Financing Weekly Report | 29 public financing events; tokenization company Securitize completed US$47 million in financing, led by BlackRock

- WBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBforward

- 2024-05-06 13:58:011041browse

What to watch in this issue

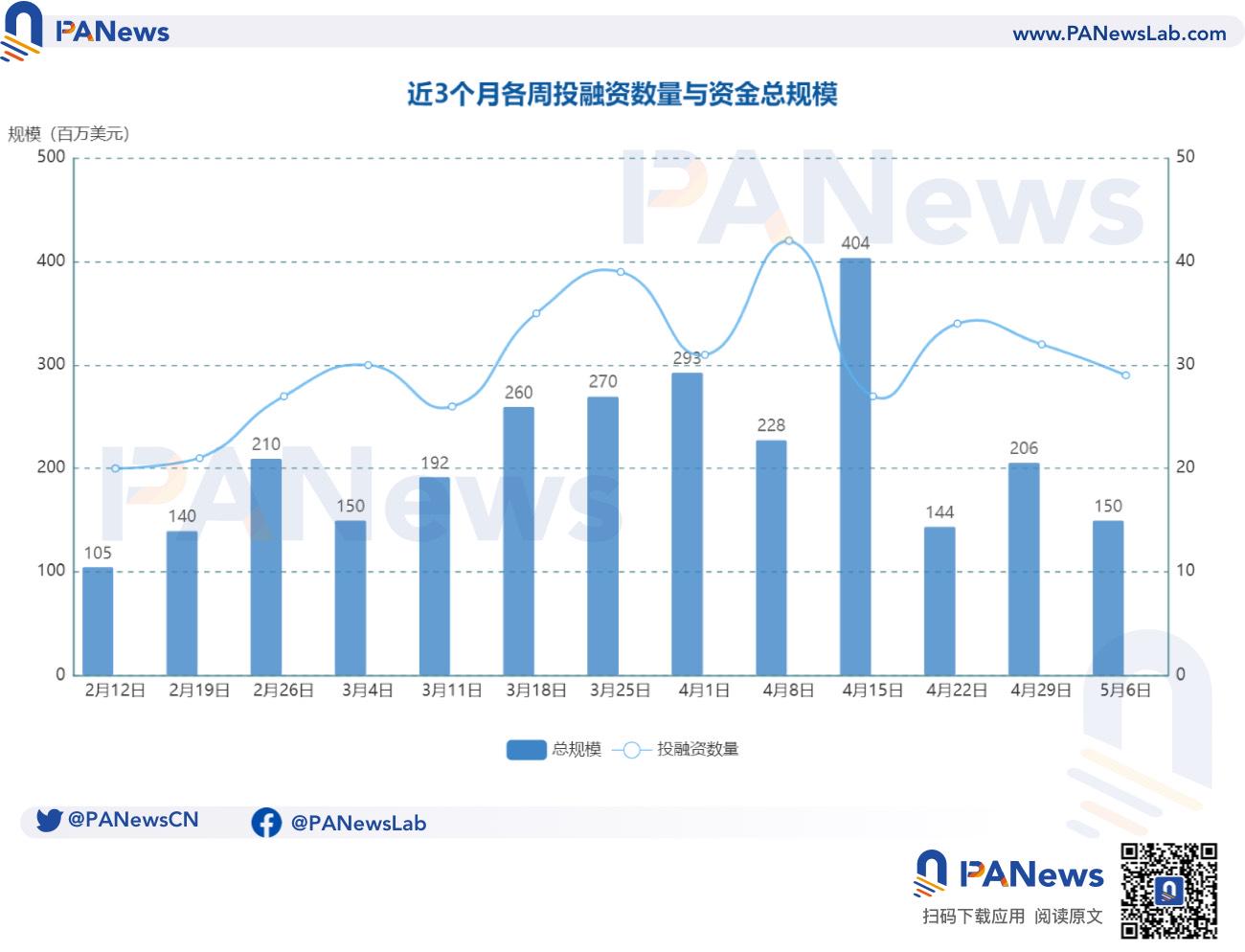

According to incomplete statistics from PANews, there were 29 investment and financing events in the global blockchain last week (4.29-5.5), with the total scale of funds exceeding US$150 million. Compared with the previous week All have decreased, and the overview is as follows:

