web3.0

web3.0 Do you need OTC to raise money to repay the loan? Curve founder CRV liquidation crisis reappears, lending health rate as low as 1.1

Do you need OTC to raise money to repay the loan? Curve founder CRV liquidation crisis reappears, lending health rate as low as 1.1

This site (120btC.coM): Seeing the recent correction in the crypto market, the health of lending users on various chains has also been put into crisis, and Curve founder Michael Egorov is also on the list . On-chain analyst Ember discovered that Egorov’s lending positions worth more than $90 million are once again on the verge of liquidation, with some positions having a health score as low as 1.1.

CRV liquidation crisis reappears?

As the price of Bitcoin once fell to US$60,000, various alternative coins also experienced a decline of 10% to 30% in two days; among them, Curve (CRV) fell as much as 39% in three days. At the time of writing, the decline narrowed to about 26%.

Ember tweeted that due to the sharp drop in CRV price, Curve founder Michael Egorov’s lending position has once again entered a dangerous state: As the CRV price reached $0.42, Egorov’s lending on multiple platforms The health rate has dropped to a dangerous level of about 1.1.

According to his statistics, Egorov mortgaged a total of 371 million CRV through 5 addresses on 6 lending platforms, and lent a total of US$92.54 million in stable coins.

At a Glance Michael Egorov’s Loan Status

Chain News compiled Michael Egorov’s loan status on various protocols. Even after Ember’s tweet, Egorov did replenish collateral or repay the loan. to avoid liquidation.

However, there are still 3 platforms with loan health scores lower than 1.2, which are quite dangerous in the current extremely volatile market; once they face a drop of about 20% again, they may incur value losses. Massive liquidation of tens of millions of dollars.

Ember expressed concern about this, emphasizing that Egorov will need to make a choice: if it is not to sell CRV through OTC to repay the loan as before; or to stabilize the previously lent currency, partially transferred back to repay the loan.

And added, "Or don't take action for the time being, betting that the market will not continue to fall."

Reviewing the previous liquidation crisis, Egorov OTC raising money

In August last year, Curve Finance was attacked by a vulnerability. In addition to losing more than 70 million U.S. dollars, its token $CRV also fell 24% in two days, which almost caused Michael Egorov's positions in various lending protocols to be liquidated continuously, causing ripples to the entire DeFi ecosystem. serious crisis.

At that time, Egorov had a total debt of up to 110 million US dollars, with more than 427.5 million CRV mortgaged, accounting for nearly half of the circulating supply.

It was not until the following days that Egorov sought out 33 institutional and individual investors and sold a large number of CRV tokens over the counter OTC to pay off its own debts, and the financial situation gradually returned to health.

The above is the detailed content of Do you need OTC to raise money to repay the loan? Curve founder CRV liquidation crisis reappears, lending health rate as low as 1.1. For more information, please follow other related articles on the PHP Chinese website!

什么是OCO订单?Apr 25, 2023 am 11:26 AM

什么是OCO订单?Apr 25, 2023 am 11:26 AM二选一订单(OneCancelstheOther,简称OCO)可让您同时下达两个订单。它结合了限价单和限价止损单,但只能执行其中一个。换句话说,只要其中的限价单被部分或全部成交、止盈止损单被触发,另一个订单将自动取消。请注意,取消其中一个订单也会同时取消另一个订单。在币安交易平台进行交易时,您可以将二选一订单作为交易自动化的基本形式。这个功能可让您选择同时下达两个限价单,从而有助于止盈和最大程度减少潜在损失。如何使用二选一订单?登录您的币安帐户之后,请前往基本交易界面,找到下图所示的交易区域。点

