$2.4 Billion Crypto Options Expiration: Market Volatility Is Coming?

- 王林forward

- 2024-05-03 21:10:12976browse

Crypto options expiration is here again, with a large number of Bitcoin and Ethereum contracts set to expire today.

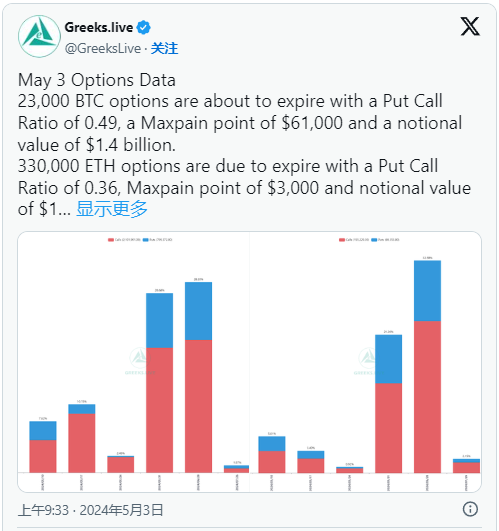

There are approximately 23,000 Bitcoin options expiring on May 3. The options have a notional value of approximately $1.4 billion, which is comparable to previous expiration events.

The crypto market had been falling sharply throughout the week, but recovered slightly in late trading on May 2. However, the price of Bitcoin remains below $60,000 and short-term sentiment has turned bearish.

Bitcoin Options Expiration

The put/call ratio for today’s high-volume Bitcoin contract is 0.49. This means that there are twice as many call contracts (long contracts) as there are put contracts (short contracts) expiring.

The maximum pain point price for these options is $61,000, which is slightly higher than the current spot price. The biggest pain point refers to the price that will cause the greatest loss when the contract expires.

There is still a lot of open interest in options with strike prices above $70,000, according to Deribit data. Even with the slim chance that BTC will hit the $100,000 strike price in the short term, there is still $661 million in open interest at the $100,000 strike price under current market conditions.

Crypto derivatives solutions provider Greeks Live commented on this week’s launch of a spot crypto ETF (exchange-traded fund) in Hong Kong. The company noted that while the Hong Kong market responded positively to the launch of these new financial products, the listings "did not generate much incremental transaction volume." In addition, the company also mentioned that even in the United States, spot Bitcoin ETFs continued to face outflows this week.

Greeks Live further analyzed the market situation, adding that the current market weakness has led to weakening investor confidence. This drop in confidence comes against the backdrop of continued declines in implied volatility across all major tenors. Implied volatility is a measure of the market’s expectations for future volatility and is derived from expiring crypto derivatives contracts.

The firm also noted that current levels of implied volatility are comparable to average levels seen during the last winter bull market, suggesting the market has found some support at current levels. Based on this analysis, Greeks Live believes that buying now is a good option given the current state of implied volatility and the support provided by the market.

In short, Greeks Live's view is that although the market has shown weakness and declining confidence in the short term, the market has reached an attractive entry point from an implied volatility perspective, at least on the implicit side. This is true in terms of expectations for future volatility as implied by inclusive volatility.

Implied volatility is a measure of expected future volatility derived from expiring crypto derivatives contracts.

In addition to today’s Bitcoin options, approximately 330,000 Ethereum options are also set to expire. The options have a notional value of approximately $1 billion, bringing the total value of today’s crypto contract expiration event to $2.4 billion.

ETH options have a put/call ratio of 0.36 and the biggest pain point is $3,000, a level that has only recently been recovered.

Crypto market recovery

This Friday, the cryptocurrency market experienced a certain degree of recovery, with the overall market capitalization increasing. Bitcoin (BTC) has seen some price gains after a period of volatility, but has yet to reach the widely-focused $60,000 mark.

Ethereum (ETH) had a strong performance during the day’s trading, with the price briefly surpassing the psychologically important $3,000 mark, but has since fallen back below that level.

In addition, some other well-known alternative currencies, such as Solana, Dogecoin, Toncoin, Shiba Inu and Polkadot, are also showing signs of recovery and the market performance is solid.

The above is the detailed content of $2.4 Billion Crypto Options Expiration: Market Volatility Is Coming?. For more information, please follow other related articles on the PHP Chinese website!