LBP Participation Guidelines and LBP Protocol Token Potential

- WBOYforward

- 2024-04-26 09:13:271265browse

Fjord Foundry native token $FJO LBP ended successfully on the 19th. The closing price of $FJO LBP was 1.91U and a total of 15.35M funds were raised. The current price of $FJO is around 2.79U.

I will also take part in this trend and talk about my potential for Fjord Foundry tokens and my views on LBP (by the way, let’s talk about another LBP protocol)

Let’s dive in together⬇️

1. What is LBP?

LBP is the abbreviation of Liquidity Bootstrapping Pool (Liquidity Bootstrapping Pool), its model is similar to the Dutch beat. Fjord Foundry is an LBP platform.

A simple understanding is that before the LBP starts, the project parties participating in the LBP will determine two things: 1) the number of issued tokens; 2) the tokens in the LP and another asset (usually ETH or stablecoins), such as 99% tokens and 1% stablecoins.

After the start of LBP, based on the dynamic pricing of this model, the price continues to decrease (the supply of tokens increases). When it reaches the user's psychological price, the user can buy it. After it rises (such as a node user If you buy more (demand > supply), users can also sell.

After the event, the project party will generally use part of the proceeds from the token sale to add a pool to the DEX.

2. Advantages and some uncertainties

For users, the advantage of LBP is fairness. In the absence of whitelists and scientists, users can purchase tokens at psychological prices.

For project parties, they can participate in the start-up funds obtained by LBP at a low threshold and use it to guide liquidity.

So, what is uncertainty?

First, I personally believe that the LBP model requires users’ own cognition. Users need to do research before participating in LBP so that they can purchase tokens within a reasonable range. Without doing research, users can easily lose money in LBP.

1intro’s LBP is a good example. Due to lack of understanding of the 1intro protocol and the LBP model, many users purchased 1intro tokens when LBP just started (I remember the valuation at the opening was 1 billion), resulting in losses.

Second, in order to promote token sales, the protocol may announce some good information during the LBP period. For example, users who bought tokens during the LBP period and did not sell them can receive some additional income. Therefore, users should always pay attention to the project community and social media. If there is good news, they can make a profit by buying and selling as soon as possible (1intro is also an example in this regard).

Third, the project team’s own insufficient structure will also affect the token price. For example, after the market opened, the project side added too little liquidity. The current pool size of $FJO is 5.8M, which is okay.

3. Fjord Foundry token economic model and protocol data

$The total amount of FJO is 100 million.

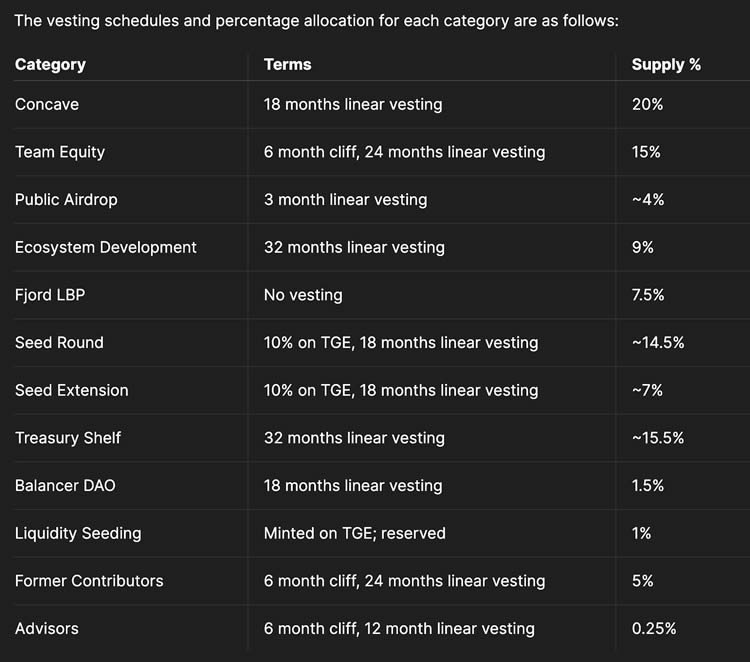

The distribution is as follows ⬇️ The initial circulation is about 10.65% (calculated by myself, corrections are welcome), and the Seed financing price is 0.2 - seed round participants will make profits by selling directly.

