Ethena Reserve into Bitcoin! It is said that USDe's current scale of 2 billion can be expanded by 2.5 times.

- WBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBforward

- 2024-04-06 09:10:011264browse

This site (120bTC.coM) synthesizes the US dollar stable currency protocol Ethena and issues the US dollar stable currency USDe with its "Delta Neutral" mechanism. The original composition behind this mechanism is based on Ethena. The value of spot ETH and ETH futures short positions are hedged to become a "Delta neutral" stable asset. Today (4th), in view of the unprecedented growth of USDe, with the current market value exceeding US$2 billion, Ethena officially announced that Bitcoin will be included as a reserve asset of USDe to support the further expansion of the scale of USDe.

Reason for inclusion in Bitcoin

Ethena noted that hedging transactions conducted by Ethena have accounted for one-fifth of the value of all Ethereum open interest (OI) currently on the market so far. one. As the size of USDe continues to expand, the existing Ethereum open interest constraints in the market may not be sufficient for Ethena to perform sufficient hedging operations. Therefore, the introduction of Bitcoin as a reserve asset has become a crucial decision. Ethena said that every $25 billion of Bitcoin open interest constraints allows Ethena to perform delta hedging, which allows the potential size of USDe to be expanded by more than 2.5 times.

Over the past year, Bitcoin’s open interest on major exchanges (excluding CME) has surged 150% to $25 billion, while Ethereum’s growth rate has been 100%, unflattering The volume of open positions reached US$10 billion. In this regard, Ethereum stated: The rapid growth of the Bitcoin derivatives market exceeds that of Ethereum, but Delta hedging transactions provide better scalability and liquidity.

In addition, Ethena also mentioned that compared to Ethereum liquidity pledged tokens, Bitcoin has greater advantages in liquidity and term characteristics.

Will Bitcoin’s lack of staking income affect USDe APY?

The original USDe income mainly comes from "Ethereum PoS pledge income" and "funding rate for contract short position holdings". However, since Bitcoin does not have the native staking income like staking ETH, this change may have an impact on USDe's income. However, Ethena pointed out that during the bull market, when the funding rate exceeds 30%, the staking income of 3~4% is actually capped, and the current market conditions are extremely suitable to increase the scale and scalability of USDe.

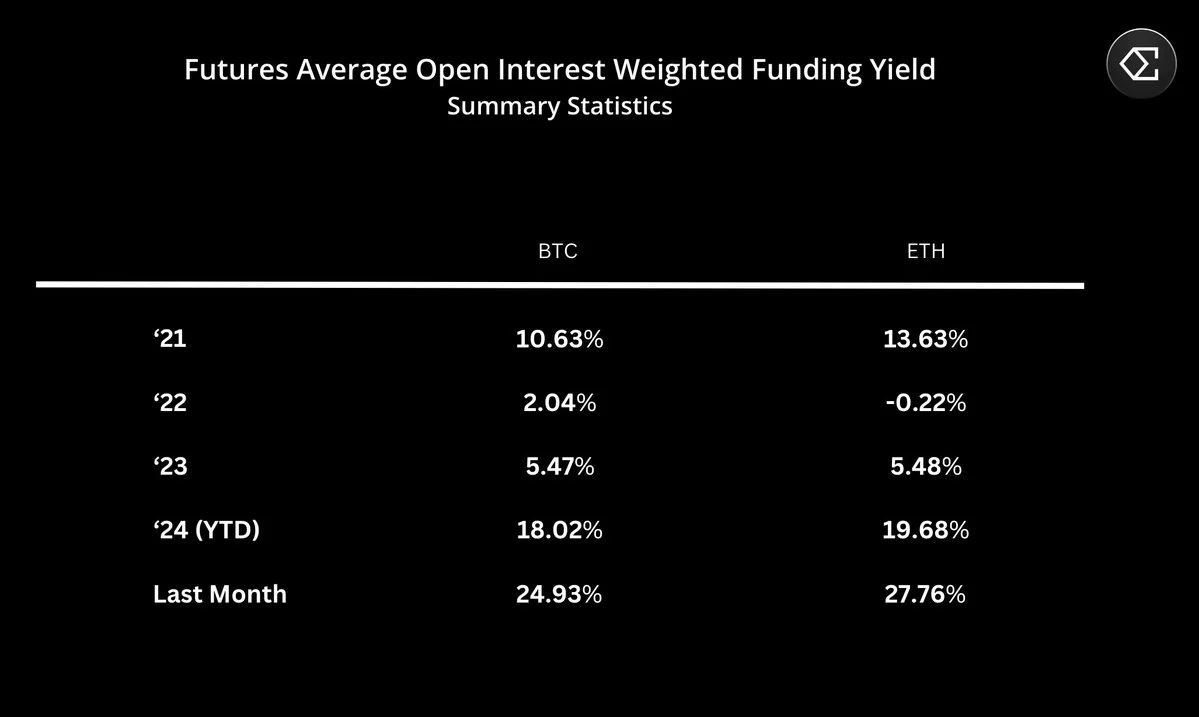

According to Ethena statistics, Bitcoin’s funding rate in 2021 is comparable to Ethereum. But in the bear market of 2022, Bitcoin’s funding rate gains exceeded those of Ethereum, at 2% and 0% respectively. During bull markets, Ethereum’s funding rate often exceeds that of Bitcoin.

Currently, users can view USDe’s mortgage asset portfolio through Ethena’s official website. Although it has not yet been shown that Bitcoin has been included, the mortgage assets already include USD 736 million worth of USDT and USD 870 million in ETH, respectively. Accounting for 38% and 44% of the total value of all USDe mortgage assets.

Bitcoin and Ethereum funding rate comparison table

The above is the detailed content of Ethena Reserve into Bitcoin! It is said that USDe's current scale of 2 billion can be expanded by 2.5 times.. For more information, please follow other related articles on the PHP Chinese website!

Related articles

See more- Ranking of the top ten Bitcoin-friendly countries in the world in 2024

- List of BTC apps that can still be used in China. List of Bitcoin trading apps.

- Domestic formal virtual currency trading platform Top ten formal exchange apps ranking

- How to check the market capitalization of Ethereum?

- Yiou Exchange app official website download Apple