Derivatives veteran 'Cyclonus', can SynFutures ignite the 'Blast Summer' of on-chain derivatives?

- WBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBforward

- 2024-03-29 09:11:01496browse

In less than a month since its launch, the transaction volume has soared over 90 times, and TVL has become the leader of Blast derivatives. It is the three most intuitive tags of SynFutures recently.

The derivatives competition has always been one of the most popular on-chain narratives. As the SynFutures V3 version that was launched simultaneously with the Blast mainnet, it has made rapid progress in less than 4 weeks, with an increase in transaction volume. With a speed ratio of over 9400%, it is the best in the world, far exceeding the established leaders such as dYdX and GMX.

This article analyzes why SynFutures can usher in the attention and influx of market funds, and whether it can open up a new valuation space through the overlapping interaction of "derivatives" and "Blast Summer" in the future, as well as the relationship behind Dip in dividends.

Behind the rise of Synfutures whose daily trading volume surpassed GMX

From a certain perspective, in fact, SynFutures has always been regarded as a "veteran" in the field of DeFi derivatives that has been tested by time and the market:

In early 2021, there was an in-depth discussion on on-chain derivatives in the industry. SynFutures pioneered the permissionless contract market model, allowing anyone to add liquidity through a single currency and list the currency in 30 seconds. It has become widely adopted by many on-chain derivatives. one of the universal standards.

The SynFutures team has a comprehensive background in world-class investment banks, Internet companies and crypto OGs. In addition, they have just completed a new round of financing of US$220 million in October 2023, including many from Pantera Capital, SIG, HashKey Capital and other top investment institutions.

As of June 2021, of the US$140 million in Series A financing, in addition to the participation of leading VC players such as Polychain Capital, Framework Ventures, Bybit, Wintermute, CMS, Kronos and IOSG Ventures, the cumulative financing The amount has exceeded US$38 million. These investment institutions have a unique presence in the field of decentralized finance.

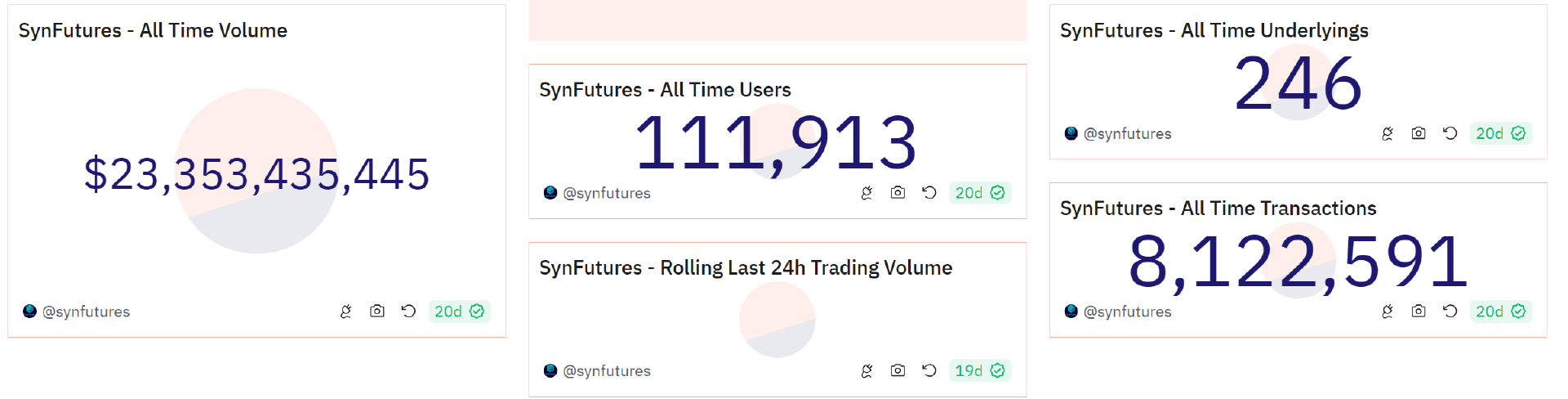

As of March 26, 2024, Dune statistics show that SynFutures has been successfully running for more than 2 years, with more than 110,000 users, and a cumulative transaction volume of more than 23 billion US dollars (V1 V2), with a total number of transactions reaching 8.12 million, and it has been active as the leading decentralized derivatives exchange to this day.

