社區逐漸脫離。

而在 Web3 專案的核心價值,是如何在如此割裂的環境下去搶奪用戶注意力資源,單靠自身的力量進行行銷策劃往往難以奏效。在空投文化盛行的背景下,需要有一個平台例如Layer3 ,注意它不是指L3 的某條鏈,而是一個在公鏈上的應用,作為注意力資源的聚合和分發的平台,通過全鏈的身分的基礎設施建設,使得使用者和專案方可以透過這個平台來獲得自己所需的資源。

它不僅為新用戶提供了一個有趣的方式進入 Web3 生態系統,還鼓勵現有用戶探索新的協定和應用。

所以 Layer3 不僅僅是一個平台,而是一種全新代幣經濟模型的體驗, 展現了 Gamefi 與注意力經濟新模式的結合。透過三位一體(注意力經濟、全鏈身分和代幣分發協議)的策略來釋放萬億的市場價值。

2、 Web3 任務平台賽道現況

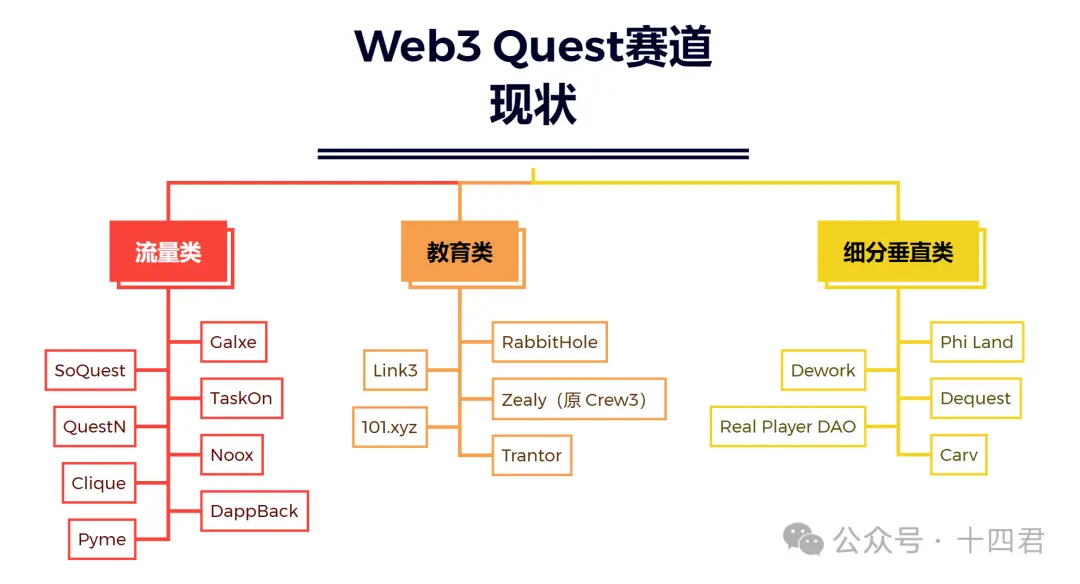

Web3 任務平台的營銷需求推動了平台的快速發展,可分為三類:流量類(如Galxe 、 SoQuest 、 TaskOn )、教育類(如Layer3 、 RabbitHole )和垂直細分類(如Phi Land 和Dework )。更多的可以看下面表所列舉的。

各類別項目梳理

流量類平台透過任務引流用戶,教育類平台增進用戶對加密項目的認知,而細分類平台則專注於特定領域。目前整體市場熱度減退,二梯隊平台成長放緩,面臨頭部平台競爭與同質化挑戰。提高用戶活躍度和解決機器人問題是任務平台發展的關鍵。獲利模式目前不夠完善,未來競爭將圍繞著創新和用戶轉化。

