web3.0

web3.0 SOL falls below $170! Will selling FTX at a low price of 66% to institutions crash the market? How long is the lock-up period?

SOL falls below $170! Will selling FTX at a low price of 66% to institutions crash the market? How long is the lock-up period?SOL falls below $170! Will selling FTX at a low price of 66% to institutions crash the market? How long is the lock-up period?

It was reported last weekend that the FTX liquidation team selected Galaxy Asset Management to assist in the sale of the 41 million SOL locked in it. It is reported that Neptune Digital became the first company to publicly announce the acquisition of its SOL, purchasing 26,964 SOL at a price of US$64 each. The price per SOL has reached an all-time high.

If the SOL price was 188 US dollars when the news was exposed, the discount rate of 64 US dollars would be as high as 66%, which means that if you sell it immediately, you can directly make a cash profit of more than 290%. However, in order not to immediately affect the market, the two parties agreed to lock Warehouse agreement.

Note: The U.S. Bankruptcy Court ruled in mid-September last year that the crypto exchange FTX can use Galaxy’s assistance to sell up to $200 million in crypto assets per week, or to pledge or hedge its crypto holdings. currency to repay creditors.

FTX continues to sell SOL, and the currency price falls

And Bloomberg quoted the latest report from people familiar with the matter that nearly two-thirds of the 41 million SOLs have been sold, raising approximately US$1.9 billion for FTX Liquidity, sources revealed that funds participating in and bidding for DSOL include:

Galaxy Trading is one of the funds that raises funds from investors to bid for locked SOL. Investors can pay $64 per coin. Price participation, the fund will charge a 1% management fee, and BitGo is the SOL token custodian.

At the beginning of this month, Pantera also raised funds from investors to establish a fund and purchase locked SOL worth US$250 million. The Pantera plan charges a 0.75% management fee and a 10% performance fee.

However, perhaps affected by the news or dissatisfied with Solana being controlled by institutions, the price of SOL continued to fluctuate lower this week. Last night (5) it fell to a low of $167.84, the lowest in nearly two weeks.

How long is the lock-up time?

As for what many investors are concerned about, when will SOL, which was bought cheaply by institutions, be unlocked?

According to Neptune Digital, which bought 26,964 SOL, 20% of the tokens will be unlocked in March 2025, and the remaining tokens will be unlocked linearly every month until 2028.

In other words, these institutions will not be able to sell the tokens in their hands for nearly a year, and it will take four years to fully unlock them. However, since their entry cost is very low, will they choose to exit at a profit, or will they continue to wait for a higher price to be realized? It remains to be seen.

The above is the detailed content of SOL falls below $170! Will selling FTX at a low price of 66% to institutions crash the market? How long is the lock-up period?. For more information, please follow other related articles on the PHP Chinese website!

Tether CEO Paolo Ardoino Completes Visit to the United States, Meeting with Lawmakers in Washington, D.C. to Discuss Stablecoin RegulationApr 15, 2025 am 11:24 AM

Tether CEO Paolo Ardoino Completes Visit to the United States, Meeting with Lawmakers in Washington, D.C. to Discuss Stablecoin RegulationApr 15, 2025 am 11:24 AMHis visit comes as the U.S. Congress moves closer to introducing legislation regulating stablecoins, which Ardoino believes is necessary for financial inclusion and preserving U.S. dollar dominance.

Why XRP Price May Not 'Go Parabolic' Post-SEC SettlementApr 15, 2025 am 11:22 AM

Why XRP Price May Not 'Go Parabolic' Post-SEC SettlementApr 15, 2025 am 11:22 AMThe XRP price holds still in the $2.10-2.20 range for the past few days, but this is not stopping Ripple's community from continuing to post various content about XRP

Metaplanet Expands Its Bitcoin Treasury Holdings by Another 319 BTCApr 15, 2025 am 11:20 AM

Metaplanet Expands Its Bitcoin Treasury Holdings by Another 319 BTCApr 15, 2025 am 11:20 AMIn an announcement made earlier today, Japanese firm Metaplanet revealed it has acquired another 319 Bitcoin (BTC), pushing its total corporate holdings beyond 4,500 BTC.

