Crypto Investment Research Monthly Report (2024.02): ETF drives BTC to rise, Meme track is crazy

- PHPzforward

- 2024-03-24 09:21:271202browse

Introduction:

ETF drove and dominated the market in February. The market performance revolved around BTC and ETH, and the occasional sector rotation further promoted the overall rise of tokens. With the UNI proposal, the long-standing DEFI sector has also seen comprehensive growth; the MEME currency sector has begun to show a new round of wealth creation effects; and the BTC Staking ecosystem has also quietly emerged amid the token rise and market carnival.

1. Macro perspective

1.1 The U.S. is expected to cut interest rates in June, and the market attitude is optimistic

The U.S. Department of Labor announced the number of non-farm employment in January There was a significant increase to 353,000, which was the largest monthly increase since January 2023 and significantly exceeded the estimate of 185,000 and the previous value of 216,000. This strong job market performance raised concerns that inflation may rise, which was later confirmed by the year-on-year growth data of the Consumer Price Index (CPI) released on February 13. The CPI increased by 3.1% year-on-year in January. , exceeding market expectations of 2.9%.

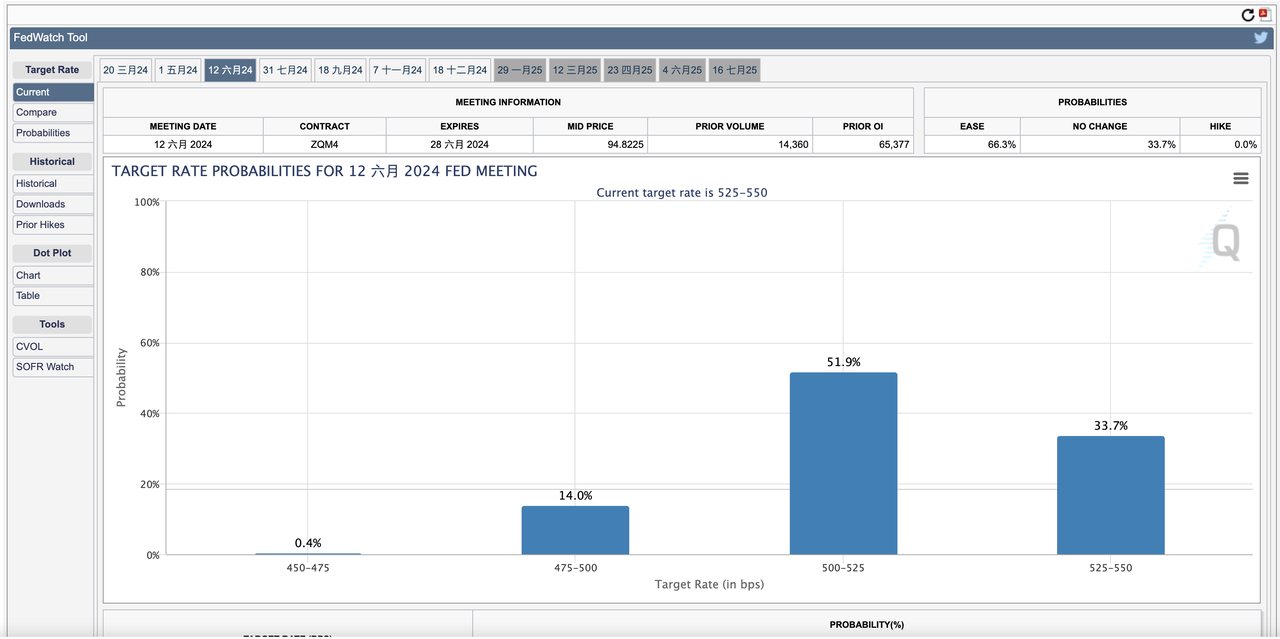

FedWatch

It can be seen from FedWatch data that although there were certain expectations of interest rate cuts before, the latest data and analysis show that the market generally expects that the U.S. Federal Reserve (Fed) may not start until June. Cut interest rates.

Goldman Sachs has also adjusted its forecasts and now expects four interest rate cuts this year instead of the five previously expected, and no longer expects a rate cut in May. This adjustment reflects the market's reassessment of continued U.S. economic growth and inflationary pressures.

Although the U.S. economy is currently facing a certain degree of inflationary pressure, the performance of the stock and crypto asset markets has not been significantly affected. The market remains optimistic about future economic development and monetary policy adjustments, and the U.S. Federal Reserve is generally expected to be able to find an appropriate balance between responding to inflation and promoting economic growth. Under this circumstance, investors generally have optimistic expectations for market trends, believing that the U.S. economy is expected to gradually stabilize and achieve sustained growth. As the market continues to change and policies are adjusted, investors still need to remain cautious and pay close attention to changes in the global economic situation to formulate appropriate investment strategies.

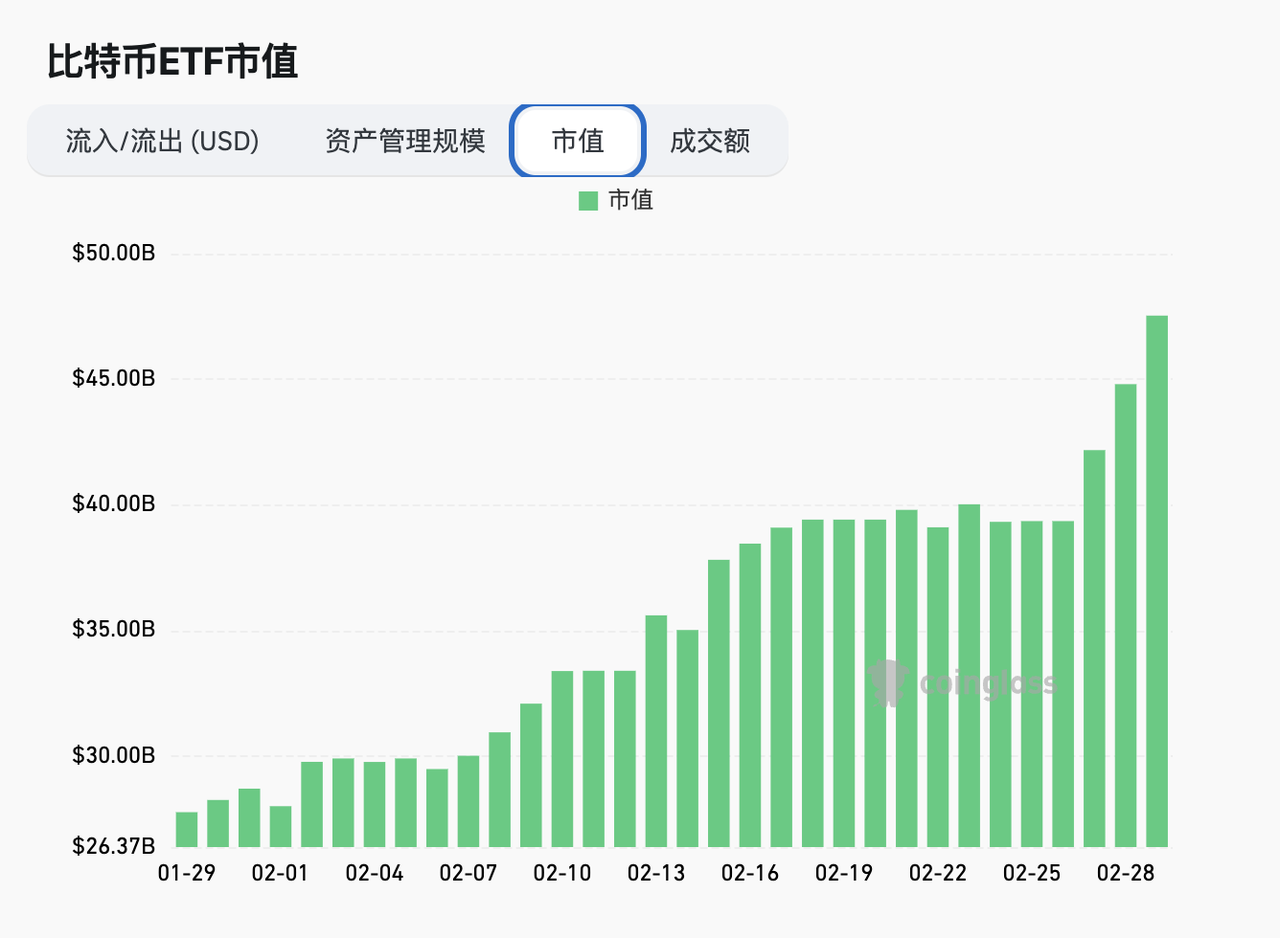

1.2 The rise of BTC is mainly led by ETFs and MicroStrategy

The price of BTC has been rising rapidly, rising continuously from the price of 43,000 US dollars at 0:00 on February 8, to a maximum of around 64,000 US dollars, an increase of 32%.

coinglass比特币ETF总览

From the perspective of ETF inflows, the rising time interval overlaps with ETF capital inflows, and the role of ETFs in promoting the price of Bitcoin is extremely obvious. . As of the 29th, the cumulative management scale of 11 ETFs has reached 42.238 billion U.S. dollars, and the market value of currency holdings accounts for 3.81% of the total market value of Bitcoin. This data exceeds the number of Bitcoins owned by the Binance exchange wallet address.