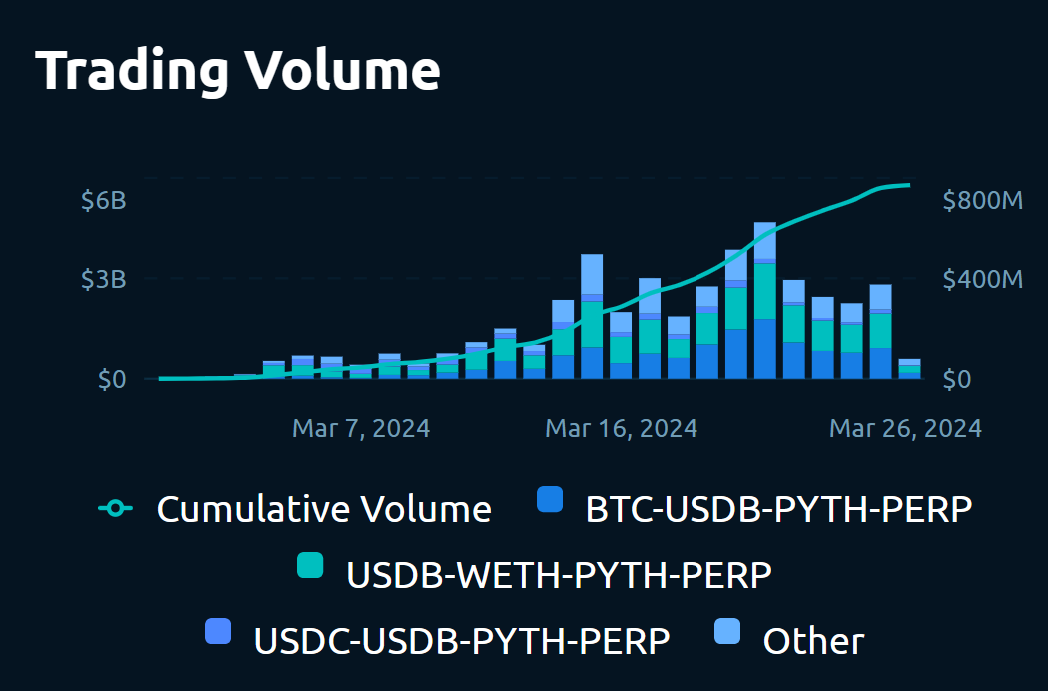

On March 1st, the SynFutures V3 platform was officially launched on the Blast mainnet, and the transaction volume continued to rise. On March 21st, it hit a record high of US$623 million. As of March 26th, only V3 The cumulative transaction volume of this version is close to 5.8 billion US dollars.

In other words, less than a month after its launch on Blast, the cumulative transaction volume of the V3 version has been equivalent to 25% of the total transaction volume of V1 V2 in the past two years or more.

In contrast, we may be able to more intuitively feel how fierce the growth momentum of the Synfutures V3 version is:

As we all know, GMX is the largest Arbitrum ecosystem DeFi protocol is also the on-chain derivatives market with the highest TVL in the entire network (DeFiLlama data), but its daily trading volume is currently lower than Synfutures - as of the time of publication, GMX’s 24-hour trading volume is 270 million US dollars, while Synfutures V3's daily trading volume is approximately $375 million.

Among all on-chain derivatives protocols, Synfutures is also leading the growth rate of the same period by at least an order of magnitude:

- In the 7-day dimension, the leaders dYdX and Hyperliquid grew The growth rates of dYdX and Hyperliquid were -18% and -42% respectively, while Synfutures' growth rate was 67% in the same period;

- On a monthly basis, the growth rates of dYdX and Hyperliquid, which are leaders, were 77% and 91% respectively, while Synfutures' growth rates were over 9,400 in the same period. %;

From this perspective, after the launch of the V3 version on Blast, Synfutures’ growth momentum has been extremely fierce, almost leaving other decentralized derivatives far behind. It seems that it has finally ushered in Your own moment of wind.

Synfutures V3 enters second half with derivatives?

In fact, in the current mature financial market, derivatives trading is higher than spot trading in terms of liquidity, capital volume and transaction scale. The Crypto world has also confirmed this at least in the CEX field. Market rules:

