Over 50 billion U.S. dollars swept up in the U.S. Bitcoin spot ETF: Asset management companies are the 'main force” in subscriptions, and many Hong Kong institutions are on the list

- 王林forward

- 2024-05-09 21:16:141135browse

Since the Bitcoin spot ETF opened the floodgates for mainstream capital inflows, it has shown strong gold-absorbing power in a short period of time. Recently, with the release of the US 13F (Institutional Position Report), the positions of institutions involved in "sweeping" Bitcoin spot ETFs have also been exposed. So, what is the market development of Bitcoin spot ETF? Which ETF products do the investment giants allocate, and what investment signals do they release?

More than US$50 billion has poured in, and the United States accounts for nearly 90% of the global share

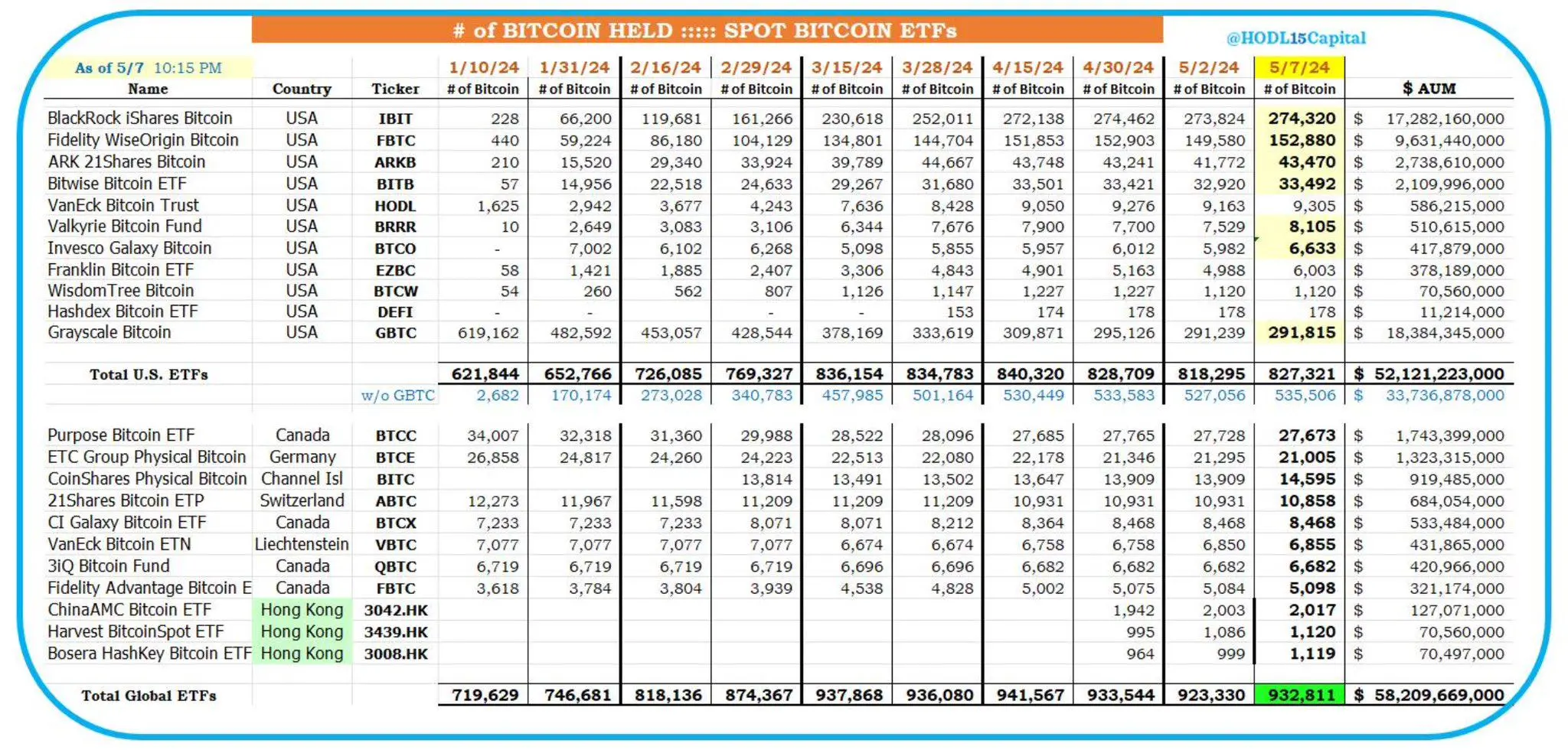

Looking at the size of the global Bitcoin spot ETF market, the United States is undoubtedly the main force. According to HODL15Capital data monitoring, as of May 7, the U.S. Bitcoin spot ETF had held 8,273.21 million BTC within four months of its launch, with a value of approximately US$52.1 billion, accounting for 89.5% of the global market.

However, from the perspective of capital growth rate, the capital inflow of the U.S. Bitcoin spot ETF mainly came from the two months after its listing, and reached a peak of 83.6 in mid-March this year. million BTC, and then began to show a slight downward trend month by month.

