Short-selling is a strategy of betting on the decline in the price of cryptocurrency. Contrary to long-selling, the method of operation is to borrow cryptocurrency and sell it, and then buy it back at a lower price to realize a profit from the price difference. Short-selling currency speculation involves risks such as unlimited loss potential, liquidation risk, and borrowing costs, but it also has the advantages of profit potential, hedging risks, and market neutrality.

#What is short selling?

Short selling is a trading strategy in which traders bet that cryptocurrency prices will fall. It is the opposite of going long on a currency, which is a bet that the price will rise.

How short selling works

When short selling, a trader borrows a certain amount of cryptocurrency and then sells it at the market price. They hope to buy back the cryptocurrencies later at a lower price and take the difference as profit.

For example, if a trader borrows 10 Bitcoins (BTC) and sells them for $10,000, they will receive $100,000. If the price of Bitcoin drops to $8,000, they can buy back 10 Bitcoins for $80,000 and return the loan. They will make a profit of $20,000 ($100,000 - $80,000).

Risks of short-selling currency speculation

There are the following risks in short-selling currency speculation:

- Unlimited loss potential:Encryption Currency prices can theoretically rise indefinitely, which means that short-selling and speculating on currencies may result in unlimited losses.

- Liquidation Risk: If cryptocurrency prices increase, traders may be liquidated and forced to buy back the borrowed cryptocurrency at a loss.

- Borrowing costs: Short selling usually requires borrowing cryptocurrency, which incurs borrowing costs.

Advantages of short-selling currency speculation

The advantages of short-selling currency speculation include:

- Profit potential:If the price of a cryptocurrency falls, shorting the currency can generate substantial profits.

- Hedging risk: Shorting cryptocurrency can help balance the risk of holding a cryptocurrency position.

- Market neutral strategy: Short selling can be used as a market neutral strategy to make profits when the market is in a downward or consolidation trend.

The above is the detailed content of What is short selling in currency speculation?. For more information, please follow other related articles on the PHP Chinese website!

Tether CEO Paolo Ardoino Completes Visit to the United States, Meeting with Lawmakers in Washington, D.C. to Discuss Stablecoin RegulationApr 15, 2025 am 11:24 AM

Tether CEO Paolo Ardoino Completes Visit to the United States, Meeting with Lawmakers in Washington, D.C. to Discuss Stablecoin RegulationApr 15, 2025 am 11:24 AMHis visit comes as the U.S. Congress moves closer to introducing legislation regulating stablecoins, which Ardoino believes is necessary for financial inclusion and preserving U.S. dollar dominance.

Why XRP Price May Not 'Go Parabolic' Post-SEC SettlementApr 15, 2025 am 11:22 AM

Why XRP Price May Not 'Go Parabolic' Post-SEC SettlementApr 15, 2025 am 11:22 AMThe XRP price holds still in the $2.10-2.20 range for the past few days, but this is not stopping Ripple's community from continuing to post various content about XRP

Metaplanet Expands Its Bitcoin Treasury Holdings by Another 319 BTCApr 15, 2025 am 11:20 AM

Metaplanet Expands Its Bitcoin Treasury Holdings by Another 319 BTCApr 15, 2025 am 11:20 AMIn an announcement made earlier today, Japanese firm Metaplanet revealed it has acquired another 319 Bitcoin (BTC), pushing its total corporate holdings beyond 4,500 BTC.

Metaplanet Scoops Another 319 Bitcoin, Pushing Its Total Corporate Holdings Beyond 4500Apr 15, 2025 am 11:18 AM

Metaplanet Scoops Another 319 Bitcoin, Pushing Its Total Corporate Holdings Beyond 4500Apr 15, 2025 am 11:18 AMIn an announcement made earlier today, Japanese firm Metaplanet revealed it has acquired another 319 Bitcoin (BTC), pushing its total corporate holdings beyond 4,500 BTC.

Ripple (XRP) price rallied through a weekend riseApr 15, 2025 am 11:16 AM

Ripple (XRP) price rallied through a weekend riseApr 15, 2025 am 11:16 AMRipple (XRP) price rallied through a weekend rise from its $2.00 critical support mark to reach $2.23.

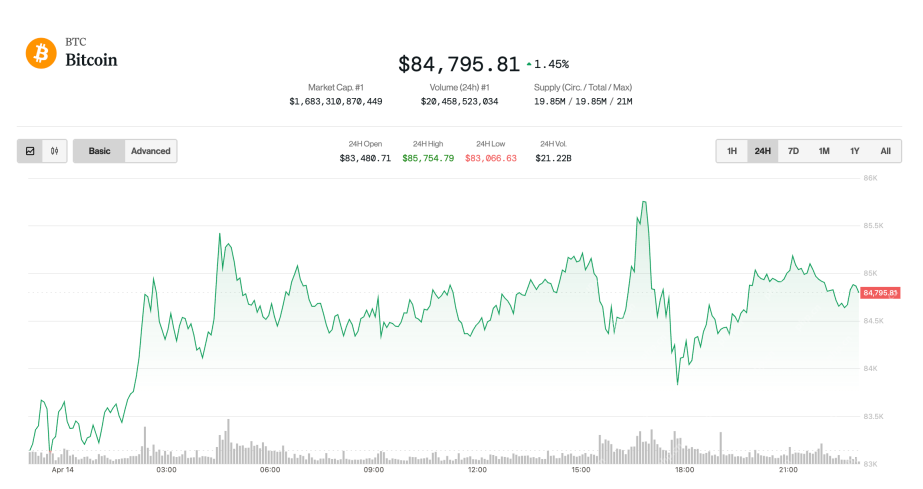

Bitcoin (BTC) drifts upwards as the broader market adjusts favorably to trade-related newsApr 15, 2025 am 11:14 AM

Bitcoin (BTC) drifts upwards as the broader market adjusts favorably to trade-related newsApr 15, 2025 am 11:14 AMThe largest cryptocurrency was up 1.6% in the last 24 hours and is now trading just shy of $85,000. Ether (ETH), meanwhile, rose 2.7%

Is ADA the Sleeper Pick for the Next Bull Run? Hoskinson's $250K BTC Forecast Says YesApr 15, 2025 am 11:12 AM

Is ADA the Sleeper Pick for the Next Bull Run? Hoskinson's $250K BTC Forecast Says YesApr 15, 2025 am 11:12 AMADA has risen by 1.5% in the past 24 hours, with its move to $0.644 coming as the crypto market suffers a 2% loss today.

Solana Leads Market Recovery After Brief Dip Below $100Apr 15, 2025 am 11:10 AM

Solana Leads Market Recovery After Brief Dip Below $100Apr 15, 2025 am 11:10 AMJimmy has nearly 10 years of experience as a journalist and writer in the blockchain industry. He has worked with well-known publications such as Bitcoin Magazine, CCN, and Blockonomi, covering news...

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

SublimeText3 Chinese version

Chinese version, very easy to use

MantisBT

Mantis is an easy-to-deploy web-based defect tracking tool designed to aid in product defect tracking. It requires PHP, MySQL and a web server. Check out our demo and hosting services.

PhpStorm Mac version

The latest (2018.2.1) professional PHP integrated development tool

WebStorm Mac version

Useful JavaScript development tools

ZendStudio 13.5.1 Mac

Powerful PHP integrated development environment