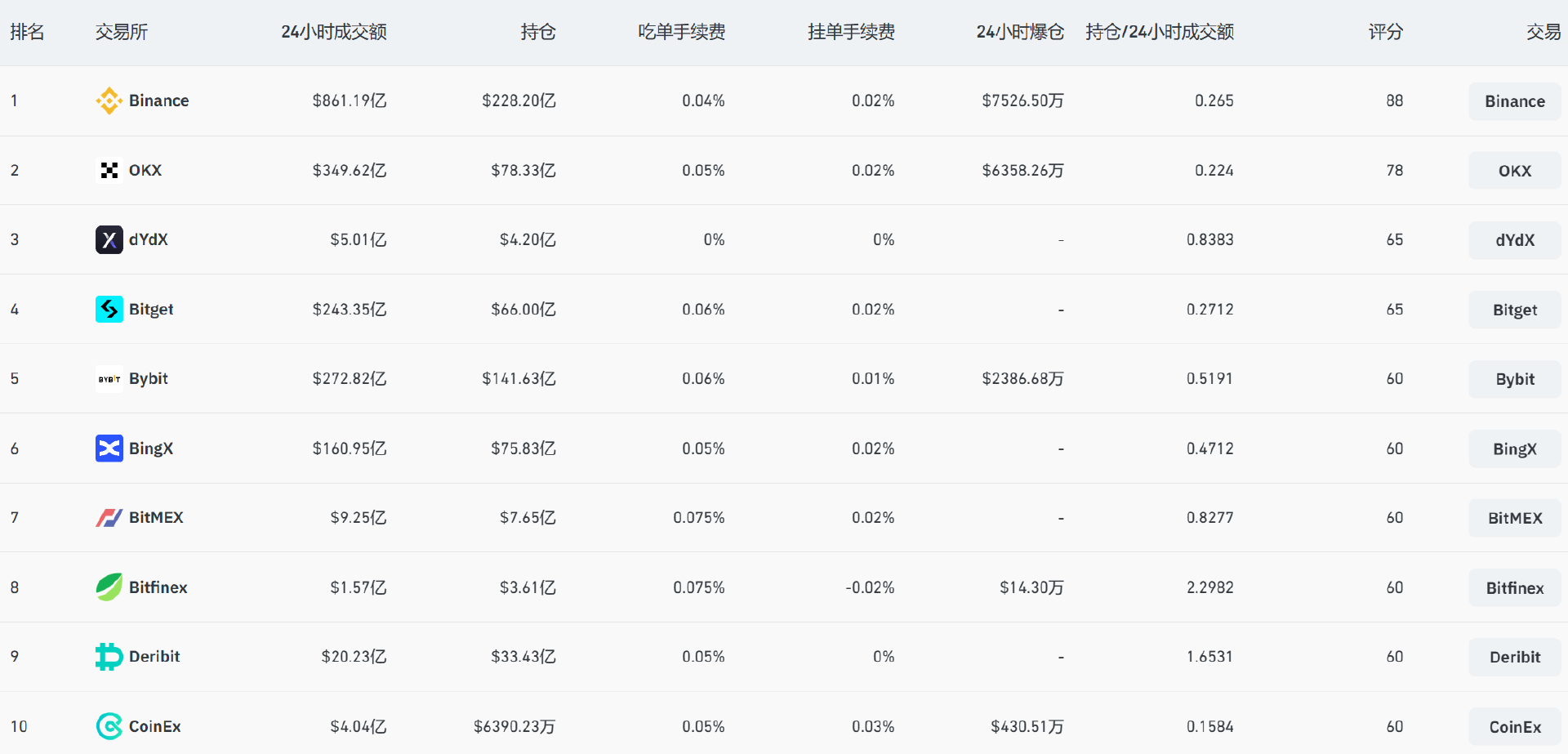

As early as 2020, derivatives trading represented by contract futures on CEX began to replace spot trading and gradually became the dominant market. Coinglass data shows that in the past 24 hours, the daily trading volume of the top five CEX contract futures has reached tens of billions of dollars, and Binance, the leader, has exceeded 80 billion U.S. dollars.

The trading volume of CEX derivatives in one day is equivalent to the trading volume of spot in one week - combined with The Block data, the total daily trading volume of Binance derivatives is equivalent to 2 16% of the total monthly spot trading volume ($506.2 billion).

But on the chain, the spot trading volume of DEX represented by Uniswap still greatly crushes the trading volume of decentralized derivatives trading protocols such as dYdX, even if it is regarded as the "old brand" of on-chain derivatives protocols The leader" GMX and TVL only have less than 750 million US dollars, ranking around 40th among all categories of DeFi protocols in the long term.

In the final analysis, the development of on-chain derivatives protocols such as GMX and dYdX, which have been at the forefront for a long time, is far from keeping up with the changing narrative - DeFiLlama statistics show that as of March 12, 2024, the entire The total scale of DeFi has exceeded US$100 billion, but the total volume of derivatives protocols is less than US$30 billion, accounting for less than 30%.

Therefore, the derivatives market, as the most imaginative narrative of the on-chain DeFi track, is in urgent need of new ideas to break the situation.

For today's Blast ecosystem, SynFutures, with its surge in transaction volume, is the best example. It may have shown that with the performance and cost advantages of L2, coupled with Blast's own traffic effect, derivatives themselves have been greatly affected. Many use cases limited to the Ethereum main chain can be gradually implemented.

Therefore, with the help of the Blast airdrop in the future, the narrative of on-chain derivatives seems to have ushered in a period of development opportunities at the right time. Among them, how to first lay out the possible seeds of this wave of "Blast Summer" Player?

