Will the crypto bubble burst? JP Morgan: Web3 market venture capital investment is weak, not even as good as last year

- 王林forward

- 2024-04-13 08:01:261306browse

This site (120bTC.coM): JP Morgan analysts, led by Nikolaos Panigirtzoglou, issued a research report on Thursday stating that despite the recent recovery in the cryptocurrency market, inflows this year will The relative lack of enthusiasm for venture capital funding in the cryptocurrency industry poses downside risks to the cryptocurrency market: Our various measures of cryptocurrency venture capital flows look quite weak so far this year compared to previous years. We have previously argued that a resurgence in crypto VC inflows is necessary for a sustainable recovery in the cryptocurrency market, so weak VC inflows so far this year pose potential downside risks in our view.

VC funding is slowly recovering

The Block Pro data shows that the cryptocurrency industry attracted US$3.2 billion in venture capital this year, compared with more than US$4 billion in the same period last year.

JPMorgan analysts pointed out that although the financing momentum of venture capital companies in the cryptocurrency field has picked up so far this year, it still lags behind previous years. However, he also added: As the currency market rebounds this year, more and more venture capital companies are raising or have raised new funds. Earlier this month, 1kx raised $75 million to establish a new fund to support early-stage cryptocurrency startups.

Paradigm also reported this month that it is raising US$750 million to US$850 million for a new fund. Galaxy Digital, Hack VC and Hivemind Capital have also raised US$100 million, US$100 million and US$50 million respectively for their new funds. .

Cryptocurrency incubator Alliance has completed the first fundraising of its third fund in February, raising $10 million from Brevan Howard Digital and Galaxy Digital respectively, and plans to raise another $80 million by July Dollar.

There are various signs that venture capital funds seem to be beginning to slowly recover. In addition, JPMorgan Chase also pointed out that cryptocurrency hedge funds have been more active this year, and their assets under management have increased significantly in the past six months, estimated to be approximately 20 billion Dollar.

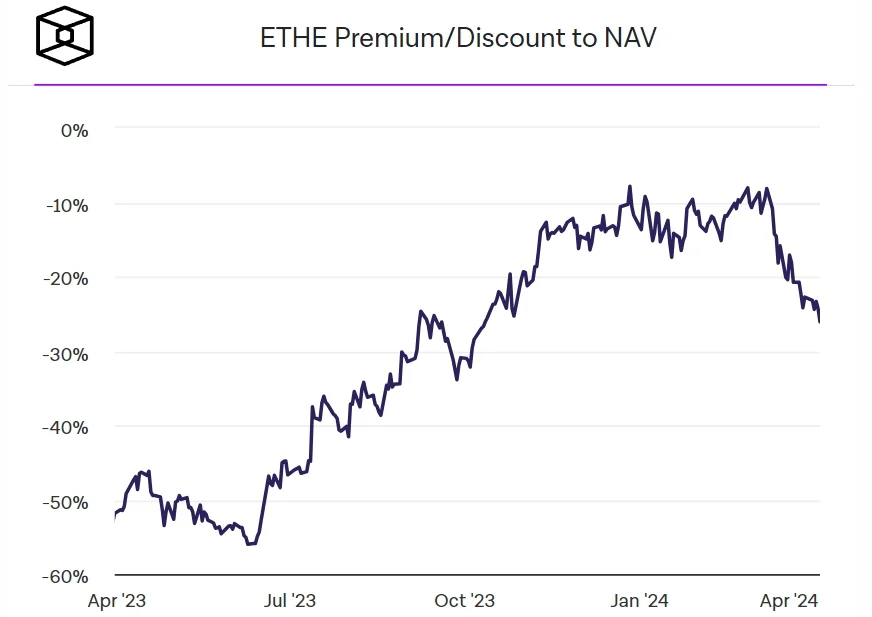

Ethereum spot ETF will eventually be approved

In addition, JP Morgan analysts also reiterated in a report on Thursday that the U.S. Securities and Exchange Commission (SEC) approved the listing of the Ethereum spot ETF in May Although the probability is not more than 50%: After the SEC’s investigation into the Ethereum Foundation, the market’s optimism about the approval of the Ethereum spot ETF before May 23 seems to have gradually faded in pricing, which can be seen from the Grayscale Ethereum Trust The discount to the net asset value of the fund (ETHE) shows that the discount has expanded from 8% to 22% in the past month.

But in general, analysts believe that the SEC will eventually approve such ETFs.

Grayscale Ethereum Trust Fund (ETHE) negative premium expands

The above is the detailed content of Will the crypto bubble burst? JP Morgan: Web3 market venture capital investment is weak, not even as good as last year. For more information, please follow other related articles on the PHP Chinese website!

Related articles

See more- How to roll back an operation in git

- The importance and role of PHP encryption technology in network security

- Learn how to buy cryptocurrencies with TP wallet from scratch

- Solana's founder says it has the potential to become an Ethereum Layer 2-compatible platform after a sharding upgrade

- What does Dencun's upgrade mean? How does the Cancun upgrade affect Ethereum and Layer 2?