With re-staking back on the horizon, what is the liquidity of LRT themselves?

- WBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBforward

- 2024-04-11 09:01:02934browse

Key Summary:

LRT may integrate with centralized exchanges and introduce market makers to liquidity in these centralized venues Risk/Reward for Sex Providers.

Liquidity The liquidity of the recollateralized tokens is not amazingly good. The overall liquidity is acceptable, but each individual LRT is related to it. The nuances are greater and will only continue to grow as agency strategies differ over the long term.

Except EtherFi, none of these LRT providers have withdrawal functionality enabled.

It is expected that liquidity re-pledge is a winner-take-all market structure, and liquidity will bring more liquidity.

Text:

EigenLayer’s first AVS is officially launched on the mainnet.

Today EigenLabs’ data availability AVS-EigenDA was released on the mainnet, officially marking the beginning of the re-staking era. While the EigenLayer market still has a long way to go, one trend is already very clear: Liquid Re-staking Tokens (LRT) will become the main avenue for re-stakers. Over 73% of all EigenLayer deposits are made through LRT, but how liquid are these assets? This report will delve into the issue and explain the nuances surrounding EigenLayer.

Introduction to EigenLayer and liquid re-staking tokens

EigenLayer uses a token called “re-staking” ”’s new cryptoeconomic tool enables the reuse of ETH on the consensus layer. ETH can be re-staking on EigenLayer in two main ways: through native re-staking of ETH, or using Liquid Staked Tokens (LST). The re-staking ETH is then used to secure other applications known as Active Validation Services (AVS), allowing re-stakers to earn additional staking rewards.

The main complaint from users about staking and re-staking is the opportunity cost of staking ETH. This problem is solved for native ETH staking using Liquid Staked Tokens (LST), which can be thought of as liquid receipt tokens that represent the amount of ETH staked by the user. The LST market on Ethereum is currently approximately $48.65 billion, making it the largest DeFi sector. Today, LST accounts for approximately 44% of all Ethereum staking, and as restaking grows in popularity, we expect the liquid restaking token (LRT) space to follow a similar, if not more aggressive, growth pattern.

Although LRT has some similar characteristics to LST, they are significantly different in mission. The end goal of every LST is essentially the same: stake users’ ETH and provide them with liquid receipt tokens. However, for LRT, the ultimate goal is: delegate staking representation of users to one or more operators, and then support a basket of AVS. Each individual operator can choose how to distribute their delegated staking among these various AVS. Therefore, the operator to which LRT delegates its staking has a large impact on the overall liveness, operational performance, and security of the staking ETH. Finally, they must also ensure proper risk assessment for the unique AVS supported by each operator, as risk reduction may vary depending on the service provided. Note that curtailment risk will be essentially zero in the early stages of most AVS listings, but over time we will slowly see the “training wheels” being removed and the staking market becoming increasingly permissionless.

Editor's note: Training wheels refer to the protective measures provided in the initial stage to avoid or reduce risks. As time goes by and the capabilities of participants improve, these protective measures will be gradually removed, making the system Or markets are more open and free.

However, despite the differences in structural risk, one similarity remains the same: LRT reduces the withdrawal period by providing productive collateral that can be used as DeFi or exchange. Liquid receipt tokens reduce the opportunity cost of re-pledged capital. This last point is especially important because one of the main advantages of LRT is that it circumvents the traditional withdrawal period, which EigenLayer alone has a withdrawal period of 7 days. Taking into account this core principle of LRT, we expect that with the entry barrier to restaking being so low, but the exit barrier being so high, we will naturally see net selling pressure on them, so the liquidity of these LRTs will be that they lifeline.