- DeFi announced 9 investment and financing events, and the RWA market Ironlight completed US$12 million in financing, most of which came from individual investors with Wall Street background;

- The Web3 game track announced 6 investment and financing events, among which Swedish game studio Patriots Division has raised US$5 million for its Web3 game Shadow War;

- AI related fields announced 1 investment and financing event, Web3 developer platform Airstack completed a US$4 million seed round of financing, led by Red Beard Ventures; the

- infrastructure and tools track announced 5 financings, of which the modular liquidity protocol Mitosis announced the completion of US$7 million in financing , Amber Group and Foresight Ventures led the investment;

- Seven financings were announced in other blockchain/encryption applications, of which Web3 content publishing platform Paragraph completed US$5 million in financing, with USV and Coinbase Ventures participating;

- One financing was announced in the centralized finance field. LazyBear announced the completion of strategic financing of 4 million USDT. Participating investors and strategic partners include Gogeko Labs, DWF Labs, etc.

DeFi

Tokenization company Securitize completed US$47 million in financing, led by BlackRock

Tokenization company Securitize announced the successful completion of US$47 million in strategic financing. BlackRock led the investment, with participation from Hamilton Lane, ParaFi Capital, Tradeweb Markets, Aptos Labs, Circle and Paxos. As part of the funding round, Joseph Chalom, BlackRock’s head of global strategic ecosystem partnerships, has been appointed to Securitize’s board of directors. Securitize is the first to expand investor access to the traditionally exclusive private markets sector by tokenizing real-world assets (RWA).

RWA market Ironlight has completed US$12 million in financing and plans to launch the SEC registration process

RWA market Ironlight has completed US$12 million in financing, most of which came from individual investors with Wall Street backgrounds. Founded by Schroders and the former head of global trading at Abu Dhabi sovereign wealth fund ADIA, with the former TD Bank CEO serving as an adviser, Ironlight aims to broker typically illiquid private securities such as real estate, natural resources, fine arts, public infrastructure and private equity. Monetization. Its goal is to become a tokenized real-world asset (RWA) market regulated by the U.S. SEC. The development of the exchange has entered an advanced stage, and Ironlight has applied to the Financial Industry Regulatory Authority to become a regulated broker-dealer. It is expected to be approved in the next few months, and the SEC registration process will be initiated subsequently.

Tokenized asset issuer Backed completed a new round of financing of US$9.5 million

Tokenized asset issuer Backed completed a new round of financing of US$9.5 million, led by Gnosis, Exor Seeds, Cyber Fund, Mindset Ventures, Stake Capital Ventures, Blockchain Founders Fund, Blue Bay Capital and Nonce Classic participated in the investment. With this investment, the company aims to accelerate its private token issuance and asset management company’s entry into the blockchain channel. According to the company’s website, Backed is Swiss-backed, has a Swiss base and is subject to Swiss regulation, provides tokenization services and has issued over $50 million worth of RWA assets, including ERC-20 compatible exchange trading. Token versions of funds (ETFs) and individual stocks such as Coinbase (COIN) and Tesla (TSLA).

Cross-chain DeFi protocol EYWA completed a US$7 million seed round of financing, led by the founder of Curve

Cross-chain DeFi protocol EYWA completed a US$7 million seed round of financing, led by Curve Finance founder Michael Egorov Fenbushi Capital, GBV Capital, Big Brain Holdings, Marshland Capital, Mulana Capital, etc. participated in the investment. EYWA and Curve are collaborating to develop a trustless bridge that relies on consensus for a reliable messaging protocol, eliminating the reliance on a single bridge for moving large liquidity positions.

X10, a hybrid crypto exchange founded by former Revolut employees, completed US$6.5 million in financing

The UK-based hybrid crypto exchange X10 announced the completion of US$6.5 million in financing, with investments from Tioga Capital, Semantic Ventures, Cherry Ventures, Starkware and Cyber Fund. In addition, there are also some well-known angel investors participating, such as Revolut executive and Lido founder Konstantin Lomashuk. X10 will use the new funds to build a new type of cryptocurrency exchange that combines a Revolut-like user experience with self-sustaining capabilities. X10 was founded by Revolut alumnus and former head of cryptocurrency operations Ruslan Fakhrutdinov. X10 operates as a hybrid central limit order book (CLOB) exchange. Order processing, matching, position risk assessment and trade sequencing are all handled off-chain. Stellar’s latency and throughput efforts benefit market makers, allowing them to update their order books faster. In addition to security and excellent performance, it aims to provide a similar user experience to CeFi exchanges and traditional network platforms in the DeFi field.