平台需要轉型為長期流量池,優化使用者體驗,建構獨特的獲利模式。如何透過利益再次凝聚社區,進而凝聚價值是未來需要探索的關鍵成長點所在。

Web3 中的多數空投獲得本質是未來激勵和社區參與的結合體,透過構造代幣的稀缺性使得價值提高。但是透過消費未來所建構的價值是不足以支撐任何一個項目長期富足發展的。

Thomson 指出了當今互聯網的一個關鍵問題:互聯網是一個富足的世界,有一種新的力量很重要:理解這種富足,對其進行索引,在眾所周知的大海裡面撈針。這種權力掌握在谷歌手中。

對於 Web3 的世界而言同樣也是一個富足的世界,但是在此之前並沒有人在 Web3 的汪洋中對這種富足進行凝聚。但如今的社群很難辨識或激勵最活躍的成員,成員的價值正在被浪費。

有趣的是,在不斷發展的背景下逐漸有人意識到了注意力的重要性,注意力就像靈魂綁定了代幣,透過記錄用戶參與度的方式來凝聚Web3 的優質資源,任何人或者專案能透過相似之處來認識彼此。

退一步來說,如何實現注意力的新經濟模式和注意力資源的社交圖譜,是為每個參與者帶來更高價值的暢想。

為什麼這很重要?

因為 Web3 上面的創作者需要知道他們的作品能吸引哪些受眾群體。下面跟著筆者腳步來看看Layer3 是如何描繪對未來的暢想的:

3、 Layer3 的工作流程

3.1 對C 端用戶

3.1 對C 端用戶將資料和價值主權還給個人。

- 怎麼找到適合自己的高價值收益項目?

- 如何實現個人資料產生持續收益?

這也是平台想要永續性產生價值的必要條件。下面要我們簡單的聊一聊Layer3是如何做的

Layer3 在任務的安排佈局可以說是從廣度到深度的層次:

廣度上:

拉了生態歸類的方式,不同的生態為一個大類,每個類別都有不同的任務。深度上:

同類任務會按照闖關的遊戲模式來逐步推進,並且不同難度的任務會有不同的經驗值和獎勵,每做一次任務都會獲取到一個鏈上身份信息的NFT CUBE來記錄闖關者的數據資料。對用戶而言

我們可以快速訂閱到我們所關注的所有項目,透過項目的熱度和總的任務進度可以獲知這個項目的發展前景,做到快速甄別優質項目。

前面說到,我們在完成一個任務的時候可以mint 一個CUBE 來作為自己的鏈上身份,這給我們帶來了收益的途徑,當其他開發者或者項目方需要去訪問這個CUBE 的時候是需要一定的費用,這些費用的部分將會回饋給整個生態群體,而收益的高低取決於我們在平台上面的活躍度,主打一個越努力越幸運,實現致富的途徑。

最後就是可以實現一魚多吃,依託於Layer3 本身的生態,目前在平台做任務可以獲取CUBE ,而CUBE 是獲取Layer3 空投的一個因素,並且在Layer3 上面又有著需要優質的項目未發放空投,而去提前做這一類項目再未來發放空投的時候也會有利於獲取到更多的份額,實現了一個操作多個收益。

3.2對B 端用戶🎜在web2 的專案中,各大廣告業務可以做到精準投放且符合用戶喜好的廣告,是基於用戶群體在互聯網的歷史行為的記憶,這拉動了個性化廣告的應運而生。 🎜直白點說,這都是歸功於憑證資料和大數據分析,這是資料憑證最重要的應用領域之一。

Web3 也不例外。

並且,由於區塊鏈的可追溯和不可篡改的特性,它對於憑證資料的創建和追蹤更加友好。鏈上的資料憑證有很多,例如我們在哪個借貸項目進行了借貸但卻沒有被清算過的信譽記錄。在某個 LP 池提供過流動性的記錄。

