GBTC net outflow hits record low! Bitcoin rebounds to $71,000

- 王林forward

- 2024-04-11 19:30:28846browse

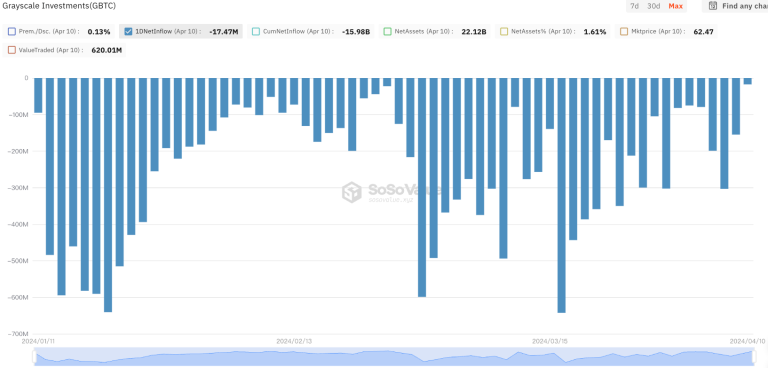

SoSoValue data shows that the Bitcoin spot ETF ended two consecutive days of net outflows, with a total net inflow of US$123 million on April 10.

Earlier, Grayscale CEO also said that he believed that the outflow of GBTC has reached a certain balance.

Among them, GBTC only outflowed -17.5 million U.S. dollars, setting a new low since its launch. The lowest net outflows of GBTC among the top three are as follows:

4/10: -17.5 million U.S. dollars

2/26: -USD 22.37 million

2/23: -USD 44.25 million

Bitcoin ETF April 10 data

Bitcoin once stood at 71K

The March consumer price index released on Wednesday was higher than expected. CPI rose 0.4% this month, and the 12-month inflation rate was 3.5%. Economists expected growth of 0.3% and 3.4% from the previous year.

The core CPI also increased by 0.4% month-on-month, 3.8% higher than the same period last year, and the forecast interest rates were 0.3% and 3.7% respectively; Bitcoin once fell to $67,506 on the evening of the 10th, and investors were concerned about the probability of an interest rate cut this year. Expectations also fell.

However, Bitcoin has since risen to a maximum of $71,190.

Hedge fund QCP Capital told CoinDesk: The rebound showed potential demand for Bitcoin, and investors viewed the decline as a buying opportunity. Even in the face of declines, long-term BTC call options still show strong demand, indicating that there is deep structural bullish sentiment in Bitcoin.

The above is the detailed content of GBTC net outflow hits record low! Bitcoin rebounds to $71,000. For more information, please follow other related articles on the PHP Chinese website!

Related articles

See more- What is Taproot and how does it benefit Bitcoin?

- Mercari: Japan's largest second-hand e-commerce begins accepting Bitcoin payments, with active users reaching 22 million

- The number of Bitcoin payment merchants will reach more than 6,300 in 2032, which can be found on BTC Map

- The top ten virtual currency trading platforms in the world. The ranking of the top ten Bitcoin platform apps.

- How to buy and sell Bitcoin? Bitcoin Trading Tutorial