Understand the entire liquidity staking ecology on Solana in three minutes

- WBOYforward

- 2024-05-09 11:40:13974browse

Compilation: 1912212.eth, Foresight News

The liquidity staking of the Ethereum ecosystem once set off a staking trend, and even the current re-staking agreement is in full swing. But an interesting phenomenon is that this craze does not seem to have spread to other chains. The reason for this is, in addition to Ethereum’s huge market value, which still occupies a significant advantage, what other deep-seated factors are at play? When we turn the implementation to Solana and the liquidity staking protocol on Ethereum, what is the current development trend of LST on Solana? This article gives you the full picture.

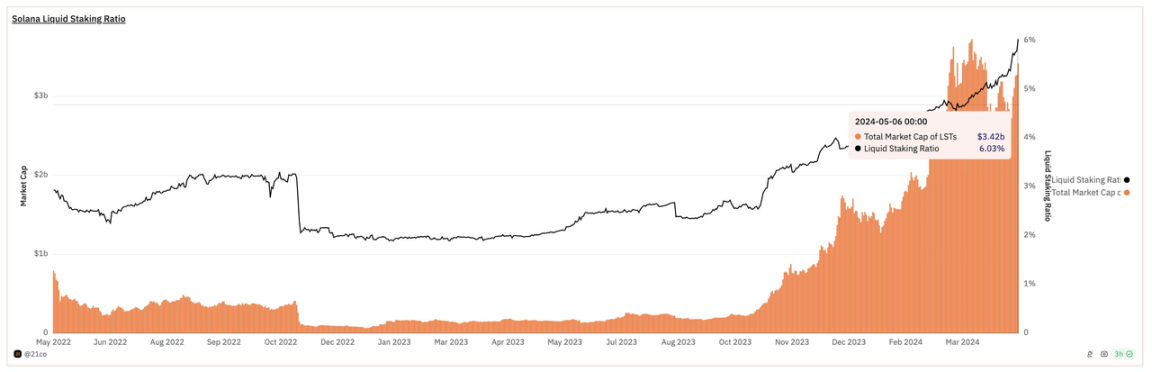

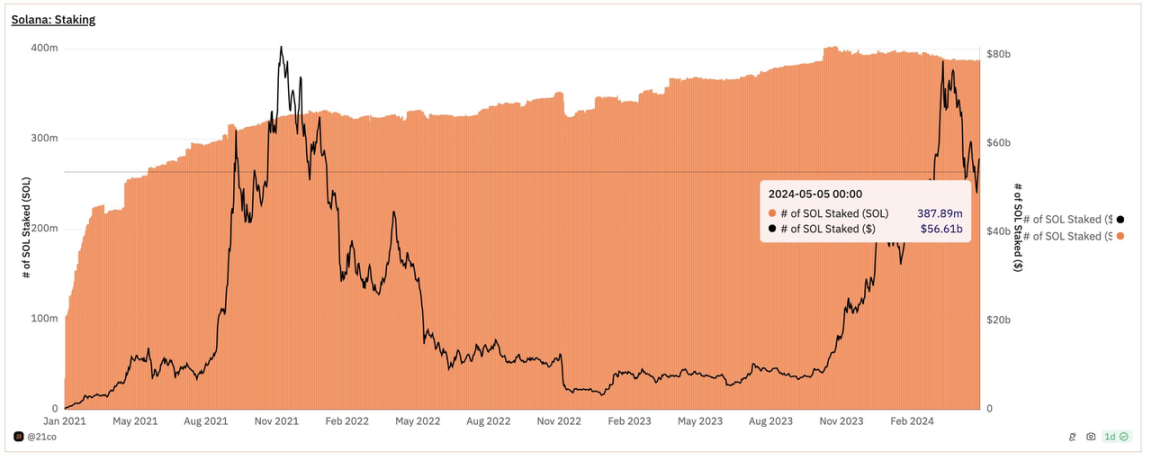

1. Although the pledge rate exceeds 60%, only 6% (3.4 billion US dollars) of pledged SOL comes from liquidity pledge

On the contrary, Ether 32% of Fang’s pledge volume comes from liquidity pledge. In my opinion, the reason for this difference is whether there is an "in-protocol delegation".

Solana provides an easy way for SOL stakers to delegate their SOL, and Lido was one of the only early ways to delegate ETH to earn staking rewards.