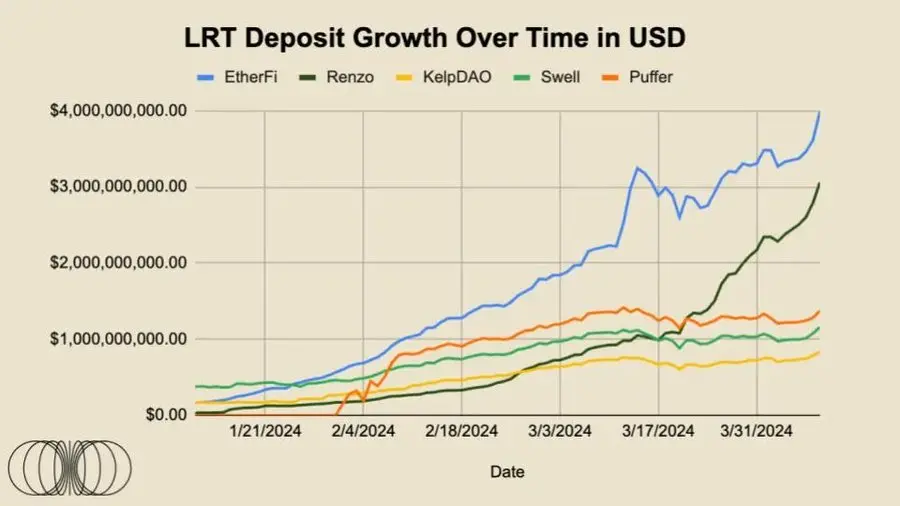

So, as EigenLayer’s total staked value continues to climb, it’s important to understand the drivers behind the protocol’s growth and how these factors will impact inflows/outflows in the coming months. At the time of writing, 73% of EigenLayer deposits are made via liquid restaking tokens. To put this into context, on December 1, 2023, LRT had approximately $71.74 million in deposits. Today, April 9, 2024, they have grown to approximately $10 billion, a staggering growth of over 13,800% in just less than 4 months. However, as LRT continues to dominate EigenLayer’s rehypothecation deposit growth, there are some important factors to consider.

Not all LRTs are composed of the same underlying assets

LRT is good for the long term Staking delegation within AVS will be different, but not much in the short term

The most important thing is the difference in liquidity characteristics between various LRTs Big

Given that liquidity is the most critical advantage of LRT, most of this report will focus on the last point superior.

The speculative nature of Eigen Points has greatly fueled the current bull run in EigenLayer deposits, and we can assume that this will translate into some form of airdrop allocation for potential EIGEN tokens. There are currently no AVS rewards going on, meaning there are no incremental benefits on these LRTs other than natural staking rewards. To drive and sustain a total staked value of over $133.5 billion, the AVS market must naturally find a balance between the incremental returns required by re-stakeholders and the natural price AVS are willing to pay for security.

For LRT depositors, we have seen the huge success of EtherFi in launching the ETHFI governance token airdrop, which is currently valued at approximately $6 billion. Taking all the above factors into consideration, it can be expected that some capital flows may gradually increase after the launch of EIGEN and other expected LRT airdrops.

However, in terms of reasonable returns, users may have a hard time finding higher returns in the Ethereum ecosystem that don’t involve EigenLayer. Several interesting revenue opportunities exist within the Ethereum ecosystem. For example, Ethena is a synthetic stablecoin backed by collateralized ETH, while also having a hedged ETH futures short position. The protocol currently offers an annualized yield of approximately 30% on its sUSDe product. Additionally, as users become more familiar with interoperability and cross-chain bridging, yield chasers may look elsewhere, potentially driving productive capital outflows from Ethereum.

Although it’s a bit complicated, overall we think it’s reasonable to assume that there won’t be any larger incremental staking than this, aside from a potential EIGEN token airdrop to re-stakers. Earnings events, and large, blue-chip AVS that have raised in private markets at high multi-billion dollar valuations may also issue their tokens to re-hypothecaters. Therefore, it can be assumed that after these events some proportion of ETH will flow out of the EigenLayer deposit contract via withdrawals.

Given that there is a seven-day cooling off period for EigenLayer withdrawals, and the vast majority of funds are re-pledged through LRT, the fastest exit route will be to convert from your LRT to ETH . However, liquidity characteristics vary widely among various LRTs, and many LRTs may not be able to conduct large-scale exits at market prices. Additionally, at the time of writing, EtherFi is the only LRT project with withdrawals enabled.

We believe that LRT’s trading price is lower than the price of its underlying asset, which may bring painful arbitrage cycles to the re-pledge protocol. Imagine if an LRT traded on its underlying ETH If 90% of the value is traded, market makers/arbitrageurs may purchase this LRT and continue the redemption process, expecting to make a net profit of approximately 11.1% assuming the price of ETH is hedged. The general rule of supply demand is that LRT is more likely to experience net selling pressure as sellers may avoid the 7-day withdrawal queue. Conversely, users looking to re-stake may deposit their ETH immediately, so buying LRT on the open market will do little good for the ETH they already own.