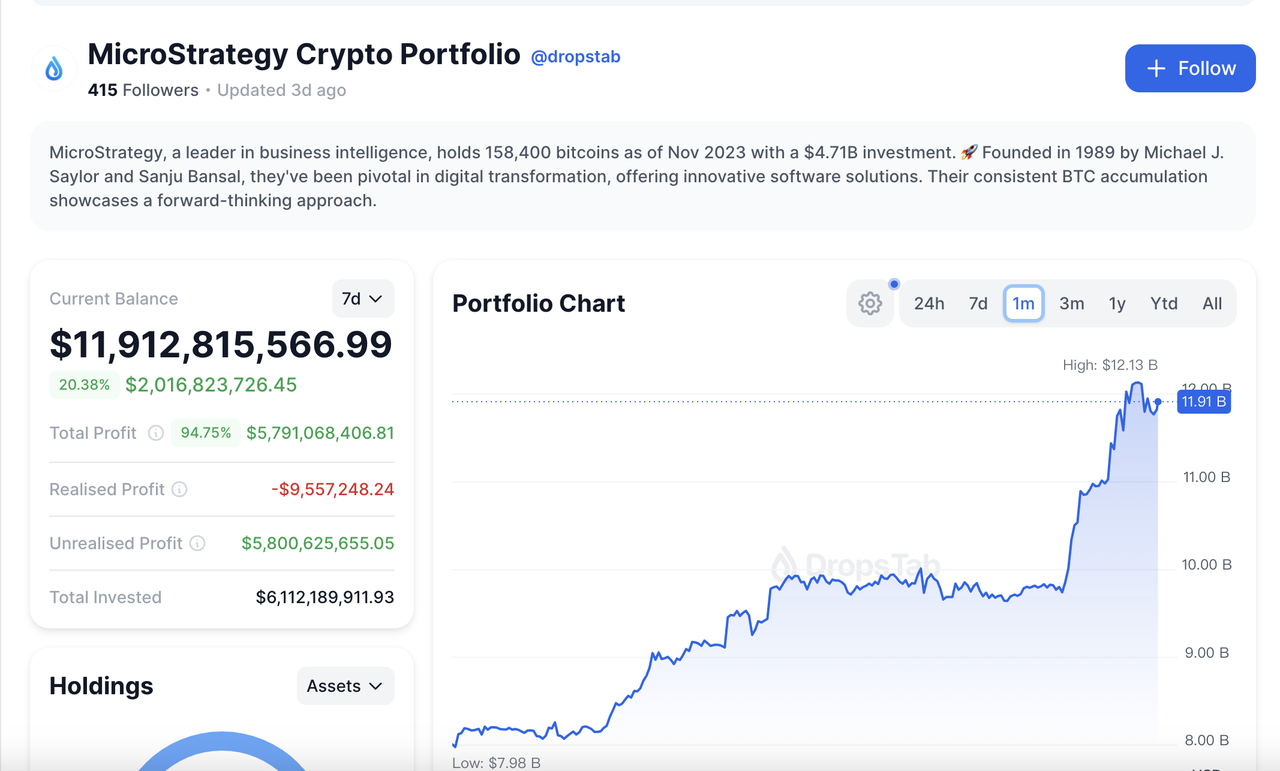

dropstab的MicroStrategy比特币持有市值部位

In addition, MicroStrategy is also a major source of capital inflows in the BTC market. On the 26th, MicroStrategy founder Michael Saylor said on his social platform that MicroStrategy bought 3,000 Bitcoins from February 15 to 25, with an average purchase price of US$51,813. So far, MicroStrategy holds a total of 193,000 Bitcoins, and its asset size has reached a high of 11.9 billion.

1.3 ETH spot ETF becomes the next market focus

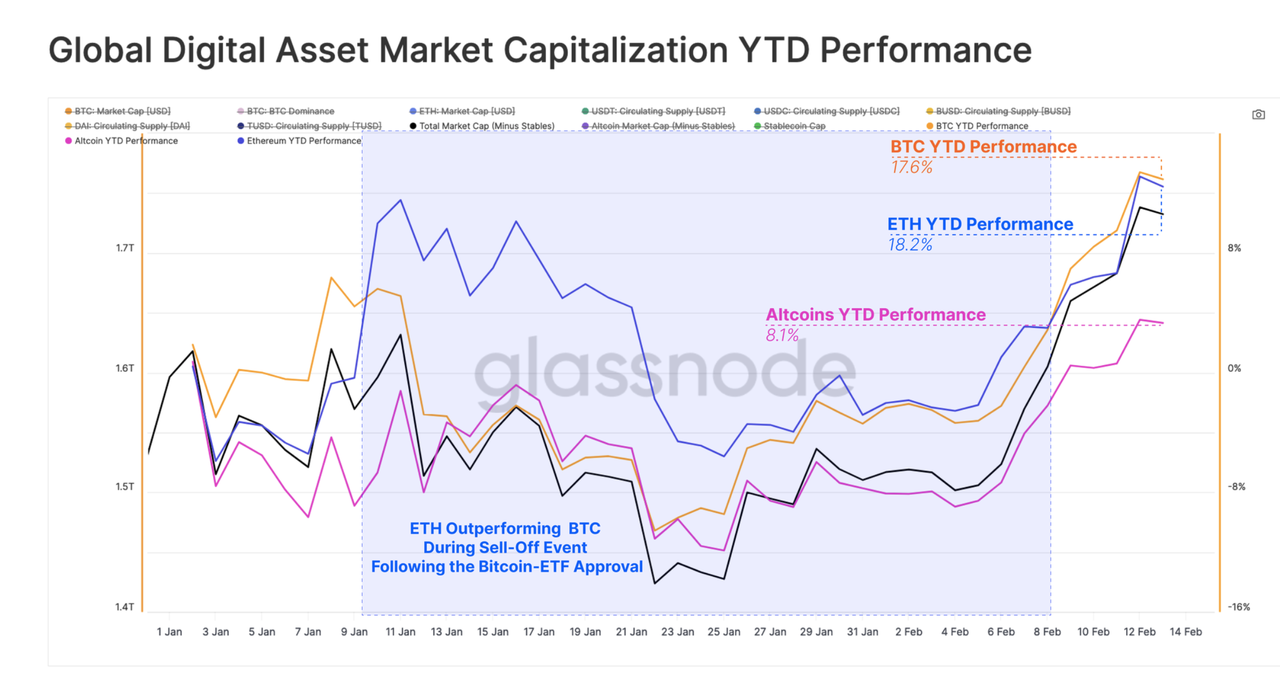

glassnode全球数字资产市场自年初以来(Year-To-Date, YTD)的市值表现

The passage of BTC spot ETF has injected great confidence into the market, so when the ETH spot ETF will be launched has become the current market question One of the focuses, at the same time, the increase of ETH also began to lead beyond BTC, and the market began to shift its focus to ETH. The most important date at the moment is May 23 (the date when the SEC makes its final decision on VanEck’s ETH spot ETF). If the subsequent ETH spot ETF can also be passed, it will represent another great victory for the crypto market and more tradition. Investors can participate in the ETH market through traditional investment tools such as ETFs and introduce new funds into the crypto market.