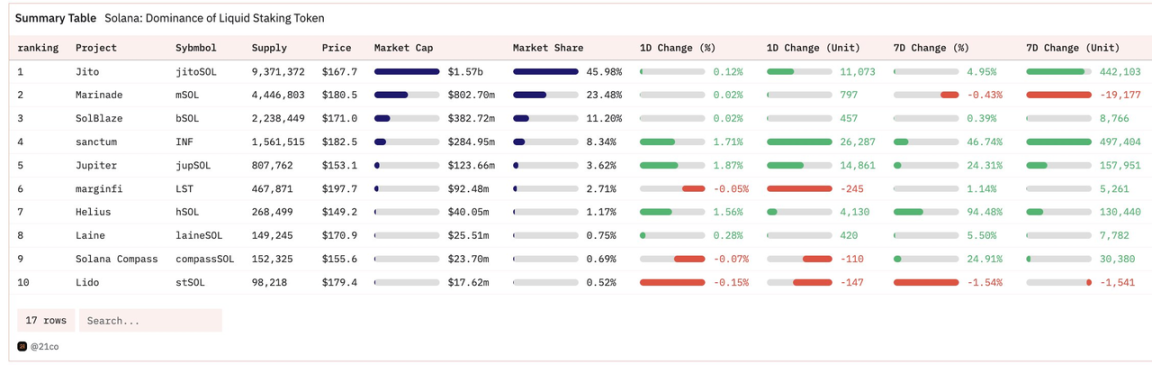

2. The market share of Solana LST (liquidity pledged token) is more balanced than that of Ethereum

On Ethereum, 68% of the market share comes from Lido. In contrast, the liquidity of staking tokens on Solana is in an oligopolistic state.

Solana The top 3 liquid pledged tokens account for 80% of the market share.

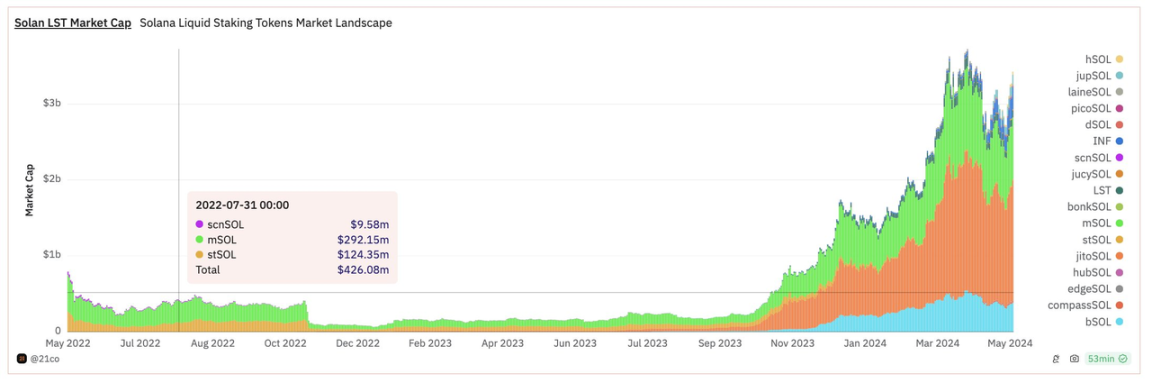

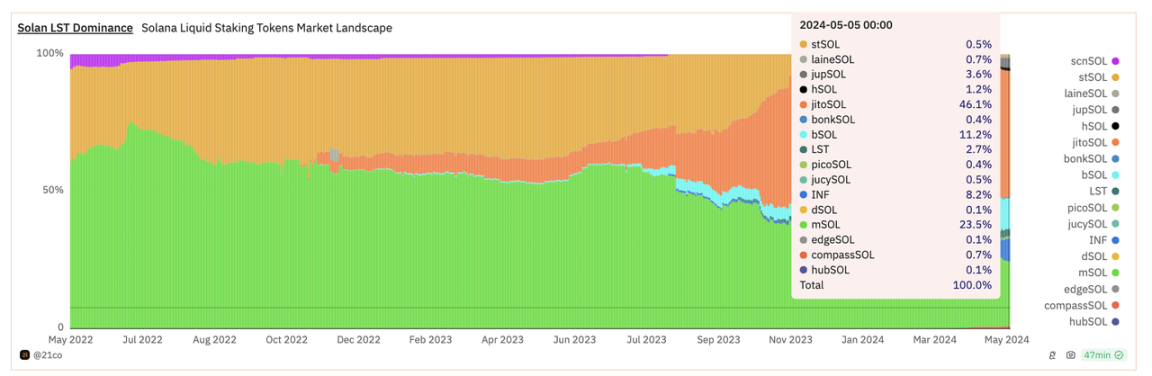

3. Liquidity staking history on Solana

The early market was divided between Lido’s stSOL (33%), Marinade’s mSOL (60%) and Sanctum’s scnSOL (7%). Solana The total market value of LST is less than US$1 billion.

