EMC Labs: The first wave of selling in the bull market is coming to an end! Bitcoin's next phase of rally is coming

- 王林forward

- 2024-04-07 19:43:201250browse

EMC Labs issued a March report stating that the bull market is a background of abundant funds, with new participants bringing funds to the scene to snap up chips. As for the market phenomenon that recommends existing holders to sell, for long-term BTC investors, the bull market is a time window for strong selling. The bull market is an opportunity to get on board, but investors also need to stay alert at all times and beware of price fluctuations.

Bull market welcomes first big sell-off

During this week, December 3, 2023 was the highest point ever for long-term holders, when they totaled It holds 14,916,832 BTC. Since then, as the bull market has gradually started, long-term holders have begun a four-year cyclical sell-off. As of March 31, the total sales amount reached 897,543 BTC.

The report pointed out that long-term and short-term investors began to sell on a large scale on February 26, and the period from February 26 to March 12 was the first half of the big sell-off. , Bitcoin was in a buying-dominated period, with the price rising from $51,730.96 to $71,475.93.

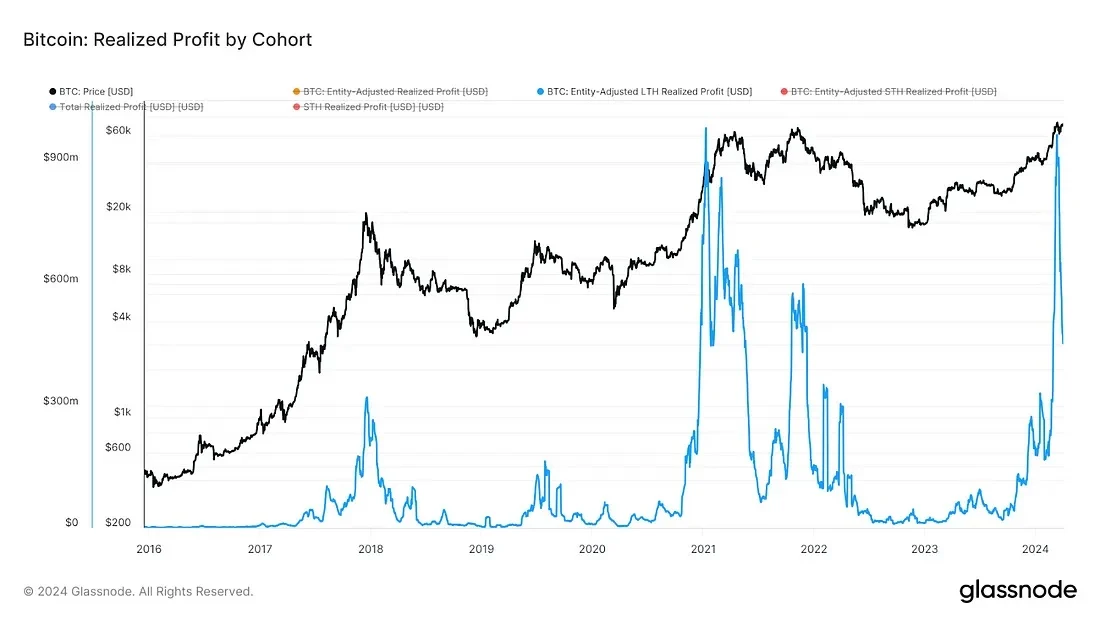

As of the second half of the big sell-off from March 13 to March 31 (not yet over), Bitcoin was in a selling-dominated period, with the price reaching 73709.99 and falling as low as $60771.74 from February 26 to 3 As of March 31, the seller had locked in a total profit of nearly US$63.1 billion.

EMC Labs said that as of the end of March, the scale of selling had dropped significantly, but it was still as high as more than 1 billion US dollars per day, causing the price rebound to fail, and the downward trend returned in April: this kind of sustained and large-scale selling, This was the fundamental reason for the decline in BTC prices from March to April. This was the first round of big sales after entering the bull market. The sellers took control of the pricing power, which dampened the enthusiasm of the bulls and led to the price decline.

The first wave of selling is coming to an end

However, EMC Labs believes that the selling power is declining significantly, and the first wave of big selling in the bull market is coming to an end, close to the period before the halving in April. A wave of large-scale selling cleared away a large number of profit-making chips and raised the cost center of BTC, which will help to increase the price in the next stage.

EMC Labs explains that during the price rise period, whether profit-locking selling will lead to a price drop depends on the balance of the game between the long and short parties. In the early stage of selling, the seller only sells tentatively, and the price It will continue to rise. As sellers continue to increase the scale of sales, ammunition for many armies will eventually be consumed, causing the price to fall.

After the price fell, due to price reasons, the seller began to reduce the scale of selling, and the power of the buyer continued to recover, which in turn pushed the price up again. The two continued to compete in the rise and fall of prices until the next selling range: in During the entire rising period, similar games often occur several times. After multiple sales, most of the chips enter the short-term holder group, and liquidity becomes increasingly abundant. This makes the buyer's power eventually lose in the long-short game, and then The bull market is over.

In the view of EMC Labs, selling is a normal phenomenon during the market rise. Based on the capital inflow of stablecoins and ETF channels and the adoption of application chains, the agency judged that the market outlook will be volatile, but This round of cryptocurrency bull market is unfolding in an orderly manner. For long-term investors, on the basis of caution, they should actively go long.

The above is the detailed content of EMC Labs: The first wave of selling in the bull market is coming to an end! Bitcoin's next phase of rally is coming. For more information, please follow other related articles on the PHP Chinese website!

Related articles

See more- Node.Js generates Bitcoin address (with code)

- Blockchain and Cryptocurrency Technology in Java

- How to confirm if you own Bitcoin? A guide to all things Bitcoin

- Learn how to buy cryptocurrencies with TP wallet from scratch

- South Korean cryptocurrency trading volume surpasses the stock market! Bitcoin kimchi premium exceeds 100 million won