Incidentally, we anticipate that once multiple AVS come online along with in-protocol rewards and slashing is fully implemented, further choices of whether to exit or continue to re-stake will ultimately depend on passing The incremental income provided by re-staking. We personally believe that many people underestimate the incremental benefits provided by re-staking. However, this is a story for later.

Data Tracking

The data portion of this month’s report begins below and will track the growth, adoption and liquidity status of the top five LRTs , and any noteworthy news we think deserves attention.

LRT Liquidity and Trading Volume

Although staking through LST and LRT has more advantages than traditional staking More key advantages, but if LRT itself is not liquid enough, this usefulness is almost completely destroyed. Liquidity refers to “the efficiency or convenience with which an asset can be converted into cash without affecting its market price.” Issuers of LRT must ensure that there is sufficient liquidity on the chain so that large holders can prepare Good asset value is exchanged for receipt tokens in liquidity pools almost 1:1.

Each LRT in existence has very unique liquidity characteristics. We expect these situations to persist for a number of reasons:

Certain protocols will have early stage investor and user support for their LRT Liquidity

#Incentivize liquidity through subsidies, token issuance, through on-chain bribery systems, or through “points” in anticipation of these events

Some protocols will have more complex and centralized liquidity providers who will keep their LRT close to the peg level with less total USD liquidity

It should be noted that concentrated liquidity can only work within a smaller price range, and any price movement outside the selected range will have a significant impact on the price.

