Web3律師:加密貨幣交易所如何收割發幣項目方?

- 王林原創

- 2024-07-12 13:51:55494瀏覽

Web3創業家面臨的風險除了傳統網路創業家面臨的柴米油鹽外,還新增了一個Hard模式的創業挑戰:Token發行。

對於不明真相的群眾來說,Web3專案方的高光時刻就是上了某交易所,畢竟好歹也是「上市公司」了,但其中的酸爽恐怕只有當事人才能懂。

作為發幣的Web3創業者,不僅要提防被監管部門認定為非法發行證券的風險,搭建海外項目架構設立基金會等合規操作,更要當心被上幣的交易所來反向收割這個天大的坑。

土狗幣上DEX,正經項目上CEX,算是業界的約定俗成。虛擬貨幣交易所已經成為許多創業者發行Token的首選,覺得有排面,但殊不知:絕大部分的虛擬貨幣交易所也只是個草台班子,存在大量新創公司的各種Bug與人為風險,最常見的就是交易所內部員工可能透過假交易量操縱Token價格來收割專案方和散戶,令人防不勝防。

曼昆律所劉紅林律師將結合自己所見之事,分享虛擬貨幣交易所圈中一點點的“黑暗森林法則”,為各位準備上交易所的Web3創業者做下心理按摩,以及實操防範建議。

交易所常見收割套路

和內地的小夥伴以為的上A股是件很困難的事情不同,作為一個Web3項目方,整體來說,要想上虛擬貨幣交易所並不是一件特別困難的事情,只要你有鈔能力願意給足上幣費,基本上可以在主流交易所橫著走。

在流程上,首先,Web3專案方需要跟交易所的上幣組工作人員對接,填寫並提交上幣申請表,提供專案白皮書,介紹專案的目標、技術方案、團隊背景、市場分析和代幣經濟模型。其次,需要提供經測試和安全審計報告,以及由專業律師出具的法律意見書,以確認代幣的合法性和合規性。

在費用方面,Web3專案方通常需要支付上幣費用,這些費用因交易所而異,從幾萬到幾十萬美元不等。此外,還需要支付法律意見書和技術審計的費用,具體費用根據服務複雜程度和提供者的收費標準,從幾千到幾萬美元不等。除了基礎的上幣費以外,交易所還會各種巧立名義多薅Web3項目方的羊毛,例如要求專案方提供一定數量的Token作為做市保證金,以確保加密市場流動性並激勵交易所為其提供良好的市場環境;例如上幣來些空投、做些市場宣發活動獎勵平台幣的持有者等等。

你以為這些明收就是虛擬貨幣交易所收入的所有內容了嗎?不,還有暗搶。

主要原因是交易這些去中心化虛擬貨幣的CEX它竟然就只是個單純的中心化公司,熟悉中心化大公司的朋友都知道,這裡頭自然有數據不透明、內部人員操作、利益衝突等問題。作為中心化平台,掌握著大量的交易資料與使用者訊息,具有強大的市場操控能力。以下是一些常見的市場操作套路,可以說是總有一款能夠收割你。

1. 製造虛假交易量:「優秀」的交易所從來不會只割項目方,它會選擇連著散戶一起割。最常見的方式是交易所內部員工或關聯方透過大量買賣單製造出假交易量,吸引更多散戶投資人的進場,進而操控Token價格。這種行為通常被稱為「刷量」或「刷單」。先前由區塊鏈透明性研究所(Blockchain Transparency Institute, BTI)發布的報告顯示,全球前25大交易所中,有超過80%的交易量是透過虛假交易量製造出來的。該報告指出,某些交易所的實際交易量不到其報告交易量的1%。在該報告發出不久,某頭交易所負責人進行轉發並評論:這是我見過最準確、最深刻的加密交易所排行。

2. 數據操控:所謂我的地盤我做主,交易所也可以透過後台權限,直接修改特定項目的交易數據,影響Token的市場表現。例如,操控K線圖、成交量等關鍵指標,誤導投資人決策。這種操作常常在市場波動較大的時候進行,以製造市場假象,誘導投資者跟隨交易。最近紅林律師留意到的某上幣新項目被虛擬貨幣交易所操控價格,連續多日數據異常,許多投資者懷疑這是虛擬貨幣交易所內部交易和數據操控所致。