Liquidity staking protocol MilkyWay completed a US$5 million seed round of financing, led by Binance Labs and Polychain Capital

Celestia ecological liquidity staking protocol MilkyWay completed a US$5 million seed round of financing. Binance Labs and Polychain Capital co-led the investment, with participation from Hack VC, Crypto.com Capital and LongHash Ventures. MilkyWay is the first Celestia ecological liquid staking protocol launched in December last year. Currently, its only competitor is Stride. MilkyWay is also “tailor-made for modular ecosystems,” although it is currently focused solely on Celestia (TIA) token liquidity staking. Data shows that MilkyWay’s TVL is approximately US$24 million. MilkyWay also plans to launch its own token and conduct an airdrop in the coming months. MilkyWay is currently running a points program called mPoints.

DeFi protocol Amphor announced the completion of a US$4 million seed round of financing

The DeFi protocol Amphor, incubated by the hedge fund MEV Capital, announced the completion of a US$4 million seed round of financing with the participation of more than 80 crypto industry angel investors The project aims to use algorithms and on-chain technology solutions to simplify investment in the DeFi field for ordinary investors. Its specific valuation data has not yet been disclosed. The new funds will be used to expand the team, build its technology stack and expand into other areas. Blockchain network. According to the project to potential investors, only 1.4% of crypto users are involved in DeFi.

RWA blockchain platform Balcony completed a Pre-Seed round of financing, with Avalanche Blizzard Fund participating

Balcony, a blockchain infrastructure company in New Jersey, USA, announced the completion of a Pre-Seed round of financing with Avalanche Blizzard Fund participated in the investment, and the specific amount and valuation information have not yet been disclosed. The new financing will be used to expand operations and development efforts. It is reported that Balcony is committed to building an RWA blockchain platform for institutions and government agencies, providing on-chain transactions and asset settlement services, and is currently mainly used in the real estate field.

Multi-chain liquidity re-pledge protocol BedRock completed a round of financing, led by OKX Ventures and others

Multi-chain liquidity re-pledge protocol Bedrock completed a round of financing, OKX Ventures, LongHash Ventures and Comma3 Ventures Led the investment, with participation from Waterdrip Capital, Lbank Labs, Amber Group, ArcheFund, Whale Ground and angel investors including Babylon co-founder Fisher Yu. Bedrock’s total value locked (TVL) on Ethereum (uniETH) and IoTeX (uniIOTX) has exceeded $200 million. It has launched a native cross-chain restaking service (Native Cross-Chain Restaking) and deployed it on multiple chains including Arbitrum, Linea, Scroll and Manta, and will continue to expand to more chains in the future. In addition, Bedrock will soon release the first liquid pledged Bitcoin (uniBTC) based on the Babylon protocol to provide users with Bitcoin pledge services. Bedrock hopes to achieve the next phase of growth with its liquidity staking Bitcoin (uniBTC) and expects to introduce this service before the launch of the Babylon mainnet to push the limits of staking innovation.

Web3 Games

Web3 game Shadow War completed US$5 million in financing, led by Momentum 6

Swedish game studio Patriots Division has raised a seed round for its Web3 game Shadow War and raised $5 million in Series A funding led by Momentum 6, with participation from iAngels, Cointelligence Fund, Xborg, Andromeda VC, Cogitent Ventures and Cluster Capital. Shadow War is a 5-on-5 third-person action game set in a sci-fi future. It draws inspiration from well-known games such as "Overwatch" and "League of Legends" and focuses on the fusion of futurism, fantasy, action and competition. Shadow War emphasizes melee combat and tactical strategy and is designed to reward skill-based players while avoiding pay-to-win elements that hinder competitive integrity.