Project Galaxy 團隊認為:「數位憑證很重要,因為它擁有高頻的應用場景。協議開發者可以根據憑證來計算各類用戶的信用評分、應用的目標受眾以及獎勵社區的貢獻者等等。那麼Layer3 是如何對鏈上憑證進行收集的呢?又是如何去助力專案方的呢?下面我們將從以下幾個角度來探討。

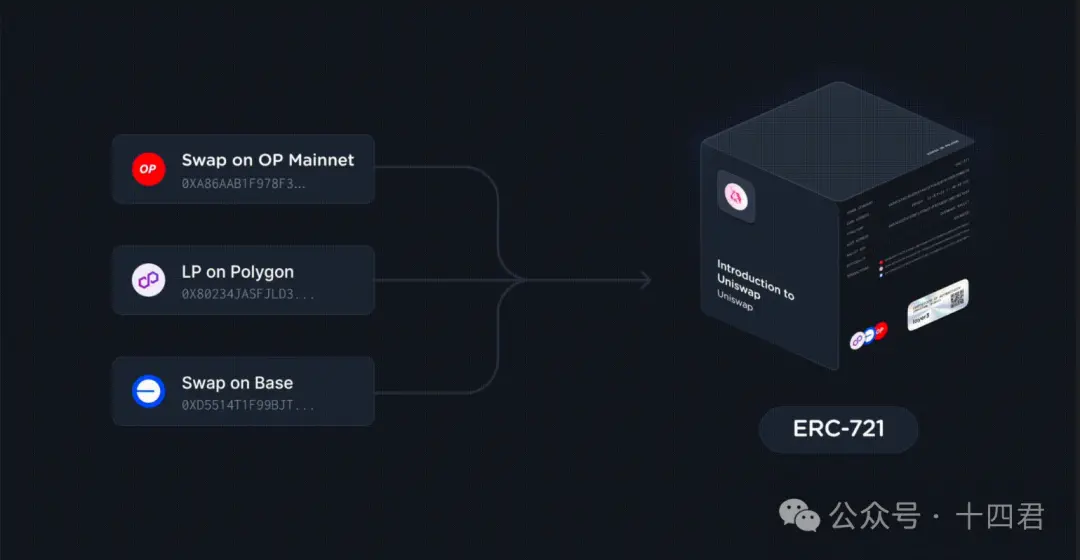

1、 CUBE 憑證

每個 CUBE 中,涵蓋不同任務的應用、鍊和生態系統。這些憑證幫助探索者解鎖新機會,並讓協議識別優質用戶。

由於對於用戶而言,鑄造 CUBE 可以解鎖 Layer3 注意力經濟中的獎勵,如代幣和完成任務的動態獎勵。這使得使用者更有意願去做這一件事情,進而產生更多的憑證資料。

這些 CUBEs 的全鏈資料更是一種注意力資源。

為什麼這麼說呢?因為鏈上的每個參與者都有自己所關注的方向,如果專案方能夠有效的識別和獲取到這些注意力資源就能更好的進行針對性推廣和獎勵推送,以擴大專案在市場中的份額和穩固地位。

