Grayscale's Mini Bitcoin ETF Will Have Some of the Lowest Trading Fees on the Market

- WBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBforward

- 2024-04-23 19:07:01959browse

Grayscale plans to launch a new version of its mini Bitcoin exchange-traded fund (ETF) that will be the market leader in terms of fees, according to a recent filing.

The world’s largest asset manager has launched a new mini Bitcoin exchange-traded fund (ETF) aimed at maintaining its position as the market leader in spot Bitcoin ETFs after massive capital outflows from its flagship GBTC product. .

To achieve this, Grayscale has filed to launch a smaller Bitcoin exchange-traded fund (ETF) that is highly competitive in terms of fees and aims to compete with ten others on the market. competitors. .

Grayscale’s new ETF (Bitcoin Mini Trust) will set fees at just 0.15%, according to its latest filing with the Securities and Exchange Commission.

Grayscale’s Mini Bitcoin Fund

On April 21, Bloomberg ETF analyst Eric Balchunas reacted to the news, exclaiming:

“Wow, GBTC’s mini Bitcoin ETF will charge 15 basis points, which means Grayscale will have the cheapest Bitcoin ETF on the market.”

He went on to say that this is just a hypothesis and does not mean that the fund's fees will necessarily be 15 basis points. "But the good news is that they had to pick a fee standard and realized that everyone was paying attention to this setting, so they chose 15 basis points as a tentative fee," he further explained.

The existing Grayscale Bitcoin Trust charges a fee of 1.5%, which partly explains why it loses a lot of assets under management compared to competitors with lower fees.

The Franklin Bitcoin ETF (EZBC) is currently the new fund’s closest competitor, with a fee of 0.19%.

Additionally, when the Bitcoin Mini Trust (BTC) launches, the company will put 10% of GBTC assets into the new fund, according to the filing.

As of this writing, this is equivalent to approximately 30,500 Bitcoins and is worth approximately $2 billion. But if GBTC continues to experience steady outflows before the Mini Bitcoin Fund is launched, then this number may be lower than this asset valuation.

In addition, shares of the new fund will be automatically issued and distributed to GBTC stock holders.

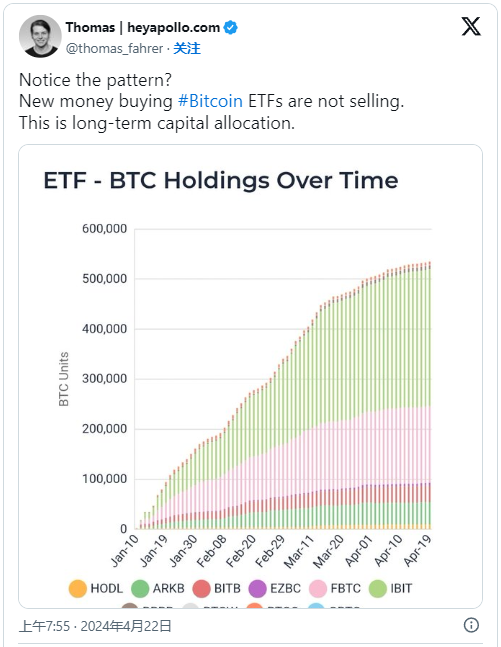

GBTC has lost over 50% of its Bitcoin holdings since converting to a spot ETF in mid-January. Following an outflow of $45.8 million on Friday, the fund’s remaining balance totals 304,970 BTC.

Last week, Grayscale lost $458 million, although outflows began to slow by the end of the week. In addition, April 19 was the first time in a week that total single-day capital inflows reached $59.7 million.

ETH ETF may not be approved

On April 19, ETF Store President Nate Geraci said that the spot ETH ETF was “exceptionally quiet.”

He confirmed that the consensus among industry analysts is that the filings are expected to be rejected by the U.S. Securities and Exchange Commission (SEC) at the end of May due to a lack of participation.

The above is the detailed content of Grayscale's Mini Bitcoin ETF Will Have Some of the Lowest Trading Fees on the Market. For more information, please follow other related articles on the PHP Chinese website!

Related articles

See more- Top 10 Bitcoin Exchanges Ranking Top 10 Recognized Bitcoin Exchanges in China

- What is the Chinese name of poloniex trading platform app poloniex exchange?

- Foreign Bitcoin exchanges, foreign Bitcoin trading software

- Domestic formal virtual currency trading platform Top ten formal exchange apps ranking

- How much does Tether transaction cost?