Discuss the application of chatbots in the financial field

From interacting with customers to overseeing payments and transactions, chatbots are taking financial management to the next level.

Although the development of artificial intelligence has proven to be beneficial in many fields, high-performance artificial intelligence applications will still take some time to achieve. The use of artificial intelligence has proven beneficial in many fields. One such area is dealing with human interactions. Chatbots that simulate human cognition and communication are increasingly used for this purpose in many industries. The adoption of chatbots in financial services is only natural given that chatbots have proven successful and useful in financial services.

Chatbots in Financial Services

Here are five functions performed by bots in financial management and banking institutions:

1. Providing customer support

## The most common application of #bots in the financial sector or any related field is customer support and engagement. Chatbots have become a common part of many enterprise customer relationship management (CRM) programs, including banks, Apple Bank, and Capital One Bank, which are just some of the many financial institutions using chatbots to interact with customers. Using chatbots for customer service ensures that customer communications receive timely responses regardless of the time. Chatbots can also quickly access large amounts of information to provide accurate solutions to customer issues. The overall cost-effectiveness of such chatbots compared to regular customer service makes the choice a no-brainer. 2. Provide investment adviceIf you are a financial services professional, you are familiar with the concept of "robo-advisor", an artificial intelligence chatbot application that requires almost no human intervention can provide investment advice to investors. It collects information from users in a personalized, interactive way and leverages its ever-growing database of information to provide highly relevant investment advice. Some robo-advisors can even invest the user’s assets on their behalf. Although AI applications are not yet developed enough to provide fully independent and accurate advice, the idea that it will eventually be possible is not far-fetched. 3. Prevent Fraudulent TransactionsPeople can detect fraud by spotting trends and anomalies in general behavior. Artificial intelligence powered by machine learning to detect anomalies in behavioral and statistical patterns that humans cannot detect. This application is becoming more and more common, and some of us may have seen it in action, albeit in a very basic form. Additionally, notifications are automatically received from the bank when logging into the online banking portal or when one's spending patterns deviate from normal. This is a form of bot that automatically responds to certain events, such as accessing an online banking portal from a new device. 4. Bookkeeping and AccountingIn financial services, bookkeeping and accounting are important aspects. These two functions, while important, can be time-consuming and seem routine. Furthermore, they need to be done with a very high degree of accuracy, otherwise it can lead to very serious consequences. The reliability and sophisticated computing power of AI robots can help financial services institutions and individuals perform these functions. 5. PaymentsPayPal has experimented with the concept of using chatbots to perform peer-to-peer (P2P) payments, enabling users to pay via chat messages. The application makes payments more convenient for users. Another application of artificial intelligence in payments is speech recognition tools. The app enables users to make payments using voice commands in everyday languages. The use of chatbots in financial services is just the beginning of a whole world of innovations that could revolutionize the industry. With continued investment and development, AI can not only enhance the day-to-day operations of financial institutions, but also help develop and implement long-term strategies.The above is the detailed content of Discuss the application of chatbots in the financial field. For more information, please follow other related articles on the PHP Chinese website!

How to Run LLM Locally Using LM Studio? - Analytics VidhyaApr 19, 2025 am 11:38 AM

How to Run LLM Locally Using LM Studio? - Analytics VidhyaApr 19, 2025 am 11:38 AMRunning large language models at home with ease: LM Studio User Guide In recent years, advances in software and hardware have made it possible to run large language models (LLMs) on personal computers. LM Studio is an excellent tool to make this process easy and convenient. This article will dive into how to run LLM locally using LM Studio, covering key steps, potential challenges, and the benefits of having LLM locally. Whether you are a tech enthusiast or are curious about the latest AI technologies, this guide will provide valuable insights and practical tips. Let's get started! Overview Understand the basic requirements for running LLM locally. Set up LM Studi on your computer

Guy Peri Helps Flavor McCormick's Future Through Data TransformationApr 19, 2025 am 11:35 AM

