Bitcoin ETF resumes net inflows! 10X Research: Next target is $83,000

- 王林forward

- 2024-03-28 14:35:121195browse

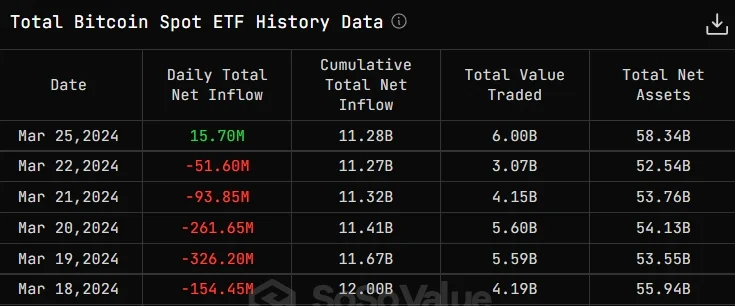

According to SoSoValue data, Bitcoin broke through the $70,000 mark again today. The BTC spot ETF recorded a net inflow of US$15.7 million on the 25th, ending five consecutive days of net outflows last week.

Previously, within the five trading days from the 18th to the 22nd, the net outflow of Bitcoin spot ETFs reached US$887 million.

Changes in net inflows and outflows of Bitcoin spot ETFs

Changes in funds of major Bitcoin ETFs on the 25th

According to the chart data, As of the 25th, Grayscale GBTC had a net outflow of US$350 million, while BlackRock's IBIT showed a net inflow of approximately US$35.5 million. At the same time, Fidelity’s FBTC had a net inflow of approximately US$261.8 million, and Bitwise’s BITB also saw a net inflow of approximately US$14 million.

Changes in Net Inflows and Outflows of Bitcoin Spot ETF

Is the recent decline in BTC due to Genesis liquidation?

Also about the reason for the selling pressure on Bitcoin last week? Coinbase issued a report last Saturday stating that between March 18 and March 21, GBTC had a net outflow of US$1.83 billion, which was the main reason for the huge net outflow of Bitcoin spot ETFs last week, and the selling pressure on GBTC is likely to It was caused by the liquidation of bankrupt crypto lender Genesis.

But despite this, Bloomberg ETF analyst Eric Balchunas pointed out that BlackRock and Fidelity’s Bitcoin spot ETFs have experienced net inflows of funds for 50 consecutive trading days, which is unheard of for new ETFs. of. However, there is still a long way to go before breaking the 160 consecutive days of net capital inflows set by the JPMorgan Equity Premium Income Active ETF.

10X Research is optimistic about breaking through 83,000 US dollars

While the Bitcoin spot ETF returned to net inflows, the analysis agency 10X Research released this week’s market analysis report stating that after two weeks of bearishness, , three reversal indicators show a bullish trend, and Bitcoin is expected to rise sharply this week unless the key support of $68,000 falls below.

10x Reaearch founder Markus Thielen said yesterday that if Bitcoin stands firm at US$68,330, it will technically form a head and shoulders bottom pattern, and Bitcoin will rush directly to the next all-time high target price of US$83,000, or even Passed the $100,000 mark.

The above is the detailed content of Bitcoin ETF resumes net inflows! 10X Research: Next target is $83,000. For more information, please follow other related articles on the PHP Chinese website!

Related articles

See more- Ransomware Bitcoin Worm Solution

- How to confirm if you own Bitcoin? A guide to all things Bitcoin

- Bitcoin price prediction after 2024 halving: Will there be a surge?

- The latest list of the three major domestic digital currency exchanges (steps in the process of buying Bitcoin in one minute)

- How to buy Bitcoin