At the macro level, despite facing the challenge of rising inflation, the market situation in February was not affected at all, and it still reached a new high with the strong promotion of ETF funds. At present, the market is more concerned about the postponement of interest rate cuts, rather than the possibility of continuing to raise interest rates. As the selling pressure of gray-scale investments gradually subsides, we will continue to pay attention to the market capital inflows and observe whether BTC can continue to create new history. .

2. Industry data

2.1 Market value & ranking data

30Days increase of BTC and ETH this month Both are close to 50%, mainly due to the actual fund inflow of ETF and the expected push of ETH ETF. However, for ETH, the hype of its Dencun upgrade on March 13 has not yet seen obvious market reaction. For ETH spot ETF, it has passed As for the time, the current market prediction is that it will be before May 23.

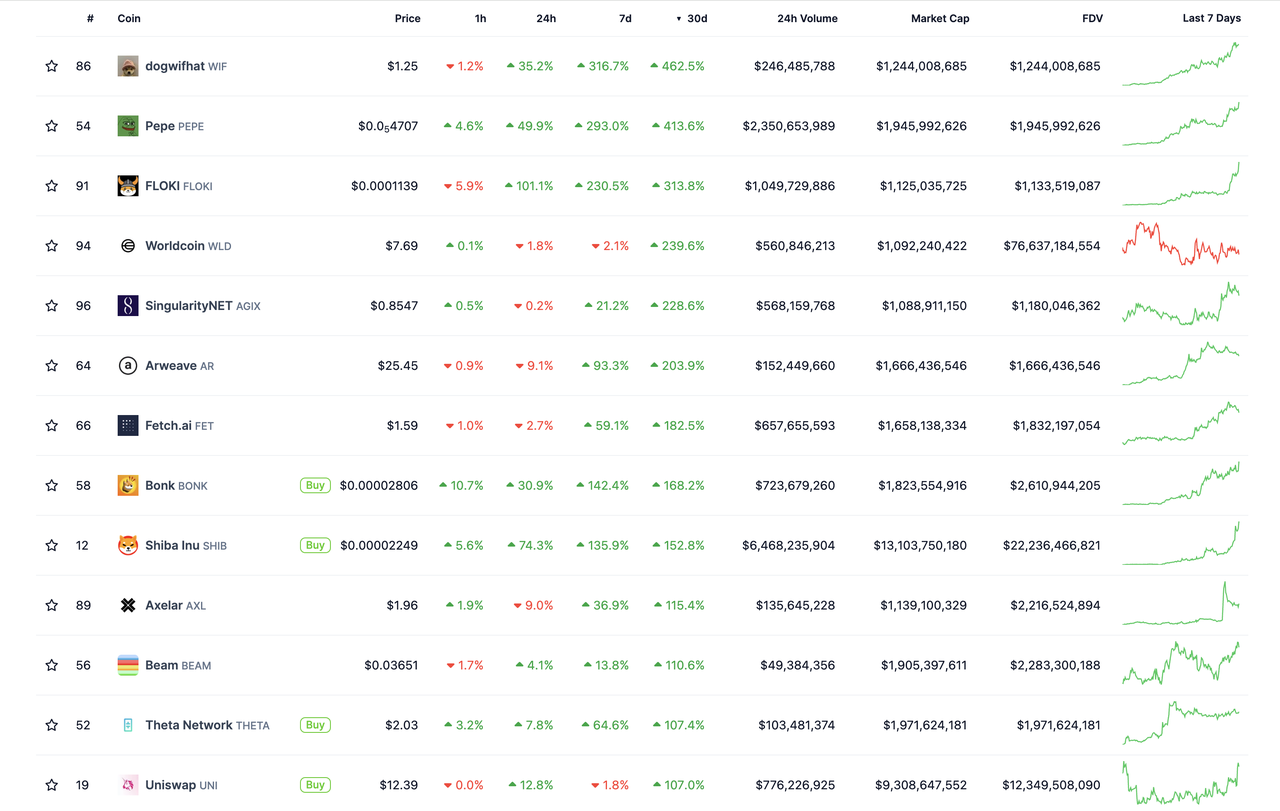

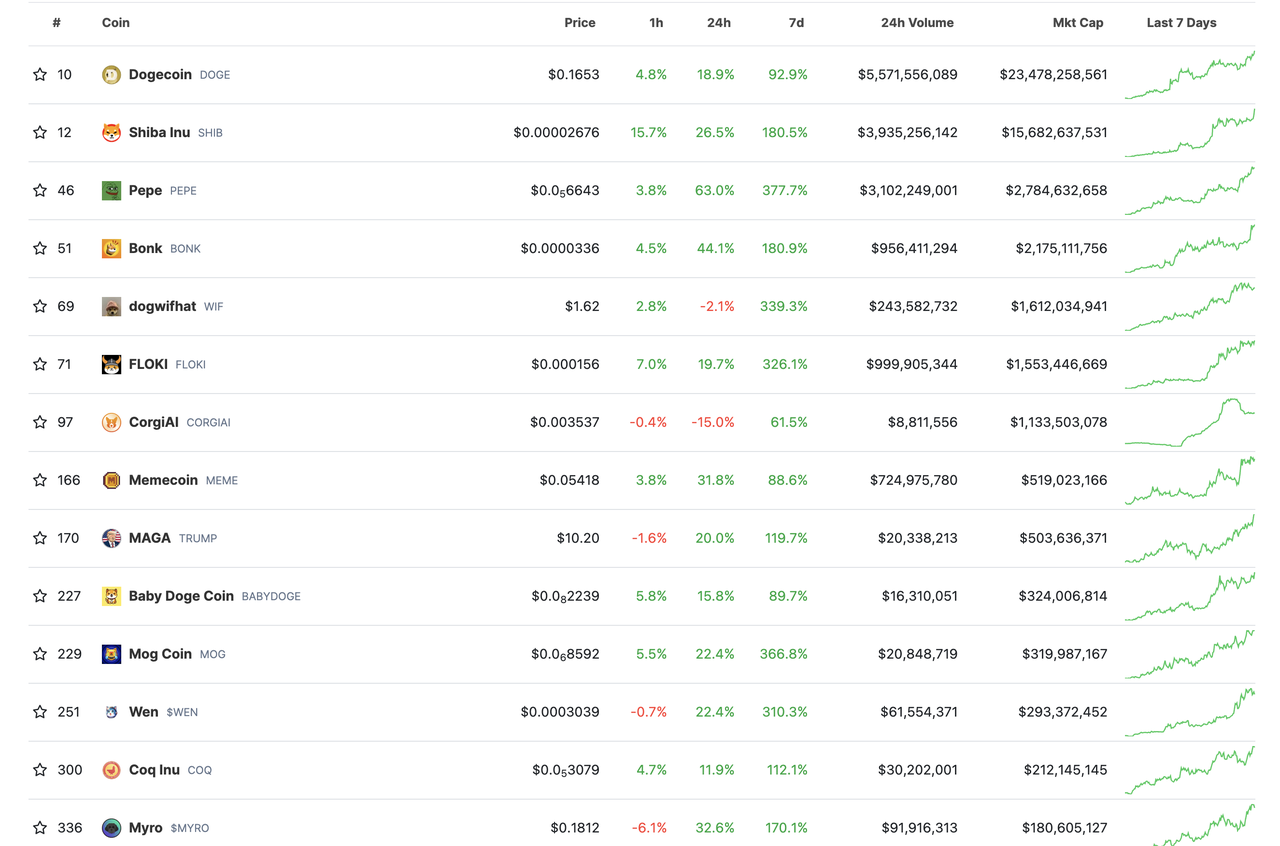

Among the top 100 tokens by market capitalization, the tokens with the highest gains in February were WIF (462.5%) and PEPE (413.6% ), FLOKI (313.8%), the rising performance was mainly concentrated in the last week of February, and there are obvious signs of sector rotation. The current rally is concentrated in the MEME coin sector, which is very different from the performance of past cycles, especially the bull market cycle.

Note: It is recommended that investors remain cautious after the sector rotates to MEME coin. In past cycles, MeMe coin was usually the last sector to be rotated, which means that the rise in this round is nearing the end of the period.

Among the top 100 tokens by market value, only Monero fell 14.2% in February (StarkNet was launched less than 30 days ago). The main reason was that Binance issued an announcement on February 6 that it would drop XMR, Aragon, Multichain, Vai and other tokens. Binance stated that “these tokens did not meet expected standards.”

