web3.0

web3.0 Bitcoin spot saw net outflows for 3 consecutive weeks! Analysts warn of BTC falling channel forming

Bitcoin spot saw net outflows for 3 consecutive weeks! Analysts warn of BTC falling channel formingBitcoin spot saw net outflows for 3 consecutive weeks! Analysts warn of BTC falling channel forming

After experiencing continuous large net inflows in the first few weeks, the Bitcoin spot ETF craze seems to have subsided. According to HODL Capital data, the Bitcoin spot ETF continued to have gains in the 16th week. There was a significant outflow of funds, totaling 5,176 Bitcoins. This is the third consecutive week of net outflows.

Net outflow for 3 consecutive weeks

Analyst: 1,310 BTC will be outflowed at the opening of Monday

In addition, according to on-chain analyst Ember According to the data, in the trading on April 26, the eleven U.S. Bitcoin spot ETFs collectively experienced a net outflow of US$83.61 million. This number also indicates that after the U.S. stock market opens next Monday (April 29), there will be a total net outflow of approximately 1,310 Bitcoins from the custody addresses of these ETFs.

Among them, the ETF with the most outflows is Grayscale’s GBTC. Together with the other two ETFs, a total of about 1,395 Bitcoins have been outflowed, and the corresponding capital outflow is US$89.04 million. Overall, the current eleven The total number of Bitcoins held by the BTC spot ETFs is 833,562, with a market value of approximately US$5.321 billion.

US Bitcoin spot ETF status on Monday

10X Research: BTC may fall to the $52,000 range

In terms of market conditions, according to According to 10X Research analysis, Bitcoin currently faces certain downside risks and may fall further towards the expected range of US$52,000 to US$55,000. This risk assessment comes from multiple market structure data, including the reduction in Bitcoin miner income, which to some extent reflects problems with Bitcoin’s fair value.

After Bitcoin hit an all-time high on March 15, it has already experienced two significant price drops. These downward behaviors are generally regarded in the market as signals of exhaustion of upward momentum.

#10X Research analysts believe that Bitcoin has currently settled on the short-term high of a downward trend and is entering a descending channel that may point to $52,000 in the future. 24 hours will be a critical moment in determining whether Bitcoin will fall further.

The above is the detailed content of Bitcoin spot saw net outflows for 3 consecutive weeks! Analysts warn of BTC falling channel forming. For more information, please follow other related articles on the PHP Chinese website!

Meme Coins' Hot Streak Cooled Dramatically in Q1 2025Apr 18, 2025 pm 12:24 PM

Meme Coins' Hot Streak Cooled Dramatically in Q1 2025Apr 18, 2025 pm 12:24 PMThis sharp drop happened as investor interest faded and a major scandal hit the highly speculative market.

We Tend to Think Coin Flips Are Unfair When We LoseApr 18, 2025 pm 12:22 PM

We Tend to Think Coin Flips Are Unfair When We LoseApr 18, 2025 pm 12:22 PMDespite being pretty much the iconic example of “random” – well, that and dice rolls – we can't help but feel like there's some element of skill involved. Especially when we lose.

Bitwise Announces the Listing of Four of Its Crypto ETPs on the London Stock Exchange (LSE)Apr 18, 2025 am 11:24 AM

Bitwise Announces the Listing of Four of Its Crypto ETPs on the London Stock Exchange (LSE)Apr 18, 2025 am 11:24 AMBitwise, a leading digital asset manager, has announced the listing of four of its crypto Exchange-Traded Products (ETPs) on the London Stock Exchange (LSE).

Bitcoin Set to Explode After Gold's Rally: Here's When BTC Could Break All-Time HighsApr 18, 2025 am 11:22 AM

Bitcoin Set to Explode After Gold's Rally: Here's When BTC Could Break All-Time HighsApr 18, 2025 am 11:22 AMBitcoin may be poised for a massive rally—but only if gold continues its upward climb, according to Joe Consorti, Head of Growth at Theya.

Shiba Inu (SHIB) Price Prediction 2025: Targeting $0.0000399 By Year-EndApr 18, 2025 am 11:20 AM

Shiba Inu (SHIB) Price Prediction 2025: Targeting $0.0000399 By Year-EndApr 18, 2025 am 11:20 AMThe Shiba Inu price continues to attract the attention of analysts, who are watching for its next potential move. By Samuele Piar. Updated April 14, 2025.

Ripple and U.S. Securities and Exchange Commission (SEC) Agree to Hold the Appeal in AbeyanceApr 18, 2025 am 11:18 AM

Ripple and U.S. Securities and Exchange Commission (SEC) Agree to Hold the Appeal in AbeyanceApr 18, 2025 am 11:18 AMThe joint motion of Ripple and U.S. Securities and Exchange Commission (SEC) to hold the appeal in abeyance has been granted by the Circuit Judge Jose A. Cabranes.

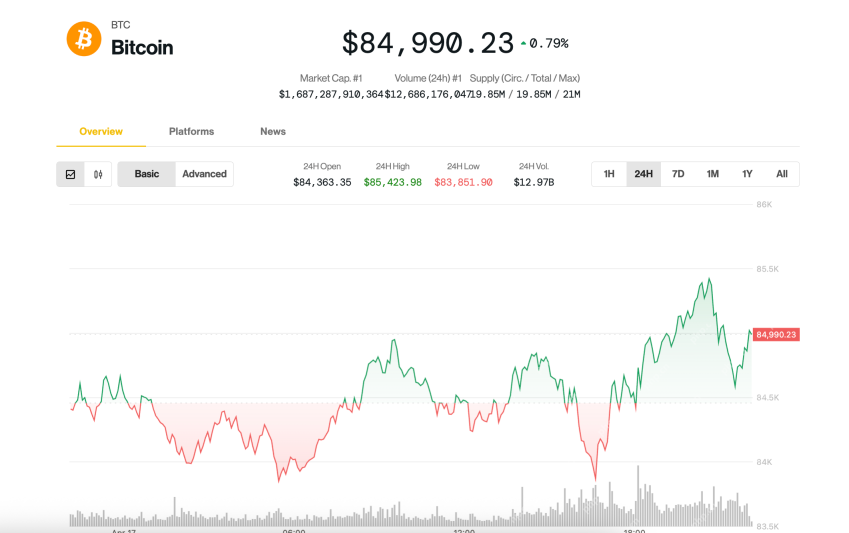

Bitcoin (BTC) was treading water just below $85,000Apr 18, 2025 am 11:14 AM

Bitcoin (BTC) was treading water just below $85,000Apr 18, 2025 am 11:14 AMBitcoin (BTC) was treading water just below $85,000 late Thursday as tensions between U.S. President Donald Trump and Federal Reserve Chair Jerome Powell added another layer of uncertainty for investors.

AB DAO Launches Dual Reward Campaign in Collaboration with Bitget to Celebrate Its Token Generation EventApr 18, 2025 am 11:12 AM

AB DAO Launches Dual Reward Campaign in Collaboration with Bitget to Celebrate Its Token Generation EventApr 18, 2025 am 11:12 AMToday, AB DAO officially announced the launch of a dual reward campaign in collaboration with Bitget (bitget.com), the world's second-largest digital asset trading platform.

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Atom editor mac version download

The most popular open source editor

MantisBT

Mantis is an easy-to-deploy web-based defect tracking tool designed to aid in product defect tracking. It requires PHP, MySQL and a web server. Check out our demo and hosting services.

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use