Home >Software Tutorial >Office Software >Detailed operation process of using formulas to calculate taxes in WPS Office2012

Detailed operation process of using formulas to calculate taxes in WPS Office2012

- 王林forward

- 2024-04-25 14:34:191228browse

Having trouble calculating your taxes? Don't worry, PHP editor Strawberry brings you the detailed operation process of formula calculation of tax in WPS Office2012. Whether you're a tax professional or do your taxes on a daily basis, this guide will take you step-by-step to solve your tax woes with ease. Read on to learn how to use the formula function of WPS Office2012 to calculate taxes efficiently and conveniently.

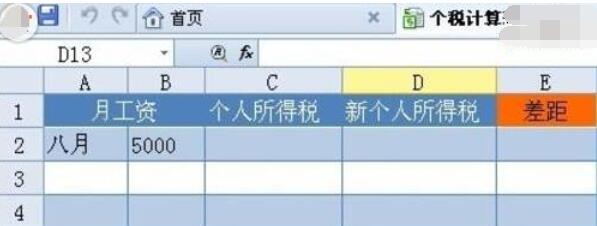

First, make an ET table as shown below:

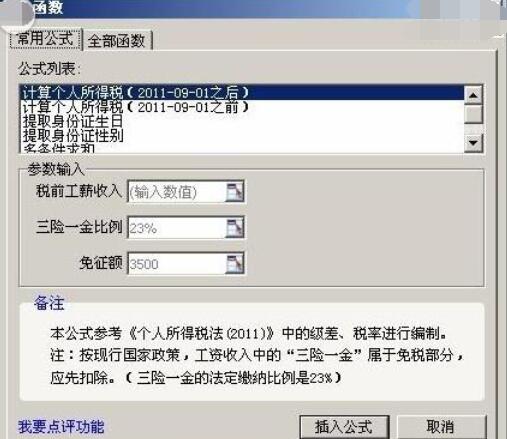

Select cell C2, click the [Insert Function] button in the Formula tab to open the Insert Function dialog box box, click [Calculate Personal Income Tax (Before 2011-09-01)], enter all cells [C2] of August’s salary in [Pre-tax Salary Income] (inputting values can directly calculate the results, here for obvious Reference cell data is used for comparison), click the Insert Formula button, and the personal income tax that should be paid to adjust the personal income tax is calculated. Isn't it very simple?

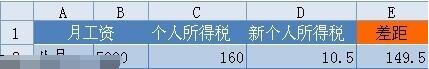

Use the same method to calculate the personal income tax that should be paid after September 1, 2011 in D2. Enter the formula [=C2-D2] in cell E2 to quickly calculate how much less you will pay.

The above is the detailed content of Detailed operation process of using formulas to calculate taxes in WPS Office2012. For more information, please follow other related articles on the PHP Chinese website!