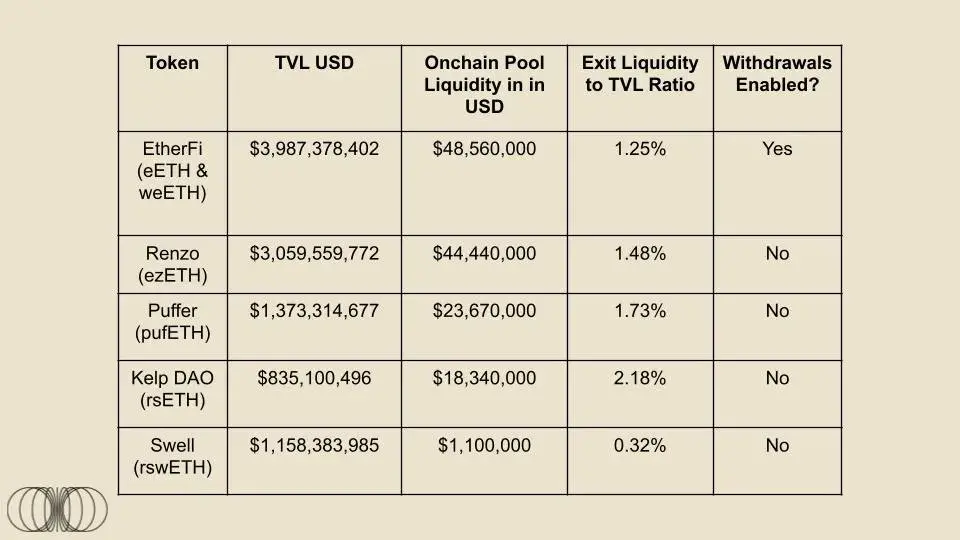

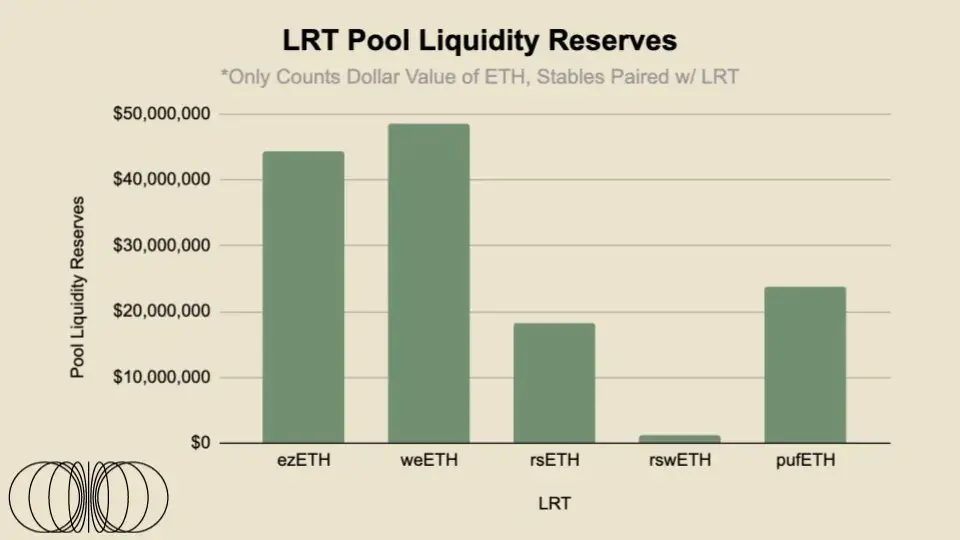

The following is a very simple analysis of the on-chain pool liquidity of the top five largest LRTs on the Ethereum mainnet (Arbitrum). Exit liquidity refers to the cash-like USD value in the LRT liquidity pool.

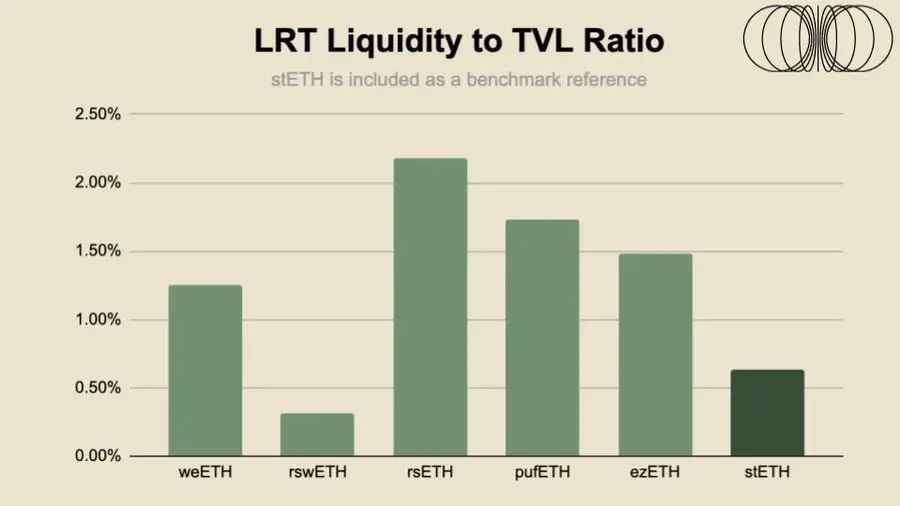

##For the pool liquidity of these five largest LRTs, there is a total of more than $136 million in liquidity available Available for use across Curve, Balancer and Uniswap. However, to get a clearer picture of how liquid each LRT is, we will apply a Liquidity/Market Cap ratio to each asset.