Metaplanet Scoops Another 319 Bitcoin, Pushing Its Total Corporate Holdings Beyond 4500Apr 15, 2025 am 11:18 AM

Metaplanet Scoops Another 319 Bitcoin, Pushing Its Total Corporate Holdings Beyond 4500Apr 15, 2025 am 11:18 AMIn an announcement made earlier today, Japanese firm Metaplanet revealed it has acquired another 319 Bitcoin (BTC), pushing its total corporate holdings beyond 4,500 BTC.

Ripple (XRP) price rallied through a weekend riseApr 15, 2025 am 11:16 AM

Ripple (XRP) price rallied through a weekend riseApr 15, 2025 am 11:16 AMRipple (XRP) price rallied through a weekend rise from its $2.00 critical support mark to reach $2.23.

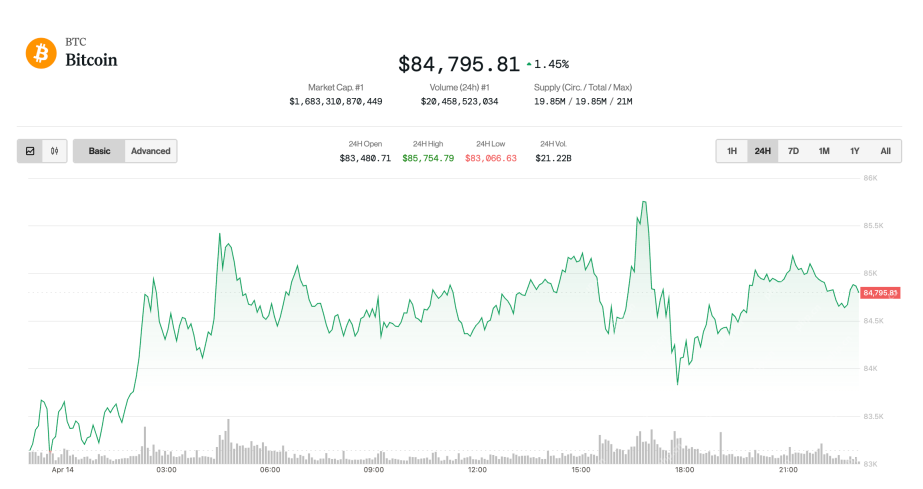

Bitcoin (BTC) drifts upwards as the broader market adjusts favorably to trade-related newsApr 15, 2025 am 11:14 AM

Bitcoin (BTC) drifts upwards as the broader market adjusts favorably to trade-related newsApr 15, 2025 am 11:14 AMThe largest cryptocurrency was up 1.6% in the last 24 hours and is now trading just shy of $85,000. Ether (ETH), meanwhile, rose 2.7%

Is ADA the Sleeper Pick for the Next Bull Run? Hoskinson's $250K BTC Forecast Says YesApr 15, 2025 am 11:12 AM

Is ADA the Sleeper Pick for the Next Bull Run? Hoskinson's $250K BTC Forecast Says YesApr 15, 2025 am 11:12 AMADA has risen by 1.5% in the past 24 hours, with its move to $0.644 coming as the crypto market suffers a 2% loss today.

Solana Leads Market Recovery After Brief Dip Below $100Apr 15, 2025 am 11:10 AM

Solana Leads Market Recovery After Brief Dip Below $100Apr 15, 2025 am 11:10 AMJimmy has nearly 10 years of experience as a journalist and writer in the blockchain industry. He has worked with well-known publications such as Bitcoin Magazine, CCN, and Blockonomi, covering news...

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

SublimeText3 Linux new version

SublimeText3 Linux latest version

SAP NetWeaver Server Adapter for Eclipse

Integrate Eclipse with SAP NetWeaver application server.

VSCode Windows 64-bit Download

A free and powerful IDE editor launched by Microsoft

Dreamweaver Mac version

Visual web development tools

Atom editor mac version download

The most popular open source editor