BlackRock tokenization fund BUIDL surpasses $1 billion! The highest proportion of RWA assets deployed on Ethereum

- WBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBforward

- 2024-03-29 08:41:131137browse

It is said that BlackRock announced the launch of its first asset tokenization fund "BlackRock USD Institutional Digital Liquidity Fund" (BUIDL) on the 20th. The assets are 100% invested in cash, U.S. Treasury bonds and repurchase agreements, allowing investors to earn income while holding tokens on the blockchain.

Currently, BUIDL has only been launched for a week, and its market value has reached US$244.8 million, making it the second largest tokenized U.S. Treasury bond fund.

Dune Analytics data shows that BUIDL’s current asset size has only declined after Franklin Templeton launched the “Franklin On Chain US Government Money Fund (FOBXX)” for 11 months. The fund currently holds about $360.2 million in U.S. Treasury securities.

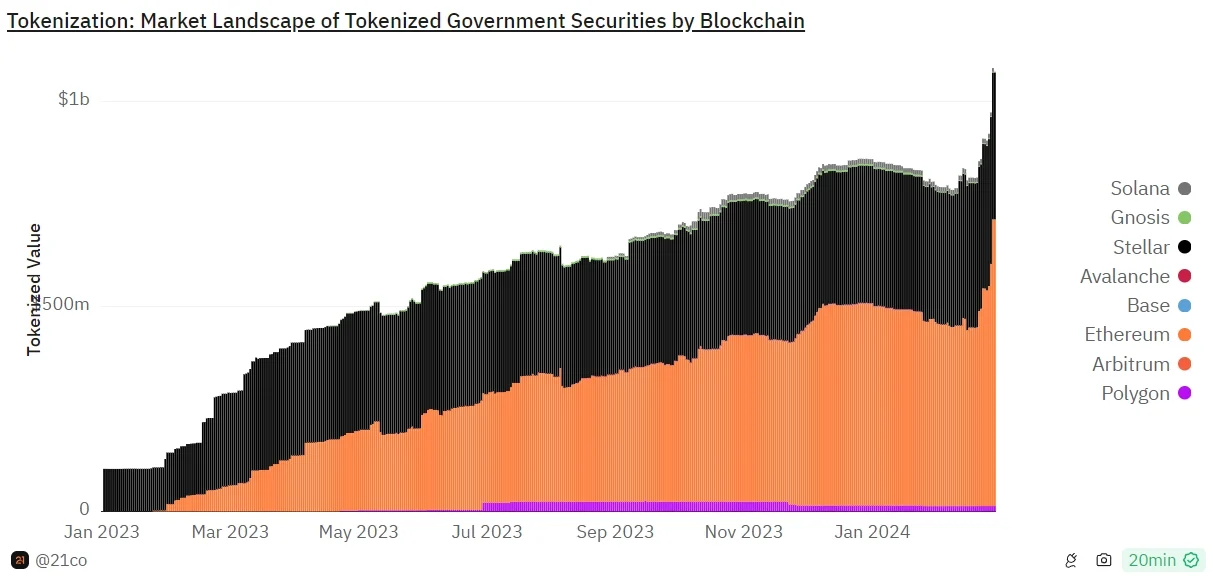

With the support of the launch of BUIDL, currently US$1.08 billion worth of U.S. Treasury bonds have been tokenized through 17 products, setting a milestone record.

$1.08 billion worth of U.S. Treasuries tokenized through 17 products

The latest transaction, which injects $79.3 million into BUIDL, was funded by a real-life Conducted by Ondo Finance, a company that provides world asset tokenization (RWA) services. Ondo Finance currently owns 38% of BUIDL, which is priced 1:1 with the U.S. dollar and pays interest directly to investors every month. The fund is deployed on Ethereum via the Securitize protocol.

Ethereum accounts for the highest proportion

BlackRock CEO Larry Fink recently said that tokenization can improve the efficiency of capital markets. The Boston Consulting Group also predicts that the tokenized asset market will flourish. , its size may surge to $16 trillion by 2030.

Currently, RWA assets deployed on Ethereum reach US$700 million, accounting for the highest proportion

RWA deployed on Stellar and Polygon The asset size is the second and third largest respectively, reaching US$358 million and US$13 million

Franklin Templeton's FOBXX is deployed on Stellar and Polygon.

The highest proportion of RWA assets deployed on Ethereum

The above is the detailed content of BlackRock tokenization fund BUIDL surpasses $1 billion! The highest proportion of RWA assets deployed on Ethereum. For more information, please follow other related articles on the PHP Chinese website!

Related articles

See more- PHP implements content parsing for interaction with Ethereum through JSON-RPC

- What are the application areas of blockchain technology?

- Blockchain Wallet Development Guide in PHP

- Publishers and SEC address Bitcoin spot ETF issues, but Ethereum ETF faces difficulties

- Ethereum price could rise 75% via Bitcoin ETF