VanEck: About $175 billion in Bitcoin is held by ETFs, countries and companies! The first choice for high return investors

- WBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBforward

- 2024-05-03 08:07:17548browse

This site (120bTC.coM): Bitcoin spot ETF issuer VanEck stated in a report released yesterday (1) that approximately US$175 billion in BTC was traded by ETFs, countries and corporate holdings, while more and more merchants and businesses are willing to accept Bitcoin as a form of payment.

About $175 billion in BTC is held by ETFs, countries and companies

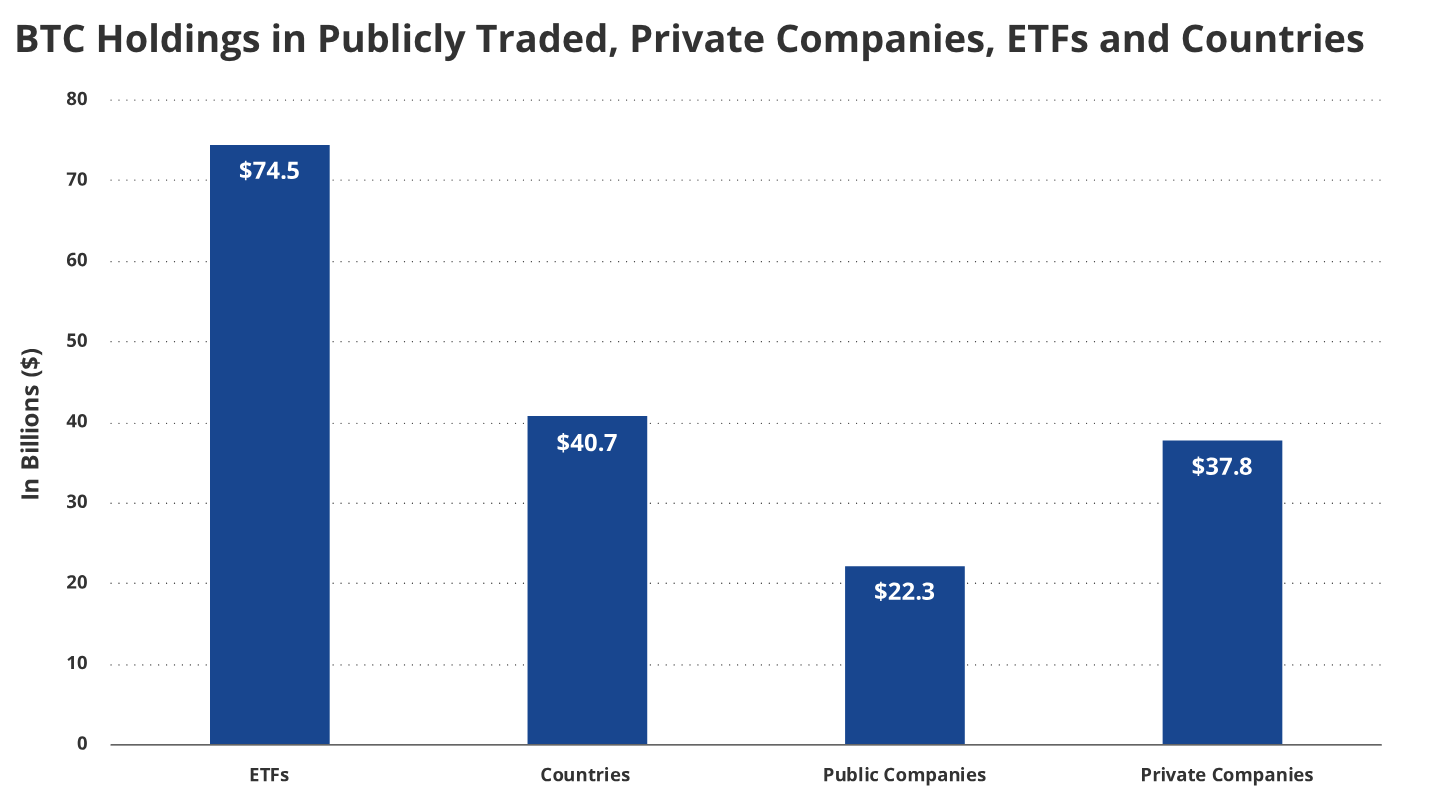

According to the report, institutional investors are gradually increasing their interest in Bitcoin. And hedge funds, asset managers, and endowments are also embracing Bitcoin as a store of value and a way to enrich their asset allocation. Currently, ETFs, countries, public companies, and private companies collectively hold approximately $175 billion worth of Bitcoin.

Since VanEck’s statistical time is until March 31, converted based on the BTC price at that time, US$175 billion accounts for approximately 12.77% of the total supply of Bitcoin.