About WIF (dogwifhat)

dogwifhat is the MEME currency on the Solana chain. The project started planning in April 2023. The currency price around 0.15 has been trading sideways for about 3 months. As of March 2, 2024, the market value has reached 1.2 billion US dollars. It is a dark horse that suddenly appeared in this round of MEME market, and its entire website design is also very interesting. (This token is not yet listed on Binance)

About PEPE

PEPE is a MEME coin that will be launched in April 2023. The MEME coin, which had the largest increase in the round, reached its peak at $0.00000372 on May 6, 2023. BTC also reached its recent stage peak after that, and then there was an overall correction, falling all the way to October 20, 2023. It was recently restarted on February 5, 2024, reaching a historical high of $0.00000444, with a market value of $1.863 billion.

About FLOKI

FLOKI first hit the market in the summer of 2021, following news that Tesla’s founder bought a Shiba Inu and Name it Floki. FLOKI, which is Musk's pet concept, has soared into the sky. Musk often posts pictures of his pets on X, and its price has increased more than three times in the past month.

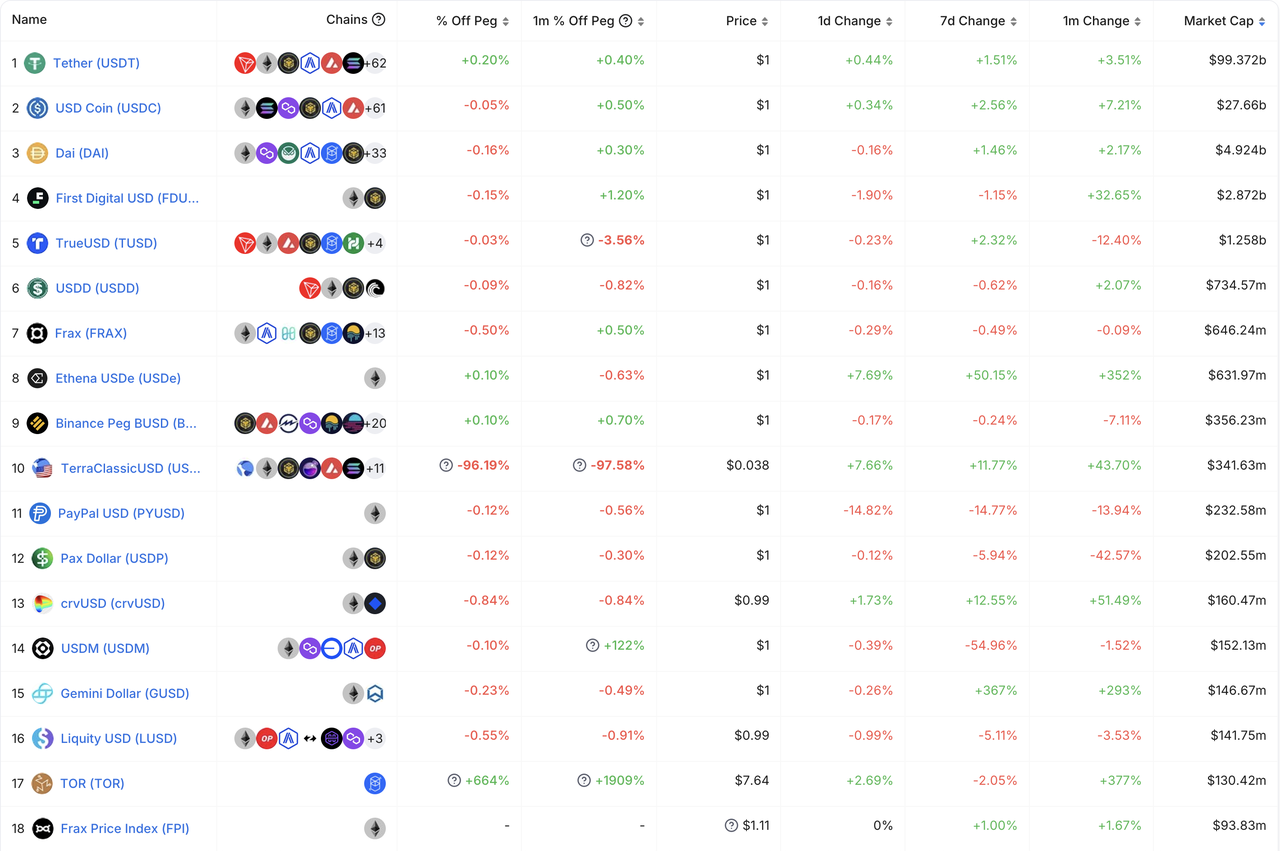

2.2 Stablecoin inflow and outflow

The growth in the number of stablecoins continued in February, and Its slope indicates that this growth may still be accelerating, and the total number of stablecoins has reached $141.2 billion. The fastest growing stablecoin this month is FDUSD, which is the same as January (up 32.65% this month and 20.41% in January). According to this trend, FDUSD is expected to surpass DAI within a quarter and become the third largest stable currency.

FDUSD is issued by FD121 Limited (brand name: First Digital Labs), a subsidiary of Hong Kong-based custody company First Digital Limited. It is a stable currency linked to the U.S. dollar at a ratio of 1:1. The rapid growth of FDUSD is believed to be caused by Binance listing its related trading pairs to replace BUSD.

Statistics from the public chain dimension: The stablecoins on Ethereum are approximately US$73.7 billion, accounting for 52.2% of all public chain stablecoin reserves. Except for the two major stablecoin public chains Ethereum and Tron, the growth of other public chains is relatively small.