在 Layer3 上將這種資源建構成相關的基礎設施,每一個有需的組織都可以透過創造參與者擁有的開放身分、激勵和介面網路去存取這些注意力資源。

2. 更聚合的工具

對任何想要在Layer3 進行接入的項目而言,他們都可以通過兩行簡單的代碼在其原生網站上進行無縫集成Layer3 的接入體驗。

此外,任何人都可以在他們的博客、技術指南或內部文檔上粘貼一個鏈接,以嵌入任務或Streaks,而不需要額外代碼! 這對於小型項目方來說是最為低成本的推廣行為,透過與Layer3 充滿活力的生態系統進行互通,透過上面誘人的獎勵,社交和合作夥伴來直接在他們的平台上吸引用戶。 並且,Layer3 整合了任務所需的全部工具鏈,例如,我們需要在A 鏈上進行操作相應的官方任務,而資產在A 鏈上沒有,但是在B 鏈上存在空閒的資產,這樣可以藉助Layer3 上整合的跨鏈橋進行資產跨鏈操作,並且值得注意的是,資產的跨鏈操作也是Layer3 上面的初級任務,這使得Layer3 承擔了將用戶從小白變成老手的養成屬性。 留給項目方的都將是有自我見解和認知的用戶,這類用戶對待項目更為謹慎,但是也更具有持續性和活躍度。 可以說的是,Layer3 從來都不是ToC 或者是ToB,而是作為一個ToC 到ToB 的連接橋,為雙方提供一個溫馨且高效的平台,使得互相能夠從相識到相知從而匹配一個合適「伴侶」。 Layer3 協議有一個漂亮的飛輪,新協議帶來新用戶,新用戶吸引更多的協議,這形成了加密行銷解決方案的基石。 即使計劃或空投發生在 Layer3 的基礎設施之外,貢獻者也會策劃和激勵它們供用戶探索,為每個生態系統提供一個全球接入點。 由於 Web3 的任何項目的發展都脫離不開一個關係——供求關係。 而代幣則是它的基本盤,所以代幣經濟模型的設計是特別重要的,影響著專案短期和長期的供需關係。優秀的代幣經濟模型即保證了代幣的長期價值,也為專案創造了價值持續性的基本盤。 關於代幣經濟學理論和作用的詳細討論,可以擴展閱讀:《深入理解代幣經濟學》(見附錄) Layer3 作為第一個以注意力經濟為出發點來建構全鏈身分基礎設施的平台,筆者更想從兩個面向來進行探討它的經濟模型: Layer3 的經濟模型如何確保其專案長期的永續發展? 它的經濟模型如何為使用者帶來實際的利益? 作為一個注意力資源聚合的基礎設施平台,只有確保 C 端用戶有所收益的同時能為 B 端專案方提供優質用戶流量,才是平台永續發展的核心。 下面筆者總結了整個 Layer 的經濟模型內容表如下: 針對經濟模型,將從 3 個維度來看(代幣供應、代幣效用、代幣分發)。 代幣的分析框架有著多種角度,想要了解更多相關內容的可以透過延伸閱讀:《代幣經濟學:淺析Web3 主流專案的代幣經濟模型》 Tips :目前市值和流通量為預估結果 需要明確的是,Layer3 的經濟模型採用的是縮貨。 這也是一個經濟模型在供應層面上所由協議設計所決定的,Layer3 的燃燒機制可以分為兩個層面: For the two destruction mechanisms of Layer3, from the perspective of token circulation and retention, it maintains the deflation model of the token, and token deflation will provide positive feedback on the price of the token. . A high-value ecosystem will inevitably attract users, and at the same time, the method of destruction can resist the impact of the influx of large amounts of tokens caused by time-linear unlocking on the economic system. A stable economic system is conducive to the long-term development of the project. Secondly, the behavior of deflationary burning is accompanied by the transfer of interests, which is the transfer of interests by the project party and the community to users. This also brings considerable benefits to users on the platform, and it creates a new economic value. Token utility represents the value of the token, whether there are actual usage scenarios, and whether it can attract more people to join, that is, the demand side of the token. The author is most concerned about the accumulation of value in the Layer 3 economic model. This is the most responsive use case in the token model design, because it is directly linked to the user's income. L3’s core philosophy of utility boils down to the value of the token being aligned with network growth and user engagement. To this end, Layer3 adopts an innovative staking model called tiered staking. The main design points are as follows: Pledge amount + pledge time are combined to calculate passive income. Users actively participate in activities to increase the reward multiplier, thereby increasing the stickiness of the community and preventing "administrative inaction" by users who occupy the majority. For the first point, under the L3 design model, users can perform liquidity staking in the system to provide LP for the entire ecosystem, and users can passively obtain the benefits brought by LP, and users are interested in the platform Trust will also be taken into consideration to form a two-way mutually beneficial relationship. The income is no longer based on the amount of pledge. The length of pledge is also an important part of the income acquisition coefficient. A user who is willing to take root in the long term will gain more than a short-term wooly party. The benefits are bound to be greater. For the second point, I think it is the most interesting point in the entire economic model design. In the past, the income standards provided by other platforms were based on the amount of pledge, and some also took the time factor into consideration. Although this can It has long-term users, but it cannot guarantee to obtain high-quality users and more complete user behavior data. In the L3 model design, the user's activeness in participating in activities has also become a factor in how much income can be obtained. This makes the income of an inactive user who has pledged a large amount less than an active user who has