Web3 game startup GFAL completes US$3.2 million in seed round financing

Web3 game startup GFAL completed US$3.2 million in seed round financing. Investors include Supercell and Mitch Lasky, and e-sports company ESL Former joint managing director Heinrich Zetlmayer, Bonduc Bioscience SL, BCNBCNLVC, Sandsoft CEO David Fernandez. It is reported that GFAL has launched the GFAL token in the first quarter of 2023 and raised US$4.4 million in funds. The GFAL team is led by Manel Sort, and team members have held positions in companies such as King Entertainment, Activision Blizzard, ElectronicArts, and Netflix Digital Chocolate. The company’s GaaS approach to video game ownership that applies blockchain technology is called Web3 GaaS. GFAL believes that the Web3 GaaS model can replace the previous model because it provides players with a more comprehensive and enjoyable experience.

Style Protocol, a platform for converting NFTs into 3D assets that can be used in any game or metaverse, announced the completion of a $2.5 million seed round. Seed round financing, the specific investment institution has not been disclosed.

According to the project white paper: “Style Protocol aims to be built on top of Polkadot to increase interoperability with all blockchains and make NFTs available on every blockchain. But the protocol is built to Making it flexible and available on all blockchains requires two steps: first, create the bridging logic using smart contracts on Solidity and get all Ethereum Virtual Machine (EVM) compatible blockchains. Create logic on Parachain to be compatible with all other blockchains.”

Full-chain NFT protocol Holograph completed US$3 million in financing, aiming to expand into the blockchain game market

LayerZero ecological full-chain NFT protocol Holograph announced the completion of US$3 million in strategic financing, led by Mechanism Capital and Selini Capital, with participation from Northrock Capital, Arca, Courtside Ventures and Hartmann Capital owned by Hal Press. Holograph has raised a total of $11 million in funding to date. Holograph’s full-chain technology allows the creation of NFT assets that can be used on multiple Ethereum-compatible chains. The new funds are designed to accelerate its expansion into the growing chain gaming market, focusing on support for Ethereum-compatible network tokens, including Optimism and Arbitrum. , Avalanche, BNB Chain, Base, Mantle, Zora and Linea, etc.

On-chain game engine manufacturer Blade Games has completed a $2.4 million seed round of financing

On-chain game studio and infrastructure provider Blade Games has completed a $2.4 million seed round of financing, PTC Crypto It co-led the investment with IOSG Ventures, with participation from Bonfire Union Ventures, Animoca Ventures, Mantle, ForesightX, Formless Capital, Public Works, Puzzle Ventures, K300 Ventures, etc. The new funds will be used to drive the development and adoption of trustless on-chain games based on WebAssembly and zkVM technology stacks. Blade Games' self-developed game Dune Factory will launch a closed beta on May 1, and announced the rules and rewards for the closed beta on April 29. The game is scheduled to go into public beta at the end of May. It is reported that games built using Blade Game’s self-developed zk game engine can run game logic in zkVM and push the state difference to the chain as a zkSNARK proof, which is then verified on L2. The zk game engine can currently handle up to 12-15 frames per second, and will soon be updated with batch proof capabilities. The engine currently supports all game studios developing survival, tower defense, RPG and roguelike card building games.

TRALA LAB has completed a strategic round of financing, with Animoca Brands participating in the investment

TRALA LAB announced that it has completed a new strategic round of financing, with Animoca Brands participating in the investment. The specific financing amount and valuation data have not yet been disclosed. TRALA LAB is a subsidiary of Joycity, a listed Korean game company. After receiving investment from Animoca Brands, the two parties will cooperate in the global Web3 GameFi field. It is reported that TRALA LAB plans to focus on building a long-term sustainable game platform and plans to build a long-term sustainable game platform in zkSync. Access to a series of AAA-level global game IPs.

AI

Web3 developer platform Airstack completed a $4 million seed round of financing, led by Red Beard Ventures

Airstack, a Web3 developer platform powered by artificial intelligence, completed $4 million US dollar seed round financing, this round of financing was led by Red Beard Ventures, with participation from SuperLayer, Polymorphic Capital, Superscrypt, Hashed Emergent, Delta Blockchain Fund, CSP DAO, Primal Capital, NGC, Kyber, Resolute Ventures, Will Holt, etc. In May last year, Airstack completed US$7 million in financing, led by Superscrypt, with participation from Polygon, Hashed Emergent, NGC, Primal Capital, UOB Ventures and Signum Capital. This is the second half of the pre-seed round of financing. The first half will be completed in the third quarter of 2023, with participation from Polygon and others. Airstack allows developers to access and leverage on-chain data using AI-powered natural language requests. Alongside the funding announcement, Airstack launched an updated version of its Jam social app. Airstack currently offers its service for free, but the company plans to implement a pricing model in the future.