From a product perspective, "old and latecomer" DeFi protocols like SynFutures undoubtedly have the most advantages:

- On the one hand, SynFutures developed Oyster AMM (oAMM) in V3 , which combines the advantages of order books and AMM, can maximize capital efficiency. With the increase in ecological TVL after the Blast airdrop, it is easier to absorb the influx of funds;

- On the other hand, as an established chain On the agreement, SynFutures has not yet issued coins. Users can enjoy derivatives trading services while accumulating potential airdrop opportunities, thereby sharing the possibility of Blast and the on-chain derivatives track to make big dividends in the future;

Going back to the data level, Synfutures' transaction volume to TVL ratio in the past 30 days has reached 12.7, which can be said to be one of the most underestimated projects in the on-chain derivatives track - compared with GMX and dYdX that have issued coins, they are as low as With a ratio of 0.43 and 3.03, he is simply the most cost-effective seed player.

How to use SynFutures to "eat more from one fish" in the Blast ecosystem?

As an ordinary user, what opportunities do you have to realize "eat more from one fish" in the Blast ecosystem through SynFutures and maximize the early dividends of Synfutures (V3) and Blast?

On the day the V3 version was launched as mentioned above, that is, March 1, Synfutures simultaneously launched a triple points event (Blast points, Blast Big Bang championship points, SynFutures O_O points), and the points competition is expected to continue. 3 to 4 months.

What's the meaning? That is to say, users who participate in the interaction of SynFutures V3 at this time can receive triple rewards including Blast points, Blast Gold and SynFutures points at the same time.

It is rumored that the Blast public chain has the highest value is Blast Gold. In the first round of Gold distribution officially announced by Blast last Saturday, SynFutures received the second most Gold incentives in the entire ecosystem, receiving nearly 500,000 in one go. pieces. The market price for Blast Gold is generally US$5-10 per piece. SynFutures announced earlier that 100% of Blast Gold will be awarded to users. For Blast Gold alone, the value of SynFutures' first round of rewards is already between US$2.5 million and US$5 million. On the day this article was written, SynFutures TVL was US$32 million, and the trading volume on that day was US$380 million. The official has announced that 50% of Blast Gold's distribution will be awarded to liquidity providers (makers), and the other 50% will be provided to traders (takers). We will continue to pay attention to the details of the project's allocation of rewards.

The allocation of Blast Gold by SynFutures is closely related to the number of SynFutures O_O points itself. In one sentence: the more SynFutures O_O points, the more Blast Gold.

Interestingly, SynFutures launched the Trading Grand Prix trading competition with a prize pool of US$500,000 on March 12. While the team launched this Blast points competition and trading competition, it also stated that it was studying token issuance. , saying that the points plan will last for 3-4 months, and hinted that there will be plans for currency issuance and airdrops.

The latest news is that the project team will conduct the first contract snapshot on April 9, which may mean Good things related to token airdrops are coming soon, so the window period is constantly shortening, so you still need to participate in the interaction as soon as possible.

Summary

In 2020, we have witnessed the explosive growth of the DeFi world. Among them, the derivatives track (futures, options, synthetic assets, etc.) was once regarded as the most promising to take over DeFi and It is a hot topic in the entire industry, but what is unsatisfactory is that the performance limitations of Ethereum have not brought the expected wind to the derivatives track.

The wheel of time points to the beginning of 2024. The recently activated Dencun upgrade has improved the cost-effectiveness ratio of L2, which makes people vaguely feel that a screw has become loose in the decentralized derivatives track.

Especially as the strongest catfish in the new L2 war, the follow-up Blast will be accompanied by the inflow of funds and the increase in market attention. If it can bring incremental value to the derivatives track, the shared track will do Big bonus, the on-chain derivatives association may really be just one tipping point away from the "Cambrian Explosion".

從這個角度看,作為兼具老牌玩家與新秀龍頭的Synfutures,無論是疊加其勢頭兇猛的衍生品增速,還是HashKey Capital 等一線機構投資背景,都在逐步積蓄勢能,大概率會走出完全不一樣的步伐。

2024 年,無論我們是相信 Blast 生態,還是衍生性商品賽道的想像空間,或許都應該對 Synfures 這樣的種子選手給予足夠的關注。

The above is the detailed content of Derivatives veteran 'Cyclonus', can SynFutures ignite the 'Blast Summer' of on-chain derivatives?. For more information, please follow other related articles on the PHP Chinese website!

Related articles

See more- 2023 Digital Currency Exchange Ranking (List)

- The latest list of the three major domestic digital currency exchanges (steps in the process of buying Bitcoin in one minute)

- Overseas Bitcoin Exchange Bitcoin Exchange Ranking

- How much is Binance's handling fee?

- How to reset Binance exchange password? Binance exchange password reset method