聊一聊AI有哪四种类型Apr 09, 2023 pm 11:31 PM

聊一聊AI有哪四种类型Apr 09, 2023 pm 11:31 PM随着人工智能成为一种趋势,人们对它如何工作以及可以做什么存在很多问题。一个经常被问到的问题就是——AI有哪四种类型。下面小编就来为大家解答一下。AI有哪四种类型反应性机器反应性机器在AI中是一个非常受欢迎的概念。这是因为它是最基本也是最古老的AI类型。反应性机器是指仅对某些刺激和场景有反应性的机器。与之后的许多人工智能软件不同的是,它们不能利用以前的经验或负载的知识来评估和应对特定的情况。甚至不使用GPS或数字地图来导航周围的环境或绘制路线。相反,它们会根据所看到的东西移动。反应型机器擅长象棋和

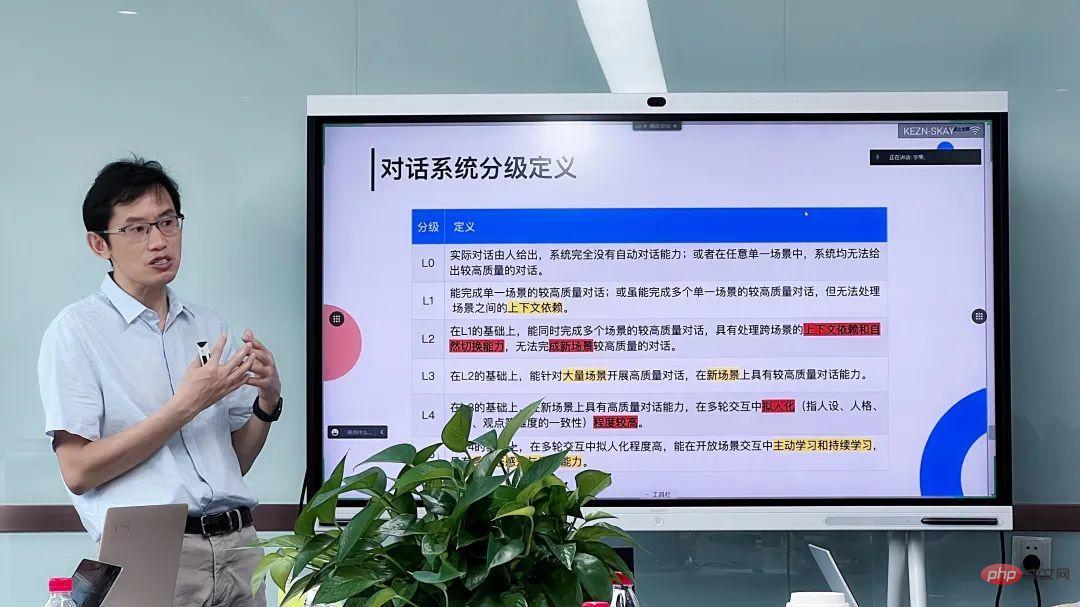

对话清华黄民烈:借用自动驾驶分级定义AI对话系统,元宇宙虚拟伴侣或位于L5Apr 12, 2023 pm 11:34 PM

对话清华黄民烈:借用自动驾驶分级定义AI对话系统,元宇宙虚拟伴侣或位于L5Apr 12, 2023 pm 11:34 PM本文转自雷锋网,如需转载请至雷锋网官网申请授权。“我很庆幸能陪在你身边,通过你的目光看世界(I'm so happy I get to be next to you and look at the world through your eyes.)。"这是影片《Her》中的一句台词,由AI语音助手Samantha对男主角说出。这句话对于迷失在钢铁森林中,感到失落而无力的男主角来说是莫大的安慰。Samantha是一款几乎万能的自我学习型操作系统。她能帮助男主角筛选出最优秀的信件,发给他喜

人工智能新兴岗位走热,虚拟人、数字员工前景看好Apr 09, 2023 pm 12:11 PM

人工智能新兴岗位走热,虚拟人、数字员工前景看好Apr 09, 2023 pm 12:11 PM随着人工智能迅猛发展及人口红利消失,大批新兴岗位如雨后春笋般涌现,机器人、虚拟人、数字员工在各种场景中频繁亮相上岗,引发了广泛关注。机器人大家都比较熟悉,接受度普遍较高。那么,虚拟人和数字员工又是什么样的职业?就业前景如何呢?下面跟随小编一探究竟吧!数字时代的职场,人类不仅要和自己的“同类”打交道,还要具备和“异类”——虚拟人、数字员工协作共事的认知和技能,适应和迎接“混合型”人机团队的新型工作方式已成为一种趋势。虚拟人去年,“元宇宙”的概念大火,带火了虚拟人。AYAYI、艾灵、华智冰、小诤、

