Internal Rate of Return

Using Corticon's iterative execution capabilities, we can solve calculations that require solving for the best possible answer.

Internal Rate of Return (IRR) is a financial measure used, among other things, to evaluate the profitability and opportunity cost of an investment. A typical use case would be to evaluate whether to pursue an investment wherein:

- Initial expense (investment cost) of $5000

- Year 1 - $0 return

- Year 2 - $2000 return

- Year 3 - $0 return

- Year 4 - $4000 return

- Year 5 - $0 return

- Year 6 - $9000 return

The internal rate of return is solved for by using the formula:

Plugging in our numbers, we have:

~0 = (0/(1 IRR)^1 2000/(1 IRR)^2 0/(1 IRR)^3 4000/(1 IRR)^4 0/(1 IRR)^5 9000/(1 IRR)^6) - 5000

We are seeking the IRR at which the Net Present Value (NPV) is zero (or as close as we can get within X number of decimal points). We thus need to recurringly try different values for IRR to get as close to zero as possible.

The Rules

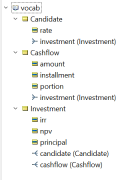

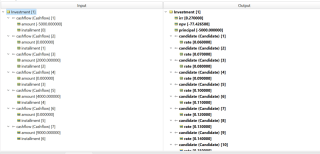

First, our rule vocabulary.

We have 3 entities, Candidate, Cashflow, and the root entity, Investment. The investment has any number of cashflows which we'll be evaluating. It also has any number of candidates that will be created during the decision execution, representing various rates that will be plugged in.

The inputs will be simply the parent entity, Investment, with all corresponding cashflows and an installment number marking their sequence. The first cashflow is always the cash outflow, so its amount is thus always negative. It will use the value 0 for its installment number.

Next our rules.

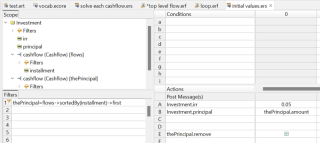

- We start by initializing a value for IRR, which will be incremented up or down depending upon the resulting NPV. We likewise will slot the initial cashflow's value into the 'principal' attribute of the Investment entity, and then remove that cashflow to more easily operate upon only the future flows.

- We'll drag this first rulesheet onto a new ruleflow which will be generated into the runtime decision service later on. A ruleflow can contain any number of rulesheets and any number of 'embedded' ruleflows. We're going to create an embedded ruleflow containing two more rulesheets, and loop through this embedded ruleflow as we try candidate IRR rates by applying the 'Iterative' option to it from the ruleflow pallete.

- When an object on a ruleflow is set to iterate, it will repeatedly re-execute until the values derived by the object’s rules cease to change. Once values in the object cease changing, the iteration stops and execution continues to the next object (as determined by the Connectors).

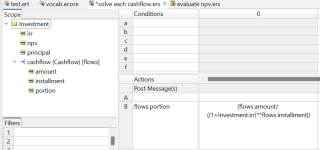

- Within the inner ruleflow, we have two rulesheets.

- The first will calculate each individual cashflow's portion it contributes to the final calculation-- for example, the 'portion' attribute of cash flow 3 would be the result from 0/(1 IRR)^3.

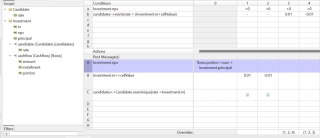

- The second rulesheet in the embedded ruleflow will:

- Set Investment.npv to the sum of each cashflow's portion less the initial investment

- If that npv is greater than zero, increment the irr up by .01, or if less than zero, down by .01.

- However, we need to know if we've already tried a given rate or not so we don't end up in an endless loop. This is where the Candidates come in. We create a new candidate for each rate that we try, until we run into a rate that has already been tried, at which point no action is triggered an we return the calculated value.

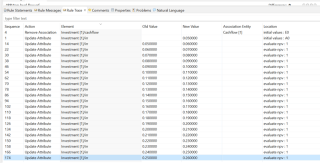

Testing against the top level ruleflow, we set the input based upon the use case listed above for the $5000 investment. We see that Corticon has settled on an IRR of .27 (27%).

rutrace로 규칙 테스트를 실행하면 Corticon이 투자의 NPV에 대해 가능한 한 0에 가까워질 때까지 각 조정된 비율로 규칙을 반복했는지 확인할 수 있습니다.

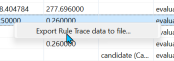

규칙 추적 데이터를 CSV로 내보낼 수도 있습니다.

GitHub에서 프로젝트 다운로드

위 내용은 Corticon을 사용한 내부 수익률 솔버의 상세 내용입니다. 자세한 내용은 PHP 중국어 웹사이트의 기타 관련 기사를 참조하세요!

고급 Java 프로젝트 관리, 구축 자동화 및 종속성 해상도에 Maven 또는 Gradle을 어떻게 사용합니까?Mar 17, 2025 pm 05:46 PM

고급 Java 프로젝트 관리, 구축 자동화 및 종속성 해상도에 Maven 또는 Gradle을 어떻게 사용합니까?Mar 17, 2025 pm 05:46 PM이 기사에서는 Java 프로젝트 관리, 구축 자동화 및 종속성 해상도에 Maven 및 Gradle을 사용하여 접근 방식과 최적화 전략을 비교합니다.

