根據圖1.1所示,展現了美國股市、加密貨幣市場和黃金市場的市場價值比較。美國股市總市值(Wilshire 5000指數所涵蓋的美國股市中所有上市公司的總市值)超過54兆美元,遠遠領先其他兩個市場。相較之下,加密貨幣市場的市值僅2.5兆美元,約為美國股市的1/25。黃金市場的市場價值超過15兆美元,是加密貨幣市場的6倍左右,但仍不到美國股市的1/3。這顯示美國股市的市場價值顯著高於加密貨幣和黃金市場,後者的市場規模相對較小。透過對比發現,無論是透過吸引傳統市場資金流入,或是充分發揮自身的潛力優勢,加密貨幣市場的總市值都有巨大的成長空間。

據圖表1.2所示,2023年,加密貨幣的年平均交易量高達36.6萬億,遠遠超過了黃金的1626億、標普500指數的2529億以及道瓊斯指數的445億瓊斯。這樣的交易量的差距,展現了加密貨幣市場具有高度的流動性和參與度,吸引了大量投資者和投機者,顯示出市場對新興資產類別的強烈興趣和信心。這種高流動性也增強了市場的抗風險能力,使得市場在面對突發事件時能夠迅速調整,維持穩定。這也顯示加密貨幣市場在全球範圍內越來越重要,成為金融體系中的重要部分。

| |

年平均交易量(2023年) |

黃金 | | 252.9B

| 道瓊指數 | 44.5B

| 加密貨幣 | 36.6T

Source: World Gold Council,CoinGecko 图1.2

1.2 加密货币市场的潜力

用户量基础庞大

加密货币市场正处于快速发展的阶段,用户数量在不断增加,市场结构逐渐成熟。越来越多的个人和机构投资者加入市场,推动了整体市场的繁荣。加密货币市场对 2024 年加密产业的用户大幅成长持乐观态度,近期,2024年6月8日币安宣布平台全球注册用户数已突破两亿大关。