Guy Peri Helps Flavor McCormick's Future Through Data TransformationApr 19, 2025 am 11:35 AMGuy Peri is McCormick’s Chief Information and Digital Officer. Though only seven months into his role, Peri is rapidly advancing a comprehensive transformation of the company’s digital capabilities. His career-long focus on data and analytics informs

What is the Chain of Emotion in Prompt Engineering? - Analytics VidhyaApr 19, 2025 am 11:33 AM

What is the Chain of Emotion in Prompt Engineering? - Analytics VidhyaApr 19, 2025 am 11:33 AMIntroduction Artificial intelligence (AI) is evolving to understand not just words, but also emotions, responding with a human touch. This sophisticated interaction is crucial in the rapidly advancing field of AI and natural language processing. Th

12 Best AI Tools for Data Science Workflow - Analytics VidhyaApr 19, 2025 am 11:31 AM

12 Best AI Tools for Data Science Workflow - Analytics VidhyaApr 19, 2025 am 11:31 AMIntroduction In today's data-centric world, leveraging advanced AI technologies is crucial for businesses seeking a competitive edge and enhanced efficiency. A range of powerful tools empowers data scientists, analysts, and developers to build, depl

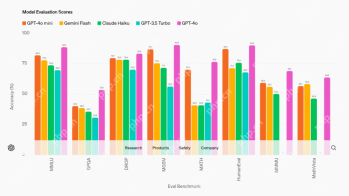

AV Byte: OpenAI's GPT-4o Mini and Other AI InnovationsApr 19, 2025 am 11:30 AM

AV Byte: OpenAI's GPT-4o Mini and Other AI InnovationsApr 19, 2025 am 11:30 AMThis week's AI landscape exploded with groundbreaking releases from industry giants like OpenAI, Mistral AI, NVIDIA, DeepSeek, and Hugging Face. These new models promise increased power, affordability, and accessibility, fueled by advancements in tr

Perplexity's Android App Is Infested With Security Flaws, Report FindsApr 19, 2025 am 11:24 AM

Perplexity's Android App Is Infested With Security Flaws, Report FindsApr 19, 2025 am 11:24 AMBut the company’s Android app, which offers not only search capabilities but also acts as an AI assistant, is riddled with a host of security issues that could expose its users to data theft, account takeovers and impersonation attacks from malicious

Everyone's Getting Better At Using AI: Thoughts On Vibe CodingApr 19, 2025 am 11:17 AM

Everyone's Getting Better At Using AI: Thoughts On Vibe CodingApr 19, 2025 am 11:17 AMYou can look at what’s happening in conferences and at trade shows. You can ask engineers what they’re doing, or consult with a CEO. Everywhere you look, things are changing at breakneck speed. Engineers, and Non-Engineers What’s the difference be

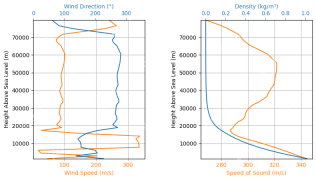

Rocket Launch Simulation and Analysis using RocketPy - Analytics VidhyaApr 19, 2025 am 11:12 AM

Rocket Launch Simulation and Analysis using RocketPy - Analytics VidhyaApr 19, 2025 am 11:12 AMSimulate Rocket Launches with RocketPy: A Comprehensive Guide This article guides you through simulating high-power rocket launches using RocketPy, a powerful Python library. We'll cover everything from defining rocket components to analyzing simula

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

SublimeText3 Linux new version

SublimeText3 Linux latest version

Dreamweaver Mac version

Visual web development tools

ZendStudio 13.5.1 Mac

Powerful PHP integrated development environment

SecLists

SecLists is the ultimate security tester's companion. It is a collection of various types of lists that are frequently used during security assessments, all in one place. SecLists helps make security testing more efficient and productive by conveniently providing all the lists a security tester might need. List types include usernames, passwords, URLs, fuzzing payloads, sensitive data patterns, web shells, and more. The tester can simply pull this repository onto a new test machine and he will have access to every type of list he needs.

SublimeText3 Mac version

God-level code editing software (SublimeText3)