The Bitcoin value of ETFs, countries, public companies and private companies has value

Diverse applications of Bitcoin

On the other hand, The report states that as Bitcoin becomes more mainstream, its adoption rate has grown significantly, and many merchants and businesses have begun to accept Bitcoin as a means of payment. Furthermore, the convenient infrastructure has removed the technical barriers faced by investors when purchasing cryptocurrencies.

At the same time, the report also pointed out that after the COVID-19 pandemic, the global money supply increased significantly, leading to inflation and weakening the purchasing power of existing fiat currencies. Conversely, Bitcoin, with a fixed total supply, is an attractive option for investors as a potential inflation hedge.

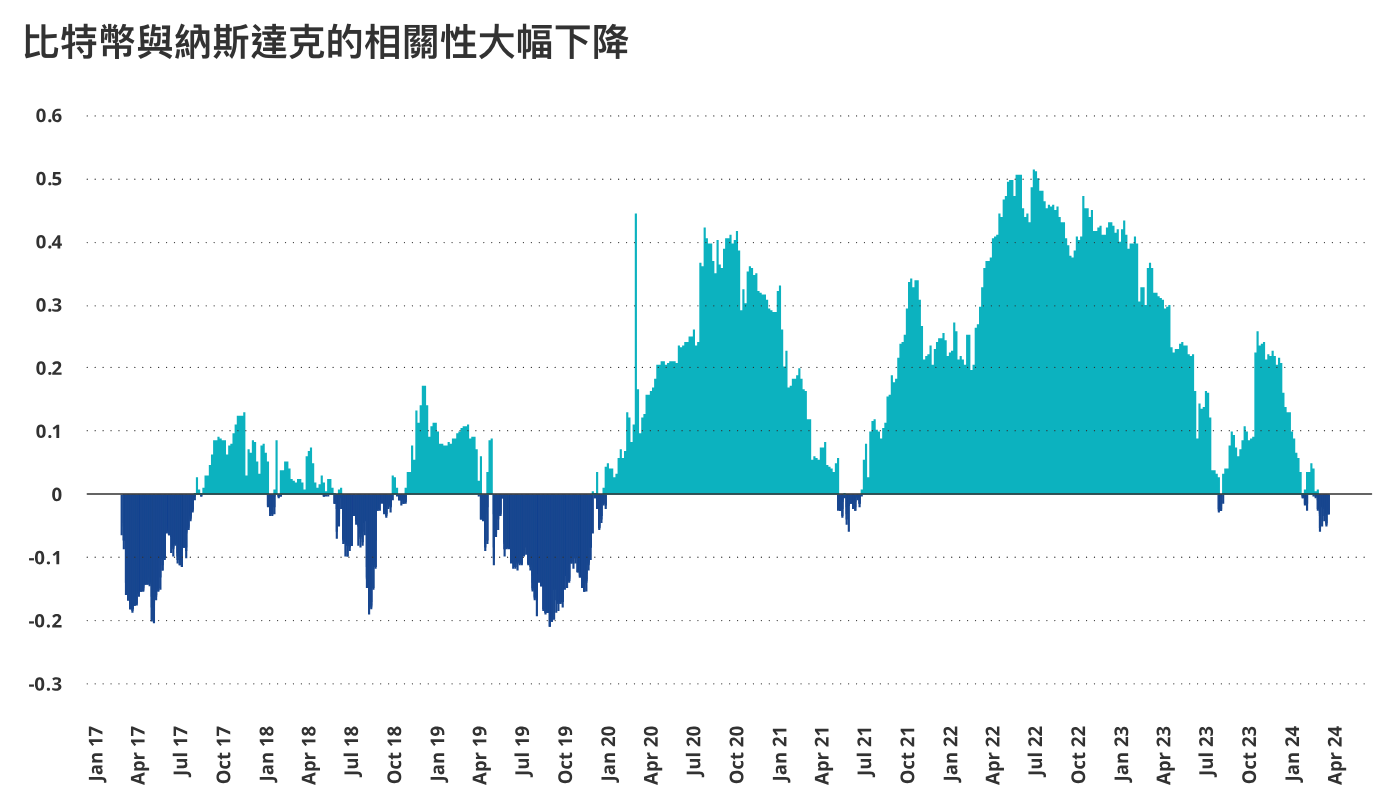

In addition, Bitcoin can also add diversity to an investment portfolio because it has a low correlation with traditional assets.

The above is the detailed content of VanEck: About $175 billion in Bitcoin is held by ETFs, countries and companies! The first choice for high return investors. For more information, please follow other related articles on the PHP Chinese website!

Related articles

See more- How to use PHP to develop applications using the Bitcoin Coinbase wallet library (detailed steps)

- How to Choose the Best Cryptocurrency: SOL Coin vs. ATOM Coin

- 2023 Global Cryptocurrency Exchange Rankings Ranking of the Top Five Domestic Digital Currency APPs

- How to buy Bitcoin

- Grayscale launches crypto-staking dynamic income fund