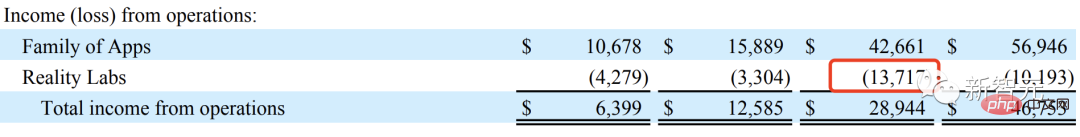

Meta推出4年硬件路线图,致力于打造「圣杯」AR眼镜,烧了137亿美元Apr 24, 2023 pm 11:04 PM

Meta推出4年硬件路线图,致力于打造「圣杯」AR眼镜,烧了137亿美元Apr 24, 2023 pm 11:04 PM现在,谁还提元宇宙?2022年,Meta实验室RealityLabs在AR/VR的研发投入已经亏损了137亿美元。比去年(近102亿美元)还要多,简直让人瞠目结舌。也看,生成式AI大爆发,一波ChatGPT狂热潮,让Meta内部重心也有所倾斜。就在前段时间,在公司的季度财报电话会议上,提及「元宇宙」的次数只有7次,而「AI」有23次。做着几乎赔本的买卖,元宇宙就这样凉凉了吗?NoNoNo!Meta近日公布了未来四年VR/AR硬件技术路线图。2025年,发布首款带有显示屏的智能眼镜,以及控制眼镜的

人工智能将如何影响元宇宙Apr 12, 2023 pm 07:16 PM

人工智能将如何影响元宇宙Apr 12, 2023 pm 07:16 PM不久以前,你只能在科幻小说中找到人工智能,但现在,它是一个非常标准的技术工具,变得越来越重要。那么,人工智能到底是什么,它如何影响互联网,它将如何帮助改变web3和元宇宙的世界?什么是人工智能?人工智能,简称AI,基本上是计算机系统对人类智能的模拟。人工智能通常会模仿与人类技能相关的任务,比如那些需要逻辑或推理的任务。在这个阶段,大多数AI都是作为一个算法或几个算法一起工作形成一个AI系统。人工智能系统通常通过分析大量数据,找到模式,然后使用这些模式预测未来的事件来工作。例如,语音识别、计算机视

Unity大中华区平台技术总监杨栋:开启元宇宙的数字人之旅Apr 08, 2023 pm 06:11 PM

Unity大中华区平台技术总监杨栋:开启元宇宙的数字人之旅Apr 08, 2023 pm 06:11 PM作为构建元宇宙内容的基石,数字人是最早可落地且可持续发展的元宇宙细分成熟场景,目前,虚拟偶像、电商带货、电视主持、虚拟主播等商业应用已被大众认可。在元宇宙世界中,最核心的内容之一非数字人莫属,因为数字人不光是真实世界人类在元宇宙中的“化身”,也是我们在元宇宙中进行各种交互的重要载具之一。众所周知,创建和渲染逼真的数字人类角色是计算机图形学中最困难的问题之一。近日,在由51CTO主办的MetaCon元宇宙技术大会《游戏与AI交互》分会场中,Unity大中华区平台技术总监杨栋通过一系列的Demo演示

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

SublimeText3 Chinese version

Chinese version, very easy to use

WebStorm Mac version

Useful JavaScript development tools

Zend Studio 13.0.1

Powerful PHP integrated development environment

SublimeText3 Linux new version

SublimeText3 Linux latest version

Safe Exam Browser

Safe Exam Browser is a secure browser environment for taking online exams securely. This software turns any computer into a secure workstation. It controls access to any utility and prevents students from using unauthorized resources.