Among these 11 U.S. Bitcoin spot ETFs, the top three, Grayscale, BlackRock and Fidelity, have shown strong “gold-attracting power” and hold a total of 719,000 BTC (valued 26.91 billion U.S. dollars), accounting for 86.9% of the total, approximately 3.3 times more than MicroStrategy, the “big Bitcoin player”. In comparison, Franklin Templeton, WisdomTree and Hashdex performed relatively weakly, accounting for only 8.8%.

In terms of asset size, only two Bitcoin spot ETFs, Grayscale and BlackRock, both exceed US$10 billion. Among them, Grayscale has been in a state of continuous outflow of funds since GBTC was converted to spot ETF. It was not until recently that the first inflow of funds occurred. The number of BTC currently held is only 47% of that in January this year; BlackRock has basically been in a state of outflow in the past few months. It is growing, but the expansion rate has slowed down or even declined slightly since mid-April.

In addition, as the first market in Asia to issue spot Bitcoin ETFs, as of May 7, the three Hong Kong Bitcoin spot ETFs have so far held a total of 4,256 BTC, with an asset management scale of US$270 million. However, It was only nearly 0.7% of the price on the first day of listing of the U.S. Bitcoin spot ETF, and there was no obvious growth trend within a week of its launch. It is worth mentioning that the market has recently reported that the Hong Kong Bitcoin spot ETF may be included in the Shanghai-Hong Kong Stock Connect plan, but the Hong Kong ETF issuer denied it, saying that it was the same as the previous rumors that southbound funds could purchase the Hong Kong Bitcoin ETF. , purely a rumor.

Asset management is the "main force" in subscriptions, and these three major products have become the mainstream choices

13F report is considered an important channel to obtain Wall Street investment trends. According to U.S. SEC regulations, equity asset institutions with stock assets under management exceeding US$100 million must currently hold U.S. equity within 45 days after the end of each quarter (three months) and provide the whereabouts of relevant funds. According to information disclosed in the existing market, many institutions have listed Bitcoin spot ETFs as investment targets. For example, Fintel data shows that IBIT has 207 holding institutions and shareholders, and GBTC has 402 institutional owners and shareholders.

Below, PANews took stock of some institutions that purchased Bitcoin spot ETFs and found that among them, asset management institutions invested relatively more funds and had a richer product selection, but they accounted for a relatively small proportion of their overall investment portfolio. However, banks are more cautious in product selection and have limited investment funds. Among the many Bitcoin spot ETFs, GBTC, IBIT and FBTC are almost the mainstream trading varieties in the market. In addition, what is interesting is that three Hong Kong institutions have invested in the U.S. Bitcoin spot ETF. Of course, this may be related to multiple factors such as fee differences and the background of the asset custodian.

Susquehanna: GBTC, FBTC, ARKB, IBIT and BITB worth $1.3 billion

Quantitative trading firm Susquehanna International Group disclosed in a filing that it purchased The USD 1.3 billion spot Bitcoin ETF includes 17.3 million shares of GBTC (valued at over USD 1.1 billion), 1.3 million shares of FBTC (valued at USD 83.7 million), 508,824 shares of ARKB (valued at USD 36.1 million), and 583,049 shares of IBIT (valued at approximately USD 1.1 billion). $23.6 million), 560,832 shares of BITB (valued at $21.7 million), 256,354 shares of HODL (valued at $20.6 million), 255,814 shares of BTCW (valued at $19.3 million), 166,200 shares of BTCO (valued at $11.8 million), and 192,391 shares of BRRR (valued at $11.8 million) worth $3.9 million). These combined investments represent only a small portion of the company's total investments of $575.9 billion.

Ovata Capital Management: FBTC, GBTC, BITB and IBIT worth over $74 million The latest filing submitted by Hong Kong asset management company Ovata Capital Management to the U.S. SEC shows that it has a heavy position in U.S. Bitcoin spot ETFs, including FBTC, GBTC, BITB and IBIT, accounting for 13.5%, 11.2% and 8.8% of its investment portfolio respectively. % and 5.6%, with a total value of more than $74 million.

Hightower: GBTC, FBTC, IBIT, ARKB, BITB and EZBC worth over US$68 million

Hightower, an asset management company with a management scale of US$130 billion, stated in an SEC filing It was disclosed in that it had purchased US Bitcoin spot ETFs worth more than US$68.34 million, including US$44.84 million of Grayscale GBTC, US$12.41 million of Fidelity FBTC, US$7.62 million of IBIT, US$1.7 million of ARKB, US$990,000 BITB and EZBC of $790,000. But this part of the investment only accounts for less than 0.1% of its total investment of US$61.7 billion.

Yong Rong Asset Management: IBIT worth about $38 million

Hong Kong-based Yong Rong Asset Management purchased IBIT worth about $38 million, accounting for 12% of the investment portfolio ranks first in BlackRock Bitcoin Spot ETF holdings. Yongrong (Hong Kong) Asset Management Co., Ltd. is a securities investment and asset management company established in 2012. It includes three funds and an asset management scale of hundreds of millions of dollars. In addition to Bitcoin spot ETFs, the institution’s latest investment portfolio also includes Nvidia, Tesla, META, Pinduoduo and Luckin.