적절한 버전 및 종속성 관리로 Custom Java 라이브러리 (JAR Files)를 작성하고 사용하려면 어떻게해야합니까?Mar 17, 2025 pm 05:45 PM

적절한 버전 및 종속성 관리로 Custom Java 라이브러리 (JAR Files)를 작성하고 사용하려면 어떻게해야합니까?Mar 17, 2025 pm 05:45 PM이 기사에서는 Maven 및 Gradle과 같은 도구를 사용하여 적절한 버전 및 종속성 관리로 사용자 정의 Java 라이브러리 (JAR Files)를 작성하고 사용하는 것에 대해 설명합니다.

카페인 또는 구아바 캐시와 같은 라이브러리를 사용하여 자바 애플리케이션에서 다단계 캐싱을 구현하려면 어떻게해야합니까?Mar 17, 2025 pm 05:44 PM

카페인 또는 구아바 캐시와 같은 라이브러리를 사용하여 자바 애플리케이션에서 다단계 캐싱을 구현하려면 어떻게해야합니까?Mar 17, 2025 pm 05:44 PM이 기사는 카페인 및 구아바 캐시를 사용하여 자바에서 다단계 캐싱을 구현하여 응용 프로그램 성능을 향상시키는 것에 대해 설명합니다. 구성 및 퇴거 정책 관리 Best Pra와 함께 설정, 통합 및 성능 이점을 다룹니다.

캐싱 및 게으른 하중과 같은 고급 기능을 사용하여 객체 관계 매핑에 JPA (Java Persistence API)를 어떻게 사용하려면 어떻게해야합니까?Mar 17, 2025 pm 05:43 PM

캐싱 및 게으른 하중과 같은 고급 기능을 사용하여 객체 관계 매핑에 JPA (Java Persistence API)를 어떻게 사용하려면 어떻게해야합니까?Mar 17, 2025 pm 05:43 PM이 기사는 캐싱 및 게으른 하중과 같은 고급 기능을 사용하여 객체 관계 매핑에 JPA를 사용하는 것에 대해 설명합니다. 잠재적 인 함정을 강조하면서 성능을 최적화하기위한 설정, 엔티티 매핑 및 모범 사례를 다룹니다. [159 문자]

Java의 클래스로드 메커니즘은 다른 클래스 로더 및 대표 모델을 포함하여 어떻게 작동합니까?Mar 17, 2025 pm 05:35 PM

Java의 클래스로드 메커니즘은 다른 클래스 로더 및 대표 모델을 포함하여 어떻게 작동합니까?Mar 17, 2025 pm 05:35 PMJava의 클래스 로딩에는 부트 스트랩, 확장 및 응용 프로그램 클래스 로더가있는 계층 적 시스템을 사용하여 클래스로드, 링크 및 초기화 클래스가 포함됩니다. 학부모 위임 모델은 핵심 클래스가 먼저로드되어 사용자 정의 클래스 LOA에 영향을 미치도록합니다.

분산 컴퓨팅에 Java의 RMI (원격 메소드 호출)를 어떻게 사용할 수 있습니까?Mar 11, 2025 pm 05:53 PM

분산 컴퓨팅에 Java의 RMI (원격 메소드 호출)를 어떻게 사용할 수 있습니까?Mar 11, 2025 pm 05:53 PM이 기사에서는 분산 응용 프로그램을 구축하기위한 Java의 원격 메소드 호출 (RMI)에 대해 설명합니다. 인터페이스 정의, 구현, 레지스트리 설정 및 클라이언트 측 호출을 자세히 설명하여 네트워크 문제 및 보안과 같은 문제를 해결합니다.

네트워크 통신에 Java의 Sockets API를 어떻게 사용합니까?Mar 11, 2025 pm 05:53 PM

네트워크 통신에 Java의 Sockets API를 어떻게 사용합니까?Mar 11, 2025 pm 05:53 PM이 기사는 네트워크 통신을위한 Java의 소켓 API, 클라이언트 서버 설정, 데이터 처리 및 리소스 관리, 오류 처리 및 보안과 같은 중요한 고려 사항에 대해 자세히 설명합니다. 또한 성능 최적화 기술, i

Java에서 사용자 정의 네트워킹 프로토콜을 어떻게 만들 수 있습니까?Mar 11, 2025 pm 05:52 PM

Java에서 사용자 정의 네트워킹 프로토콜을 어떻게 만들 수 있습니까?Mar 11, 2025 pm 05:52 PM이 기사에서는 맞춤형 Java 네트워킹 프로토콜을 작성합니다. 프로토콜 정의 (데이터 구조, 프레임, 오류 처리, 버전화), 구현 (소켓 사용), 데이터 직렬화 및 모범 사례 (효율성, 보안, Mainta를 포함합니다.

핫 AI 도구

Undresser.AI Undress

사실적인 누드 사진을 만들기 위한 AI 기반 앱

AI Clothes Remover

사진에서 옷을 제거하는 온라인 AI 도구입니다.

Undress AI Tool

무료로 이미지를 벗다

Clothoff.io

AI 옷 제거제

AI Hentai Generator

AI Hentai를 무료로 생성하십시오.

인기 기사

뜨거운 도구

에디트플러스 중국어 크랙 버전

작은 크기, 구문 강조, 코드 프롬프트 기능을 지원하지 않음

SublimeText3 Linux 새 버전

SublimeText3 Linux 최신 버전

WebStorm Mac 버전

유용한 JavaScript 개발 도구

스튜디오 13.0.1 보내기

강력한 PHP 통합 개발 환경

Atom Editor Mac 버전 다운로드

가장 인기 있는 오픈 소스 편집기