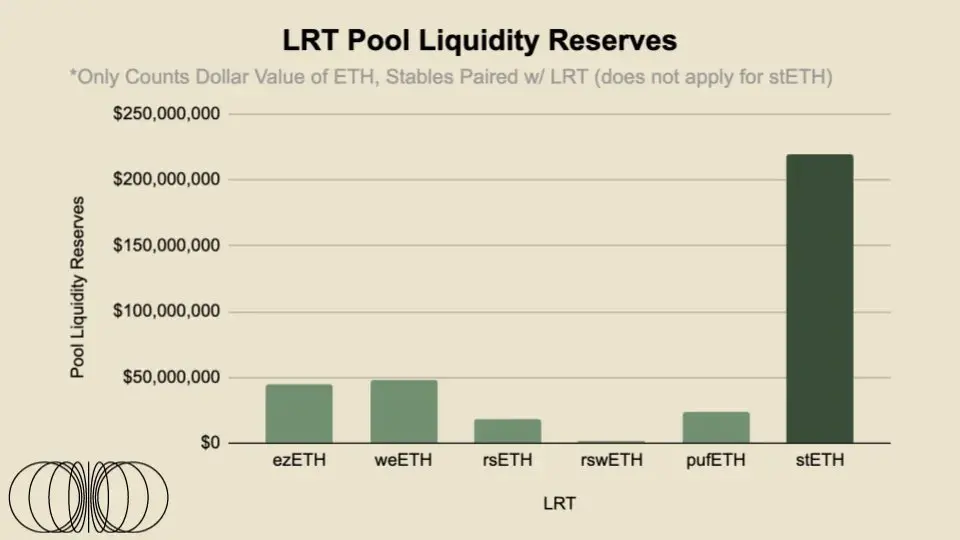

Compared with the top LST - stETH, LRT liquidity ratio is not overly worrying. However, LRT’s liquidity may be more important than LST’s liquidity given the increased risk of re-staking and Eigenlayer’s addition of a seven-day withdrawal period on Ethereum’s unlock queue. Additionally, stETH is traded on several large centralized exchanges, with order books managed by professional HFT firms, meaning there is much more liquidity to stETH than what is seen on-chain. For example, on OKX and Bybit, there is approximately -2% order book liquidity of over $2 million. Therefore, we believe that LRT may also explore this avenue, which is to work with centralized exchanges to integrate and introduce market makers to the risks/rewards of being a liquidity provider in these centralized venues. In next month’s article, we will dive deeper into the allocation of centralized liquidity between stable pool liquidity, x*y=k liquidity, and top LRT trading pairs.

LRT anchor data

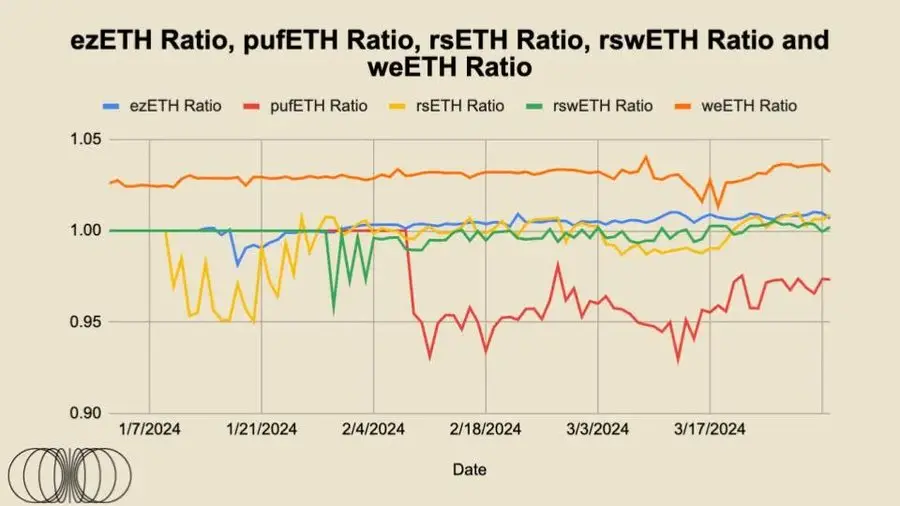

The anchoring of these LRTs is very important because they essentially represent the degree of trust that market participants have in the project as a whole, which is directly determined by the capital invested or the willingness of arbitrageurs to trade these premiums and The discount is determined by maintaining the token's trading "fair value." Note that all of these tokens are non-benchmark tokens, meaning they compound interest automatically and instead trade based on a redemption curve.

It can be seen that for ezETH and weETH, the two most liquid LRTs, their transactions have been relatively stable over a period of time, and most of them are at par with fair value. The reason why EtherFi's ezETH deviates slightly from fair value is mainly due to the launch of its governance token. Opportunistic airdroppers swapped out this token, and naturally other market participants also joined the transaction to exchange it. Discount arbitrage. We may see something similar happen after Renzo launches its governance token.