Infrastructure & Tools

Modular liquidity protocol Mitosis completes US$7 million in financing, led by Amber Group and Foresight Ventures

Modular liquidity protocol Mitosis announces the completion of US$700 US$10,000 in financing, led by Amber Group and Foresight Ventures, with participation from Big Brain Holdings, Folius Ventures, Citizen X, GSR, Cogient Ventures, No Limit Holdings, Digital Asset Capital Management, Pivot Global, Everstake and a group of angel investors. Mitosis is an L1 blockchain that proposes a novel ecosystem-owned liquidity (EOL) concept suitable for the upcoming multi-chain DeFi.

Non-custodial platform Volta has completed a $4.1 million seed round of financing

Multi-signature non-custodial platform Volta has completed a $4.1 million seed round of funding from Fika Ventures, Haven Ventures, Soma Capital, Dispersion Capital and Uphonest Capital participated in the investment. The platform sets a new standard for smart wallet infrastructure while providing a fast and secure solution for self-custody.

Dynamic modular service platform Crestal has completed a US$2 million Pre-Seed round of financing, with participation from MH Ventures and others

Dynamic modular service platform Crestal announced the completion of a US$2 million Pre-Seed round of financing. MH Ventures, Cogitent Ventures and NxGen participated in the investment, and the new funds will be used to accelerate the construction of modular services. It is reported that Crestal is a dynamic modular service platform that allows developers to discover, deploy and upgrade modular services by binding decentralized providers with verifiable Proof of Performance (PoP TM). Anyone can partner with a service provider and be rewarded for maintaining high-quality modular infrastructure that powers Web3 builders across all chains.

TNA Protocol received investment from venture capital institutions such as MH Ventures and Cogitent Ventures

TNA Protocol has received investments from MH Ventures, Cogitent Ventures, CSP DAO, etc. Investors and TNA Protocol will cooperate in depth in the Bitcoin ecosystem to promote the rapid implementation of TNA Protocol’s new narrative and ecological expansion. TNA Protocol is a Bitcoin asset and security protocol that integrates full-chain domain name asset issuance and DA solutions. It is supported by the Lightning Network and many second-layer solutions.

AILayer announced the completion of a new round of financing, MH Ventures participated in the investment

EVM-compatible Bitcoin L2AILayer (former AINNLayer2) announced the completion of a new round of financing, MH Ventures participated in the investment, the specific amount has not been Disclosure. It is reported that the two parties will work together to build Bitcoin Layer2 solutions to provide users and developers with a good experience.

Others

Social media

The acquisition of Mirror’s content platform Paragraph completed US$5 million in financing, with participation from USV and Coinbase Ventures

In addition to the acquisition of Web3 content publishing In addition to the platform Mirror, the Web3 content publishing platform Paragraph also announced the completion of US$5 million in financing, with participation from Union Square Ventures (USV) and Coinbase Ventures. Paragraph founder Colin Armstrong will serve as CEO, and Mirror founder Denis Nazarov will serve as an advisor. Previously, in October 2022, Paragraph announced the completion of US$1.7 million in financing, led by Lemniscap, with participation from FTX Ventures, Binance Labs, GCR and Seed Club Ventures. According to previous news, Mirror was acquired by Paragraph. The Mirror team will continue to operate independently and shift its focus to the development of "Kiosk", a Farcaster-based Web3 social application that integrates blockchain and e-commerce. Paragraph founders say Mirror and Paragraph will eventually be merged into a unified product suite.

SocialFi startup Matera completed US$3.6 million in financing, with participation from The Sandbox and others

Web3 startup Matera successfully raised US$3.6 million, with backers including Sidedoor Ventures, HighCass Crypto, Medusa Ventures, The Sandbox and Saxon Partners, among others. Matera plans to develop a blockchain infrastructure, including a DeFi platform, protocol layer and L2 network. The funds raised will be used to build a creator platform that combines DeFi with social media to solve common monetization challenges in the creator economy. Matera currently supports creators on X, enabling them to raise funds and monetize their loyal fan base, with plans to expand its integration to other social media platforms.