Token Utility ⬇️

Users can stake $FJO to obtain a portion of the tokens that the protocol uses to repurchase the revenue, and $FJO Staker will also have the opportunity Get potential project airdrops.

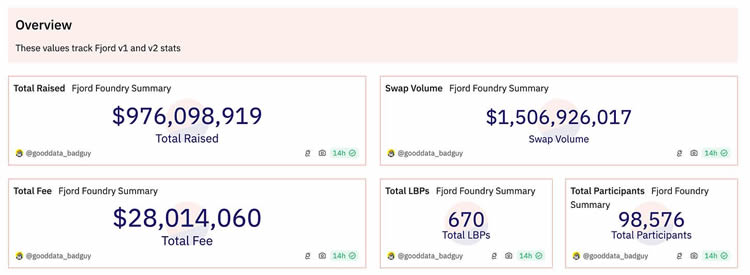

Protocol data⬇️

The total fee income is 28M.

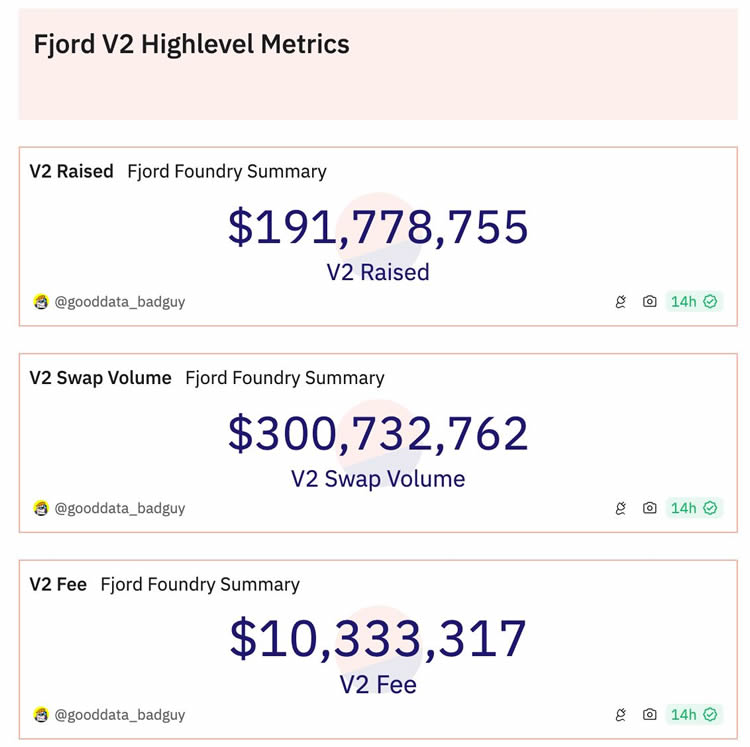

Since launching v2 in December, Fjord’s protocol revenue is 10M. Then the annualized revenue (forecast) of this protocol this year should be approximately 30M.

Conclusion

With the bull market’s upward trend confirmed, many developers will hope to get a share of the pie in this cycle. Therefore, the potential income opportunities for Fjord are quite sufficient. In the future, Fjord will also expand to other chains (such as Solana, Berachain, Fantom), and the deployment of new chains will also be a catalyst for Fjord's revenue growth.

The Fjord token cycle is to buy back and destroy $FJO through at least 90% of the protocol revenue. So the final essential logic is that the higher the income of the Fjord protocol, the better the price performance of $FJO.

The above is the detailed content of LBP Participation Guidelines and LBP Protocol Token Potential. For more information, please follow other related articles on the PHP Chinese website!

Related articles

See more- How to add background image to bootstrap

- bootstrap-table table inline editing implementation

- 10 beautiful and practical Bootstrap background management system templates (come and download now)

- Stablecoin issuer Tether invests in payment app Oobit! Expanding crypto payment scenarios

- The UK Financial Supervisory Authority plans to charge stablecoin issuers and digital asset custodians to recover US$8 million in regulatory costs