Bitcoin spot ETF hype subsides? Bloomberg analyst: This is not unusual

- 王林forward

- 2024-04-17 18:55:29907browse

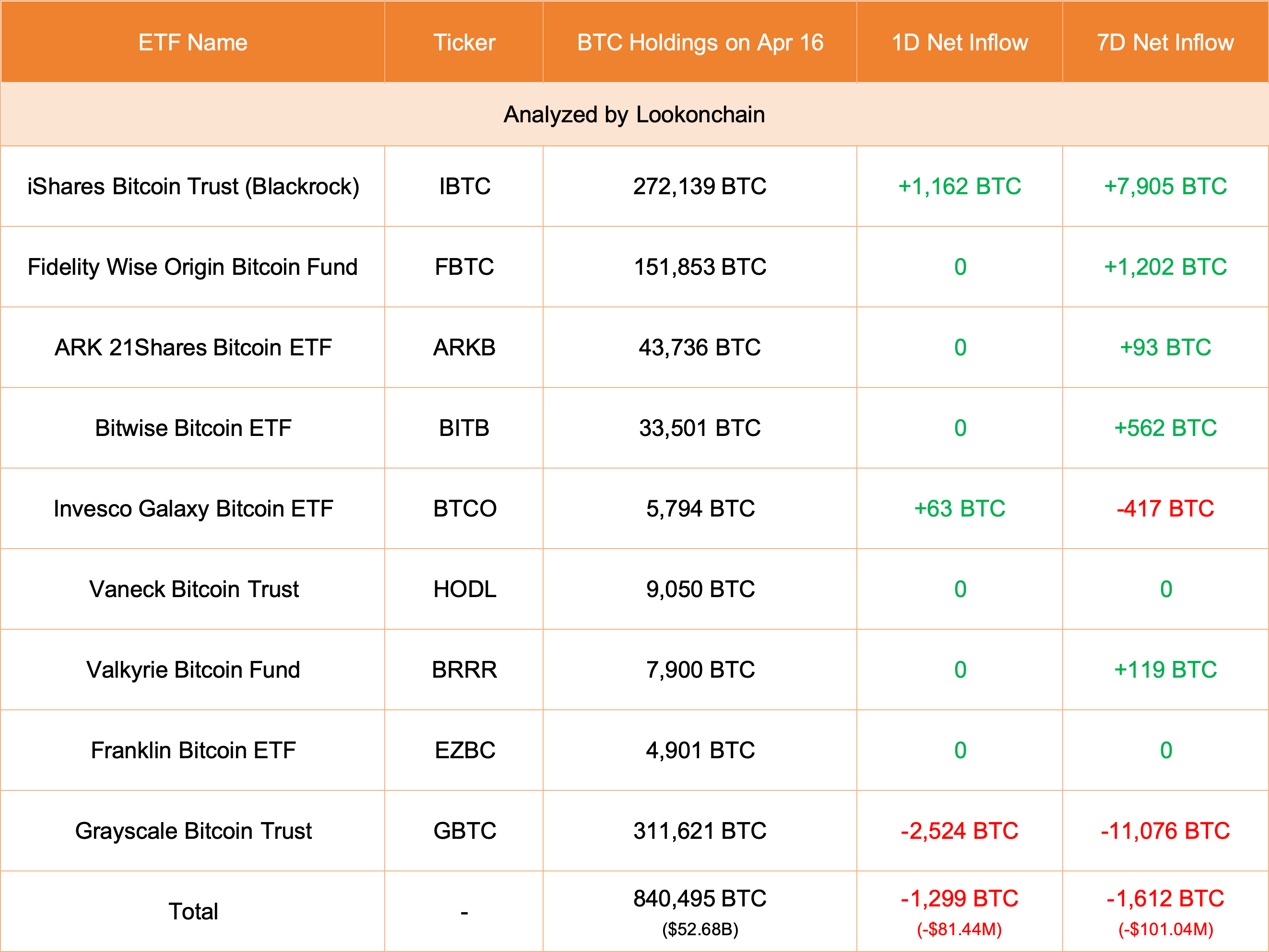

According to Lookonchain data, nine Bitcoin spot ETFs net reduced their holdings by 381 BTC on the 15th of this week, and then net reduced their holdings by 1,299 BTC on the 16th, with a net outflow of approximately 8,144 Ten thousand U.S. dollars. Among them, Grayscale’s reduction of 2,524 BTC was the largest, with a net outflow of approximately US$158.21 million. It currently holds 311,621 BTC, approximately US$19.53 billion.

Changes in net inflows and outflows of Bitcoin spot ETFs

Has the Bitcoin spot ETF hype subsided?

It is worth noting that the initial funding craze for Bitcoin spot ETFs seems to have subsided. Coindesk reported that the recent capital inflows of other ETFs have been unable to keep up with the rapid outflow of Grayscale GBTC. During the week on Friday, the Bitcoin spot ETF had a net outflow of 1,766 Bitcoins.

Upon closer inspection, Fidelity’s FBTC capital inflow was 0 last Friday and Monday, breaking the record of daily inflows since its launch on January 11, making BlackRock’s IBIT the Bitcoin Since the launch of the currency spot ETF, it is the only product that has continued to have daily capital inflows.

Most other Bitcoin spot ETFs, such as Invesco and Galaxy Ditigal’s BTCO, VanEck’s HODL and Valkyrie’s BRRR, have seen zero inflows and even occasional outflows become the norm.

Bloomberg ETF Analyst Comment

In this regard, Bloomberg ETF analyst James Seyffart believes that this is not surprising. For example, there are 3,500 ETFs in the U.S. market, but about 83 % of ETFs saw no inflows on Monday.

James Seyffart explained that the subscription and redemption of ETF shares will only occur when the mismatch between supply and demand is large enough and the cost of doing so is lower than hedging. As far as Bitcoin ETFs are concerned, the establishment of units The range ranges from 5,000 shares to 50,000 shares, and if the mismatch is smaller, the market maker treats ETF share trades like stocks.

In addition, James Seyffart does not believe that Grayscale’s GBTC net outflow will reverse. The reason is that the GBTC management fee is 1.5% (higher than other competitors). He will be surprised if GBTC has a net inflow on any day. .

What opportunities are waiting for BTC net inflow?

Despite the recent slowdown in Bitcoin spot ETF inflows, Samir Kerbage, chief investment officer of Hashdex, which converted its Bitcoin futures fund to a Bitcoin spot ETF in March, believes that Bitcoin spot ETFs will see renewed inflows: Global Many banks, endowments, and pension funds are just beginning the due diligence process to consider strategic allocations to BTC through newly launched ETFs. As these large financial institutions make decisions in the coming months, inflows are likely to increase again, potentially A new milestone in one of the most successful ETF launches in U.S. history.

The above is the detailed content of Bitcoin spot ETF hype subsides? Bloomberg analyst: This is not unusual. For more information, please follow other related articles on the PHP Chinese website!

Related articles

See more- What is the connection between SATS coin and Bitcoin?

- List of BTC apps that can still be used in China. List of Bitcoin trading apps.

- When was Bitcoin launched for online trading? When was Bitcoin released?

- Which platforms can buy and sell Bitcoin in China? Top ten domestic Bitcoin trading software apps