Web3 content distribution protocol Metale Protocol completed US$2 million in financing

Web3 content distribution protocol Metale Protocol recently announced that it has received an additional US$2 million in financing, with participation from Waterdrip Capital, Aipollo Investment and Ultiverse. So far, its total seed round financing has reached US$4 million. The new funds will be allocated to its ecological content creation fund to stimulate more content creation activities. Metale Protocol is an issuance and distribution platform on the content asset chain. It aims to build a decentralized content storage and confirmation protocol through the blockchain, and build an application ecosystem on the network to provide decentralized paid playback for the content industry. , crowdfunding management, traffic purchasing, data analysis, AI creation tools and other services. . In September 2023, the Web3 decentralized reading application Read2N announced a brand upgrade and changed its name to Metale Protocol.

On-chain social application Popset has completed a US$1 million Pre-Seed round of financing, led by Izun Partners

On-chain social application Popset has announced the completion of a US$1 million Pre-Seed round of financing, led by Izun Partners Angel investors such as PunkDAO, Michael Shaulov of Fireblocks, and Patricio Worthalter of POAP participated in the investment. According to reports, Popset will soon be available on iOS and Android, and the new financing will be used to advance development work and accelerate the launch of mobile applications.

Encryption application

Crypto voting service platform Agora completed a US$5 million seed round of financing, led by Haun Ventures

Crypto voting service platform Agora completed a US$5 million seed round of financing. Haun Ventures led the investment, with participation from Coinbase Ventures, Seed Club Ventures and Consensys Ventures. Agora hopes to create a new governance software standard for protocols to help protocols organize their voting systems more efficiently. Uniswap, Optimism and Nouns are its early customers.

Web3 wine market Baxus completed a US$5 million strategic round of financing, Multicoin Capital led the investment

Web3 Wine market Baxus completed a US$5 million strategic round of financing, Multicoin Capital led the investment, Solana Ventures, Narwhal Ventures , FJ Labs and a group of angel investors participated. BAXUS hopes to solve market inefficiencies by integrating the marketplace into a single application to connect buyers and sellers. The company said that by using the open Web3 payment infrastructure, it can reduce costs and increase transparency. Its Web3 marketplace is built on The Solana blockchain allows buyers to trade using credit cards, ACH, direct wire transfers or cryptocurrencies including USDC. It launched a beta version last summer and has facilitated $8 million in transactions so far.

Web3 security service provider Resonance Security completed a $1.5 million Pre-Seed round of financing, led by Arca and others

Web3 Integrated cybersecurity services provider Resonance Security has completed a $1.5 million Pre-Seed round of financing, co-led by Arca, Fabric VC and Blockchain Founders Fund. The new financing will be used to further accelerate expansion. It is reported that Resonance Security combines its expertise with a full set of security solutions, including smart contracts, blockchain and code auditing, penetration testing, CI/CD and cloud security, artificial intelligence threat modeling, an extensive network security product library, Built-in cybersecurity apps, notification and guidance system, fully supported cybersecurity concierge, cybersecurity education, and more.

Centralized Finance

Cryptocurrency trading ecosystem LazyBear completes 4 million USDT strategic financing

Cryptocurrency trading ecosystem LazyBear for retail traders announces completion of 4 million USDT strategy Financing, participating investors and strategic partners include Gogeko Labs, DWF Labs, Shadow Labs, Salad Labs, Bees Network, REI Network, IBIT, Crypto Bullish, SYNBO Protocol, Bazaars, Sypool, Bitcoin Gbox, GemX Crypto, Wikibit, etc. According to reports, LazyBear is a cryptocurrency trading ecosystem that is committed to providing users with an industry-low, free, inclusive and enjoyable trading experience.

VC Institution

Crypto Fund Fund XYZ completed US$5.1 million in financing, with participation from Compound founder Robert Leshner, Multicoin managing partner Kyle Samani and Gemini Lianchuang Winklevoss brothers.

The above is the detailed content of Financing Weekly Report | 29 public financing events; tokenization company Securitize completed US$47 million in financing, led by BlackRock. For more information, please follow other related articles on the PHP Chinese website!

Related articles

See more- Shock! The HTML5 Blockchain Game Alliance was established and a 1 billion development fund was established!

- How to check what the git password is

- Teach you how to convert BTC cryptocurrency in TP wallet

- Which exchanges are on BIBI Coin?

- Calm thoughts before the Ethereum Dencun upgrade: A short-term cure for the expansion problem?