Ethereum loan liquidations hit highest level since Terra crash! Aave and Compound both have high liquidations

- WBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBforward

- 2024-04-15 15:40:161106browse

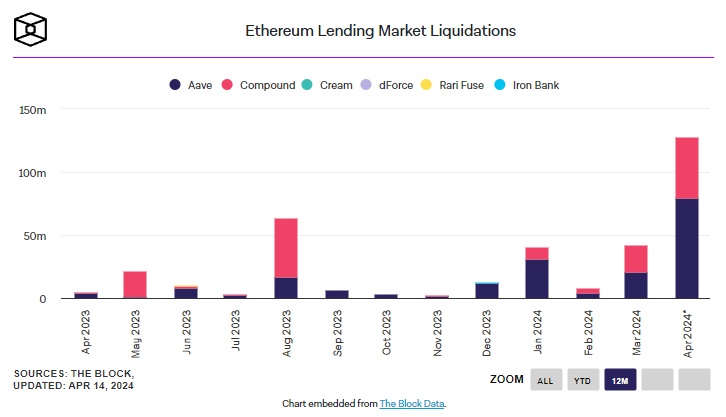

This April, the Ethereum lending market began a wave of liquidations that exceeded any monthly record since the tumultuous events of June 2022.

The highest number of liquidations since Terra collapsed!

The Block data shows that lending protocols Aave and Compound are at the center of this wave, with nearly $80 million and $50 million in liquidations respectively. The total liquidation volume is the highest since the collapse of the $40 billion Terra ecosystem in June 2022.

#The founder of Curve is in a liquidation crisis again

The crypto market has experienced a correction recently, and the health of lending users on each chain has also been put into crisis as a result, and the founder of Curve Michael Egorov is also on the list. On-chain analyst Ember discovered that Egorov’s lending positions worth more than $90 million are once again on the verge of liquidation, with some positions having a health score as low as 1.1.

Wide impact on the market

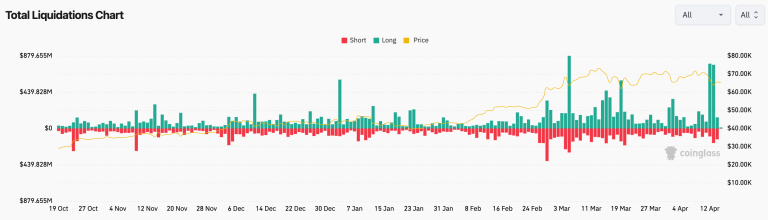

The impact of this wave of liquidations extends beyond lenders to many traders. CoinGlass data shows that crypto liquidations have reached nearly $1.7 billion in the past three days alone, mainly affecting optimistic or bullish traders.

The above is the detailed content of Ethereum loan liquidations hit highest level since Terra crash! Aave and Compound both have high liquidations. For more information, please follow other related articles on the PHP Chinese website!