United Capital Management: FBTC and BITO worth over US$34.9 million

United Capital Management holds over 350,000 shares of FBTC and 410,000 shares of BITO, respectively. 4.9% and 3% of its latest portfolio, with a total value of approximately $34.91 million. Among them, United Capital Management is one of the important shareholders of Fidelity FBTC.

United Capital Management is an investment advisory company located in the United States. It was sold by Goldman Sachs to Creative Planning, one of the largest private investment advisory companies in the United States, with investment assets of more than US$436 million.

Legacy Wealth Asset MAnagement: FBTC and GBTC

Asset management company Legacy Wealth Asset MAnagement owns over 350,000 shares worth over $28.5 million FBTC, accounting for 6.09% of its latest investment portfolio, and over 100,000 GBTC shares, accounting for 1.84%, with a total value of over $28.5 million. Legacy Wealth Asset MAnagement is also one of the major shareholders of Fidelity FBTC.

Monolith Management: IBIT worth over US$24 million

Monolith Management, an investment company owned by Cao Xi, a former Sequoia China partner, revealed in a filing that it owns With more than $24 million, IBIT has the fifth-largest holding in the BlackRock ETF, more than double its investment in Meta stock. Additionally, the company's two largest investments are Nvidia and Microsoft.

Monolith Management is headquartered in Hong Kong. It is an investment management jointly established by Cao Xi, a former partner of Sequoia China, and Tim Wang, a former secondary market partner of Boyu Capital. The scale of the first fund has exceeded US$500 million, mainly focusing on Technology, software, life sciences and consumer sectors driven by technology and innovation.

IvyRock Asset Management: IBIT worth $19 million

IvyRock Asset Management is a Hong Kong-based hedge fund management company that disclosed its holdings in its latest filing There’s BlackRock’s nearly $19 million spot Bitcoin ETF IBIT.

Quattro Financial Advisors: IBIT worth over $16.5 million

Quattro Financial Advisors is a multi-family office and the second largest holder of the BlackRock Bitcoin Spot ETF , holds 468,000 shares of IBIT, worth approximately $16.5 million, accounting for 5.4% of its portfolio.

Oxler Private Wealth: IBIT worth over $11.2 million

Investment platform Oxler Private Wealth holds 280,000 shares of IBIT in its latest investment portfolio, worth approximately $1124 million US dollars, accounting for 4.4%.

Newbridge Financial Services Group: GBTC worth approximately US$1.34 million

Newbridge Financial Services Group’s assets exceed US$340 million and holds approximately 20,000 GBTC shares. Valued at approximately $1.34 million, it represents just 0.58% of its $230 million portfolio.

Bank of New York Mellon: GBTC worth approximately $1.11 million

Bank of New York Mellon is the oldest bank in the United States, reports in SEC filings , which holds 19,918 shares of IBIT and 7,108 shares of GBTC, with a current value of approximately $1.113 million.

SouthState Bank: GBTC and IBIT worth more than $570,000

SouthState Bank disclosed in the US SEC13F filing that it has invested in two spot Bitcoins The total investment value of the ETF is US$577,198, including 6,606 shares of GBTC (valued at approximately US$417,301) and 3,951 shares of IBIT (valued at approximately US$159,897). SouthState Bank’s investment in spot Bitcoin ETFs represents only a fraction of the $1.3 billion total reported in its filings.

It is understood that SouthState Bank is a bank holding company headquartered in the United States. After merging with CenterState Bank, the total assets managed by the two entities will reach US$34 billion.

BNP Paribas: IBIT worth about US$40,000

As the second largest bank in Europe, BNP Paribas has a total asset management scale of more than US$600 billion. A recent 13F filing with the SEC revealed that it purchased 1,030 shares of IBIT, but the value was only about $40,000. BNP Paribas has been actively exploring the field of encryption since last year. In addition to providing cryptocurrency services, it also participates in related investments, such as Fnality, a traditional financial asset tokenization company. Newbridge Financial Services Group has assets of over US$340 million and holds approximately 20,000 GBTC shares worth approximately US$1.34 million, accounting for only 0.58% of its US$230 million investment portfolio.

The above is the detailed content of Over 50 billion U.S. dollars swept up in the U.S. Bitcoin spot ETF: Asset management companies are the 'main force” in subscriptions, and many Hong Kong institutions are on the list. For more information, please follow other related articles on the PHP Chinese website!

Related articles

See more- How to use PHP to develop applications using the Bitcoin Coinbase wallet library (detailed steps)

- What software is good for buying Bitcoin? Check out the top ten apps for buying Bitcoin.

- What software can be used to trade Bitcoin? Recommended sharing of the top ten Bitcoin trading apps!

- What is a cryptocurrency trading website?

- Which cryptocurrencies are cheap and worth investing in?