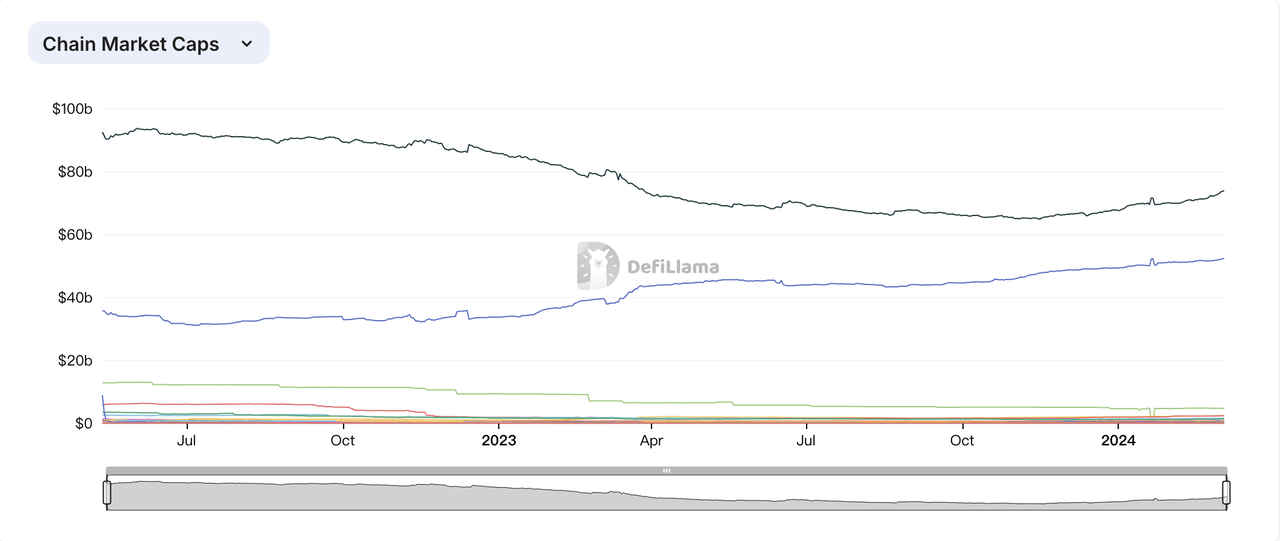

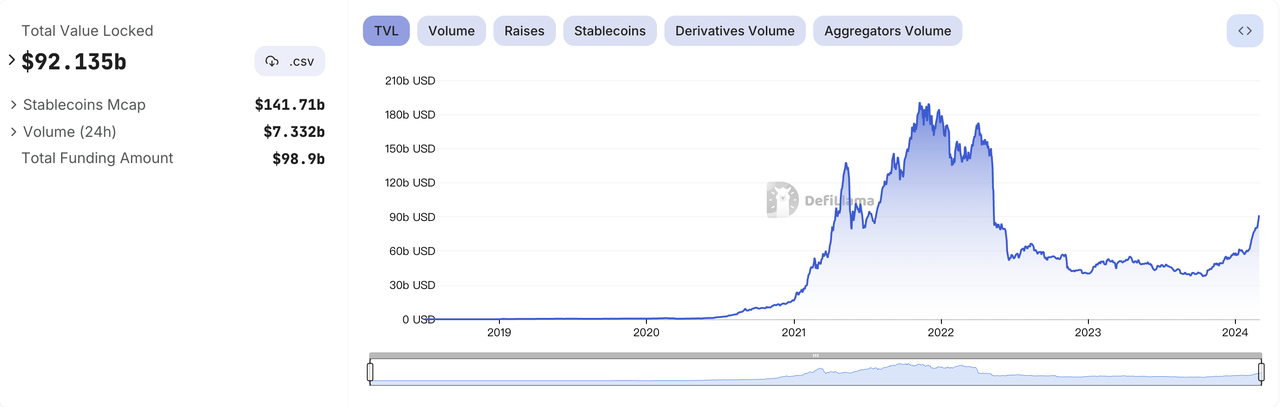

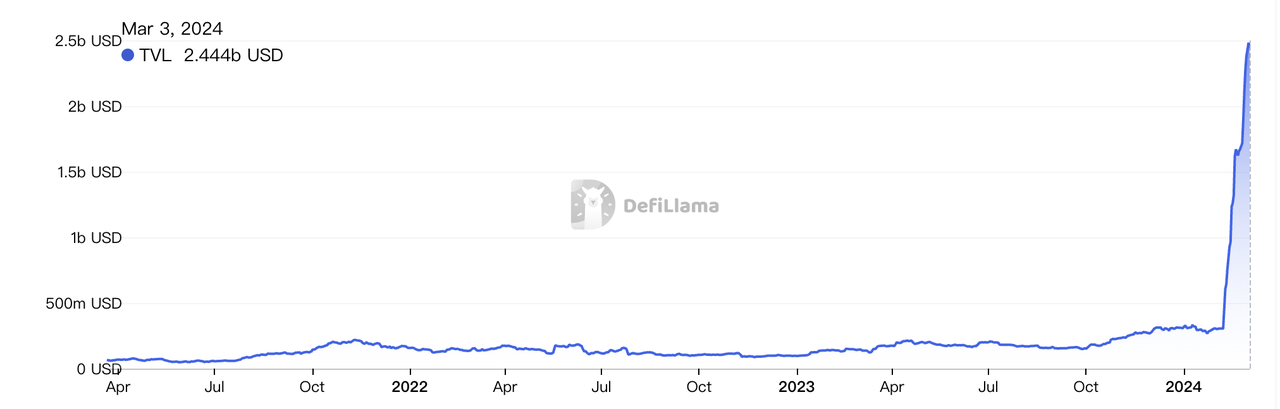

2.3 On-chain TVL ranking

U本位

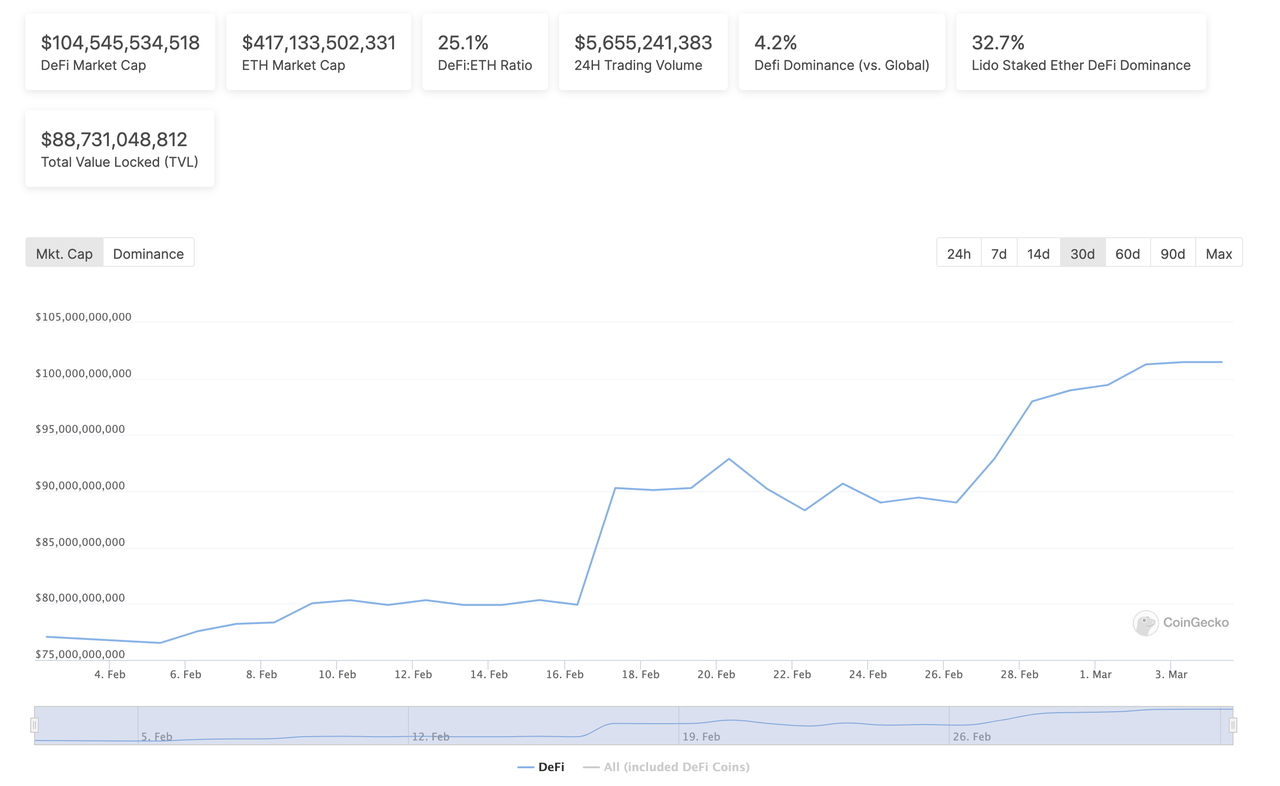

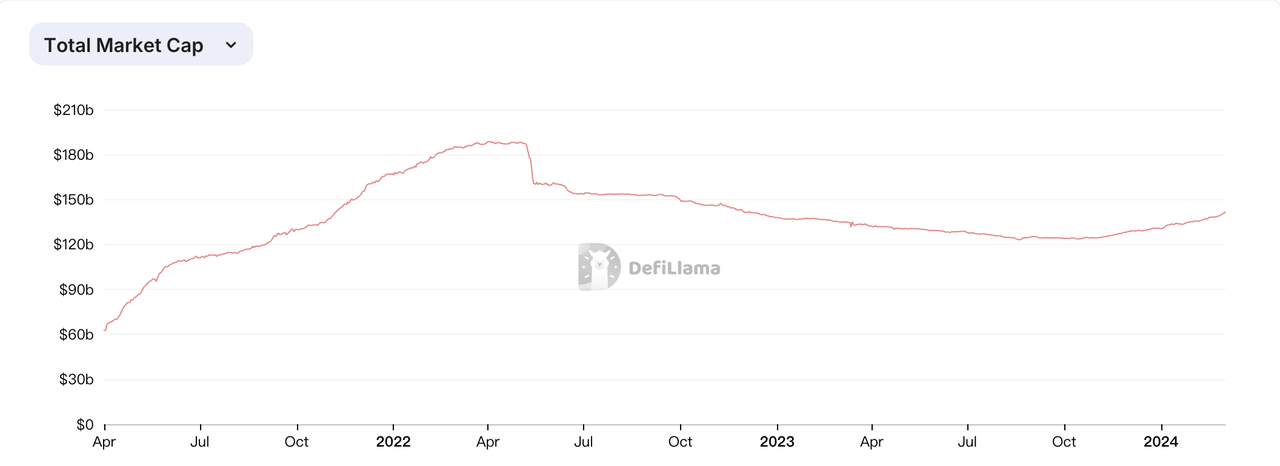

DefiLlama data: The TVL on the chain has accelerated with the increase in the price of ETH.

