Hong Kong's Bitcoin and Ethereum ETF net inflows cannot make up for the selling pressure in the United States, and trading volume is far lower than that in the United States

- WBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBforward

- 2024-05-03 09:04:28529browse

This site (120bTC.coM): The recent launch of Bitcoin and Ethereum ETFs in Hong Kong has attracted widespread attention. Despite the early excitement, these new additions do not appear to be enough to offset the selling pressure from U.S. ETFs.

Hong Kong trading volume is much lower than the United States

The debut of the Hong Kong spot Bitcoin ETF was overshadowed by heavy selling activity from similar funds in the United States.

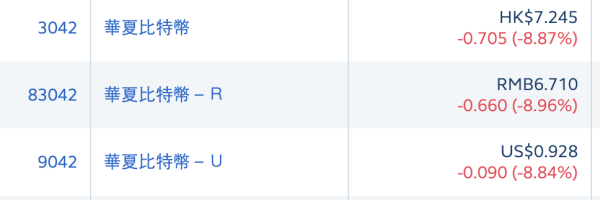

The trading volume of Hong Kong ETFs on the first day, including BTC and ETFs, was only over US$12 million, which is insignificant compared to the US$4.6 billion of US ETFs on the first day, reflecting the small size of the Hong Kong market. The trading volume on 5/2 was HK$33.14 million (US$4.24 million), and the stock prices fell by more than 7%.

The inflows affected by Hong Kong ETFs are small

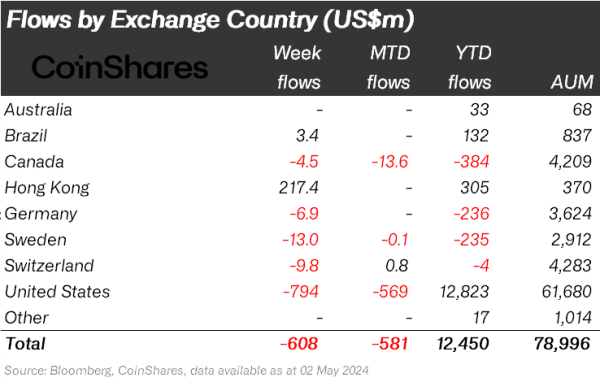

CoinShares researchers used the net asset inflows of the Hong Kong Exchange in the past week to infer the net inflows of ETFs: 2.17 One hundred million U.S. dollars.

In just two days, 4/30 and 5/1, U.S. ETFs had outflows of US$160 million and US$560 million.

Industry hopes other countries will follow suit

Market analysts believe that although Hong Kong’s ETFs represent a critical moment, their current impact is limited. Industry insiders are counting on peripheral influence: DFG Chief Executive James Wo said these ETFs could contribute to long-term price increases because other Asian markets may follow Hong Kong's lead.

While Hong Kong’s entry into the cryptocurrency ETF market was historic, its immediate effect was not as transformative as some had hoped. The continued dominance of U.S. ETFs and the inherent volatility of cryptocurrency markets suggest that the community should balance their expectations with cautious optimism. As the global financial technology landscape continues to evolve, these diverse market interactions will undoubtedly play a key role in shaping the future trajectory of cryptocurrency prices.

The above is the detailed content of Hong Kong's Bitcoin and Ethereum ETF net inflows cannot make up for the selling pressure in the United States, and trading volume is far lower than that in the United States. For more information, please follow other related articles on the PHP Chinese website!