pledged a small amount. of users . This can guide users to actively participate in platform activities to obtain airdrops and benefit cards that double their income. This is undoubtedly an innovation that improves user quality and stickiness. Token distribution reflects the fairness of the project and the project team’s confidence in the long-term success of the project, so the points that need to be concerned about a project’s tokens from the perspective of distribution are: Several aspects include the holding objects and proportions of tokens, and the release time of tokens. Layer3’s token distribution plan takes into account the interests of the community, core contributors, investors and consultants, ensuring the fairness and long-term development of the project. The lock-up period and gradual release mechanism effectively prevent fluctuations in the token market and enhance the confidence of all parties in the long-term success of the project. Overall, such a distribution system can ensure the sustainable development of the project while balancing the interests of all parties. The detailed plan of token distribution can be read: "Distribution of Layer3 Foundation" It is worth noting that once the cliff is reached, vesting is generally done on a daily basis rather than on a monthly or quarterly basis. Large unblocking after a long wait may trigger a Prisoner’s Dilemma as it causes token owners to accelerate sales to secure the best price. Daily vesting allows all parties to trade to eliminate the above risks, so there is no panic selling. Let us return to the overall process perspective to see the operation of the entire economic model. The entire L3 economic model is constructed like a stable triangle. Its core concept has three perspectives: The core of the platform lies in user traffic and providing high-quality users, so a good economic model must also consider how to realize the full-process incentives for the platform from customer acquisition to active customers. This point is passed in the model Income = passive income + other rewards * The concept of product coefficient is bound. After discussing the entire model, we will find that L3’s token economic model must have three major elements: a reasonable pledge mechanism, more application scenarios and steadily growing passive income. It is worth explaining that the token economic model is very important, but a good token economic model is by no means purely dependent on the project itself. Such a token can only be a useless "air currency". In addition to being self-complete in the ecosystem, a good token model must also be able to continuously adapt to the impact of various external market risks in the rapid evolution of the Web3 project. The relationship between the project and the economic model is not a simple parasitic relationship, but a mutually reinforcing relationship. There are still many dynamics and innovations worth exploring in the field of Web3 task platforms. As cutting-edge tools to promote project development, they not only effectively promote the ecological prosperity of the project side through various means, but also provide users with a window to obtain information, and more importantly, bring actual benefits and a sense of participation. Achieving the growth of Web3 has never been achieved overnight. Project parties can choose to grow together with the task platform while obtaining traffic. Paying attention to the platform's own growth data will help the project team make more informed decisions and lay a solid foundation for the healthy growth of users. With the growth of fragmentation and the intensification of competition for user attention, the traffic diversion methods of major project parties are still relatively simple, mainly relying on joint activities between projects. These activities usually provide some rewards to attract users, some of which are even cost-free and lack the motivation for continuous growth. And the quality of users attracted varies, and user stratification cannot be achieved. Only by building a suitable bridge for keys and locks, and finding a home for both parties, can unprecedented growth and value creation be unlocked. 3.3 小結