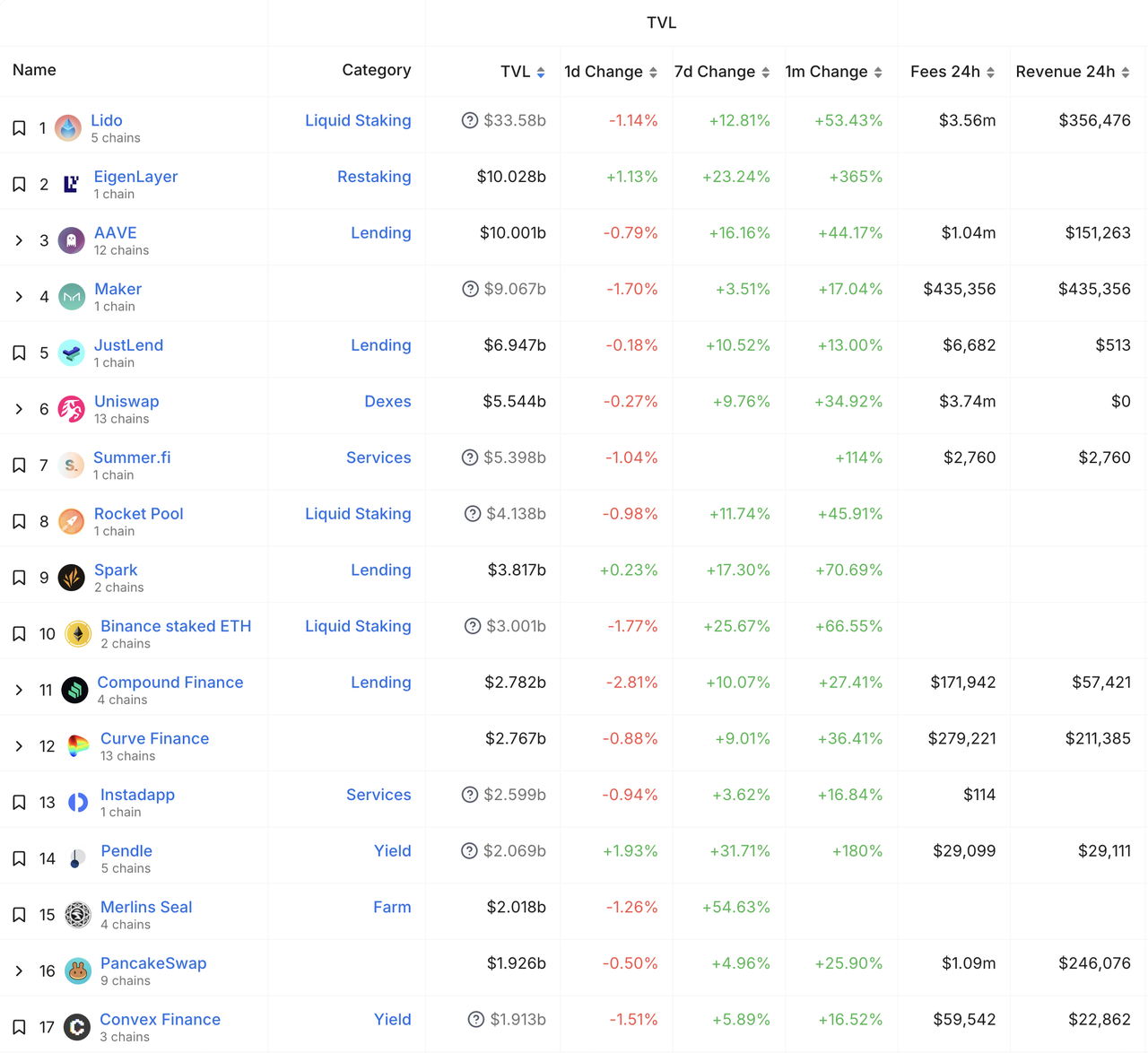

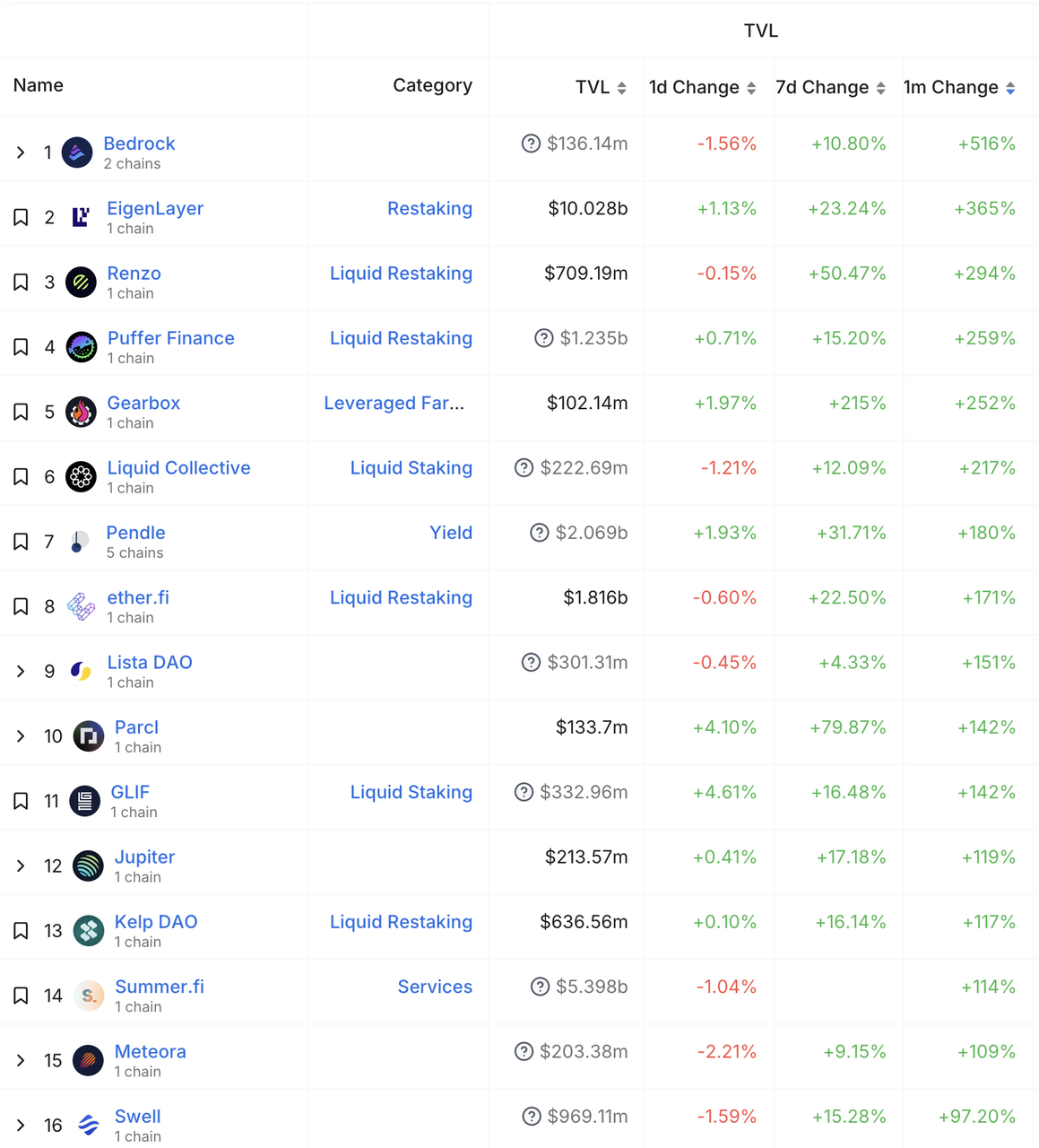

Due to the sharp rise in ETH and Uniswap’s Fee Switch proposal, the overall performance of the DeFi track is outstanding. Among them, the most watched EigenLayer project, TVL exceeded 10 billion US dollars, monthly The increase exceeded 360%, surpassing the former second place AAVE.

Defillama data: Among the 131 projects with TVL above US$100 million (only 96 in January), the largest increase was Bedrock. With the LRT market and Restaking narrative The market is gradually heating up, and the rigid demand for Pendle is gradually emerging. Especially for future institutions, Pendle may be a good tool for hedging risks.