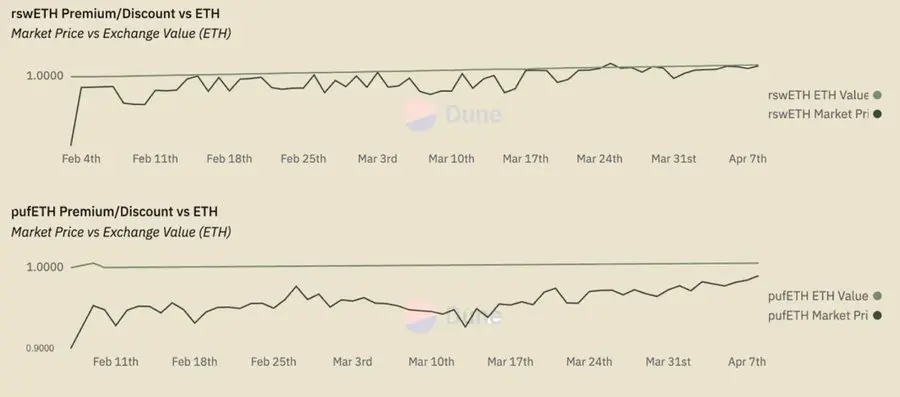

KelpDAO’s rsETH traded at a discount to fair value at launch but has gradually and steadily returned to parity with fair value.

As for rswETH, it has been trading below its fair value for most of the time, however recently it appears to have reached its fair value flat level. Among all these LRTs, pufETH is the major outlier as they only trade at a discount. However, this trend appears to be coming to an end as it moves towards parity with the value of its underlying assets at fair value.

It should be pointed out again that with the exception of EtherFi, none of these LRT providers have withdrawal capabilities enabled. We believe that sufficient liquidity combined with the ability for users to withdraw funds at any time will provide a strong attraction for market participants, which means that a large part of the liquidity needs to be obtained from the entire DeFi ecosystem.

BroaderDeFiLRT in the ecosystem

Once LRT is further integrated into the broader DeFi The importance of the ecosystem, especially the lending market, will increase significantly. For example, taking the current money market as an example, LST (specifically wstETH/stETH) is the largest collateral asset on Aave and Spark, with supply of approximately $4.8 billion and $2.1 billion respectively. As LRT becomes more integrated into the broader DeFi ecosystem, we expect these numbers to eventually exceed the supply of LST, especially as the broader market’s understanding of risk and product structure deepens, and as Over time they become more long-term credible. Additionally, both Compound and Aave have governance measures in place for Renzo’s ezETH.

However, as mentioned before, liquidity will remain the lifeblood of these products to ensure the breadth and depth of their DeFi integration and long-term vitality. We’ve already seen how LST decoupling can trigger a chain of chaos, read more here .

Ending Thoughts

Although stETH got an early advantage and dominated due to its first mover advantage, this report The series of LRT mentioned in were all launched at roughly the same time, and the market momentum is very strong. We expect this to be a winner-takes-all market structure, as the law of power applies to most liquid assets; simply put, liquidity begets liquidity. This is why Binance continues to dominate CEX market share despite all the doubts and turmoil.

In short, Liquidity Rehypothecation token liquidity is not amazing. Liquidity is acceptable, but each individual LRT has greater nuance associated with it, which will only continue to grow as agency strategies vary over the long term. From a mental model perspective, it may be easier for first-time users to think of LRT as a mortgage ETF. Many will compete for the same market share, but allocation strategy and fee structure may be the difference between winners and losers in the long term. Additionally, as products become more differentiated, liquidity will become more important due to the length of withdrawal periods. In the cryptocurrency space, seven days can sometimes feel like a month in normal time because global markets operate 24/7. Finally, as these LRTs begin to consolidate into the loan market, pool liquidity will become even more important as liquidators are only willing to take on acceptable risk due to varying liquidity profiles of the underlying collateral. We believe token incentives may play an important role in this, and we look forward to delving into different token models following possible airdrop campaigns by other LRT providers.

The above is the detailed content of With re-staking back on the horizon, what is the liquidity of LRT themselves?. For more information, please follow other related articles on the PHP Chinese website!

Related articles

See more- Türkiye: Cryptocurrency legislation has entered its final stages! Exchanges must meet regulatory requirements

- The latest official website version of ZB Exchange is the official website of ZB Exchange.

- Bitcoin fell below 68,000, and Ethereum fell below $3,800! DOGE, SHIB flameout

- Bitcoin ETF Issuer VanEck Enters Stablecoin Market, Reveals Must-Know Facts

- Binance eth wallet address