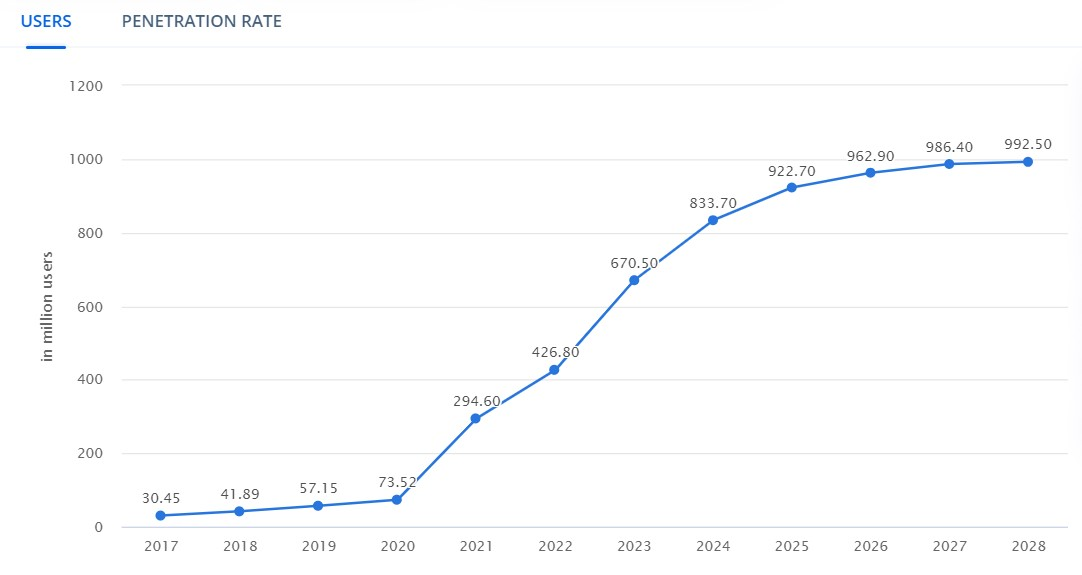

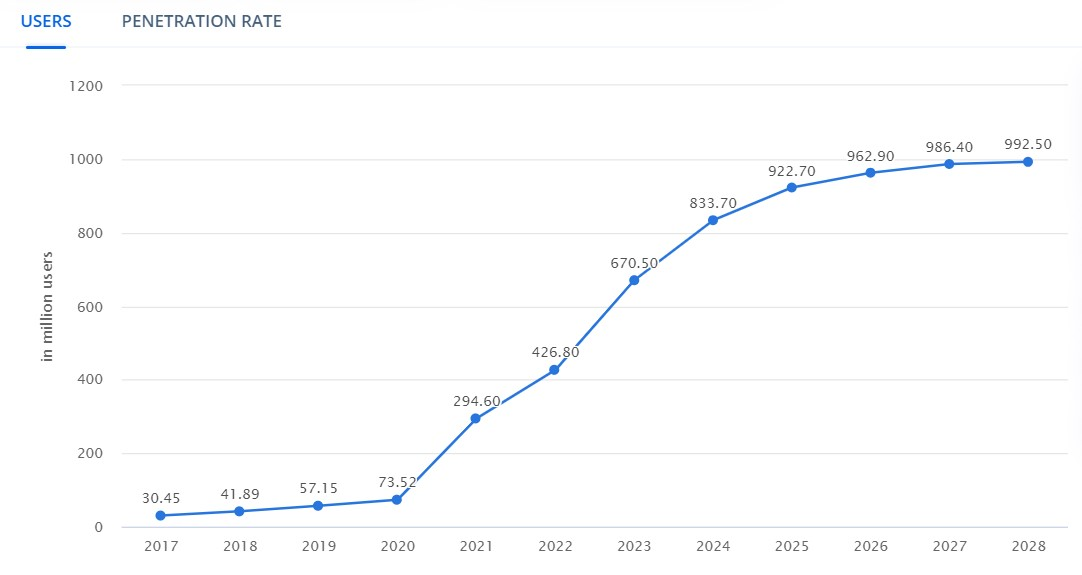

且据Statista数据网站估计,如图1.3所示,根据有利的市场条件,加密货币市场用户数量在未来将在 8.5 亿至 9.5 亿之间,这凸显了全球对加密资产日益增长的兴趣。用户量的不断增长为加密货币市场带来了显著的市场活力。大量用户的参与提升了市场的流动性,使得资产买卖更加便利和高效。

Source: Statista 图1.3

参与一级市场项目的投资

加密货币市场的准入门槛相对较低,普通投资者有更多机会参与到一级市场的项目投资。这意味着投资者不仅能够在二级市场交易,还可以在项目的早期阶段就介入,从中获取更高的回报。并且加密货币市场还拥有较高的创新性。区块链技术的发展和应用不断催生新的项目和投资机会,而这些新兴的技术和商业模式往往能在较短的时间内实现快速增长。这样的环境为投资者带来了前所未有的机会。

活跃的用户社区也为新项目的推广和发展提供了强大的支持,用户不仅是市场的参与者,也是新项目的早期投资者和推广者。这种用户驱动的市场动态,促进了加密货币技术的应用普及和生态系统的健康发展,同时吸引了更多的投资者和开发者进入市场,形成了一个良性循环,进一步增强了市场的创新能力和竞争力。

2. 利用用户量优势释放潜力

2.1 DePIN赛道:拓展用户的同时,强化资源利用

运用:DePIN赛道的概念与运作模式

DePIN(Decentralized Physical Infrastructure Networks)指的是利用区块链技术和代币激励机制,将原本由中心化公司提供的基础设施,例如存储空间、网络流量、云计算能力、能源等,分散给全球的用户来共同构建和维护的网络基础设施。

使用:实例分析:Ionet

在过去的几个月里,DePIN赛道的项目io.net 因其独特的社区参与和奖励机制吸引了广泛关注。我们先来详细探究io.net 的整个运作逻辑。如图2.1所示,Ionet通过收集游戏玩家或矿场机构的剩余GPU算力,将其打包出售给初创AI公司或开发者。由于这些初创公司和开发者在资金和团队技术方面的限制,他们不会与行业领先的AI公司竞争进行大模型训练,而是专注于对算力要求相对较低的AI模型推理和结果阶段。因此,这些初创公司和开发者更倾向于选择性价比更高的算力集成商,如Ionet,而非租用大厂的GPU算力。

io.net 的成功案例表明,DePIN本质上充当了中间人的角色,既解决了B端特定主体对算力、网络等的要求,又解决了C端用户们硬件能力范围内追求的多余经济效益。DePIN通过整合不同用户的手机或电脑的剩余算力、网络和存储空间,为需要这些资源的机构提供服务,如AI公司、游戏公司等。DePIN特别适合为AI提供算力支持,这也是人们提到DePIN时首先想到的应用场景。

io.net 不仅吸引了大量用户,还成功为初创AI公司和开发者提供了具有成本效益的算力解决方案。这种成功模式展示了DePIN在优化资源利用、降低成本和提升效率方面的巨大潜力。

Source: io.net 图2.1

实用:未来展望

io.net’s success demonstrates how the DePIN model can realize the construction of decentralized infrastructure by converting users’ idle resources into economic benefits. On the one hand, this resource redistribution model brings direct economic benefits to users and strengthens the utilization of users' remaining resources; on the other hand, it solves the urgent need for medium computing power by a large number of AI companies and developers. Therefore, DePIN not only has two-way benefits for project parties and users, but also has strong social benefits. The DePIN model reduces resource waste by improving resource utilization, while reducing costs for small and medium-sized enterprises and developers, allowing them to focus more on innovation and product development. This model not only injects new impetus into economic development, but also contributes to resource conservation. Therefore, DePIN is not only a business model innovation, but also a manifestation of social progress, with broad and far-reaching impacts.