By DeFi category, the highest TVL ranking is still the LSD track, with about 53.3 billion U.S. dollars; Restaking projects based on LSD projects, with a total of about 10 billion U.S. dollars ; Restaking-based LRT projects total approximately US$5 billion.

https://defillama.com/chains

By chain category, Bitcoin’s TVL rose 694% to $2.43 billion, and Ethereum’s TVL rose 52.3%.

Bitcoin ecology’s TVL has risen sharply, benefiting from its Layer 2 narrative. A large number of projects have begun to support staking BTC and have received financing from many top VCs. This trend is expected to continue. Continue and perform in the cyclical market.

2.4 BTC/ETH mining pool data

BTC computing power continues to rise steadily

https://explorer.btc.com/zh-CN/btc/insights-pools

Bitcoin’s mining pool data growth is as shown in the figure above. Currently, the entire network has calculated The computing power has reached 575.08EH/s. Foundry USA, AntPool, and F2Pool are the top three in the computing power list. The mining pool’s computing power continues to maintain a steady upward trend this month, with an increase of 7.2% compared to the previous month. There are currently 7,044 blocks left to enter the halving. The estimated halving time is April 19, 2024, which is 2 days earlier than the April 21 evaluated last month.

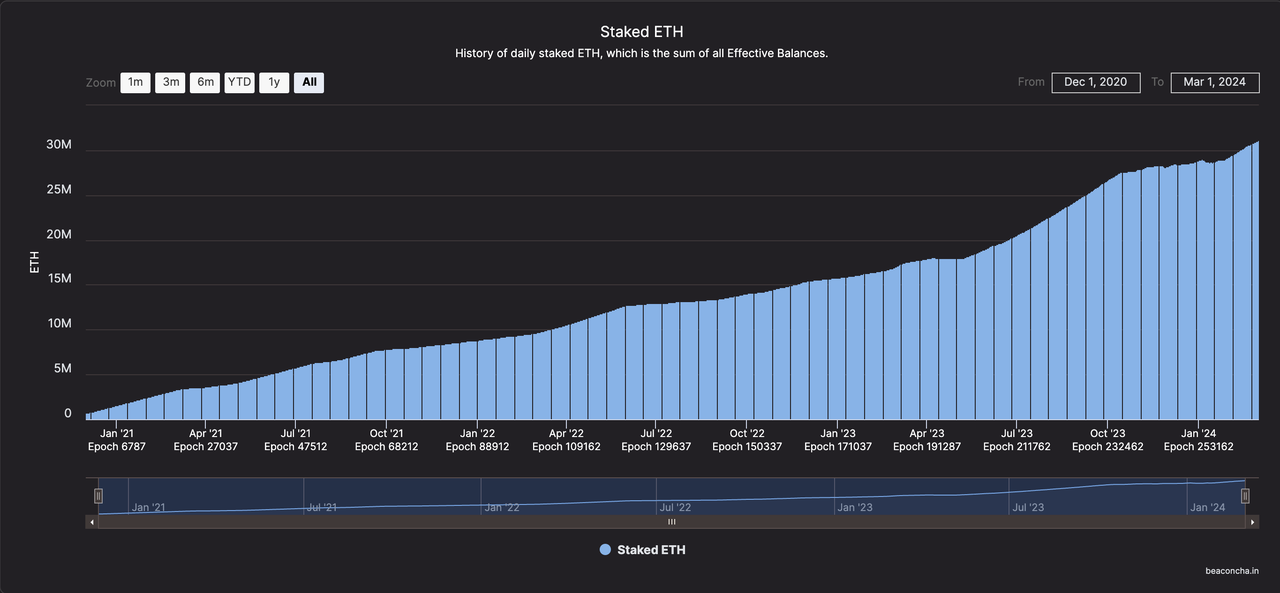

The amount of ETH pledged continues to rise

https://beaconcha.in/charts/staked_ether

The number of ETH pledged continues to rise. The current pledged amount has accounted for 26% of the total amount. The pledged amount this month is 1.82 million. The current Restaking market Still going on.

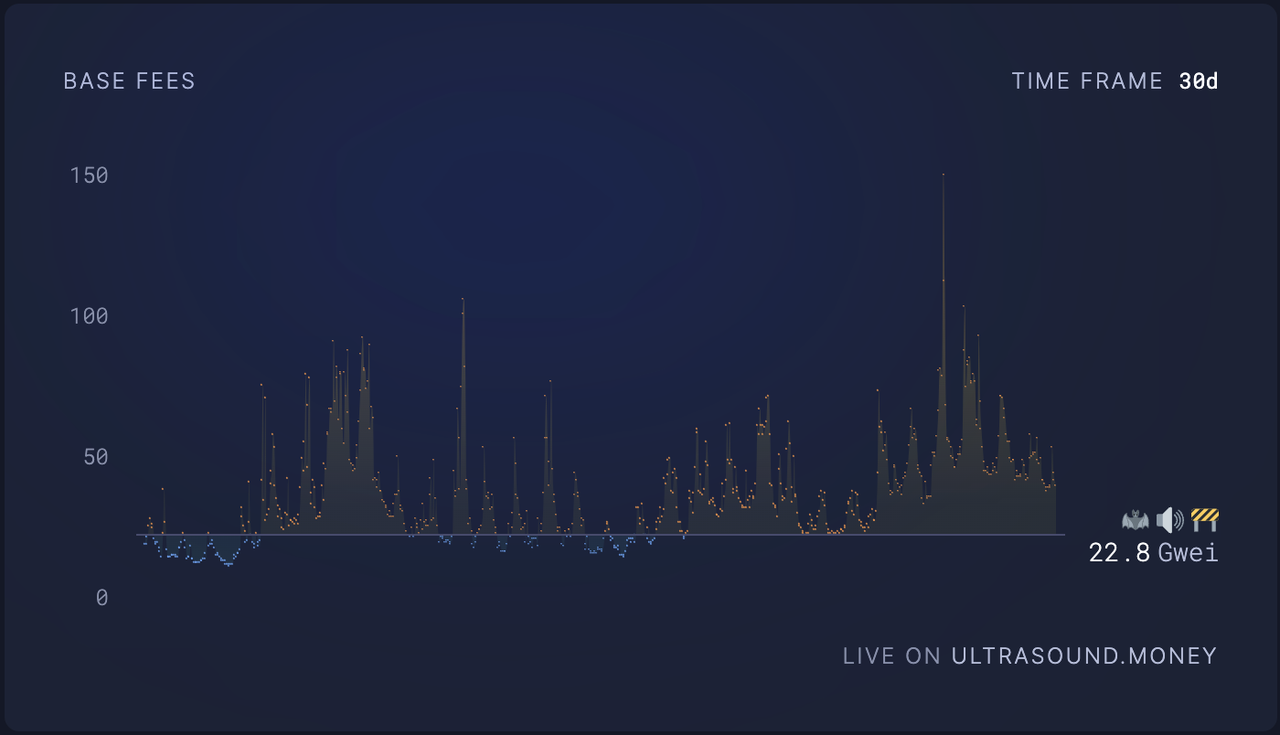

In addition, the ETH main network Gas has increased significantly along with the market. In February, the ETH main network had a net burn of 4,6839 coins. It is expected that the high Gas situation will continue until June due to the Dencun upgrade and the ETH ETF, and the total amount of Ethereum coins will then be will be less than 120 million pieces.

3. Market Trend

3.1 The DeFi sector has made up for the increase

https://www.coingecko.com/en/categories/decentralized-finance-defi

In February, the currency prices of DeFi projects all increased. Significant rise. Coingecko data shows that the market value of DeFi tokens has increased by 31% in the past 30 days. Among them, Uniswap rose by 100%. Mainly due to the Uniswap Foundation's fee switch proposal, the market has re-focused on the DEFI track, which in turn has driven the overall DEFI currency price to rise significantly.

3.2 The MEME sector has risen in rotation

The recent market rise has experienced the sector rotation of mainstream currencies, AI, DePIN, GameFi, DeFi, and MeMe. move. In February, MeMe coins such as Dogecoin, Shib, and PEPE all rose by more than 300%, and the effect of creating wealth was obvious. However, the price of MeMe coins fluctuated greatly. Recently, SHIB market makers have mainly sold, so investors still need to be cautious.