4、 Layer3 的代幣經濟

4.1 代幣經濟為何這麼重要?

4.2 Layer3 的代幣經濟模型探討

1. 代幣供應

這一系列的設計都是為了刺激用戶來進行銷毀一定量的代幣。在這種模式下,用戶有了收益,而平台代幣維持了通貨緊縮的目標。 1.從社區的角度:社區所承擔的生態調控相較於散戶而言是比重更大的,而對於一個金融市場而言代幣的價值並不是單單依賴於單一的稀有度,同時也需要有著良好的流動性,流動性的本質就是交易。那麼模型是如何兼顧流動性和稀有度的呢? 維持代幣的稀有度機制比較簡單,和上面從用戶的角度所設計的方式一樣,社區在生態上面的行為也需要去銷毀L3 代幣,只不過社區的行為體現在發布任務、部署激勵措施和存取CUBE 憑證。並且,社區在進行治理時所發起提案和投票也是需要進行相應的 L3 代幣的銷毀。 那麼流動性呢?這一點其實也不難理解,流動性的本質上就是買和賣,那麼用戶在行為與銷毀捆綁,那麼對於社區而言行為除了與銷毀捆綁也與買入捆綁。對於這一點,模型規定了社區的一些行為需要購買和銷毀 L3 代幣。 而買進的行為必將伴隨著賣方的市場。值得注意的一點是,除了社群以外,擁有大量代幣的就只有用戶、發行方和投資方三者,但是發行方和投資方的代幣有解鎖時間的限制,也就是目前能流通的代幣都在用戶手上。這樣就導致了賣方的巨大來源是用戶這個群體,這也為用戶收入提升帶來了一種新的可能性。

2. Token utility

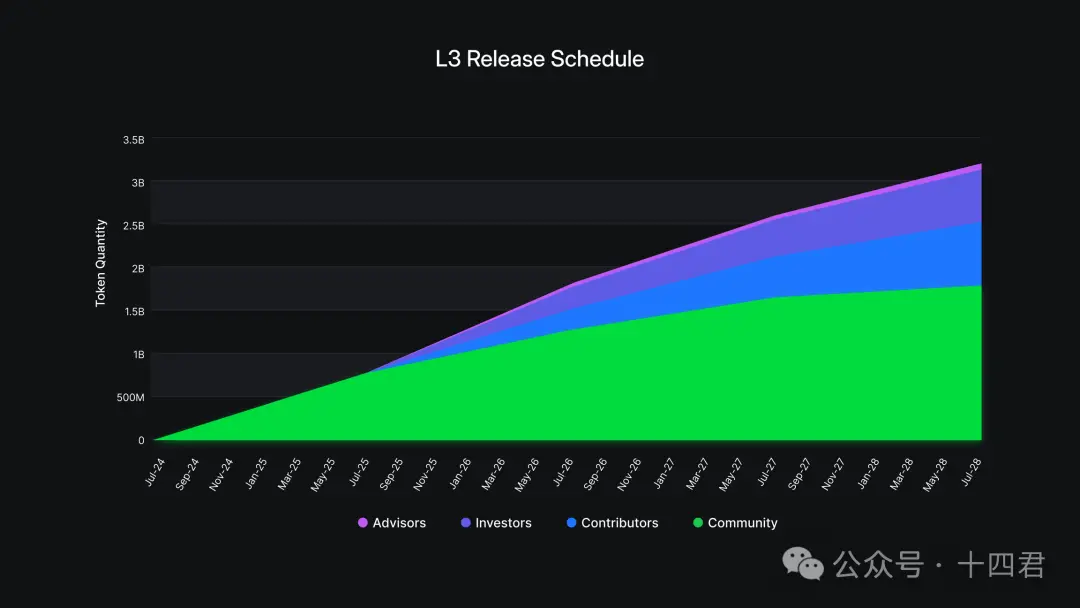

3. Token distribution

4.3 Full Perspective Review

5. Summary

以上是注意力經濟下的 Layer3:2,120 萬融資如何協助全鏈身分變革的詳細內容。更多資訊請關注PHP中文網其他相關文章!