2.2 RWA Track: Attracting Traditional Traders

Application: The Definition and Function of RWA Track

RWA (Real World Assets) refers to those assets with actual value that are tokenized through blockchain technology and have tokens. Coin means that you have ownership of this asset in the real world, and you can perform transactions such as lending, leasing, and buying and selling on the chain. The underlying assets that support its value are usually real estate, stocks, bonds, etc.

Through the RWA track, traditional Web2 traders can enter the Web3 world more conveniently. For example, by tokenizing real estate, investors can buy, sell and manage real estate assets on the blockchain, enjoying higher transaction efficiency and lower costs. Likewise, by tokenizing stocks and bonds, investors can trade on decentralized exchanges, enabling 24/7 uninterrupted trading and increasing investment flexibility.

Usage: Case study: Propbase

Propbase is a cutting-edge real estate tokenization platform that leverages the power of the Aptos blockchain to provide users with a new and exciting way to invest in real estate. The $PROPS native utility token powers the entire ecosystem and provides a unified method for all smart contract interactions, property transaction fees, and access to new listings on the Propbase DApp. PROPS coins can be used to purchase virtual goods, services and content on the platform to meet user needs. With the continuous accumulation and development of the platform ecology, the application scenarios of PROPS coins will become more extensive, further increasing its value.

Propbase facilitates the tokenization of real estate assets, enabling owners to convert physical property into digital tokens that can be easily traded, transferred, and managed on the blockchain. By breaking down traditional barriers to real estate investing, Propbase democratizes real estate investing and expands opportunities to diversify your investments.

Practical: Future Outlook

The asset tokenization of real estate and other physical assets is just the tip of the iceberg in the RWA (Real World Assets) track. The U.S. debt tokenization and credit lending market dominate this track. . According to a report by the Boston Consulting Group (BCG), the tokenization scale of RWA may reach a staggering US$16 trillion by 2030, equivalent to 10% of global GDP. This includes the tokenization of on-chain assets as well as the securitization of traditional assets (such as ETFs and real estate investment trusts). Against this backdrop, attracting traditional traders to the RWA market becomes crucial. Traditional traders are accustomed to a highly stable and regulated environment, and the tokenization of RWA provides new investment opportunities while also bringing greater transparency and efficiency. Through smart contracts and blockchain technology, RWA tokenization can significantly reduce transaction costs and improve asset liquidity, which is a huge attraction for traditional traders. In addition, the expansion of the RWA market can also promote the development of the entire encryption market, attracting more traditional financial capital to enter this emerging field, and promote the maturity and steady development of the encryption industry.

If you want to know more specific information about the RWA track and related project recommendations, you can read the previously published article "Uncovering the Wealth Code of the RWA Track: Prospect Analysis and High-Quality Project Recommendations", which contains a comprehensive introduction to the RWA track Analysis

4. Conclusion and future prospects

Conclusion

It can be seen from the above analysis that although there is still a large gap between the cryptocurrency market and the traditional financial market in terms of total market capitalization, its high liquidity and user participation Shows great potential. As the user base of the cryptocurrency market continues to expand, more and more individual and institutional investors are participating, driving the rapid development of the market. At the same time, the rise of tracks such as DePIN and RWA has further enhanced the market’s innovation capabilities and attractiveness. These emerging tracks not only bring new investment opportunities to the market, but also promote the maturity and development of the cryptocurrency market by optimizing resource utilization, reducing costs and improving efficiency.

Future Outlook

Looking to the future, the cryptocurrency market has huge potential for development. First of all, the continued growth in the number of users will inject more vitality and funds into the market and promote further expansion of the market scale. Secondly, the success of the DePIN track shows that by integrating users’ idle resources, resource utilization and economic benefits can be effectively improved, bringing new development impetus to the market. In the future, we can expect more projects similar to Ionet to emerge to further promote the development of decentralized infrastructure networks. At the same time, the emergence of the RWA track provides new possibilities for the combination of traditional assets and blockchain technology. By tokenizing real-world assets, the cryptocurrency market can not only attract more traditional investors, but also enable efficient management and trading of assets, improving market liquidity and transparency.

In general, the cryptocurrency market is in a stage of rapid development. With the continuous advancement of technology and the expansion of applications, there will be more investment opportunities and development space in the future. Market participants need to maintain keen insight, seize market changes and opportunities, and obtain greater benefits in this dynamic and potential market.

Disclaimer: Readers are requested to strictly abide by local laws and regulations. This article does not represent any investment advice