This lack of adoption can be attributed to marketing and integration. At the time, there weren’t many high-quality DeFi protocols for LST, and the focus of the narrative wasn’t liquidity staking.

When FTX crashed, the liquid staking ratio dropped from 3.2% to 2%.

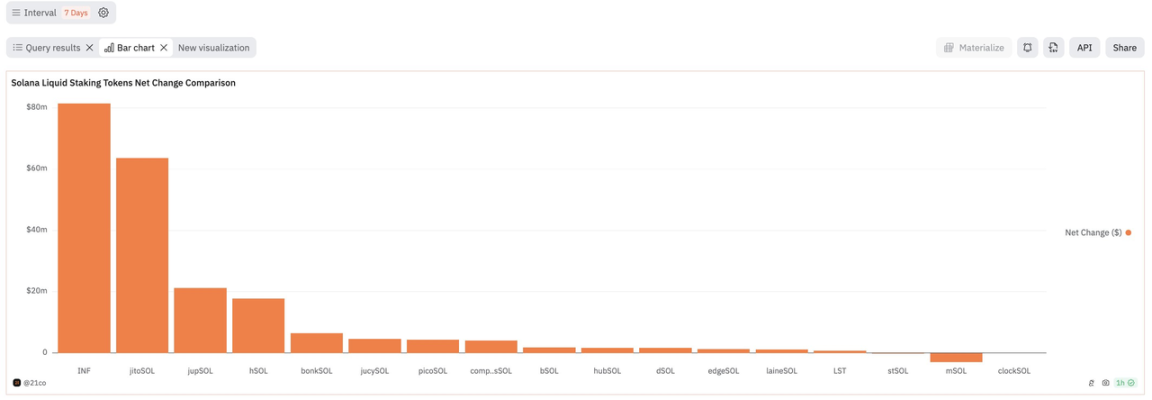

4. LST leader

Jito launched jitoSOL in November 2022. It took them about a year to reverse course and surpass stSOL and mSOL, becoming the most dominant LST on Solana. Has a market share of 46%.

Second place: mSOL (23.5%)

Third place: bSOL (11.2%)

Fourth place: INF (8.2%)

Fifth place: jupSOL (3.6%)

5. Jito’s success

In short, the most important thing is to succeed in liquid pledged tokens Factors are liquidity, DeFi integrations/partners, scaling to support multiple chains.

6. Liquidity staking is the untapped potential of Solana DeFi, which may increase its TVL to 1.5 billion to 1.7 billion US dollars

Liquidity staking tokens promote the Ethereum DeFi ecosystem System growth. For example, 40% of AAVE v3’s TVL comes from wstETH. It can be used as collateral to generate yield and unlock more potential of DeFi such as Pendle, Eigenlayer, Ethena, etc.

Here are my expectations for Solana’s liquid staking ratio in 1-2 years (based on current valuation):

Base case: 10%, DeFi An additional $1.5 billion in liquidity is provided in DeFi;

Bullish case: 15%, an additional $5 billion in liquidity is provided in DeFi;

Long-term bull case: 30%, similar to Ethereum The current pledge ratio. Adding an additional $13.5 billion in liquidity to DeFi.

7. Many excellent DeFi teams are working together to introduce more pledged SOL into DeFi

The above is the detailed content of Understand the entire liquidity staking ecology on Solana in three minutes. For more information, please follow other related articles on the PHP Chinese website!

Related articles

See more- Ethereum once again embraces the road of decentralization, but V God points directly at Sun Yuchen and Tron

- What does Dencun's upgrade mean? How does the Cancun upgrade affect Ethereum and Layer 2?

- Ranking and recommendation of the top ten Ethereum NFT trading platforms in 2022

- Ethereum browser blockchain query

- Ethereum wallet address signature