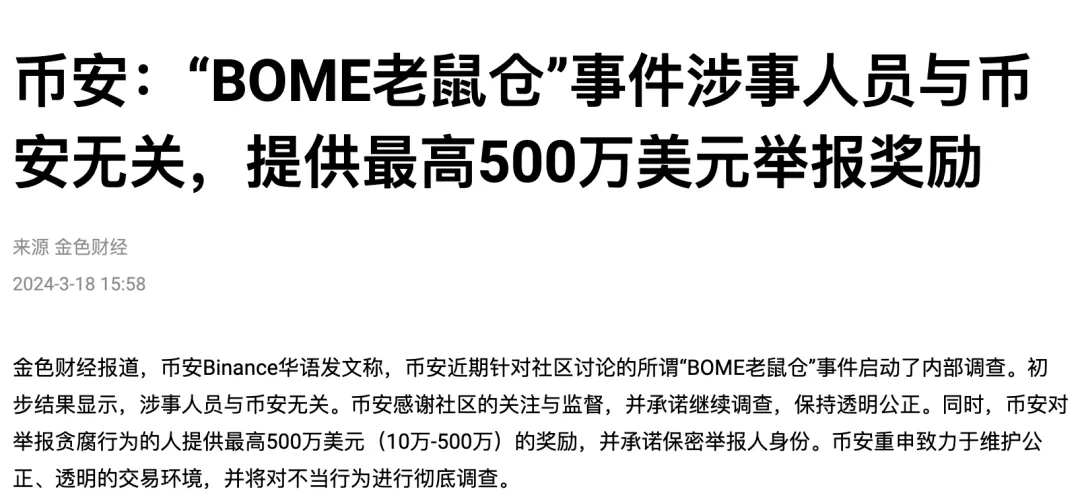

3. Insider trading: Using undisclosed market information to conduct insider trading to obtain illegal benefits. Exchange employees or related parties gain huge profits by knowing major market trends in advance and conducting advance buying and selling operations. For example, when a new Token is about to be launched or a major announcement is about to be made, buy or sell the relevant Token in advance. Just this year, in the BOME (Book of Meme) project, which was the fastest to be listed on an exchange, some media suspected that employees of the exchange were engaging in insider trading. Before An's statement, an account withdrew SOL worth approximately US$2.3 million from the exchange platform and purchased 314 million BOME at a price of US$0.0074. Since then, after BOME was listed on the exchange, the price soared by more than 1,500% on the exchange. The exchange subsequently launched an internal investigation and said it had nothing to do with internal employees of the exchange.

4. High-frequency trading and arbitrage: Many exchanges also have their own trading teams or market-making service providers. They use high-frequency trading technology to conduct millisecond-level trading operations, thereby obtaining tiny price differences and accumulating small amounts. Make more money and realize arbitrage gains. High-frequency trading often uses complex algorithms and high-performance computing equipment to complete a large number of transactions in an extremely short period of time. In 2017, an exchange attracted widespread attention due to the flash crash of Ethereum (ETH). At that time, Ethereum price fell from $319 to $0.10 in seconds before quickly recovering. Later investigations found that this was due to high-frequency trading algorithms triggering a large number of sell and buy orders when the market fluctuates violently, resulting in extreme price fluctuations.

How should entrepreneurs respond?

Looking for the reasons for problems within yourself is a good way for adults to survive. Since external factors cannot be controlled, as entrepreneurs we have to be more careful. In response to the above risks, Lawyer Honglin gives you the following suggestions:

1. Choose an exchange with a good reputation: When choosing an exchange, try to choose an exchange with a good reputation and transparent operations, and avoid choosing emerging or unknown ones. platform. It is recommended that entrepreneurs evaluate the credibility of the exchange by reviewing public audit reports, user reviews, and ratings from third-party evaluation agencies. In addition, you can communicate with other project parties to understand their actual experience and feedback on different exchanges. At the same time, try to avoid tokens being traded on only one exchange, as this will make it easier for that exchange to conduct black-box operations and price manipulation.

2. Sign a detailed currency listing agreement: When signing a currency listing agreement with an exchange, the rights and obligations of both parties should be clarified, especially the terms of data transparency and operational compliance, to protect their own interests. The agreement should include prohibition clauses on false trading volume, data manipulation and other behaviors, and set corresponding liability for breach of contract. At the same time, the exchange is required to provide regular transaction data reports to facilitate independent auditing by the project party.

3. Real-time monitoring of market trends: Use professional market analysis tools to monitor the market performance of Token in real time, discover abnormal trading situations in a timely manner, and take corresponding measures. It is recommended that entrepreneurs use multiple independent data sources for cross-validation to avoid relying on data from a single platform. At the same time, third-party monitoring services can be introduced to provide 24/7 market monitoring and risk warning.

4. Legal advisor intervention: A good legal and compliance advisory team is as important as market makers. This is a point that many coin-issuing project parties do not realize. The pragmatic advice is that once you are ready to issue a currency, you must hire a lawyer with experience in the blockchain and cryptocurrency fields to provide professional services. Professional crypto industry legal advisors can assist in handling legal matters related to exchanges and ensure that all operations comply with legal regulations. They can not only participate in the formulation and review of currency listing agreements before listing on the exchange, help identify potential legal risks, but also Able to take prompt legal action when problems are discovered. What’s more important is to be able to make suggestions for various project incidents after being listed on the exchange, so as to reduce unnecessary public relations crises.

5. Community building and user education: Those who win the community win the world. Behind every successful Web3 project is a good mass base. By holding online and offline activities, publishing educational content and interactive communication, the cohesion of the community is enhanced. and users’ investment preferences can be said to be routine operations. When the market is good, community members will definitely be led by the boss, but once the market goes bad, it is the norm in the community to flip the table, curse, physically attack, and threaten to call the police to defend their rights. Therefore, Lawyer Honglin often tells the Web3 entrepreneurs around him earnestly, don’t talk too much in the community, otherwise it will be a trap for yourself, and if you encounter an exchange or market maker, you will do this. In emergencies, it is recommended to synchronize event information in official media accounts in a timely manner to avoid user panic.

Summary

In general, there are many old scythes who are thinking about making money from Web3 entrepreneurs. For us entrepreneurs, in addition to facing legal regulatory risks in different countries and regions, we should also beware of pitfalls laid by business partners such as virtual currency exchanges and market-making service providers. I hope that through this article, everyone will be more aware of the stumbling blocks that centralized virtual currency exchanges set for us in the process of starting a business, recognize these risks, and be more cautious and prepared in the process of Token issuance and trading. The road to starting a business is not easy. I hope everyone can avoid pitfalls and welcome more opportunities and development.

以上是Web3律師:加密貨幣交易所如何收割發幣項目方?的詳細內容。更多資訊請關注PHP中文網其他相關文章!