3.3 The BTC Staking ecology is beginning to show

https://x.com/MerlinLayer2/status/1763783422529695862?s=20

acts as the underlying asset through BTC pledge, and uses the BTC market value consensus to introduce BTC ecological narrative and airdrop expectations, and is quickly absorbed BTC's increase in TVL has become a highly anticipated business model. Currently, Merlin Chain’s TVL has reached US$3 billion, of which BTC accounts for 53% and ORDI accounts for 33%. Subsequently, many BCT Layer2s have been paid attention to. For example, Babylon, which received investment from Binance, has introduced BTC re-staking to ensure the security of the Cosmos ecosystem. The broad prospects of the BTC staking track have been recognized by more people. It is recommended that stay tuned.

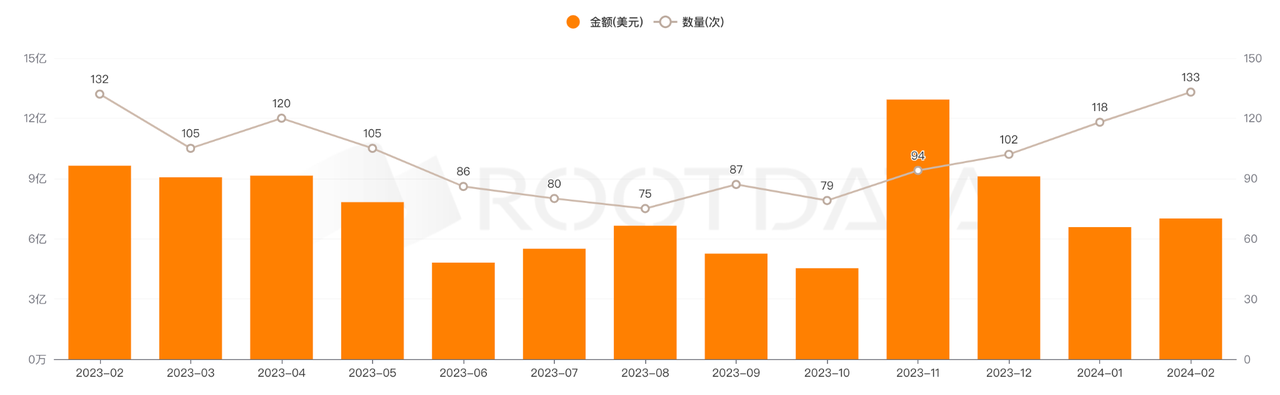

4. Investment and Financing Trends

- 134 financing events, a year-on-year increase of 55.81% (a total of 118 projects in January 2024);

- 6 acquisition events, a year-on-year increase of 20% , indicating that acquisition activity is increasing; the average financing amount of

- was US$7.2193 million, a year-on-year decrease of 10.74%; the median financing amount of

- was US$4 million, a year-on-year increase of 19.4%.

The five largest rounds of financing in February are:

- EigenLayer completed US$100 million in financing, with an undisclosed valuation;

- Flare Network completed US$35 million in financing, the valuation was not disclosed;

- Ether.Fi completed US$27 million in financing, the valuation was not disclosed;

- Avail completed a $27 million seed round at an undisclosed valuation;

- MetaStreet completed a $25 million round at an undisclosed valuation;

In addition, investment and financing events were found: 38 seed rounds (40% year-on-year), 15 strategic financing rounds (-21% year-on-year), 13 Pre-seed rounds (30% year-on-year), There were 8 cases of other types (no change), of which seed round financing events were the most, followed by strategic financing and Pre seed round financing, and there were fewer other types of financing events.

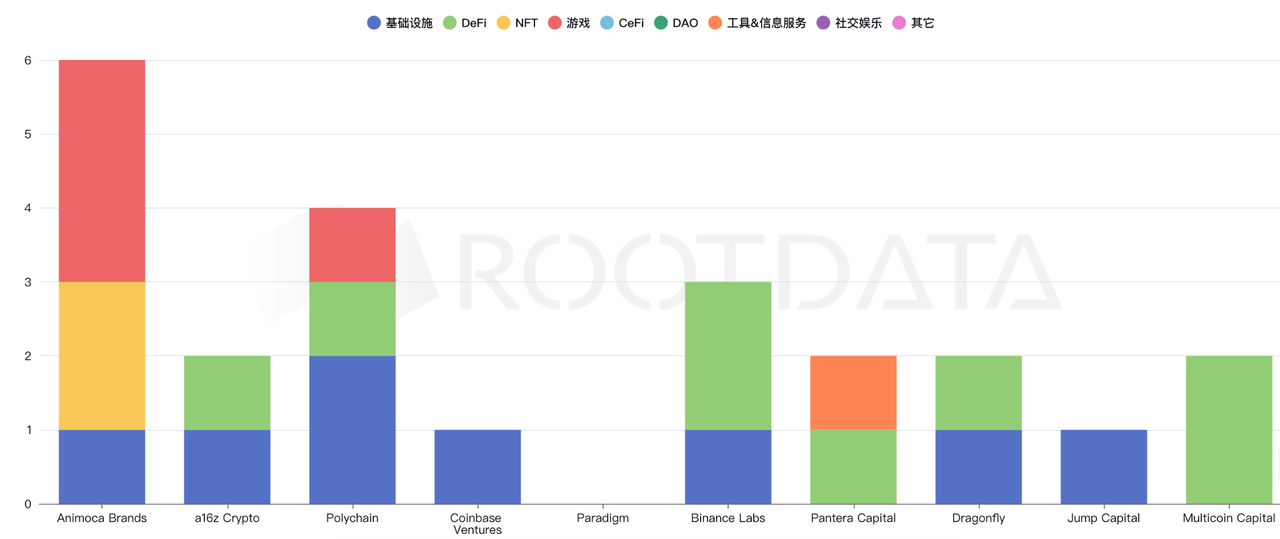

From a VC perspective, Animoca Brands has made most of its investments in the fields of infrastructure, NFT and GameFi, while Binance Labs and Multicoin Capital have invested in the DeFi field. The largest number, while other VC firms’ investments are focused on infrastructure.

Investment activities in the crypto field increased in February, both in terms of the number of projects and the amount of investment, and have reached a high point in the past year. Investments are still concentrated in infrastructure and DeFi. . This trend may have a positive impact on market sentiment in March, attracting more investors to the market.

After entering March, the development trend of cryptocurrency and blockchain investment activities will likely be affected by various factors such as global economic conditions, technological innovation, and policy environment. If there are no major adverse events or policies, market sentiment remains positive, and technological innovation continues to advance, investment activity in March is expected to continue to maintain a growth trend. However, market fluctuations and policy changes are still key risk factors, and investors must remain vigilant and continue to pay attention in order to make timely and accurate investment decisions.

5. Summary

The market conditions and dynamics in February 2024 have allowed us to see multiple important trends:

- The market’s response to macroeconomic data and policies The expected response is obvious, especially after the release of data on employment growth and inflation;

- The production increase market has shown strong momentum, especially the prices of BTC and ETH, driven by ETFs, have surged this month ;

- The continued issuance of stablecoins, the continued growth of TVL on the chain, and the steady increase in mining pool data all show investors’ optimistic expectations for the future;

- The increase in the total amount of financing shows from the side Increased market activity and investor confidence;

Although the market is facing macroeconomic uncertainty and regulatory policy challenges, investment in technological innovation and infrastructure construction continues to grow, which bodes well for The long-term potential and development space of the crypto market. Investors and market participants should continue to pay attention to macroeconomic indicators, technological innovation, and changes in the policy environment in order to make informed decisions in the ever-changing market. We look forward to the crypto market in April continuing to demonstrate its unique innovation capabilities to people. , as well as penetration and impact on the global financial ecosystem.

The above is the detailed content of Crypto Investment Research Monthly Report (2024.02): ETF drives BTC to rise, Meme track is crazy. For more information, please follow other related articles on the PHP Chinese website!

Related articles

See more- How to use PHP to develop applications using the Bitcoin Coinbase wallet library (detailed steps)

- Use Python to build a blockchain security application framework

- Detailed explanation of how Bitcoin contract trading works on Eureka Exchange

- Jupiter, the DeFi aggregator under the Solana ecosystem, is now listed on the Matcha platform, launching the Meme currency WEN and it has skyrocketed a hundred times!

- What are the Solana meme coins? How to buy Solana Meme Coins?